Reviewing Price Loss Coverage and Agriculture Risk Coverage for Seed Cotton

TOPICS

Market Intel

photo credit: Alabama Farmers Federation, Used with Permission

John Newton, Ph.D.

Vice President of Public Policy and Economic Analysis

The Bipartisan Budget Act of 2018 expanded eligibility for Title I farm programs to cotton producers by designating seed cotton, i.e., a combination of cotton lint and cottonseed, a covered commodity beginning with the 2018/19 marketing year ((Seed) Cotton is Back in the Farm Bill). Cotton producers with generic base acres have until Dec. 7 to enroll in either the Price Loss Coverage program or the Agriculture Risk Coverage-County Option program.

Price Loss Coverage

PLC is a price-based commodity assistance program with payment rates based on the difference between the marketing year average crop price and a target reference price. For seed cotton, PLC payments will be made if the marketing year average price falls below 36.7 cents per pound. PLC payments are capped at 11.7 cents per pound and represent the difference between the reference price and the loan rate of 25 cents per pound for seed cotton.

For the 2018/19 marketing year, USDA’s Farm Service Agency projects a marketing year average seed cotton price of 35.13 cents per pound and a program payment of 0.0157 cents per pound. If realized, and for a farm with a seed cotton program yield of 2,000 pounds per acre, this PLC payment rate would represent $31.40 per acre. PLC program payments are paid on 85 percent of the farm’s base acres.

Agriculture Risk Coverage

ARC-CO payments are triggered by a revenue deficiency based on Olympic moving average crop prices and county yields. Under ARC, the revenue guarantee is set at 86 percent of the benchmark revenue. The benchmark revenue is specific to each county and crop and is the product of the five-year OMA marketing year average price and the OMA county yield. Prices in the benchmark revenue calculation may not fall below legislatively specified reference prices and county yields may not fall below 70 percent of the county transitional yield. The reference price for seed cotton is 36.7 cents per pound.

ARC-CO payments are made when the actual revenue, defined as the county-level yield multiplied by the U.S. marketing year average price, falls below 86 percent of the benchmark revenue guarantee. Per-acre payments from ARC-CO are capped at 10 percent of the benchmark revenue.

ARC-CO or PLC?

The PLC reference price and the OMA seed cotton price are both 36.7 cents per pound for the 2018/19 crop year. For PLC, program payments are a function of price only and are based on the current marketing year that covers August 2018 through July 2019, with the official payment rate announced in October 2019. While USDA currently projects the seed cotton price at 35.13 cents per pound, higher cotton or cottonseed prices could push the marketing year price higher, reducing or eliminating PLC program payments.

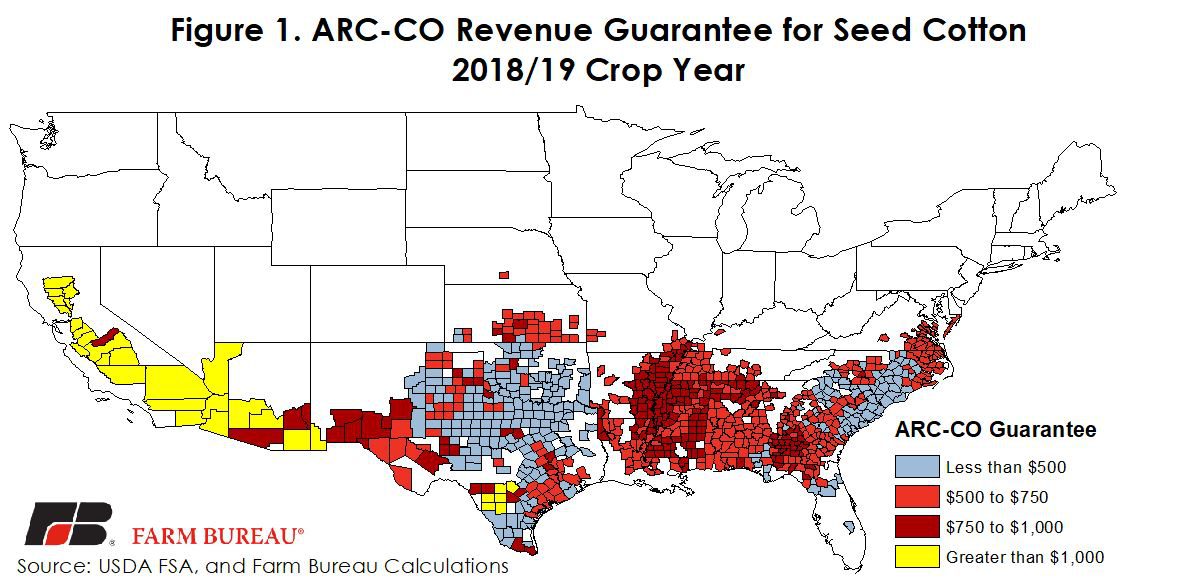

ARC program payments are a function of both price and yields. Growers who have experienced a county-wide yield decline may want to closely consider the benefits provided by ARC, as yield deficiencies alone could trigger ARC-CO. Based on OMA prices and yields, benchmark revenue guarantees range from less than $200 per acre in portions of Texas to over $1,500 per acre in portions of California. The average ARC-CO guarantee across all seed cotton counties is $593 dollars per acre, Figure 1. A 2018/19 marketing year price and yield combination that results in actual country revenue below these levels will trigger an ARC-CO payment. ARC-CO payments are paid on 85 percent of the farm’s base acres.

