Placements Were the Wildcard Leading Up to October Cattle On Feed Report

TOPICS

USDAMichael Nepveux

Former AFBF Economist

photo credit: Right Eye Digital, Used with Permission

Michael Nepveux

Former AFBF Economist

The Cattle on Feed report provides monthly estimates of the number of cattle being fed for slaughter. For the report, USDA surveys feedlots of 1,000 head or more, as this represents 85% of all fed cattle. Cattle feeders provide data on inventory, placements, marketings and other disappearance.

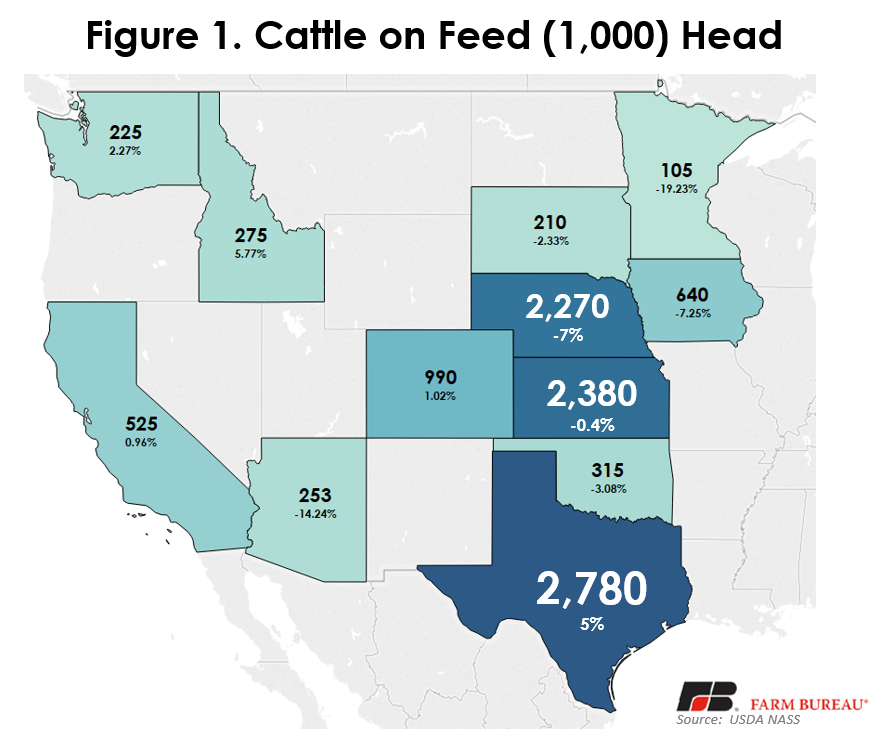

The report showed a total inventory of 11.278 million head for the United States on October 1. This year-over-year decrease of 1.1% is right on the dot of analysts’ expectations, which also anticipated an average decrease of 1.1% in feedlot inventories.

