September Crop Report Shows Slight Yield Declines

TOPICS

YieldsAFBF Staff

photo credit: Tennessee Farm Bureau, Used with Permission

While on the higher side of pre-report estimates, the USDA September Crop Production report shows corn and soybean yields are down from 2018 and lower than the projections posted in the USDA August Crop Production report.

Corn Production

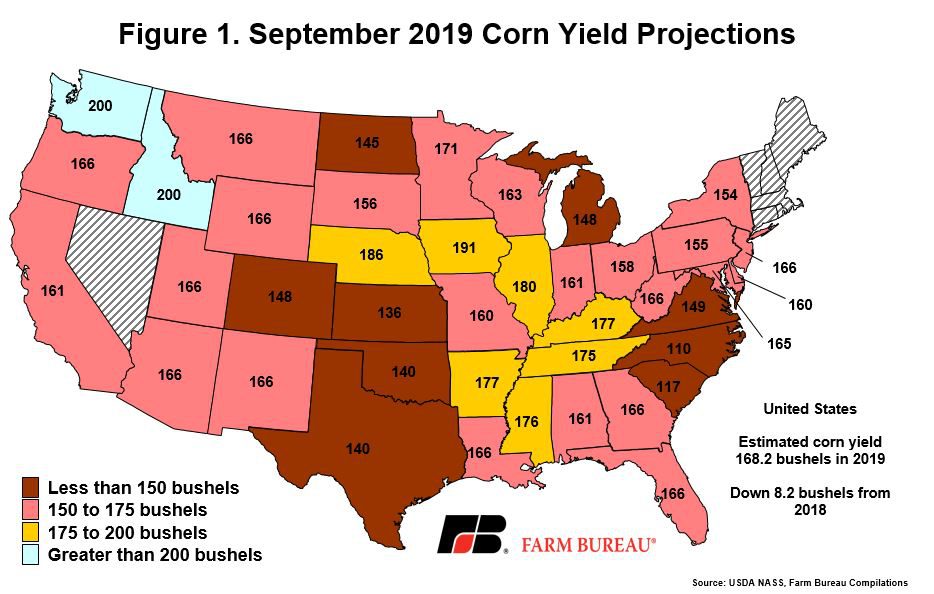

Corn production for 2019 is now projected at 13.8 billion bushels, 1% lower than the August estimate of 13.9 billion bushels and down 4% from 2018. September corn yield on a national scale is estimated to be 168.2 bushels per acre in 2019, down more than 8 bushels per acre from 2018 and 1.3 bushels per acre lower than the August estimate. Across the U.S., corn yields were the highest in Iowa at 191 bushels per acre, followed by Nebraska at 186 bushels per acre, Figure 1.

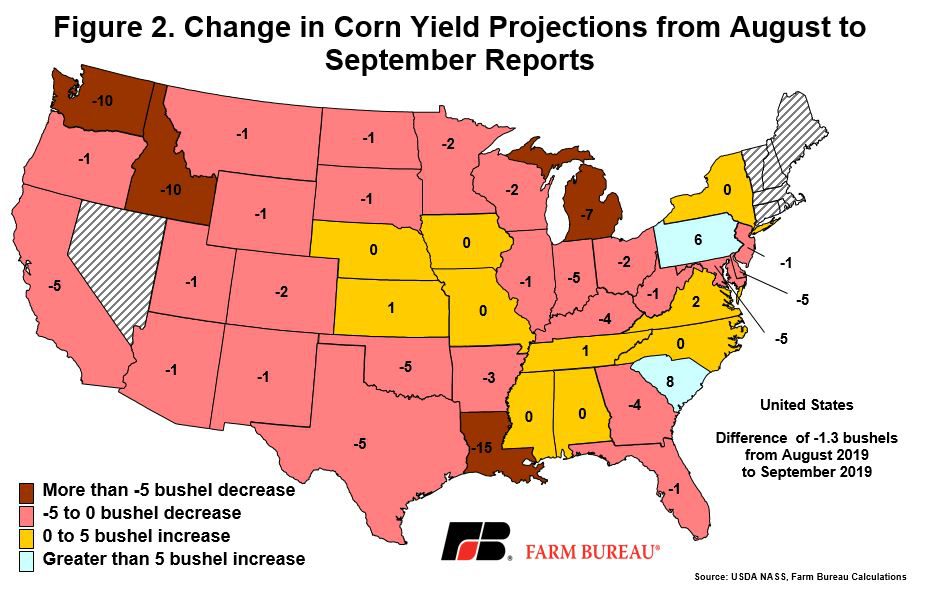

Corn yields took the biggest month-to-month hit in the Northwest and the South. Yield projections in Idaho and Washington dropped by 10 bushels per acre, while yield expectation dropped by 7 bushels per acre in Michigan. In Louisiana, the average corn yield was reduced by 15 bushels per acre. Note, these yield expectations are as of September 1, so potential yield declines related to Hurricane Dorian were not included in these estimates. Figure 2 highlights the change in yield projections from the August report to the September report.

