Long-Term Snapshot and Weekly Update on Export Inspections

Megan Nelson

Economic Analyst

photo credit: Getty

Megan Nelson

Economic Analyst

USDA’s long-term trade projections revealed that both U.S. and global commodity exports are expected to increase over the next decade. The generally positive news is somewhat overshadowerd by projections for U.S. soybean exports: As a direct result of retaliatory tariffs on U.S. soybeans, USDA projects the U.S. market share of global soybean trade will fall to 25 percent. Furthermore, USDA analysts don’t expect U.S. soybean exports to reach pre-trade war levels until 2026/27. USDA’s complete “Agricultural Projections to 2028” report, which will be released on March 13, will include a synopsis of the commodity supply and use projections and projections for farm income and global commodity trade.

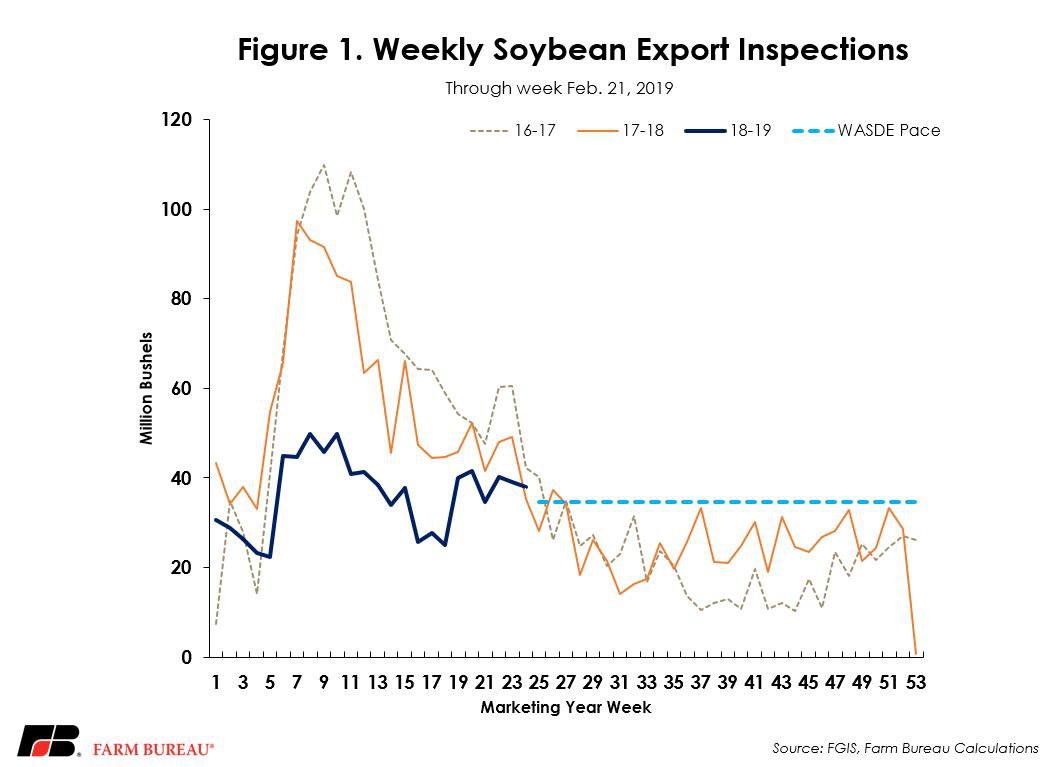

Pace of Soybean Exports

USDA’s Feb. 25 Federal Grain Inspection Service report revealed soybean export inspections at 871 million bushels, down 36 percent from prior-year levels. At the current pace, U.S. exporters still need to export 1 billion bushels in order to reach USDA’s 1.875-billion-bushel projection by the end of marketing year 2018/19. While the soybean market has been experiencing a difficult year overall, the 24th week of the marketing year was a bright spot. It was the first time all year weekly soybean export inspections surpassed prior-year levels, with 38 million bushels inspected for export through Feb. 21, up 3 million bushels from the weekly inspection at the same time last year. Figure 1 illustrates the weekly soybean export inspections through the week ending Feb. 21.

