Jobs Report Indicates Both a Strong Economy and Potential Future Inflation

TOPICS

UnemploymentBob Young

President

photo credit: Arkansas Farm Bureau, used with permission.

Bob Young

President

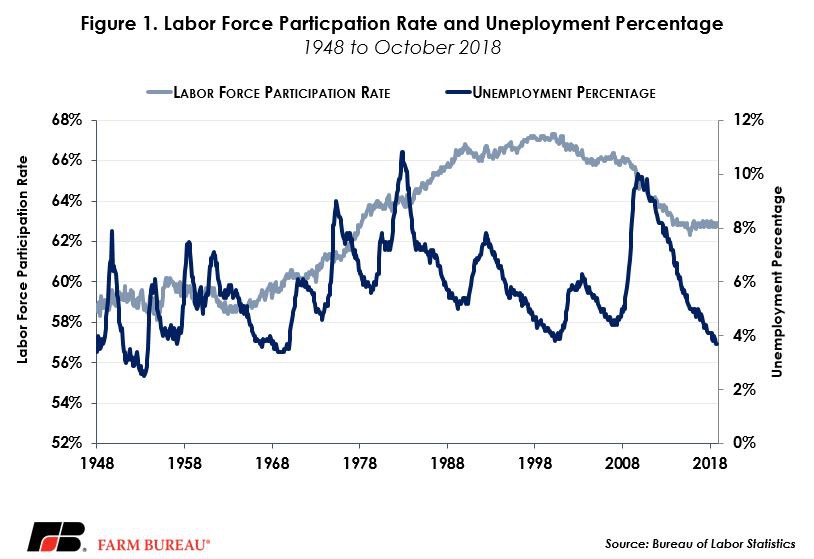

There was very little not to like in this month’s jobs report. The Bureau of Labor Statistics pegged job growth at a cool 250,000 new slots. With labor force participation up by 0.2 percent to 62.9 percent, this left the unemployment rate at 3.7 percent. Never forget that changes in labor force participation can have as much of an impact on the unemployment rate as job growth does.

Beyond the headline numbers, there were several essentially unchanged figures in the household survey data. Long-term unemployed numbers – those out of a job for 27 weeks or more – stayed at 1.4 million, or 22.5 percent of the total unemployed. Similarly, there are still 4.6 million people who are involuntarily in part-time positions. People who are marginally linked to the job market, but who did not look for work in the four-week period prior to the survey continue to sit at 1.5 million, almost identical to the figures reported a year earlier. A little deeper dive into this figure shows 506,000 people who are not looking for work because they simply believe there are no jobs that fit their needs/qualifications. Fully two-thirds of the 1.5 million individuals who did not look for work in the four-week period before the survey (984,000 people) did so because of school attendance or other family responsibilities.

Taking the establishment survey apart, a closer look at the leisure and hospitality sector is warranted after the hurricanes of the last couple of months. Leisure and hospitality employment were essentially unchanged in September, probably driven by the after-effects of Hurricane Florence. Employment numbers for leisure and hospitality were up 42,000 in October, which sounds like a pretty significant bump. Looking at September and October together, however, an average of 21,000 new jobs is right in line with the previous 12 months’ values for the sector.

Why didn’t Hurricane Michael’s Oct. 10 arrival in Florida cause leisure and hospitality employment growth to stall, as Florence did? The answer is due in part to when the survey is actually taken. The data are collected based on payrolls for the calendar week that includes the 12th of the month. So, with Hurricane Michael making landfall on the 10th, survey data may not reflect the job losses Michael caused, but it is possible recovery-related jobs will show up in the December report.

Beyond leisure and hospitality, health care continued to add numbers, with 36,000 new slots. Hospitals and ambulatory health care services made up the bulk of those figures at 13,000 and 14,000 jobs, respectively. Manufacturing came in with 32,000 additions--transportation equipment-related jobs were 10,000 of that total. Construction added 30,000 jobs, including 14,000 in residential specialty trade contractors.

The shift in how consumers buy things continues to be a large part of the changing job picture. Transportation and warehousing added 25,000 jobs – read that as Amazon and other online shopping, with wholesale and retail trade – read that as the Sears and other department stores of the world - essentially unchanged.

Along with the wholesale and retail trade sector, the information and financial activities sectors and overall government employment were essentially flat compared to last month.

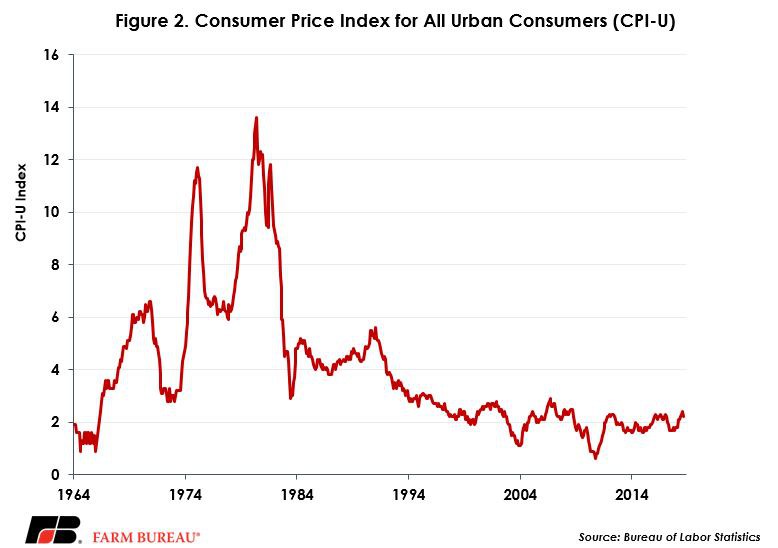

The average hourly earnings for all employees are up 3.1 percent over the year, an indicator of both a strong economy and future inflationary pressures. With the prospect of rising inflation comes the expectation of the Federal Reserve considering more tightening. This is certainly one reason the equities markets are as skittish as they have been over the last few weeks.

Top Issues

VIEW ALL