Soybean Production

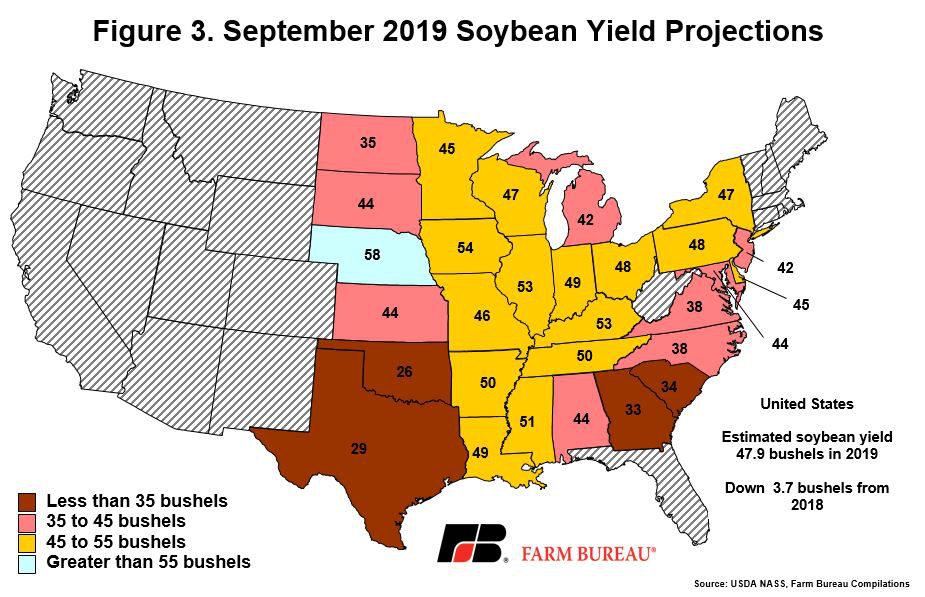

Soybean production in 2019 is now projected at 3.6 billion bushels, down slightly from the August estimate but down nearly 1 billion bushels, or 20%, from 2018. Soybean acreage is down by 12.5 million acres from last year. The large production decline is driven by the trade impasse with China and the lower soybean exports and prices that have come with it. The national average soybean yield was projected at 47.9 bushels per acre, 3.7 bushels lower than last year and down 0.6 bushels per acre from the August report. Soybean yields were the highest in portions of the western Corn Belt, Figure 3.

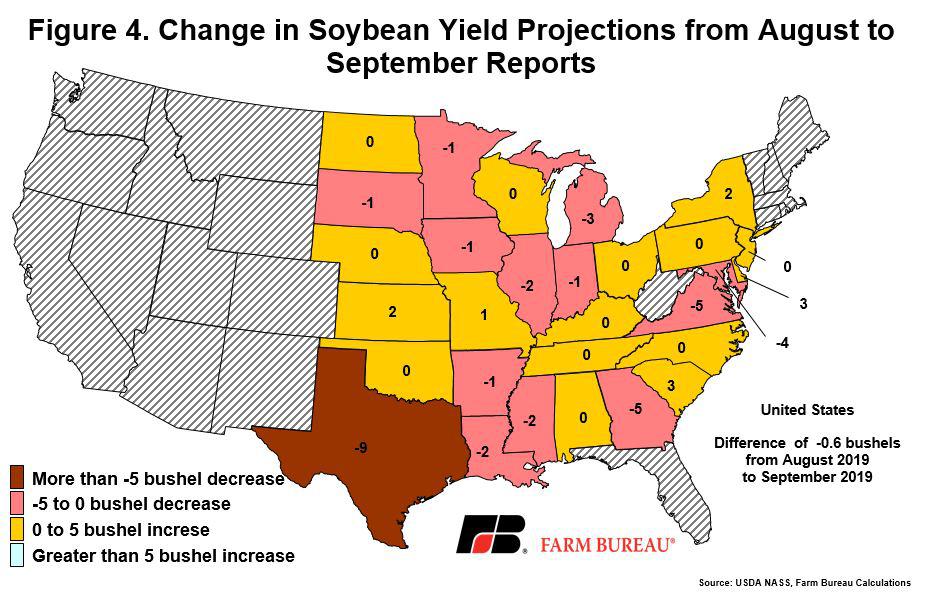

Relative to the August projection, Texas saw the largest decrease in its soybean yield, but the update is only a slight decrease from 2018 yields. Similarly, Georgia, Virginia and Maryland had lower expected yields from the August report to the September report, which pushed those states below their 2018 yields, Figure 4.

