How Pooling of Dumped Milk Works

TOPICS

Milk

photo credit: AFBF

John Newton, Ph.D.

Vice President of Public Policy and Economic Analysis

The stay-at-home and self-distancing orders instituted in the U.S. in response to the COVID-19 pandemic have pushed demand way down for food consumed away from home — at school cafeterias, full- and limited-service restaurants, bars, airlines and hotels, for example (How Consumers Purchase Food Is Changing).

Demand for dairy products in the retail channel rapidly increased, but only for a short period of time as it became clear that economic growth was likely to slow in the U.S. and abroad – destroying demand for dairy products typically destined for food service or export markets. This demand destruction coincided with the typical spring flush in the U.S.

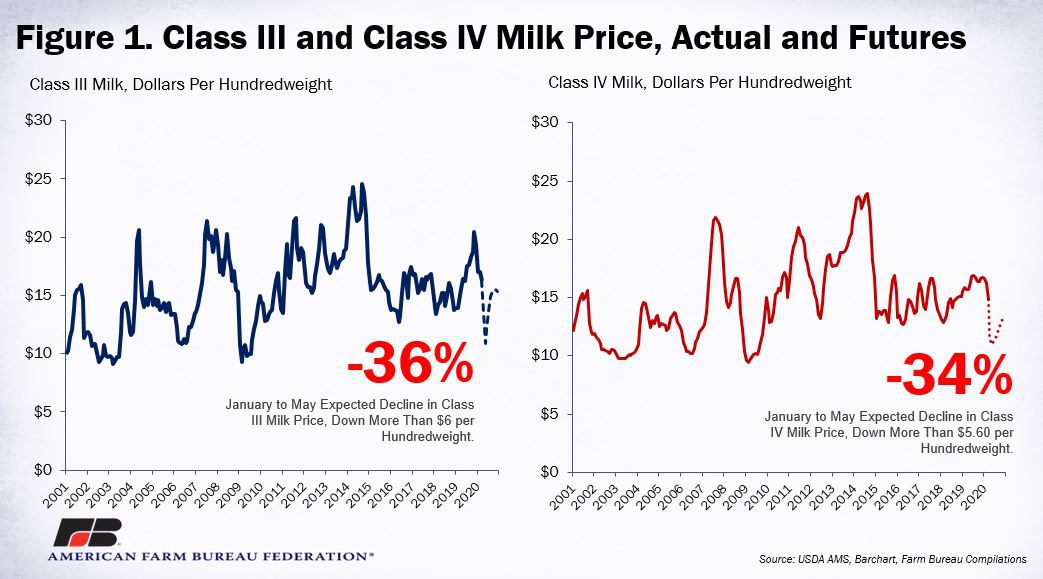

Milk prices immediately eroded, and since COVID-19 was first confirmed in China, futures prices for Class III milk and Class IV milk are now down more than 30%, i.e., Coronavirus Sends Crop and Livestock Prices into a Tailspin. As of April 14, May futures for Class III milk are below $11 per hundredweight and Class IV milk futures are slightly higher than $11 per hundredweight, $6.16 per hundredweight and $5.64 per hundredweight below January prices, respectively, The milk price decline experienced as a result of COVID-19 is the worst since the Great Recession, Figure 1.

The demand destruction compelled some of the nation’s largest dairy cooperatives and processors to initially request dairy producers dispose of milk on the farm. Some of these cooperatives and processors, but not all, are now requesting dairy producers cut back supplies by nearly 20%. In addition, some are also requesting USDA initiate a nationwide temporary supply management program in exchange for direct payments.

