New Report Details Drivers of First Quarter GDP Growth

Bob Young

President

photo credit: AFBF Photo, Morgan Walker

Bob Young

President

The economy grew at a real rate of 3.1% in the first quarter of 2019, the Bureau of Economic Analysis reminded us last week. Though we knew the topline numbers related to how the economy performed January through March, the most recent industry report gives more detail.

At the headline level, goods-producing industries – agriculture, forestry, fishing, hunting, mining, construction and manufacturing – provided 0.86% of the growth in gross domestic product. In this column, all discussion of GDP growth will be in real terms. The service-producing industries, which are pretty much everything else – utilities, wholesale and retail trade, transportation, warehousing, information, finance, insurance, real estate, rental and leasing, professional and business services, educational services, health care, social assistance, arts, entertainment, recreation, accommodation, food services and other services except government – combined to grow the overall economy by 2.36%.

The idea of changes in GDP accommodating for inflation is key for the goods-producing segment, in particular, this quarter. The actual gross value of output for the goods-producing sector fell by $53 billion (from $9.129 trillion to $9.076 trillion), but the price index used to "deflate" these terms dropped by just over a full percentage point, increasing the real value by more than the decline in the gross. That sounds a little confusing, but the mining sector alone makes this clear.

The gross value of the mining sector in the fourth quarter of 2018 was $655 billion. It dropped to $612 billion in the first quarter of 2019. The price index, however, dropped by 41% over the same period. Think about that for just a moment. The price of the good drops by 40%, but the actual dollar amount falls by only 6.5%. That can only happen if the real value of output increased significantly.

Agriculture – a goods-producing industry – did not fare so well in the first quarter of 2019. The price index for agriculture, forestry, fishing and hunting was essentially unchanged, with the gross value of output down by $2 billion ($447 billion to $445 billion).

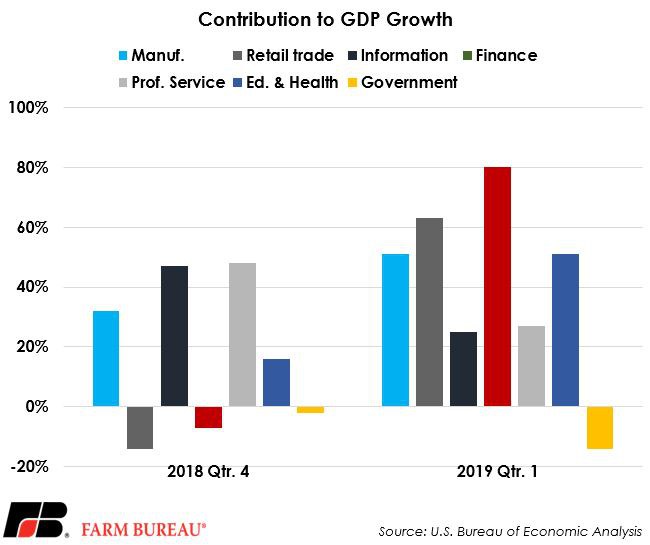

The three big contributors to GDP growth were manufacturing, retail trade and finance. Manufacturing boosted the GDP by 0.5%. The split between durable and non-durable goods manufacturing was 0.1% and.4%, respectively. Retail trade, which has shown erratic behavior over the last few years, actually added 0.6% in the first quarter of 2019. The finance, insurance, real estate, rental and leasing group stepped up with a strong 0.8% contribution. This category alone accounted for over 25% of the growth in the economy in the first quarter.

Again, this is look-back data, almost four months old at this point. In a sense, it is nice-to-know information, but not something one would use to drive a change in monetary policy. It does show clear evidence of how broadly based the uptick in economic performance was in the first quarter of 2019.

Top Issues

VIEW ALL