Summary

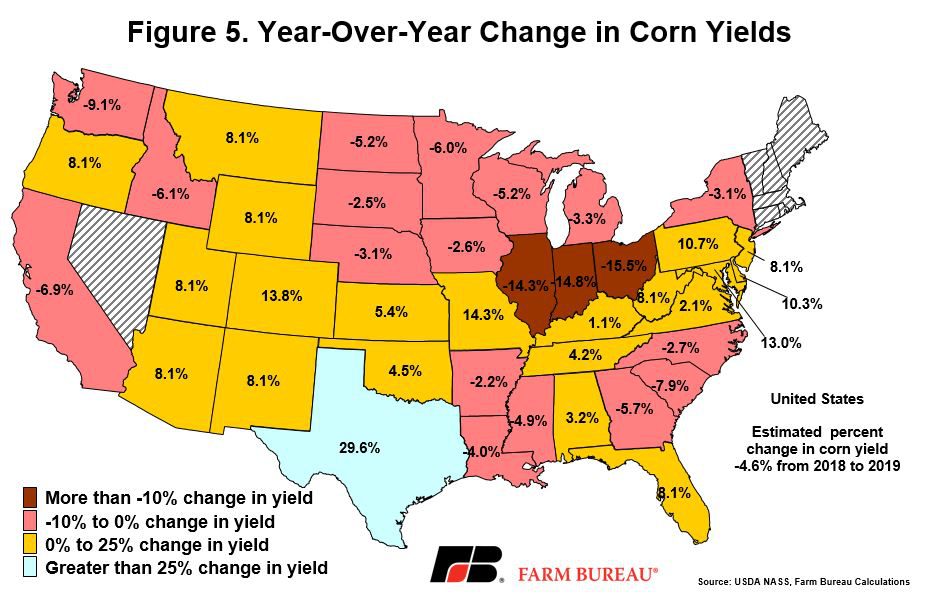

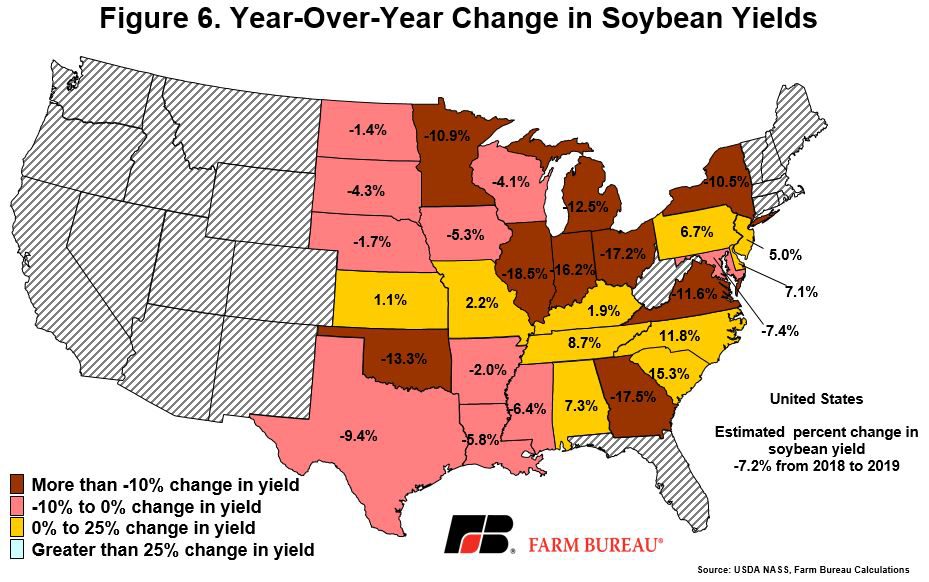

Excessive spring rains and flooding across the Midwest forced delayed and prevented plantings, pushing crop yields down in 2019. As illustrated in Figures 5 and 6, most states will experience corn and soybean yield declines in 2019.

The corn yield and production decline is not as significant as many had anticipated earlier in the growing season. First, despite the historical planting delays, farmers planted 90 million corn acres in 2019. Second, the expected 13.8 billion bushels of corn is well above the 12-billion-bushel crop that was rumored in late May and June.

The biggest unknown for new crop corn is harvested area, which many expect will decline further as a result of record-high prevent plantings and the use of corn as an approved cover crop. A reduction in the harvested area would reduce corn supplies, possibly driving ending stocks lower and prices higher.

Soybean supply and demand expectations are better than previously anticipated. First, planted acreage significantly declined. Yields, too, are below prior-year levels and below the unconditional trend. On the demand side, while exports have slowed, crushing has accelerated. Many thought it would take years to work through, but the billion-bushel-soybean carryout is now projected to fall by 360 million bushels in 2019 to 640 million bushels, 36% below 2018’s ending stocks. This has provided a boost to new-crop soybean prices that will only improve if trade is restored with China.

For soybeans, the obvious wildcard is China and African Swine Fever. When (if) China returns to the U.S. market, just how big of a buyer will they be? While they once purchased one-third of every soybean acre in the U.S., that is no longer certain given increased production in South America and a smaller hog population. Nevertheless, China’s return as a consistent soybean buyer will draw down stocks even more, helping to realign corn and soybean price ratios.