Potential Aluminum and Steel Tariffs Bring Angst to Farm Country

TOPICS

Trade

photo credit: Getty

Veronica Nigh

Former AFBF Senior Economist

Stop us if you’re heard this one before – a farmer, a heavy construction equipment operator and a vegetable canning company worker walk into a Senator’s office concerned about the impact potential tariffs on aluminum and steel imports would have on their business. This isn’t the setup to a bad joke; it’s what occurring today in Washington, D.C., after a March 1 announcement by the administration that tariffs of 25 percent and 10 percent may be applied to imports of steel and aluminum, respectively. The contractor is concerned because the price of steel impacts the cost of completing a construction project such as a bridge or high-rise condominium. The aluminum canning plant worker is concerned because the additional cost of aluminum could result in an increase in the cost of canned vegetables to customers. The farmer, who exports a large share of agricultural production to customers all over the world, is concerned that the foreign governments affected by the steel and aluminum tariffs will retaliate by increasing import tariffs on U.S. agricultural goods, making U.S.-sourced foods less competitive.

All of the visitors to the senator’s office make good points. However, here we focus on the farmer. According to industry publications, many of America’s farmers’ top international customers are also top producers of aluminum and steel. Table 1, with data provided from the U.S. Geological Survey, lists the top aluminum producing countries in 2016 and 2017. Table 2, with data from worldsteel.org lists the top steel producing countries in the same years. Followers of U.S. agricultural trade will notice several important trading partners among the list.

