September Farm-to-Retail Pork Price Spread Highest on Record

TOPICS

PorkAFBF Staff

photo credit: Alabama Farmers Federation, Used with Permission

This September the farm-to-retail pork price spread hit a new record high of $3.24 per pound. The farm-to-retail price spread is the calculation between how much the farmer receives versus how much the retailer receives on a per-pound basis. There is the assumption that all players along the supply chain must make some money to stay in business and keep product moving. However, the width of that margin varies by sector and the economic environment in which each segment operates. These calculations are done on a monthly basis by USDA’s Economic Research Service (ERS).

Over 50 percent of the retail value is in the retail-to-wholesale price spread, but in September that number surged to 68 percent. In part, this is due to the retail portion climbing since the beginning of the year. In January, ERS estimated retail pork values were $3.57 per pound, compared to September’s high of $3.98 per pound. In comparison, the wholesale value peaked much earlier this year, in July at $1.86 per pound, compared to October’s value of $1.21 per pound. It is this difference that has caused the wholesale–to-retail spread to also have set record-high margins this September. However, the October wholesale–to-retail spread dropped $0.004 per pound from September’s record-high spread of $2.69 per pound.

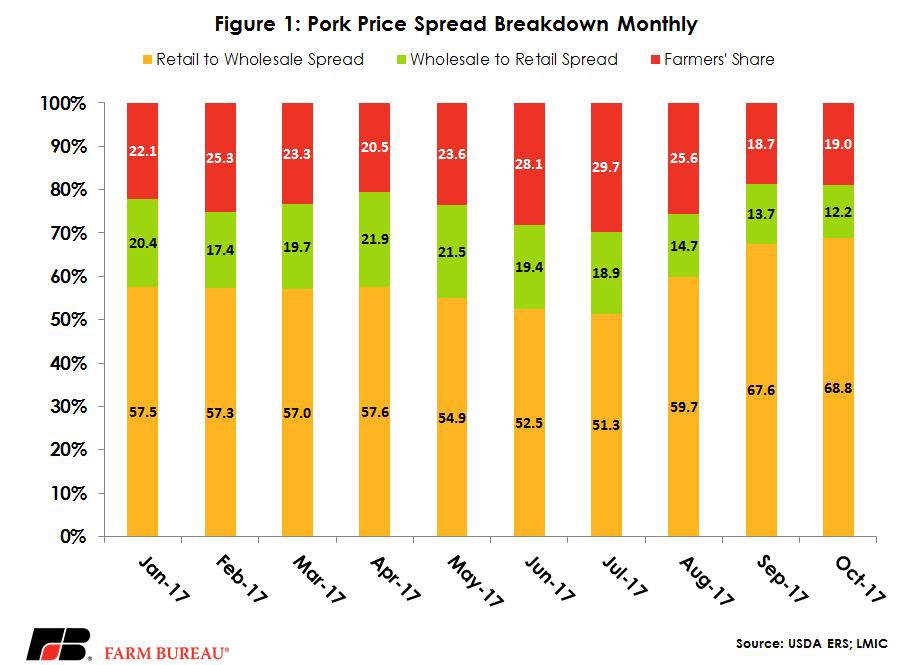

The other side of the farm-to-retail spread is the difference between net farm value and wholesale value, which captures, in essence, the price difference between what a packer pays for an animal and what they can sell it for after processing. This value is closer to the long-term average proportion of the retail value of 13.4 percent. In September, this proportion was slightly higher at 13.7 percent, followed by October coming in below average at 12.2 percent. The farmers’ share is typically just over 30 percent, but in September and October of this year that share was under 20 percent. Figure 1 shows 2017 proportions of the retail value.

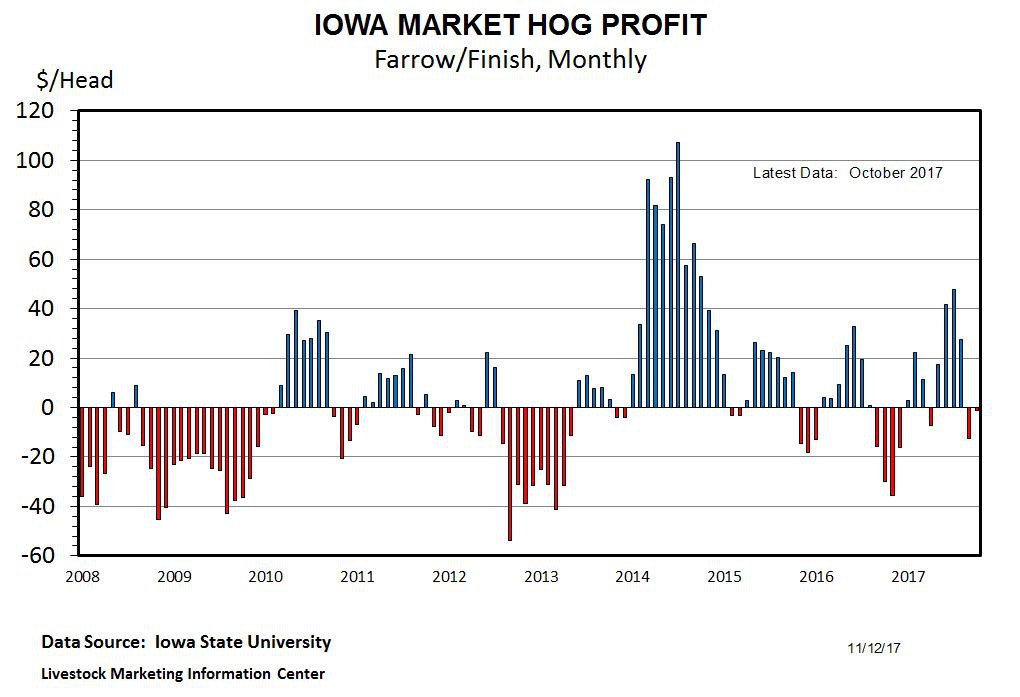

Despite some compression in packer margins, packers are still making some money on a per-head basis, which has enabled them to purchase hogs at competitive prices. The two new packing plants in Iowa and Michigan -- since opening in September -- have been ramping up production and have increased the demand for slaughter hogs. As a result from the increased competition, slaughter hog prices have rallied through October. Since the last week of September, hog prices have risen $10.54 per hundredweight, before plateauing in the most recent week at $68.01 per hundredweight. This has also bolstered margins on the producer side -- increasing farrow-to finishing returns from a loss of $13 per head in September to a loss of $1 per head in October. Figure 2 shows the Iowa State University estimated returns from farrow to finish.

Top Issues

VIEW ALL