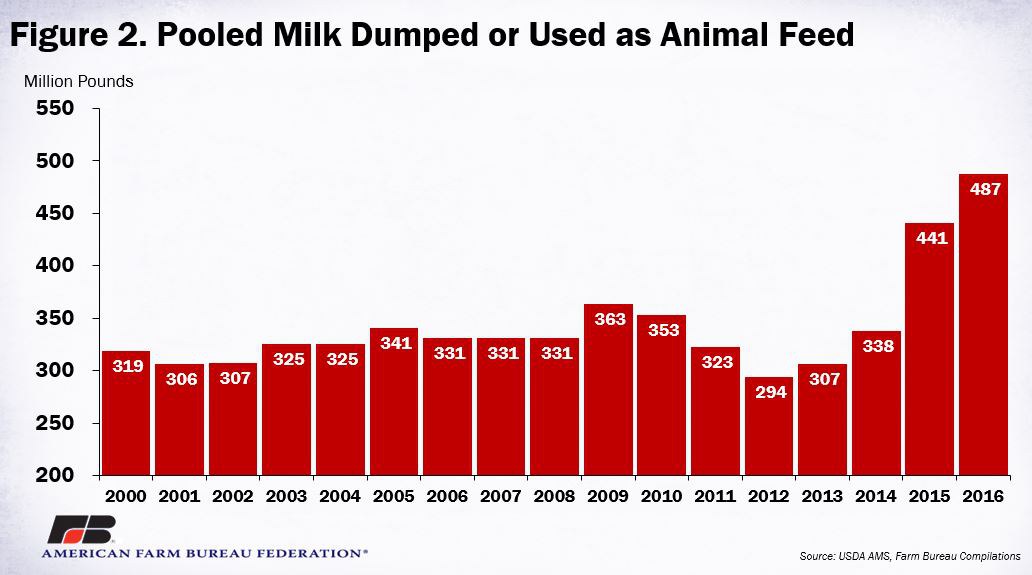

Historically, USDA’s Federal Milk Marketing Order system has allowed dumped milk to be pooled as long as the reason for the dumping is beyond the control of the farmer, cooperative or handler, e.g., lost by a handler in a vehicular accident, flood or fire. USDA expanded the ability to pool dumped milk following the downturn in milk prices beginning in 2015. During 2015 and 2016, more than 900 million pounds of milk were dumped in the U.S., Figure 2.

In response to COVID-19, USDA’s Agricultural Marketing Service has taken action through the FMMO system to facilitate the pooling of dumped milk for the time period of March-May, as needed:

“USDA will provide flexibility for the dumping of milk and limit the financial impact to producers. Milk historically associated with a FMMO will be allowed to be dumped at the farm and still priced and pooled on the FMMO. The pooling handler will need to notify the FMMO of any dumped milk.”

How is Dumped Milk Priced and Pooled?

A recent Market Intel reviewed milk pricing provisions in the U.S. (How Milk Is Priced in Federal Milk Marketing Orders: A Primer). Milk prices paid to farmers are based on market-wide revenue sharing pools whereby farmers are paid a weighted average milk price based on how milk is utilized in the marketing order. Excluding re-blending charges and other authorized deductions, farmers pooling milk in FMMOs with higher utilization in Class I beverage milk generally have the highest milk price.

