Milk Price Differentials Long Overdue for an Update

photo credit: Getty

Daniel Munch

Economist

On Aug. 23, USDA began hearing testimony on proposals to amend the Federal Milk Marketing Order system. Now reconvening in week nine of testimony, 21 submitted proposals continue to be discussed and examined by USDA and dairy industry stakeholders. Testimony on category five, which covers Class I and II differentials, is currently being heard. Many dairy and farmer organizations argue that the current values used in Class I milk differentials are long overdue for an update based on changes in milk market production characteristics and changes in delivery costs, and Farm Bureau has taken a lead in advocating for raising the Class II milk differential.

Background

The Federal Milk Marketing Order system establishes provisions under which dairy processors purchase milk from dairy farmers supplying specific marketing areas. One of the primary functions of the federal order structure is the calculation of minimum uniform prices paid to farmers. USDA does this by attempting to calculate the value of raw milk used in a dairy product based on the value the dairy product garners in the marketplace (its end use).

Currently, the FMMO system categorizes milk in one of four classes, based on what dairy products it is used to make. Each class of product has a different value in the market; the system is intended to ensure that the price dairy product manufacturers pay reflects the final market value of those goods. The four class prices are as follows: Class I – milk used for beverages; Class II – milk used in soft products like ice cream, sour cream and cottage cheese; Class III – milk used in hard cheese and spreadable cheeses; and Class IV – milk used to produce butter or powdered dairy products. USDA uses the value of sold commodity dairy products and works backward to determine the value of raw milk in those products. The primary reason for using a classified pricing system is that it promotes raw milk price equity among handlers and farmers. The intention is to ensure handlers in a similar location and who produce similar products pay the same minimum classified price for the raw milk and that farmers producing milk in the same area receive the same price (i.e., uniform pricing). Class price formulas include various numerical factors meant to best derive the value of the corresponding milk, one category of which is differentials.

Class I Differentials

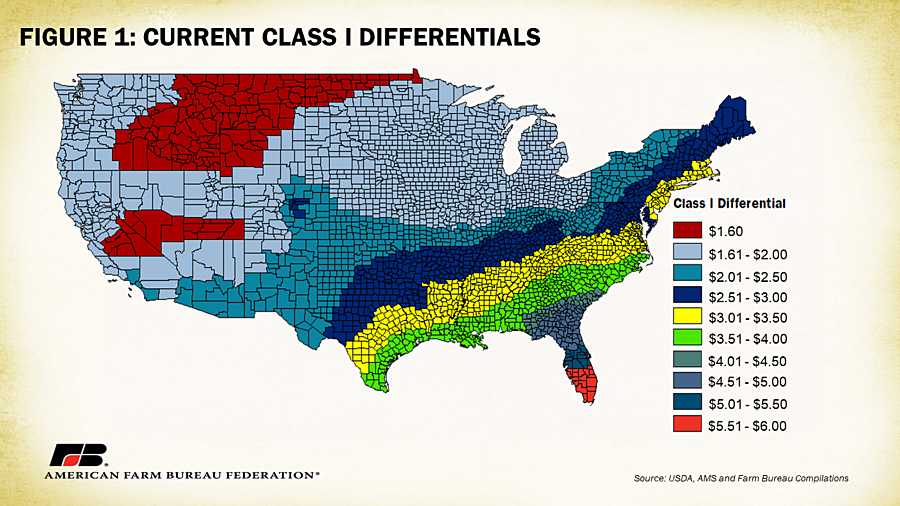

Class I location differentials, fixed values currently ranging from $1.60 per hundredweight to $6 per hundredweight, are a vital element of the Class I beverage milk price formula. Every U.S. county is assigned a Class I location differential based on the supply and demand characteristics of the region. Perishability concerns have historically steered milk marketing dynamics and continue to play a role in how efficiently milk must be hauled from the farm to a processing site. To support production and marketing in milk-deficit regions, location differentials are added to the base value of Class I milk to determine the total class value. The higher the Class I differential, the higher the usual deficit of fluid milk availability (and associated cost of transportation) in a region compared to local demand from nearby cities or processing capacity. For example, in counties located in the southern tip of Florida, where resident populations and corresponding dairy demand are very high, local production is comparatively low, and available supplemental supplies are relatively far away, current Class I differentials range between $5.51 and $6.00 per hundredweight. In the upper Midwest, where local production is very high and residential demand comparatively lower, current Class I differentials range between $1.61 and $2.00 per hundredweight. In parts of the upper West (spanning from western Oregon to Northwest Minnesota), central California, Nevada and Utah where local residential demand (and population) is extremely low and local production is often extremely high, current Class I differentials (for milk participating in an order) are $1.60 per hundredweight. The distribution of differentials is meant to incentivize movement of milk to where it is demanded and assist in maintaining regional production capacity.

