Revisiting NAFTA: Implications for U.S. Agricultural Markets

photo credit: Getty

Veronica Nigh

Former AFBF Senior Economist

Implications

The Trade Promotion Authority Act of 2015 requires that the Executive Branch provide a 90-calendar day notice to Congress before it can formally begin trade talks with another country or countries. One of President Trump’s campaign rallying cries was to make ‘big changes’ to the North American Free Trade Agreement (NAFTA); the three-country trade accord negotiated between Canada, Mexico, and the United States that went into effect in 1994. We are still waiting for formal notice to be delivered to Congress, but a draft NAFTA notice was delivered on March 28, 2017. Some believe formal consultation and notification on NAFTA cannot proceed until Robert Lighthizer, the nominee to be the US Trade Representative, is confirmed. In the meantime, we intend to explore the agreement’s impact on U.S. agriculture in a series of articles providing a commodity-by-commodity analysis of the impact of NAFTA on trade flows. We will begin this NAFTA series by reviewing the trade in all agricultural commodities.

Impact of NAFTA on U.S. Agriculture

In recent months, a lot of attention has been given to the importance of trade between the United States, Mexico and Canada since the Trump Administration began talking about potentially renegotiating NAFTA. That attention is more than deserved, especially for U.S. agriculture. Agricultural related issues that could be revisited in a “modernized” NAFTA include biotechnology, sanitary and phytosanitary measures, and geographic indicators.

Depending on the year Canada is either our largest or second largest export destination, while Mexico is consistently our third largest market. Combined, they account for about one-third of U.S. agricultural exports. Since implementation agricultural exports to Canada and Mexico have totaled approximately $310 billion and increased by more than 300 percent from pre-NAFTA levels.

We could stop there and call the case convincing, but to do so would fail to fully capture the importance of these markets to different segments of the U.S. farm economy. Our agricultural trade with Canada and Mexico over the course of NAFTA mirrors what we’ve seen in many other markets. Not only is overall trade with our NAFTA partners up significantly, but we’re also trading a different mix of product than we did pre-agreement.

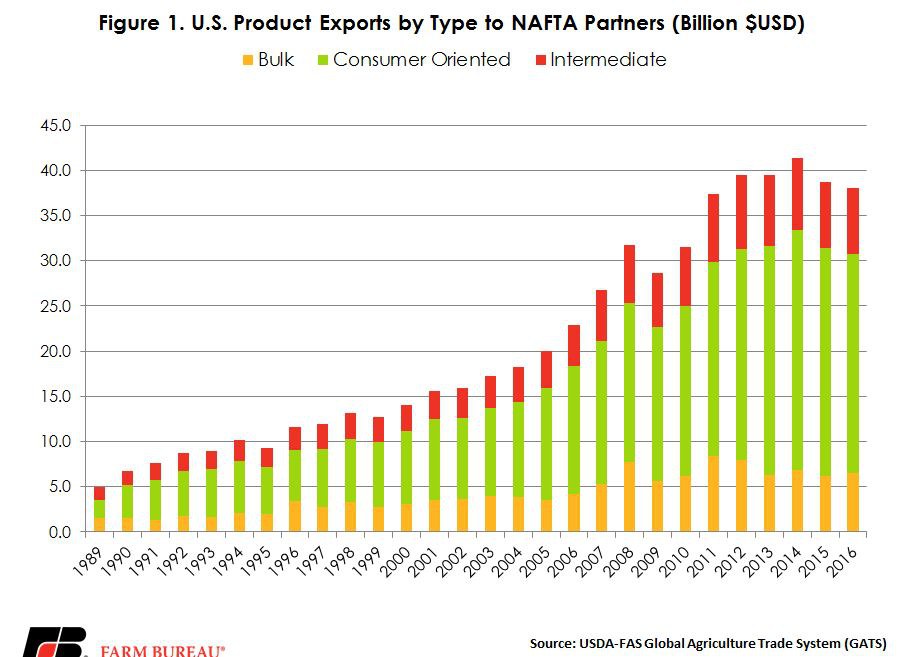

In 1993, U.S. exports to NAFTA partners totaled $8.9 billion, of which 18 percent were bulk goods, 22 percent were intermediate goods and 59 percent were consumer-oriented goods. In 2016, U.S. exports to Canada and Mexico totaled $38.1 billion, of which 17 percent were bulk goods, 19 percent were intermediate goods and 64 percent were consumer-oriented goods. The top five exports by value to Canada in 2016 were: Prepared foods, fresh vegetables, fresh fruits, snack foods and non-alcoholic beverages. The top five exports by value to Mexico in 2016 were: corn, soybeans, pork and pork products, dairy products and beef and beef products. This translates to more value being added in the United States before goods are exported, which means more U.S. jobs and tax revenues.