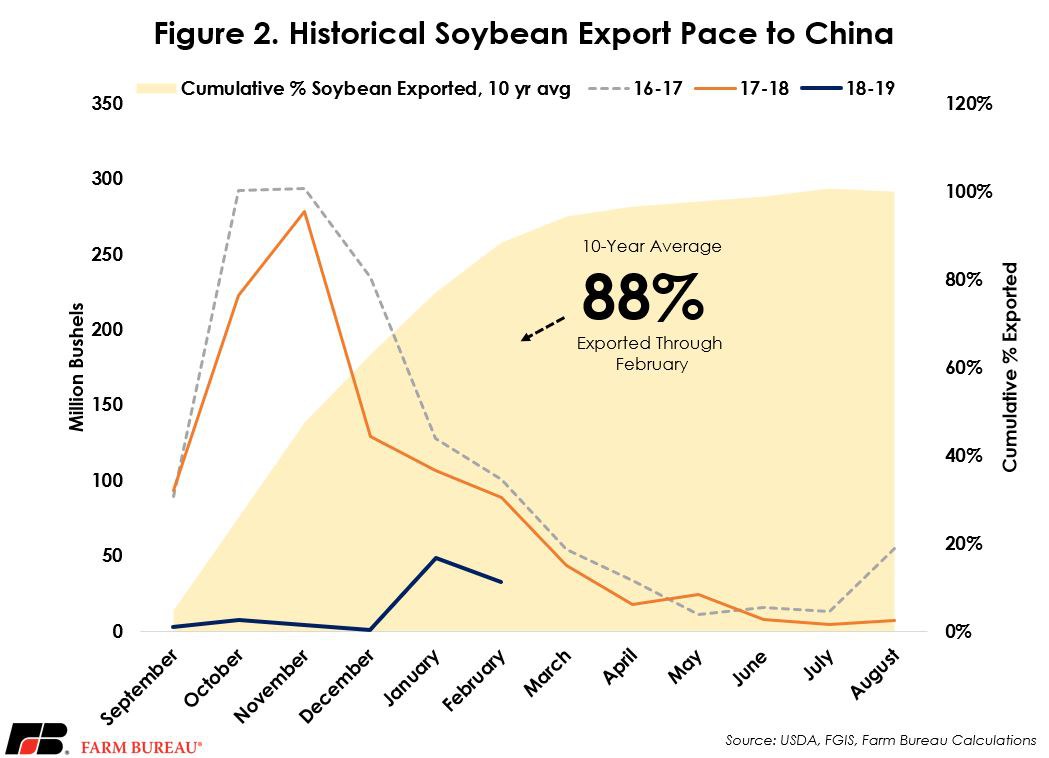

As expected, soybean export inspections to China remain well below average as we move further into the marketing year. The current export inspections total 96 million bushels, well below the billion-bushel average in the prior two marketing years and 807 million bushels below last year. The slowdown in exports to China represent a year-over-year decline of 89 percent. In prior marketing years, 88 percent of soybean export inspections to China occurred through the end of February, Figure 2.

While China has committed to buying an additional 367 million bushels of soybeans, these exports may not occur in the current marketing year, and thus, burdensome inventories could weigh over the market for the months to come.

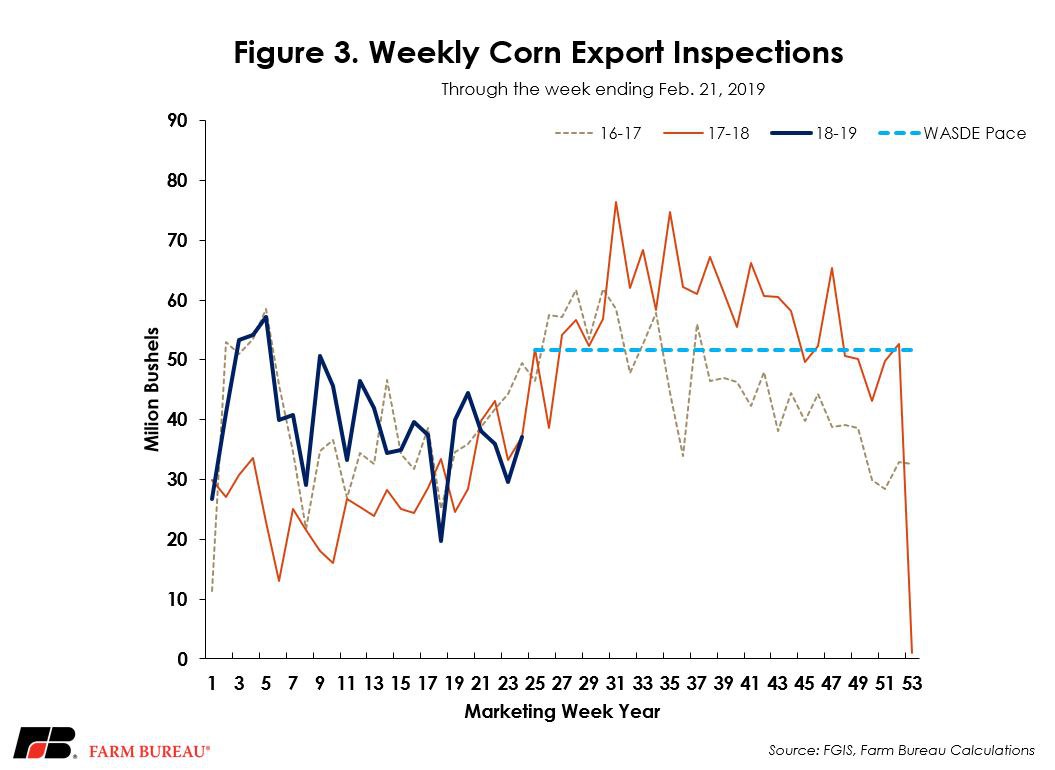

Pace of Corn Exports

Corn export inspections at 952 million bushels continue to be up from prior-year levels, representing an increase of nearly 300 million bushels, or 44 percent,from the same time last year. USDA’s Feb. 25 report revealed weekly corn export inspections increased from 30 million bushels through Feb. 14 to 37 million bushels through Feb. 21, representing a 7-million-bushel increase week-over-week. The current corn export inspection pace for the 24th week of the marketing year is on track from last year’s 37 million bushels, but down 12 million bushels from 2016/17 levels. The latest “World Agricutural Supply and Demand Estimates” report maintained USDA’s projection of 2.45 billion bushels of corn to be exported in marketing year 2018/19, placing the current pace of corn exports at about 39 percent of the way there with over half of the marketing year to go. Figure 3 outlines cumulative weekly corn export inspections through the week ending Feb. 21.

Top Issues

VIEW ALL