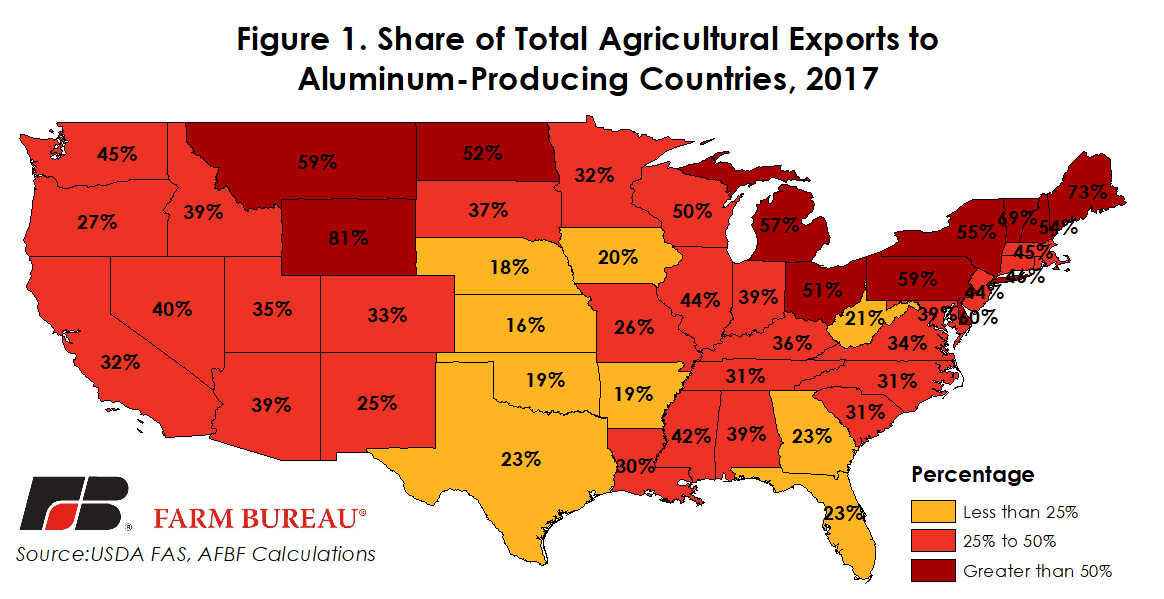

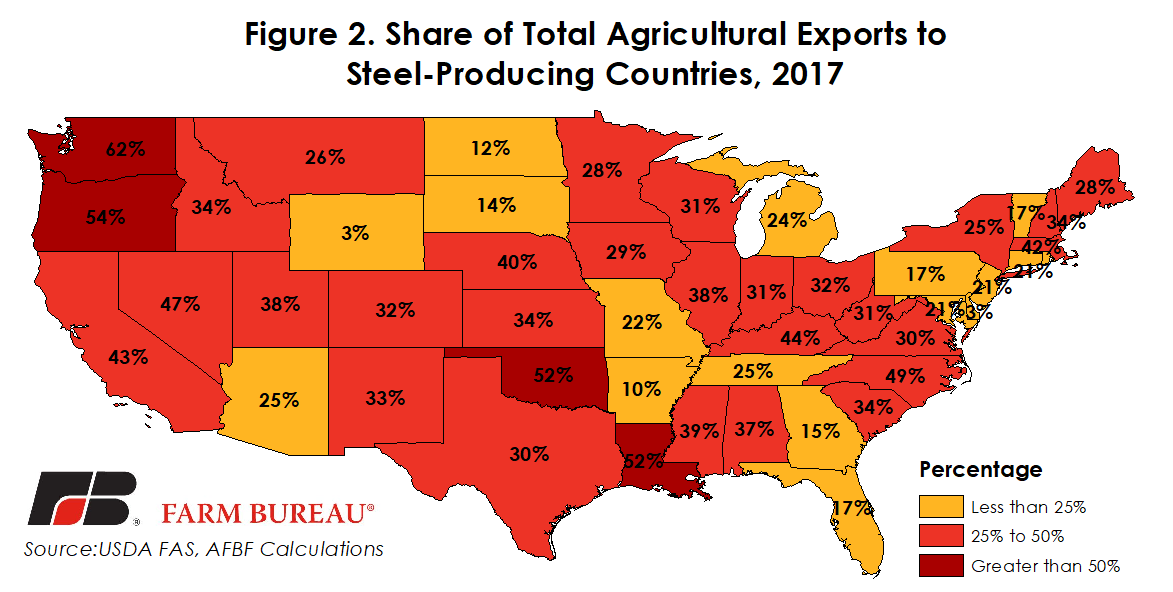

A review of trade data from USDA’s Foreign Agricultural Service reveals that, the farmer in the senator’s office has the right to be concerned. Overall, 33 percent of U.S. agricultural exports in 2017 went to the top aluminum-producing countries. Even more stark, 39 percent of U.S. agricultural exports in 2017 went to the top steel-producing countries. Figures 1 and 2 show that for many states the stakes are even higher.