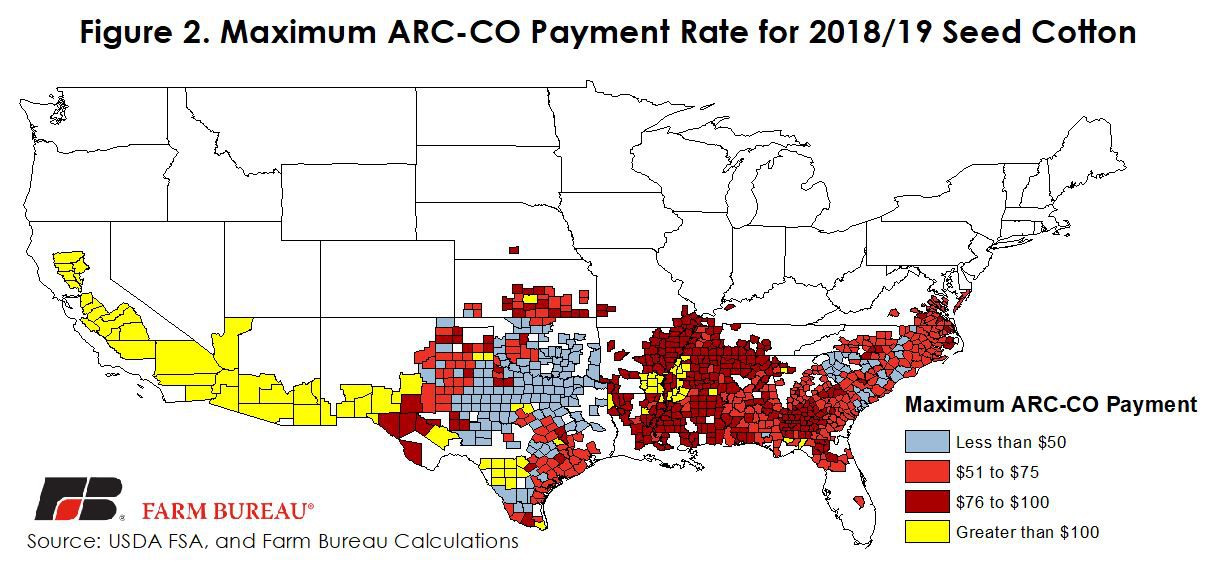

Per-acre payments from ARC-CO are capped at 10 percent of the benchmark revenue. Based on historical prices and county yields, maximum ARC-CO payments range from less than $20 per acre in portions of Texas to over $180 per acre in portions of California – reflecting differences in county-level cotton yields and irrigation. Across much of the Southeastern cotton belt, maximum ARC-CO payments are between $50 and $100 per acre, Figure 2.