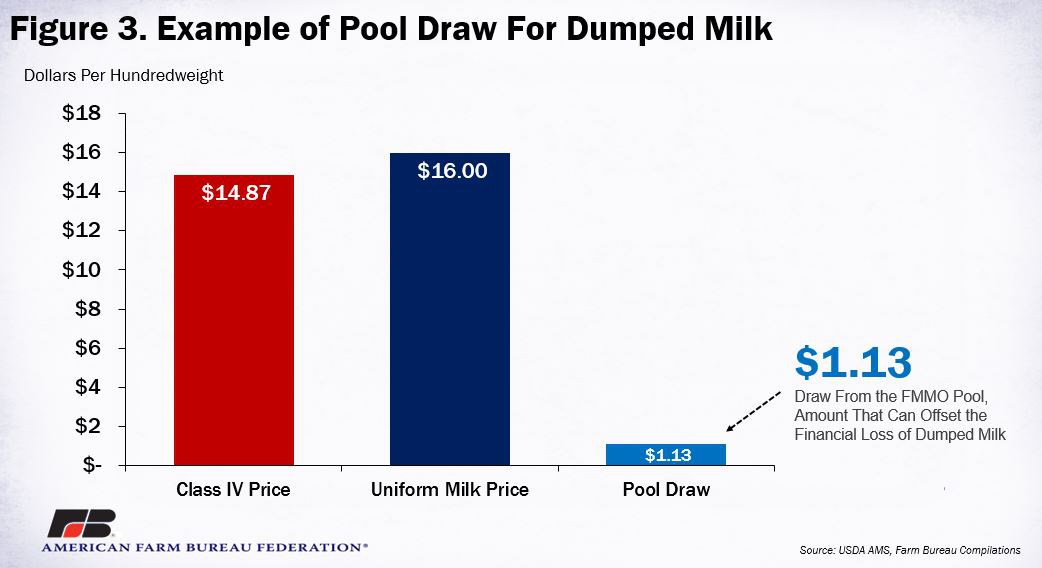

Through this revenue-sharing process, milk that is disposed of as animal feed or dumped is assigned to the lowest class price for the pooling month for pricing and pooling purposes. In the computation of the monthly statistical uniform price, the pooling handler will account to the FMMO pool for milk that is dumped as “other use” and the milk will be accounted for at the lowest class price (Class IV for March and April and Class III for May – based on announced prices and current futures prices).

Then, the handler will report their dumped milk and receive a pool draw or “credit” from the pool based on the dumped milk volume. This amount is generally equal to the difference between the uniform value of milk and the lowest-priced class. For dumped milk that is pooled, the handler will be responsible for paying the producer the minimum order value, i.e., blend price. There is no minimum price enforcement for milk that is not pooled. Dairy cooperatives are not bound to pay the minimum order value.

As a simplified example, and excluding milk component levels, skim and fat or qualification criteria, using the March Class IV price of $14.87 per hundredweight, and assuming a FMMO blend price of $16 per hundredweight, if a handler or cooperative pools milk dumped on the farm, they will account to the pool at the Class IV value of $14.87 per hundredweight. They would then receive a payment from the pool for $1.13 per hundredweight, i.e., the difference between the uniform price and the lowest-class price ($1.13=$16-$14.87).

The non-cooperative handler would be responsible for paying the producer $16 even though the pool draw was $1.13 per hundredweight and the value of the dumped milk was likely $0. At times, the processor may skim the cream from the milk and dump only the skim portion – salvaging some value from the dumped milk.

Importantly, the FMMO system has no additional money to cover the pool draw for dumped milk – as a result all producers pooling on the order are sharing in this pooling of dumped milk even if their milk may not have been dumped. Figure 3 highlights the pool draw from milk dumping included in this example.

As a result, while the dumped milk may have a market value of $0 per hundredweight, the pooling handler can receive a financial draw from the pool to offset the lost value associated with the dumped milk.

It’s possible for USDA to provide additional assistance and financially compensate for the value of dumped milk. The 2018 and 2019 disaster packages did include a WHIP-Milk Loss indemnity program to pay producers for milk that was dumped or removed without compensation from the commercial milk market due to hurricanes, floods, tornadoes, typhoons, volcanic activity, snowstorms and wildfires.

Typically, the costs associated with loads of milk that are dumped are spread among all, or a subset, of the dairy cooperative’s member producers. The collective sharing of the value of the dumped milk (called re-blending) lowers the farm-level milk price for all farmer-members of the cooperative. The financial draw from the pool can be used to reduce the aggregate balancing costs borne by the dairy cooperative members. Non-cooperative handlers may not blend the loss among their producers that results in prices below the FMMO minimum.

Summary

As a direct result of COVID-19-related demand destruction coinciding with the spring flush, milk prices in the U.S. have fallen by more than 30%. In response, many dairy processors and cooperatives are requesting that dairy farmers reduce their milk supplies in addition to also requesting USDA impose a supply management program in exchange for direct payments.

At this point, USDA has not announced a WHIP-ML type of program for dumped milk related to COVID-19. Instead, for distressed loads of milk, USDA has announced new flexibilities to allow this milk to be dumped. The dumped milk will be allowed to be priced and pooled on the FMMO. The FMMO draw will not make any pooling handler or dairy farmer whole, but it will provide nominal financial assistance to the pooling handler to offset the lost revenue associated with dumped milk.