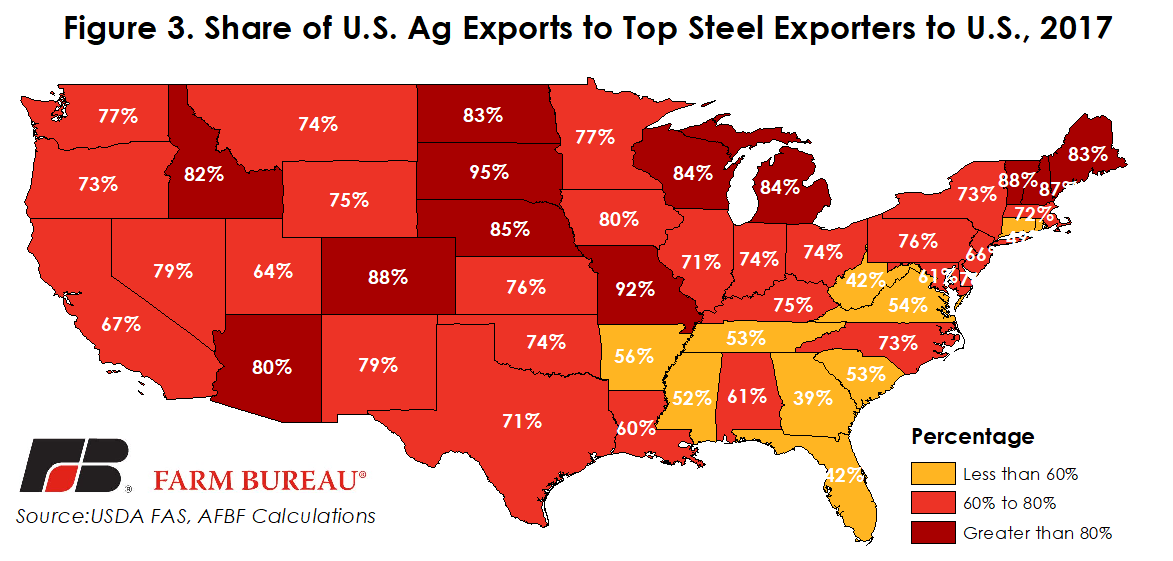

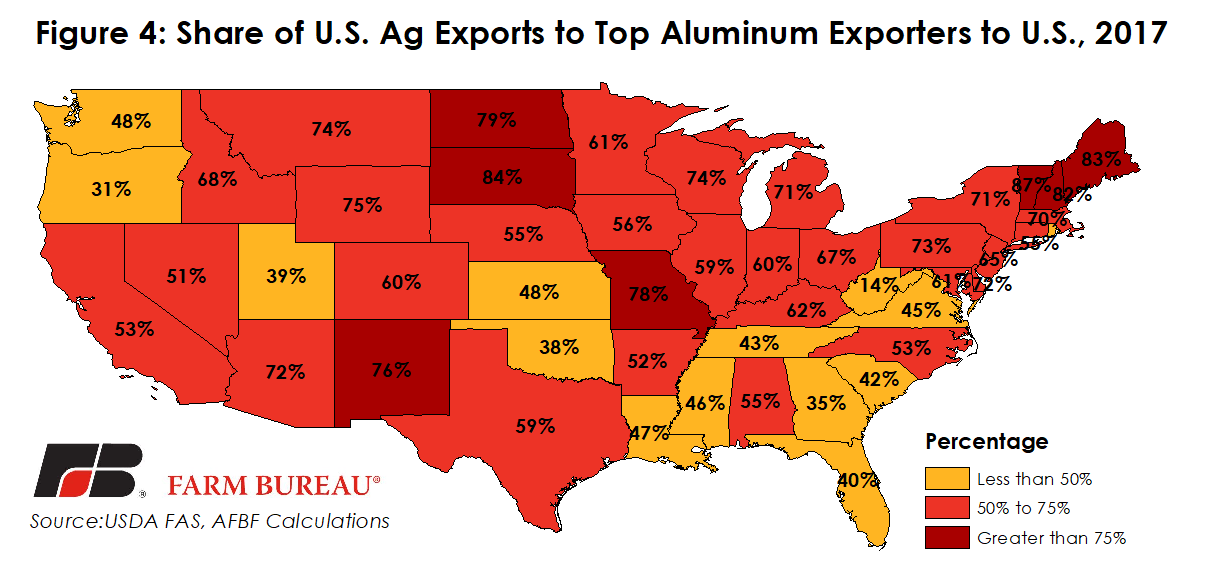

Sometimes, however, the country that produces the most of a particular item isn't as important as the country that produces a specific type of product, closer. A review of U.S. steel and aluminum imports reveals that the U.S. imports a large quality of steel and aluminum from a number of countries that are not global top producers. The two that have garnered the most attention are Canada and Mexico. In 2017, Canada was far and away the largest exporter of both steel and aluminum to the United States. Mexico was a top five exporter of both aluminum and steel. But it doesn't stop there - both Japan and Taiwan, important market for U.S. agricultural exports were also among the list of the top ten exporters of steel in 2017. What does this all mean? It means that the share of U.S. agricultural exports that could potentially be subject to retaliation grows dramatically. About 70 percent of U.S. agricultural exports in 2017 went to countries that are top steel exporters to the U.S. Slightly lower, but still dramatic, more than 50 percent of U.S. agricultural exports in the same year went to countries that are top aluminum exporters to the U.S. Figures 3 and 4 highlight the potential impact at the state level.

The farmer is concerned because a lot of his business is on the line. And as the Farmers for Free Trade pointed out on Thursday,

“The agriculture sector knows from experience that our ag exports are the first to be hit by retaliation. Whether it's our chickens in retaliation for tariffs on Chinese tires, or U.S. apples and wine exports as a result of a Mexican trucking dispute, historically, agriculture always has the biggest target on its back.”

Brian Kuehl, Executive Director of Farmers for Free Trade

In fact, FFT put together a report in February that outlined how agriculture is targeted in trade disputes. Details on what the White House has in mind are expected later this week. But for now, the farmer, the construction worker and the canning plant worker wait with baited breath.