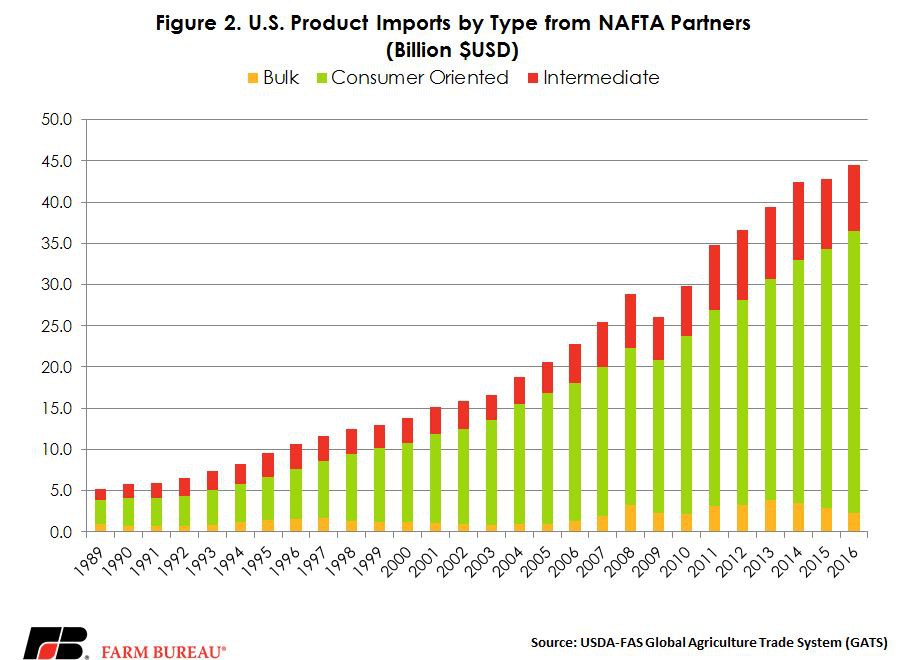

A similar situation can be observed on the import side. In 1993, the U.S. imported $7.4 billion from Canada and Mexico, of which 12 percent were bulk goods, 32 percent were intermediate goods and 56 percent were consumer-oriented goods. In 2016, U.S. imports totaled $44.5 billion, of which only 5 percent were bulk goods, 18 percent were intermediate goods and 77 percent were consumer-oriented goods. The top five imports by value from Canada in 2016 were: Prepared foods, vegetable oils, live animals, chocolate products and fresh vegetables. The top five imports by value from Mexico in 2016 were: fresh vegetables, fresh fruits, wine and beer, distilled spirits and snack foods.

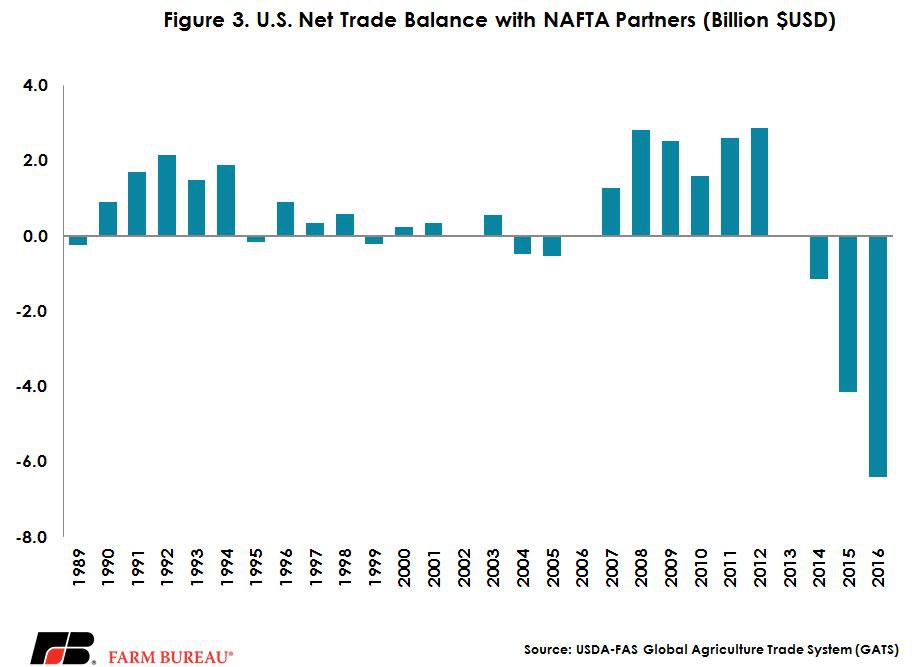

While there are many different metrics one should consider when debating the efficacy of trade agreements, trade balances – the relationship of exports to imports – has been one of the most discussed topics about trade agreements in general and NAFTA in particular. Trade balances have the benefit of being easily measured. If exports exceed imports, the trade balance is positive. When imports exceed exports, a negative trade balance results.

