It’s Turkey Time!

TOPICS

Thanksgiving DinnerAFBF Staff

photo credit: Getty Images

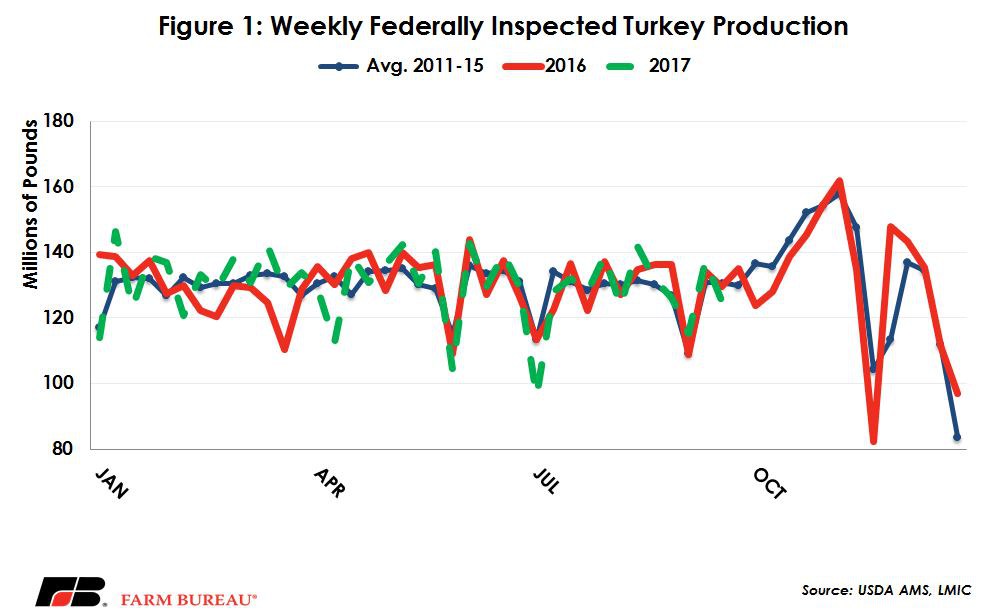

Are those words sounding a bit early? Well, for consumers it might be, but for farmers “turkey time” is now. Commercial turkey producers are beginning to harvest turkeys destined for roasting pans this holiday season. The seasonal slaughter rates for turkey remain fairly steady all year, but beginning in October those rates rise over the six to eight weeks ahead of Thanksgiving. Figure 1 shows the weekly levels of turkey production.

