Net Farm Income Does a Dead Cat Bounce

Bob Young

President

photo credit: North Carolina Farm Bureau, Used with Permission

Bob Young

President

A common phrase used often when talking about markets that recover slightly after a precipitous drop is “dead cat bounce.” A quick Google search suggests it was coined following a slight recovery after a large market drop in the Singapore and Malaysian markets. The idea is that if you throw even a dead cat on the ground, it will bounce a little.

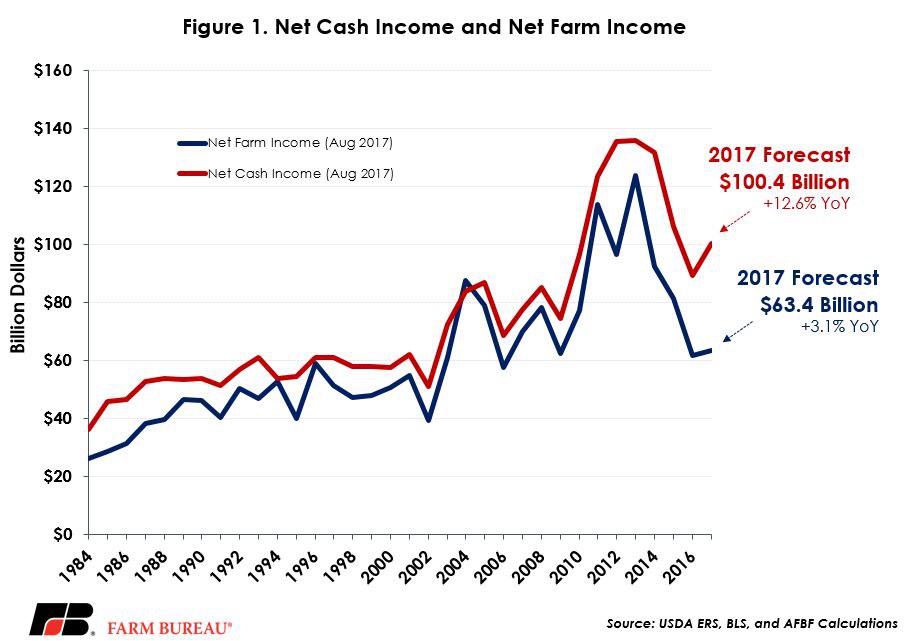

Farm incomes in 2012 and 2013 were high relative to historical standards, but have dropped substantially since then. The recent projections of farm income released by USDA’s Economic Research Service in their 2017 Farm Sector Income Forecast suggest that we may have hit bottom in 2016 and are looking at an uptick in both net farm and net cash income in 2017 to $100.4 billion and $63.4 billion, respectively Figure 1.

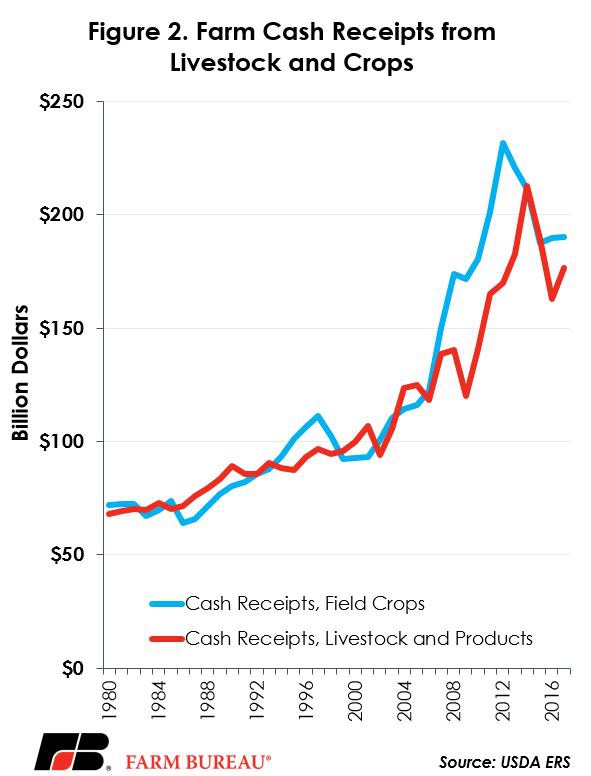

ERS last released farm income projections at the end of February, so it is interesting to compare and contrast this projection versus their earlier forecast. Both crop and livestock sectors are projected to have higher cash receipts than ERS projected in February. Crop cash receipts are now projected at $190 billion versus $187 billion earlier this year, an increase of 1.6 percent. The changes in crop cash receipts are spread throughout a number of crops and are all relatively minor.