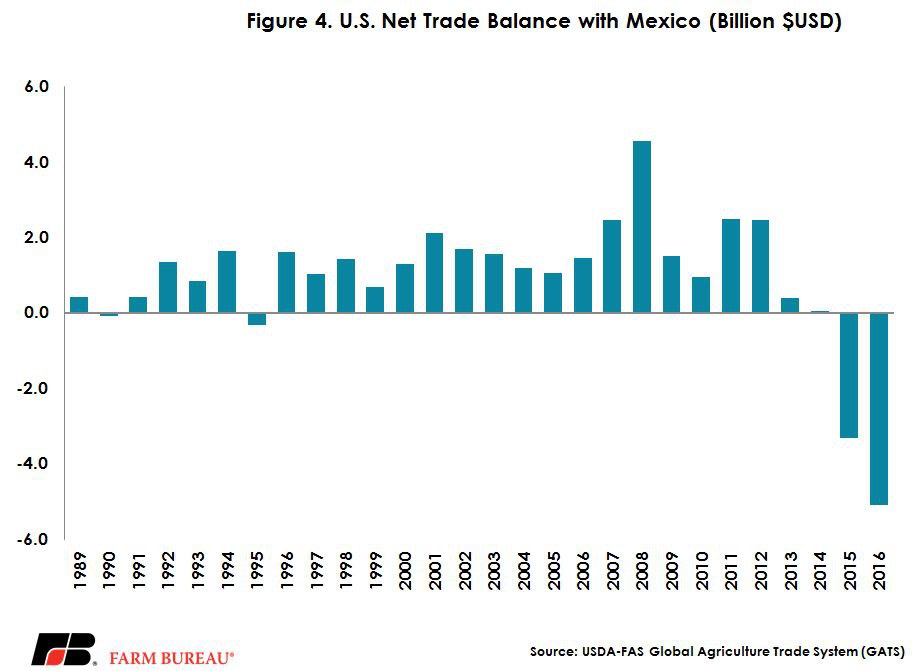

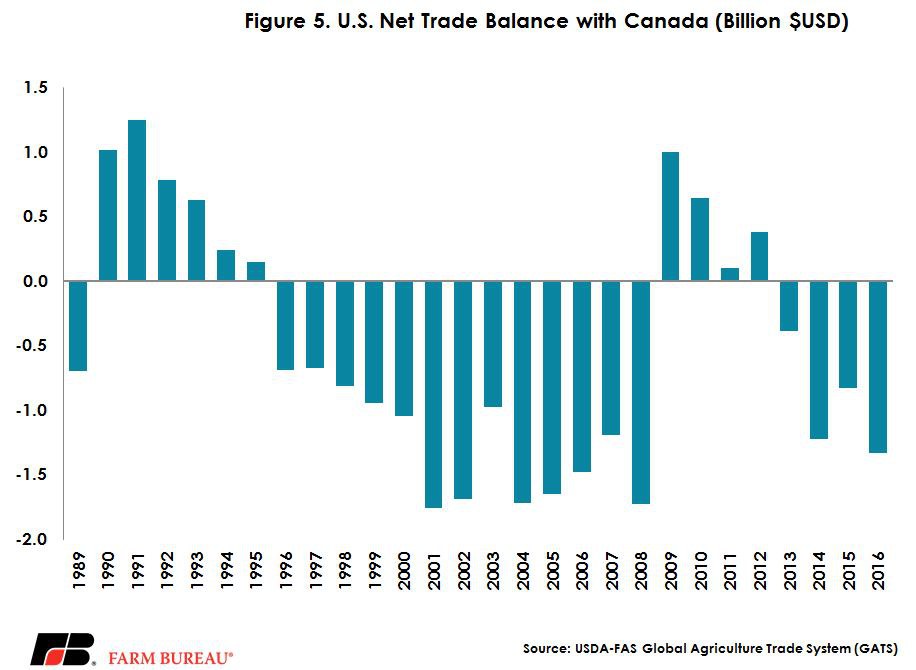

Overall, since NAFTA was enacted total U.S. net trade has been approximately $5.6 billion. Since 2014, net trade in agricultural commodities has been negative, as U.S. exports have fallen slightly due to lower commodity prices and a strong U.S. dollar, while imports, especially consumer-oriented imports, have continued to grow strongly. When NAFTA trade is disaggregated, one notices that the direction of net trade with Mexico has variated less than net trade with Canada. See figures 3 through 5 for a review of the net trade balance.

While in aggregate the U.S. currently maintains a negative trade balance, on a commodity-by-commodity basis this is not the case. Several of our agricultural sectors have a very large and positive trade balance with NAFTA partners. We look forward to exploring these commodities further and completing this deep dive of NAFTA with you over the coming months. We anticipate that we will all learn more about the interconnectedness of North American trade and its importance to the agricultural economy.

Top Issues

VIEW ALL