The current Class I differentials were established in 1998 with only a minor update in 2008 to the Appalachian, Florida and Southeast orders. Those changes were based on a linear programming transshipment model of milk supply and demand. The U.S. Dairy Sector Simulator model from Cornell University estimated shadow values at U.S. milk processing locations. Shadow values effectively represent the cost to the entire transportation system of supplying an additional hundredweight of milk at a milk processing location and were the basis for the current Class I location adjustments. The model takes the total milk supply, plant locations and product mix, and consumer demand as observed for an individual month. The authors note the model also “indicates how to move milk to plants via the existing road network and distributes the finished products to consumers also according to the road network.” In this manner, fuel costs and the basic per-mile cost of hauling milk are two of the key original determinants of Class I differentials, though differentials are never meant to completely cover the cost of transporting milk.

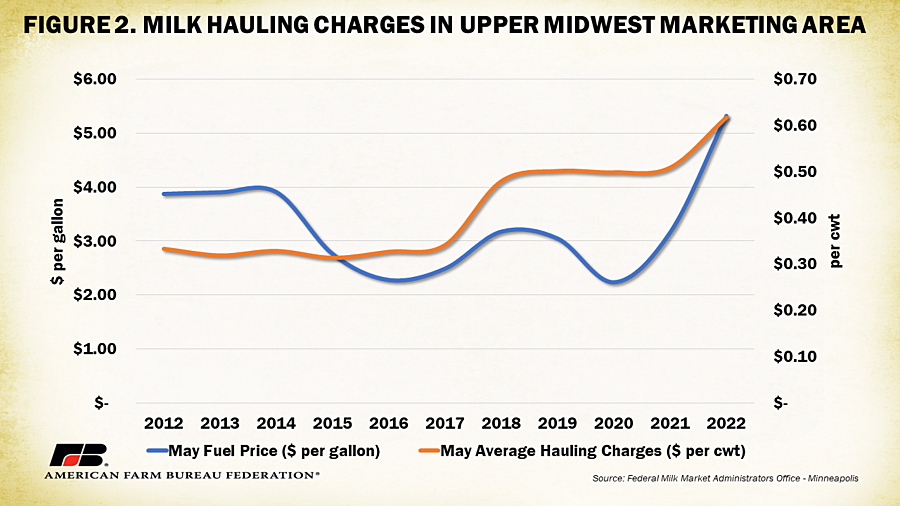

Many of these factors used to estimate current differentials have since changed, to the point that current differentials no longer reflect the cost of ensuring an adequate supply of milk to many plants. This results in disorderly marketing of milk, a condition the FMMO system is fundamentally meant to prevent. For example, policy challenges have reduced the number of hours truck drivers can work, increasing the number of drivers needed to move the same quantity of milk and the corresponding money needed to pay them. Changes in weight limits, increases in value and prevalence of road tolls, and the increased cost of vehicles, maintenance and repair have further pressured transportation costs. The National Milk Producers Federation (NMPF) noted that the cost of hauling milk has almost tripled since the majority of current Class I differentials were established. Hauling costs in the late 1990s and early 2000s were equivalent to approximately $0.347 to $0.388 per hundredweight per 100 miles. Today that cost has increased to between 92 cents to $1 per hundredweight. The Federal Milk Market Administrator’s Office for the Upper Midwest Marketing Area released a staff paper earlier this year reviewing hauling charges. Since 2012, May average hauling charges have nearly doubled from $0.3328 per hundredweight to $0.6177 per hundredweight in 2022. During the same period the May fuel price per gallon increased from $3.88 to $5.32 – up 37%.

Hauling charge increases of this magnitude in a region with generally reliable processing capacity and milk freight infrastructure likely signal even higher increases in deficit regions. One interesting example, in the Florida Order (the order most distant from reserve milk supply), dairy farmers used to benefit from regular backhauls (return trip) of bulk concentrated orange juice. A diminishing citrus industry across the state has mostly eliminated the availability of these backhauls, drastically reducing transportation availability and increasing costs for dairy suppliers. Meanwhile, the migration of residents from northeastern states into southeastern states and an increase in suburban sprawl have further increased demand for products in supply-deficit areas. These conditions have posed a true threat to the availability of Class I milk in many federal orders, a threat differentials are meant to neutralize.