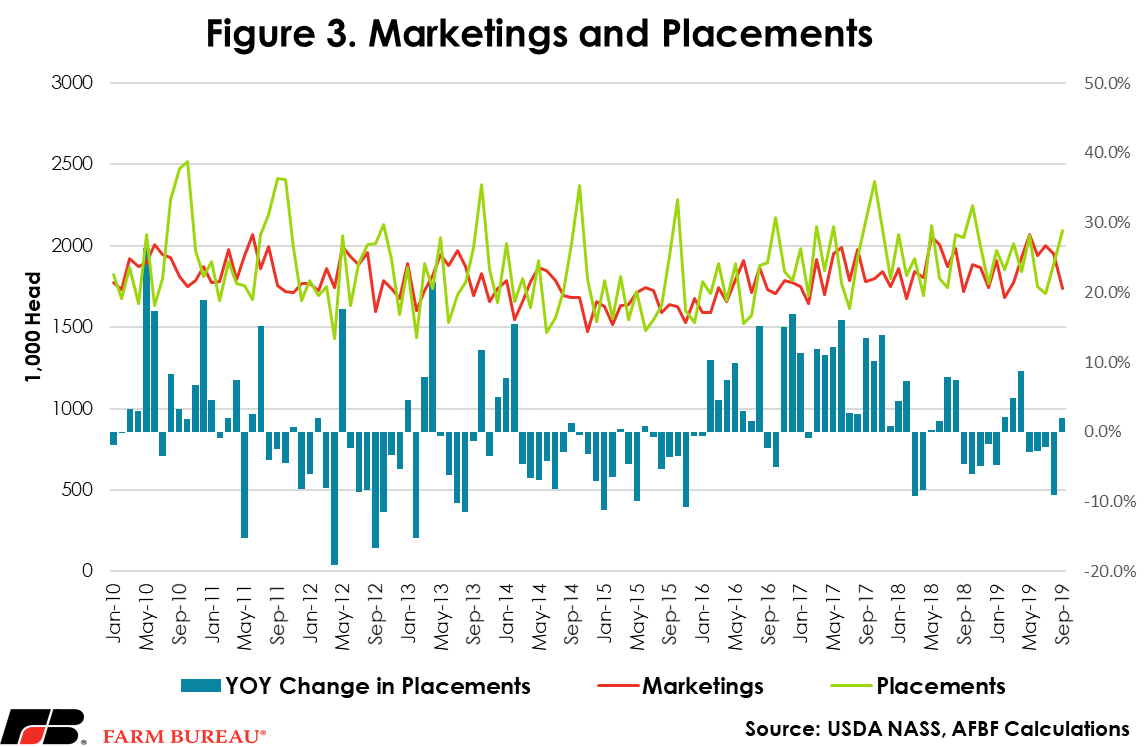

While total inventories are an important component of the report, other key factors include placements (new animals being placed on feed) and marketings (animals being taken off feed and sold for slaughter). This report came out at a time of some uncertainty in the market, particularly in placements. In terms of placements this September, analysts predicted an average 1.5% increase from August 2018. However, there was a great degree of uncertainty in analysts’ expectations for the placement number, resulting in a very large range of a 4.9% decrease to an 7.6% increase. Placements in September totaled 2.093 million head, which is 2% above 2018 levels. The number of placements came in slightly above the average analyst forecast, but remained well within the large range. September’s number breaks the four-month streak of year-over-year declines in placements.

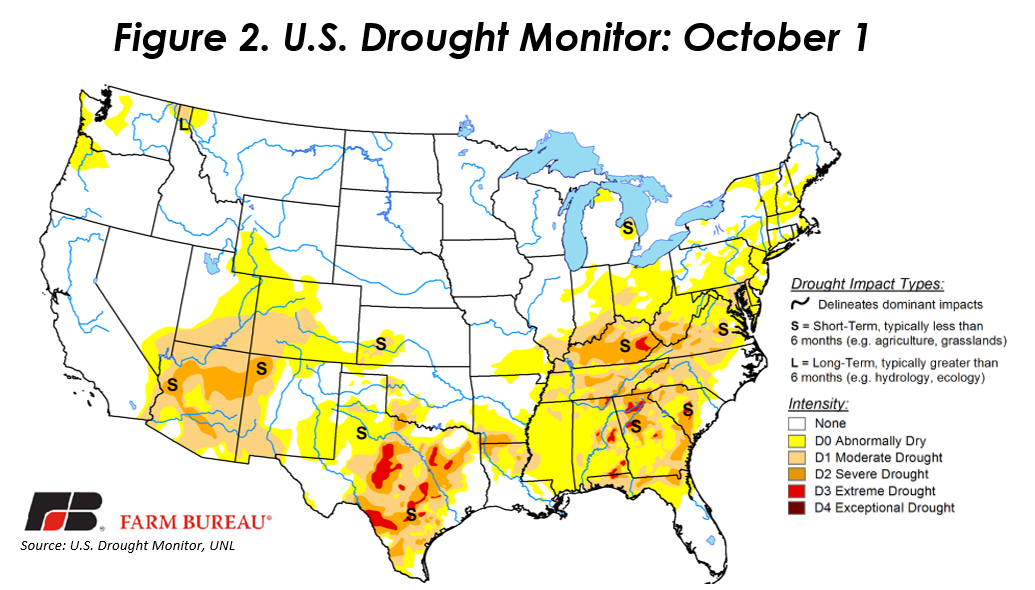

Many factors contributed to the uncertainty surrounding analysts’ estimates. Feeder and fed cattle prices have largely recovered since the August fire at Tyson’s packing plant, which some thought could mean the market was in a better place to pull more animals through the system. Drought conditions in key cow-calf regions in the U.S., as shown in Figure 2, are another key variable that could potentially impact placements. Drought across parts of Texas and the Southeast could have forced producers to pull animals off of pasture early to place on feed, which could have increased the number of feeder cattle on feed in the lighter weight categories. This report somewhat confirmed this theory, with larger increases in placements occurring in lighter weight classes year over year, as well as month over month, for the most part. Although, placements were up month-over-month in all weight classes. Month-over-month increases were highest in the 600-699 lbs category, coming in at an increase of 55,000 head.

Marketings in September were 1.738 million head, up 1.1% from a year ago, matching the average analyst expectation of a 1.1% increase.

Top Issues

VIEW ALL