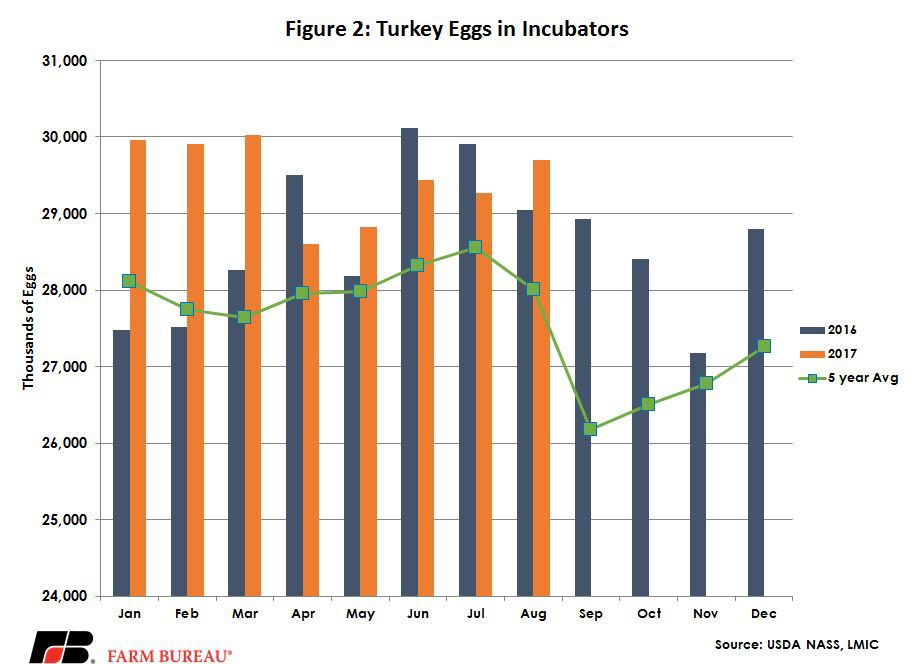

Frozen birds sold whole for Thanksgiving can be produced anytime during the year and accumulate in cold storage ahead of Thanksgiving. Fresh birds, however, have a much shorter shelf life and so the timing of placements and hatching becomes all the more critical to reach the market at just the right time. A turkey egg incubates for 28 days and then the chick is placed into a grow-out facility where it grows to slaughter weight. Hens take about 12 to 14 weeks to reach a live weight of 15 to 20 pounds, which will dress out at a 12- to 16-pound whole turkey. The highly seasonal nature of turkey consumption drives the seasonality of every other statistic related to production. Figure 2 shows the eggs in incubators. The five-year average is predictably where the production cycle indicates most of the eggs need to be hatched in order to prepare for Thanksgiving.

Turkey placements have been up this year, and much higher than seasonal trends would suggest in the first quarter of 2017. Further, cold storage values have been consistently between 10 and 17 percent higher than last year. Some of that build-up could be related to the surge in turkey exports seen this year. Year-to-date (data through July) turkey exports are up 10 percent, with large gains seen in Mexico and Canada. Imports have been sluggish so far this year, running 48 percent below year-to-date. Canada and Chile are the largest shippers to the U.S. Combined, they’ve shipped 14.7 million pounds less of ready-to-cook turkey to the U.S. so far this year. In contrast, Mexico has bought 28.5 million pounds more turkey than last year through the first seven months of the year. Mexico handily buys more than 50 percent of U.S. annual turkey exports.