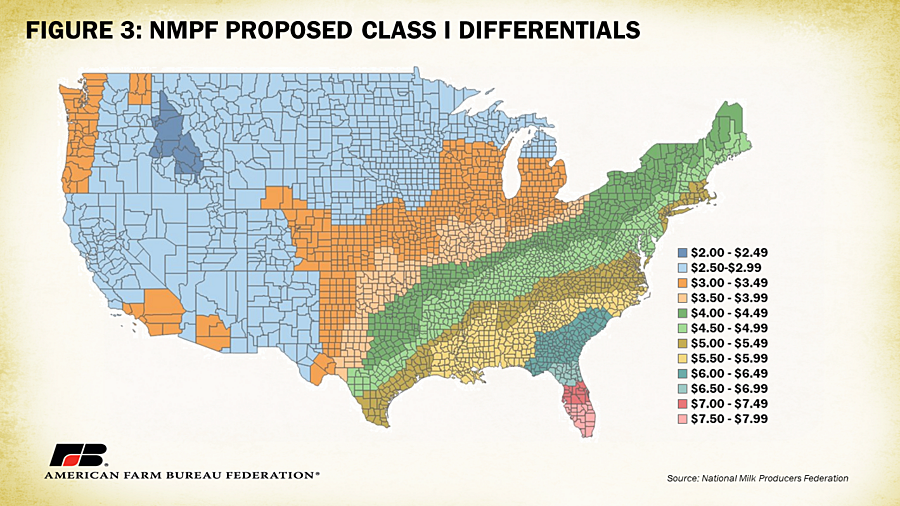

NMPF has proposed increases to Class I differentials in all counties. The basis of their proposed increases follows the previous spatial modeling approach completed by Cornell University but updated by the University of Wisconsin using 2021 model input data. Their proposal notes that the model was greatly expanded to include additional supply and demand points and more point-to-point road mileage options. The calculated values were used as a starting point which NMPF adjusted with a “variety of real-world milk movement considerations.” The new Class I surface proposal by NMPF is displayed in Figure 3. You will notice the general geographic distribution of differentials from high to low parallels that of the current Class I map.

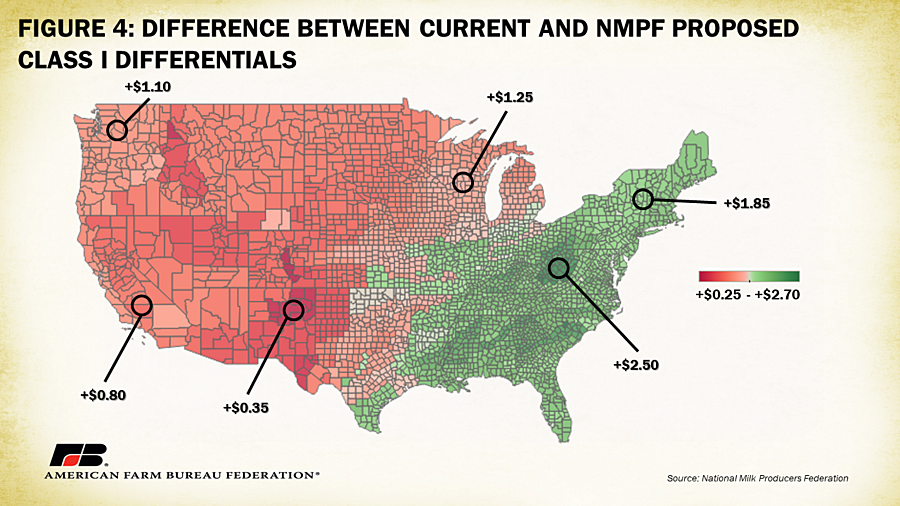

The average proposed increase in differential is $1.50 per hundredweight with a range of plus 25 cents to plus $2.70 per hundredweight. The smallest proposed increases occur in northwest New Mexico, central Colorado and northern Idaho, while the largest proposed increases occur in Appalachia such as central West Virginia as well as parts of the Southeast. Figure 4 displays the differences between the current Class I differentials and proposed NMPF differentials. Note there is a positive increase across the board, counties shaded red have a smaller increase and counties shaded green have a larger increase. NMPF will testify in support of the general increase, recognizing that their adjustments from the model are a reasonable attempt to bring the model results into alignment with practical needs, but trusting in a fair and effective decision by the staff at USDA’s Agricultural Marketing Service, who will make recommendations based on all of the testimony provided by stakeholders. In other words, final differential values will likely vary from those displayed above.

