Low-to-no Payout Expectations Drive 2020 DMC Enrollments Down

TOPICS

USDAMichael Nepveux

Former AFBF Economist

photo credit: Right Eye Digital, Used with Permission

Michael Nepveux

Former AFBF Economist

Introduction

As we start 2020, we now have two different years of enrollment data for the 2018 farm bill’s flagship dairy deficiency payment program, Dairy Margin Coverage. DMC is a voluntary program that makes payments when the national average income-over-feed-cost margin falls below a farmer-selected coverage level. The margin is the difference between the national average U.S. all milk price and the estimated costs of feeding a dairy cow with corn, soybean meal and high-quality alfalfa hay.

Coverage is available from as low as $4 per hundredweight to as high as $9.50 per hundredweight. Dairy producers pay premiums for coverage with lower premium rates for the first 5 million pounds of milk covered. In signing up for the 2019 coverage year, farmers had two different enrollment options. Farmers could select their coverage options annually or they could select the same coverage level for the 5-year life of the farm bill – with the latter option including a 25% discount on DMC premiums. Under DMC, program payments, which may be triggered monthly, are made if the margin falls below the farmer’s elected coverage level. Program payments are based on the amount of milk covered in the program and may range from 5% to 95% of a farm’s milk production history in 5% increments. Market Intel has published a number of articles delving into the revamped dairy program and its potential benefits.

DMC Enrollment

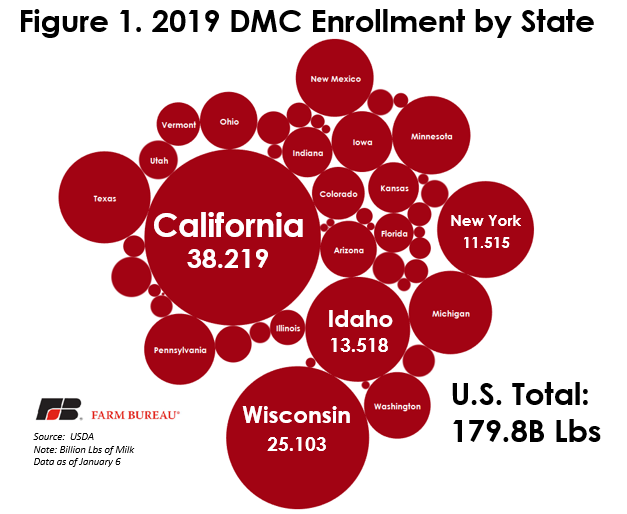

DMC enrollment coverage for 2019 opened on June 17 and, after an extension, closed on Sept. 27. When the deadline for 2019 rolled around, approximately three-quarters of the year had passed so dairy farmers had a very good idea of what the year’s payments were going to be. By that time, farmers enrolling in DMC Tier I coverage at $9.50 were guaranteed a payment above the premium they paid to enroll. Even so, only approximately 82% of the country’s dairy operations enrolled. For 2019, 23,255 dairy operations elected to enroll in DMC, covering approximately 180 billion pounds of milk. California, Wisconsin, Idaho and New York led the way in pounds of milk covered (Figure 1).

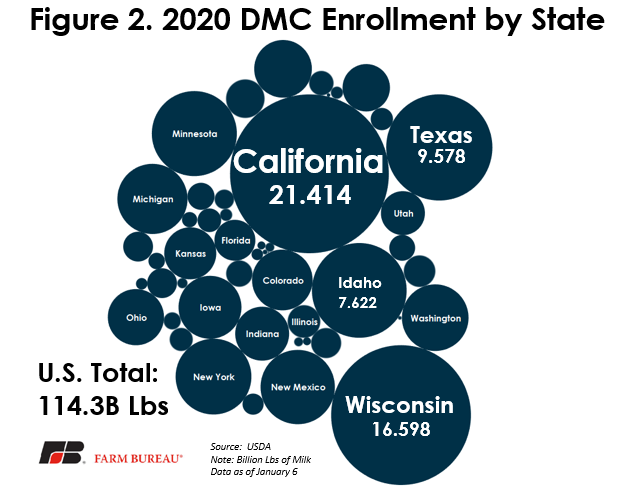

Enrollment for 2020 paints a slightly different picture. With 2020 enrollment running from Oct. 7 through Dec. 20, producers had to make an election without knowing for sure if they would receive a payment. The 2020 DMC enrollment was just 63% of 2019’s enrollment, with approximately 114 billion pounds of milk enrolled. Similar states rise to the top in 2020, with California, Wisconsin and Idaho now joined by Texas as the top states. In terms of the largest percentage decline between 2019 and 2020 enrollment, West Virginia, New Hampshire and Vermont experienced the largest drop in enrollment, with declines of 86%, 77% and 75% respectively.

