June Cattle on Feed Sets New Record

TOPICS

Market Intel

photo credit: Colorado Farm Bureau, Used with Permission

John Newton, Ph.D.

Vice President of Public Policy and Economic Analysis

USDA’s June 22 Cattle on Feed report put cattle and calves on feed for the slaughter market for June 1 at 11.6 million head, down 5,000 head from May, but up 457,000 head, or 4 percent, over prior-year levels. Importantly, this is the highest June cattle on feed inventory on record since the series first began in 1996.

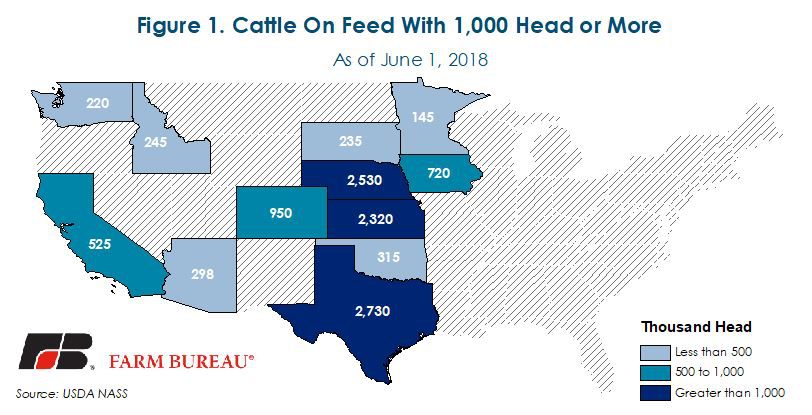

Cattle on feed have increased over prior-year levels for 18 consecutive months and 26 out of the last 28 months. They have been above 11 million head for eight consecutive months. The numbers were the highest in Texas, Nebraska and Kansas, where a combined 7.6 million cattle were on feed, Figure 1.

The increase in the number of cattle on feed was not unanticipated. Pre-report trade estimates ranged from a low of 11.4 million head to a high of 11.6 million head and averaged 11.5 million head -- all above prior-year levels. The increase in cattle on feed comes against a backdrop of lower feed prices, poorer pasture and rangeland conditions and an intense and prolonged drought across much of the Southwest.

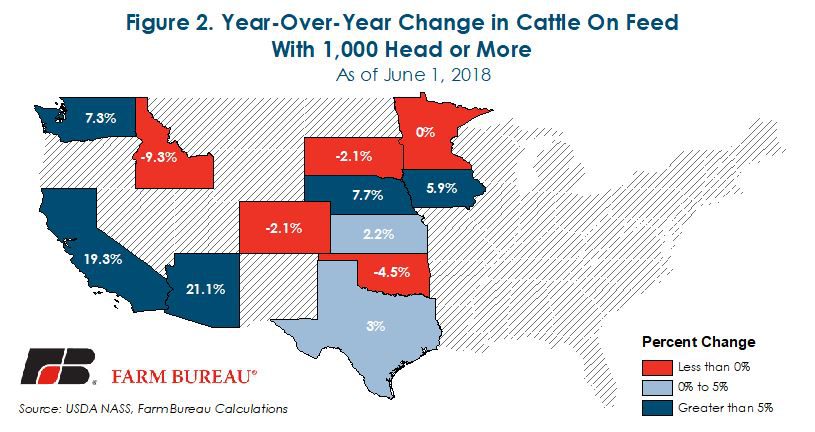

States with the largest expansion in cattle and calves on feed during May included Nebraska, California, Texas and Arizona, which added a combined 397,000 head. On a percentage basis, the expansion in cattle on feed was the greatest in Arizona and California, where cattle on feed were approximately 21 percent and 19 percent higher, respectively. Idaho experienced the largest decline in cattle on feed, down 25,000 head, or 9 percent, from prior-year levels. Figure 2 shows the year-over-year percentage change in cattle on feed.

The increase in cattle on feed is likely to continue to press fed cattle prices lower as producers look to move these cattle to the slaughter market in the coming months. Lower fed cattle prices will reduce feedlot margins and increase margins for packers. USDA currently projects 2018 beef production at a record 27.1 million pounds, up 3.6 percent over prior-year levels. 2019 beef production is expected to be a record-high 27.7 million pounds, up 2 percent from 2018 levels.

Top Issues

VIEW ALL