The American Farm Bureau Federation supports updating Class I differentials. In expressing support for NMPF’s proposal, AFBF has also indicated the need for a review of the anecdotal adjustments made to University of Wisconsin model results. In the additional proposals stage of the current Federal Milk Marketing Order hearing process, AFBF submitted a proposal to implement seasonal Class I differentials. Just as there are geographic differences in the value of milk, there are seasonal differences. In many markets, and particularly in the southeastern markets, the location value of milk can vary enormously from season to season. Milk supplies can be like an ocean, ebbing and flowing depending on the month. Class I prices that are too high for the flush season can draw too much milk into a high Class I region, without necessarily serving the market at all. Similarly, Class I prices that are too low in late summer or early spring can fail to attract enough milk to meet the basic needs of a market. Seasonal Class I differentials can incentivize milk movement when and where it is actually appropriate, reduce conditions where milk is pooled on other orders and better supply short markets by setting the right price in the right place at the right time.

Seasonal Class I differential pricing has been discussed for decades, the appetite to consider it further has, perhaps, been held back by difficulty in establishing a formula. USDA declined to further consider AFBF’s proposal in the current hearing process, citing a lack of developed process at this time. However, the significant challenges of meeting milk supply needs in the late summer and fall could support the use of the economic model results for the fall.

Other groups, such as the Milk Innovation Group, which represents several large milk processors, are advocating for a dramatic reduction in Class I differentials, opposing the sentiment of many farmer-led groups. Notably, these advocates have cited the general increases in costs as a reason to increase make allowance formula factors but they would not give the same scrutiny to cost increases that impact Class I differential values.

Class II Differential

The formula used to calculate Class II prices, which, as noted above, includes milk used in soft products like ice cream, cottage cheese and sour cream, includes a Class II skim milk differential of 70 cents per hundredweight. This factor is added to the advanced Class IV price for both Class II skim milk and butterfat, as shown here.

This current Class II differential was developed during order reform, at the turn of the century, to reflect the cost of drying and rewetting milk. The assumption at the time was that many Class II products could be manufactured by the drying and rewetting of Class IV milk, a condition that could lead to uneconomic movement and processing of milk, and the loss of Class II revenue to producers, if the Class II differential was too high. To help disincentivize Class IV milk from being used for Class II purposes, the costs associated with the drying and rewetting process were estimated and included (at 70 cents per hundredweight) to reflect the higher value of Class II milk. In other words, the price processors would pay for Class II milk would be increased to a point that helps maintain the availability of Class II milk. Given the changes in processing expenses acknowledged by many of the considered proposals, including the Class I differential proposals discussed above, AFBF proposed to update the Class II differential to better align current class prices as originally intended.

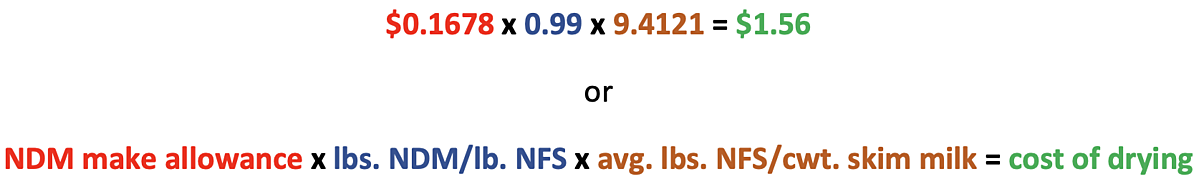

Some processors have argued that powder is not rewetted for most uses, so the minimum cost of rewetting is not an appropriate consideration for such a calculation. For this reason, AFBF proposed to include only the cost of drying in setting the Class II differential. AFBF supports cost-based formula factors such as yield factors, make allowances and differentials being based on mandatory and audited surveys of processors as described here. Since such a survey is not yet available, AFBF contends the differential can be updated using the current make allowance for nonfat dry milk, together with the current nonfat solids yield factor and updated butterfat and nonfat solids tests for milk in the federal order system. The cost of drying skim milk can then be calculated as:

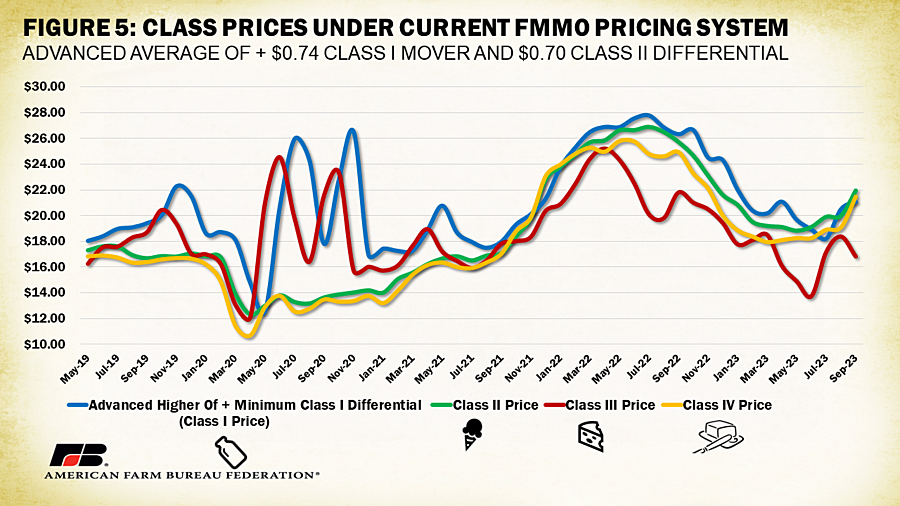

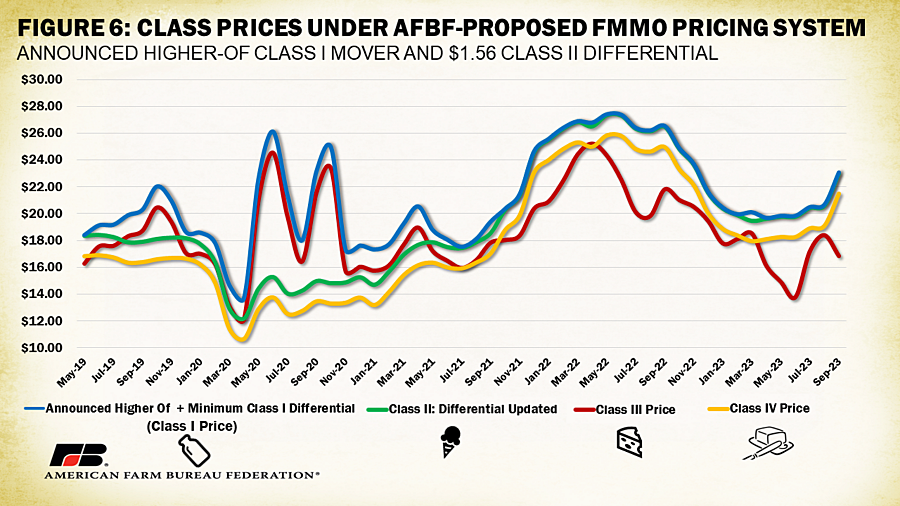

In this case, the Class II differential would be increased from 70 cents to $1.56 with the intention that any future increases in the nonfat dry milk make allowance should result in a corresponding increase in the Class II differential. Setting the Class II differential with the make allowance for Class IV skim milk could be acknowledged as a fair way to meet the purpose of incenting the availability of Class II milk in the marketplace. The impact of this change would increase the minimum order value of the Class II skim milk price by 86 cents per hundredweight, increasing the average pool value in every market and reducing the likelihood of negative producer price differentials (PPDs) and associated de-pooling. There were 14.2 billion pounds of Class II milk pooled in 2022; therefore, in a static analysis, the value of pooled milk would be increased by $122 million. The $1.56 differential is lower than the lowest current Class I differential ($1.60), so, combined with a return to the “higher-of” Class I price formula, the proposed change would maintain Class I prices above Class II every month. The comparison between current federal order pricing regulations, which include advanced pricing average-of +74 cents for Class I and a 70 cent differential for Class II, and federal order pricing regulations under a system of advanced higher-of pricing and a $1.56 Class II differential are displayed in figures 5 and 6, respectively. Please note, the Class I price series in both figures include the current lowest Class I differential of $1.60. Combined, the adjustments ensure Class I remains the highest value while keeping Class II and Class IV prices unentangled, better supporting orderly marketing conditions and reducing incentives for de-pooling and associated negative PPDs.

Summary

The Federal Milk Marketing Order system establishes provisions under which dairy processors purchase milk from dairy farmers supplying specific marketing areas. Two of the primary functions of the federal order structure are to provide a calculation for minimum uniform prices paid to farmers and to incent orderly marketing of milk. Recent price conditions have revealed disorderly marketing is present when producers do not receive uniform prices because of outdated formula factors and frequent de-pooling. The current Class I and II differential values contribute to disorderly market conditions and the frequency and magnitude of de-pooling. Given the rising costs facing producers and processors alike, increasing both Class I and II differentials is necessary to modernize the federal order system in a way that farmers are paid fairly and accurately and in a manner that supports a reliable and sufficient supply of milk for consumers across the nation.

Top Issues

VIEW ALL