The big change in expectations for farm cash receipts comes on the livestock side. Livestock cash receipts are now projected at $176 billion, compared to $168 billion in February, an increase of 4.8 percent, Figure 2. Cattle cash receipts are now projected $4 billion higher than in February, with hogs and poultry up by $2 billion and just under $2 billion, respectively. Despite projections for higher milk prices, dairy receipts are surprisingly slightly lower than February figures.

Cash expenses are also essentially unchanged from the earlier figures and still hold at $309 billion. While up $5 billion from 2016 costs, cash expenses are $30 billion below that observed in 2014. But do not forget that one of the larger categories of cash expenses are feed costs – money that comes out of one of agriculture’s pockets only to go into another.

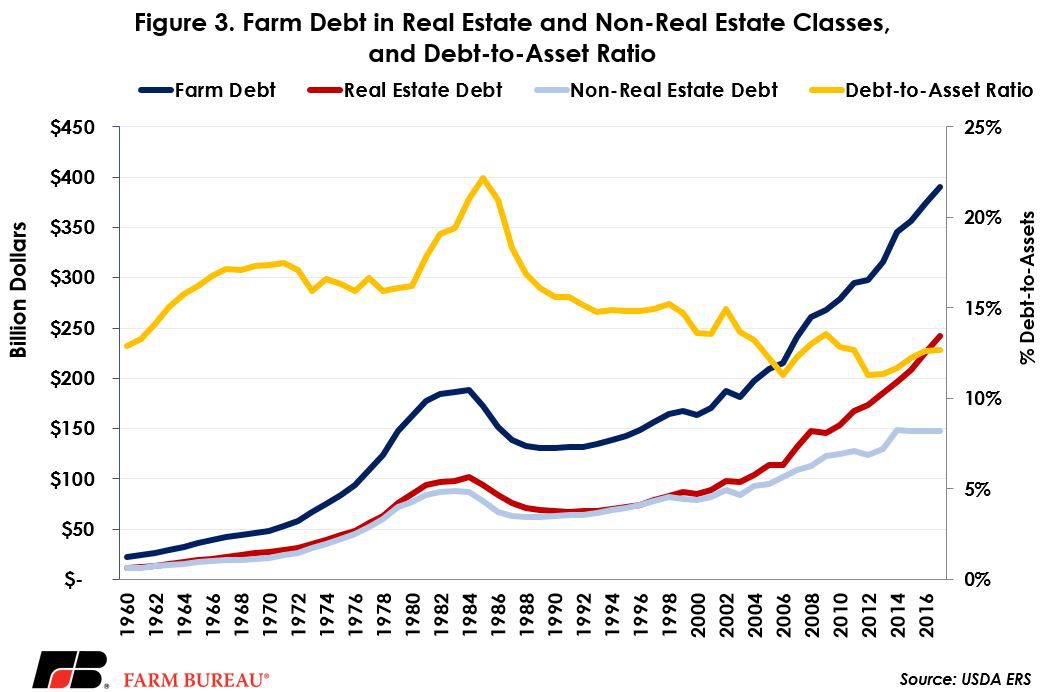

One other interesting feature of the August numbers is on the debt side. Total farm debt is projected at a record-high at $390 billion, with $242 billion representing real estate debt and $148 billion representing non-real estate debt, Figure 3. An interesting observation on the non-real estate debt is that ERS projected this figure $7 billion lower this month than they did earlier this year - $148 billion as opposed to the earlier $154 billion figure. No details are provided to back up the change but it does suggest farmers and ranchers are continuing to keep an eye on the debt side of the ledger. The net impact of lower debt levels and higher farm income in 2017 is the debt to asset ratio in 2017 is projected at 12.68 percent, marginally higher than 2016, but well below levels experienced in the 1980’s.

Top Issues

VIEW ALL