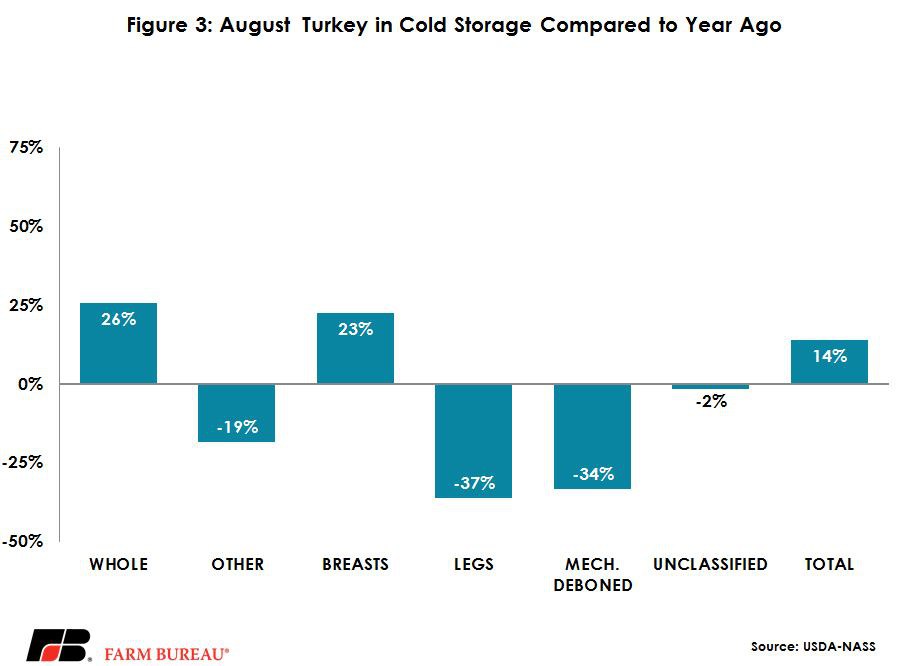

There are quite a few counter-balancing economic signals this year: higher exports, lower imports, higher cold storage and higher average slaughter. Eggs in incubators have followed the normal seasonal pattern, but net poults placed have been down this year, slightly, by about 240 thousand birds. One of the reasons these economic indicators do not perfectly tradeoff is the turkey market’s two large segments, one for whole birds and the other for turkey parts such as legs, thighs, wings, ground meat, etc. While whole birds play a major role in the domestic market, exports markets rely more heavily on dark meat in thigh, wings, and drumsticks. Most of the cold storage inventory is whole birds and breast meat, which are 26 and 23 percent higher than they were last year at this time, respectively, Figure 3.

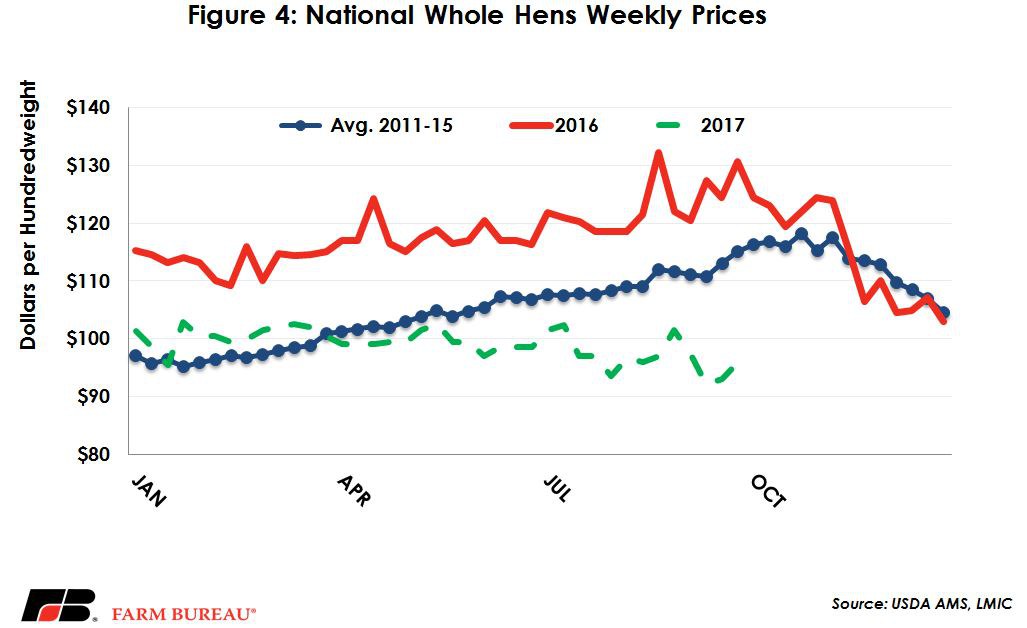

Whole bird prices, on the other hand, have been well below average for most of year. At the end of September whole hens were 35 cents per pound below last year on the same week. Prices in 2016 were notably higher - carrying a premium to the five-year average from January to Thanksgiving. Figure 4 shows the national average frozen hen price. USDA WOAB expects these hen prices to rise in the fourth quarter of this year, averaging between $1 to $1.06 per pound--a 6 percent increase from where hen prices were last week, but 14 percent lower than a year ago.

These fundamentals suggest the price of Thanksgiving’s key ingredient – the turkey – could be lower this year. While other fixings certainly drive the final cost of the meal, all eyes at this point are on the bird. On Nov. 16, AFBF will release the results of its 32nd annual informal retail price survey of classic items found on the Thanksgiving Day dinner table, including turkey, bread stuffing, sweet potatoes, rolls with butter, peas and cranberries. Last year’s feast for 10 came in at $49.87, less than $5 per person.

Top Issues

VIEW ALL