Expected Payout in 2020

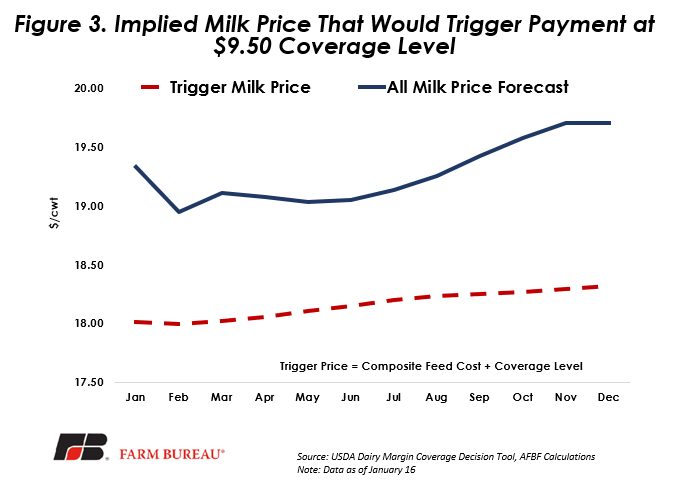

Partly driving the decline in enrollment is the brighter economic outlook for dairy in 2020. In calculating the income-over-feed-cost margin, this year we expect to see moderate strength in corn and soybean meal prices relative to the past few years, while the all milk price is forecast to remain well above 2016-2019 levels, averaging over $19/cwt for 2020 compared to prices mostly hovering in the $15-$17 range since 2016.

This expected $19+ all milk price range contrasts with the calculated composite feed cost forecasted to remain below $9 for 2020. Once we have a forecasted composite feed cost, we can calculate an implied all milk price at various coverage levels that would trigger a payment. For 2020, at the highest coverage level of $9.50, the implied trigger milk price never breaks $18.50, meaning that, absent significant market developments in feed components or milk prices, there is a low probability of DMC payments in 2020. This low expected payout, which producers would have been able to see using the DMC decision tool on the USDA website, is very likely largely responsible for the drop in DMC elections. Although, it is somewhat surprising we did not see more milk enrolled at the catastrophic coverage level, which has a premium of $0 (although there is still a $100/year registration fee).

Coverage level elections

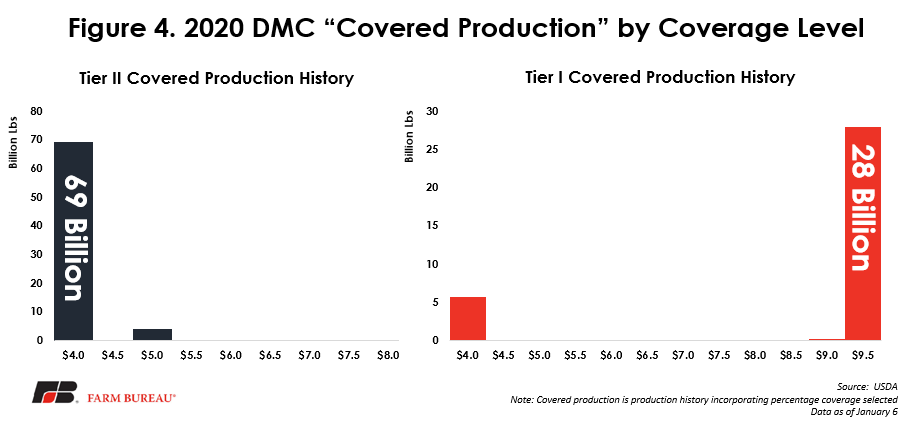

Figure 4 shows how much milk has been enrolled at each coverage level option for 2020 for both Tier I and Tier II. As a reminder, Tier I covers up to the first 5 million pounds of milk (annual output of just over 200 cows). Anything over that must be enrolled in Tier II. In this data, Tier I largely tilts toward the $9.50 coverage level at over 28 billion pounds, with a significant amount, nearly 6 billion pounds, enrolled at the catastrophic level. At first glance, this large enrollment at the highest coverage level is somewhat surprising because, as we discussed earlier, there is little chance of payout for 2020. The answer here likely lies in the five-year lock-in election that producers had the option of signing up for in 2019. Of the 12,943 operations that enrolled in DMC for 2020, 9,347, or 72%, were enrolled in the five-year lock-in election. The data for this is current as of Jan. 15 and can change as more enrollments are sent in from county Farm Service Agency offices, and as operations that are no longer operating are accounted for and removed from the list. Additionally, while the data used in this analysis did not specify coverage level by either lock-in or annual election, the low probability of a payout this year makes it more likely that the lock-in elections are the producers enrolled at $9.50 for 2020. There was a significant incentive potentially driving this lock-in enrollment at $9.50. If producers enrolled in a one-time five-year election, they received a 25% discount on their premiums.

Another feature of the 2018 farm bill was a refund of net premiums paid into the previous Margin Protection Program. Producers had two options, they could either receive 50% of their premiums in a direct cash refund, or they could apply the refund toward their DMC premiums and receive 75% of what they paid into MPP. The deadline for making this decision and filing the necessary form has already passed, but those producers who elected to apply the payments toward their DMC premiums can still use these funds even if they haven’t enrolled in DMC yet. If producers have already filed the proper form and selected this option, the funds will be applied to the first contract year that they enroll in DMC.

Summary

In 2019, DMC payments were triggered in the majority of months, resulting in program payments that exceeded premiums for the highest coverage level and a positive return on the premium for those farmers who elected to participate. In 2020, however, the probability of even one monthly payment is very low due to brightening expectations in milk prices. Even so, farmers are enrolling in the program, either at the free catastrophic coverage level, or at higher levels if they elected for the five-year lock-in option.

Top Issues

VIEW ALL