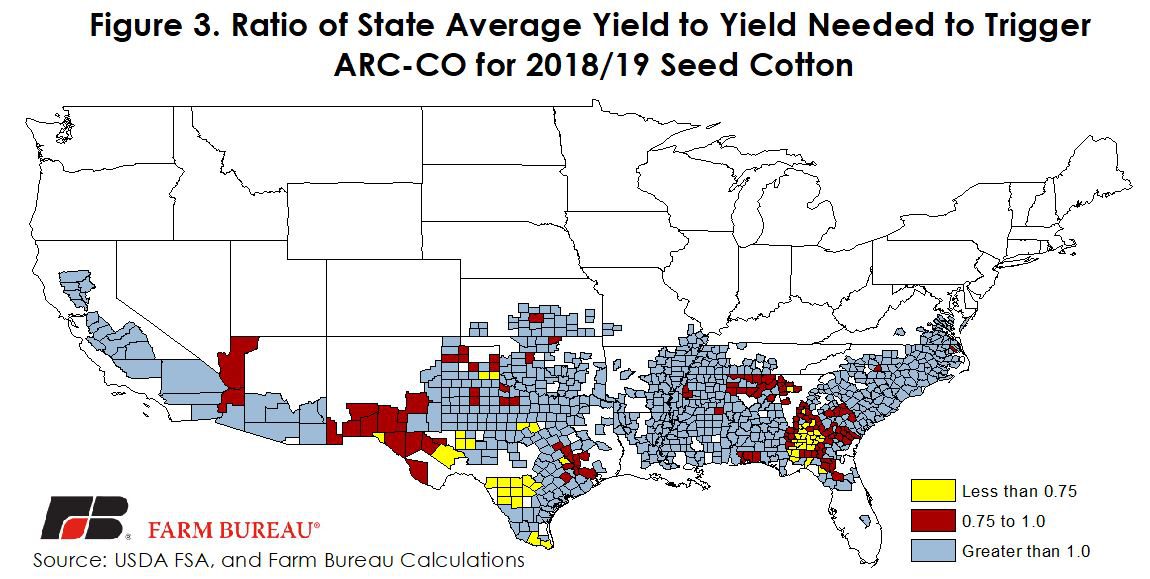

ARC-CO could likely provide more protection to growers who experienced poor county-wide cotton yields during the 2018/19 crop year. County-level cotton yields are unavailable at this point, but USDA has published state-level yield projections for the current crop, as well as projections for the marketing year average price. Cotton yields ranged from a low of 693 pounds per acre in Georgia to over 2,000 pounds per acre in California, and the seed cotton price is projected at 35.13 cents per pound.

To approximate where ARC-CO is likely to be triggered, state-level cotton yields were compared to the yields needed to trigger ARC-CO payments -- assuming the projected marketing year average price. Based on this comparison, portions of southwest Georgia, New Mexico, western Arizona and West Texas could potentially see yields below those needed to trigger ARC, Figure 3. Growers across the U.S., but especially in these areas, need to consider what their county-level yields may be, and compare the protection provided by ARC-CO and PLC before making a program selection.

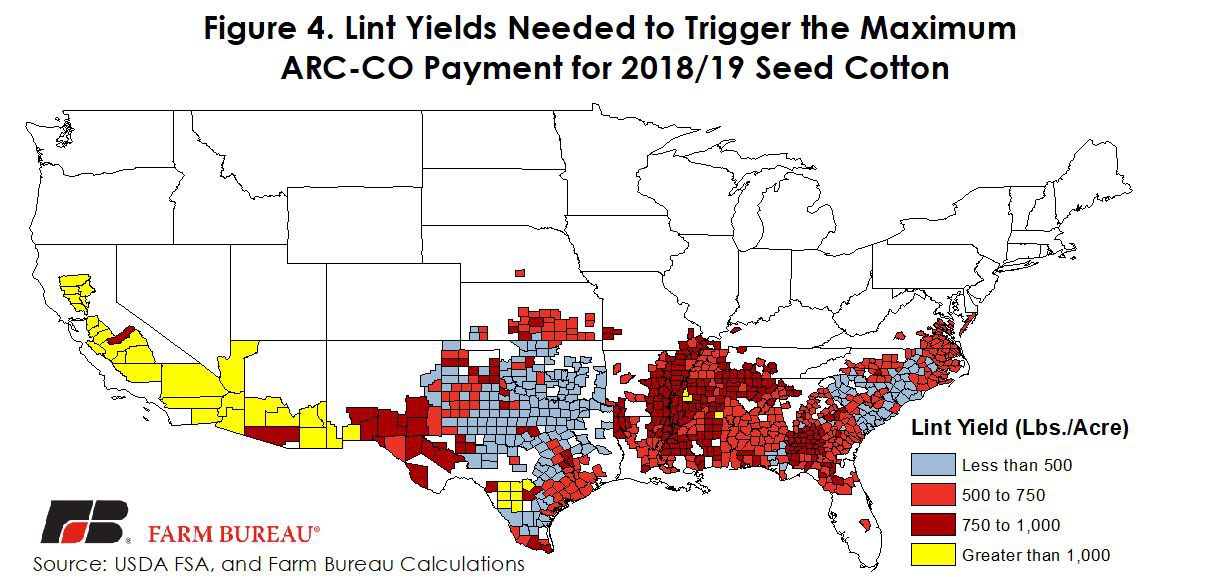

To provide additional information for the ARC-CO or PLC decision, the yields needed to trigger the maximum ARC-CO payment were calculated – assuming USDA’s current price projection. County-level cotton yields at or below these levels would result in the maximum ARC-CO payment. For example, across much of Texas, cotton yields would need to be at or below 500 pounds per acre to trigger the maximum ARC-CO payment. In California, yields below 1,600 pounds per acre are likely to trigger the maximum payment from ARC-CO, Figure 4.

Summary

Eligible cotton producers have until Dec. 7 to make an ARC-CO or PLC program election. At this point in the marketing year both county-level yields and marketing year average prices remain unknown. PLC provides price-based safety net support and is not influenced by crop yields. ARC-CO is based on county-average revenue and can provide risk management support to growers who have experienced below-average crop yields and revenue in 2018/19. Growers who’ve experienced a crop loss should closely compare ARC-CO benefits to those provided by PLC before making a program election.