Soybean Harvest Slows to a Crawl

TOPICS

SoybeansMegan Nelson

Economic Analyst

photo credit: Arkansas Farm Bureau, used with permission.

Megan Nelson

Economic Analyst

USDA’s October 15 Crop Progress report revealed the U.S. soybean harvest has stagnated, with 38 percent of the soybean crop harvested, up only 3 percentage points from last week. For the week ending Oct. 15, the soybean harvest rate is down 9 percentage points from last year and 15 percentage points from the five-year average. The current harvest pace is also slightly down from analysts’ estimates of 40 percent of the soybean harvest complete by this point. Soybean producers have harvested 1.8 billion bushels throughout the U.S. so far.

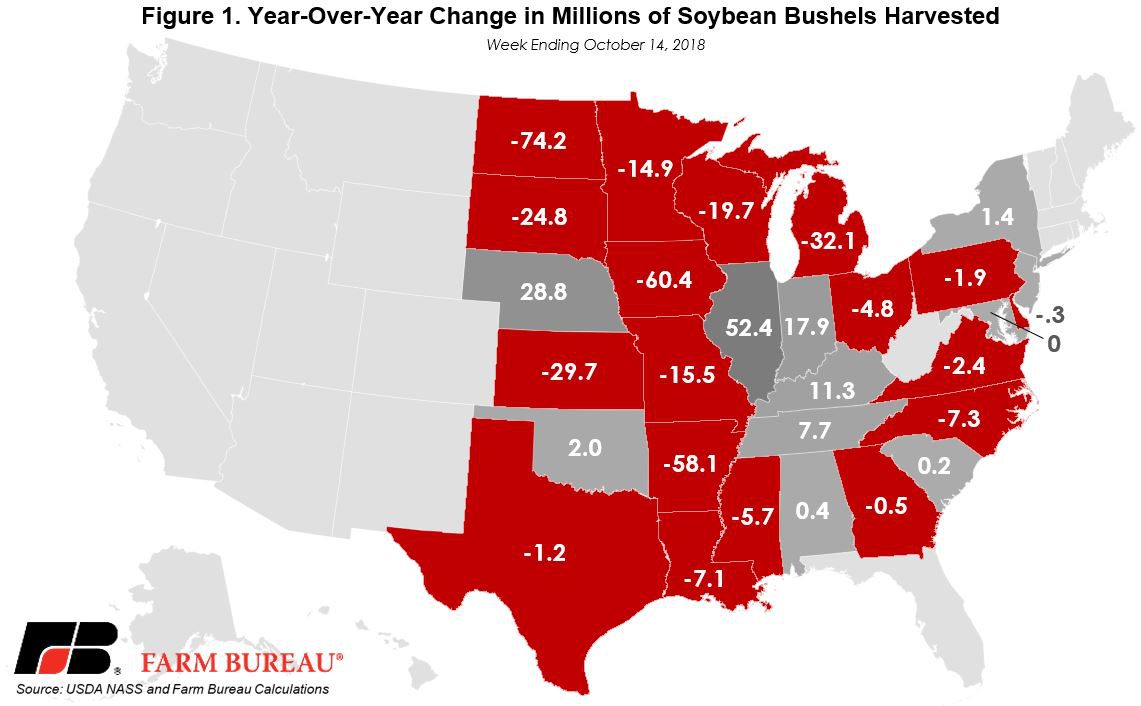

While harvest should be speeding along throughout the Midwest, excessive levels of precipitation have brought progress nearly to a halt. Relative to this time last year, the soybean harvests in North Dakota and Iowa are down 74.2 million and 60.4 million bushels, respectively. Figure 1 illustrates the year-over-year change in soybean bushels harvested on a state-by-state level.

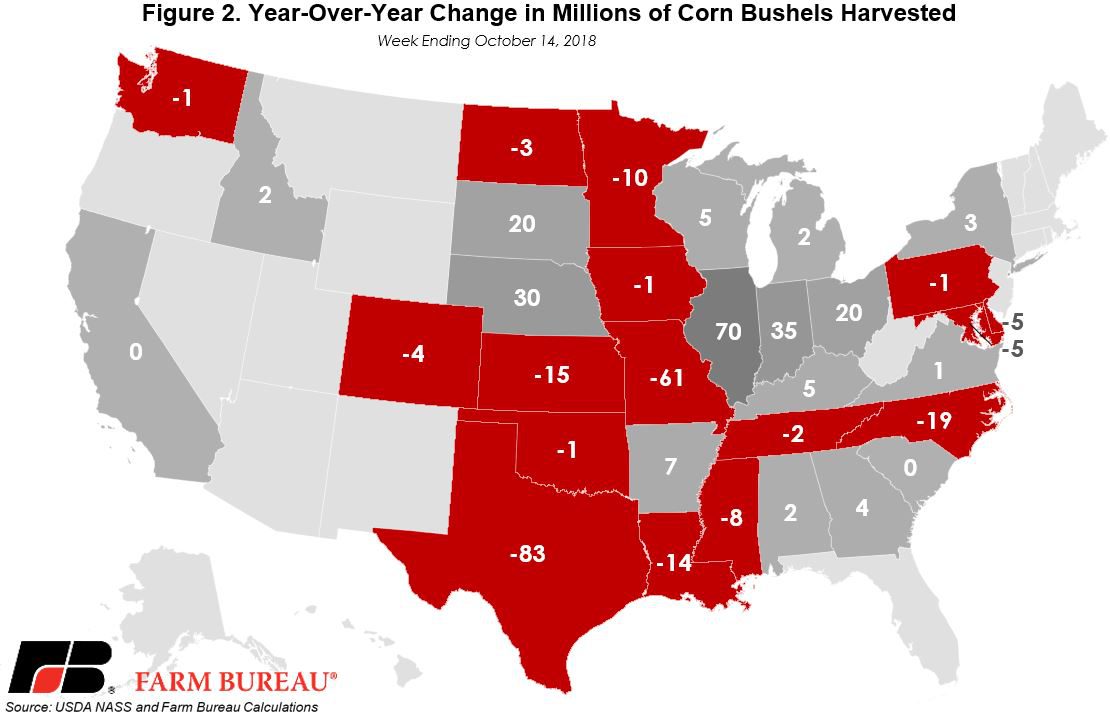

The report also shows that 39 percent of the corn harvest is complete. Corn harvest continues to outpace historical harvest pace by 12 percentage points from last year and 4 percentage points from the five-year average. U.S. corn producers have harvested 5.8 billion bushels of corn. Figure 2 illustrates the year-over-year change in corn bushels harvested on a state-by-state level.

With harvest nearly to the halfway point, the U.S. soybean crop in good-to-excellent condition decreased slightly to 66 percent. The soybean crop in poor-to-very-poor condition has increased to 11 percent. Current crops in good-to-excellent condition are up 5 percentage points from last year.

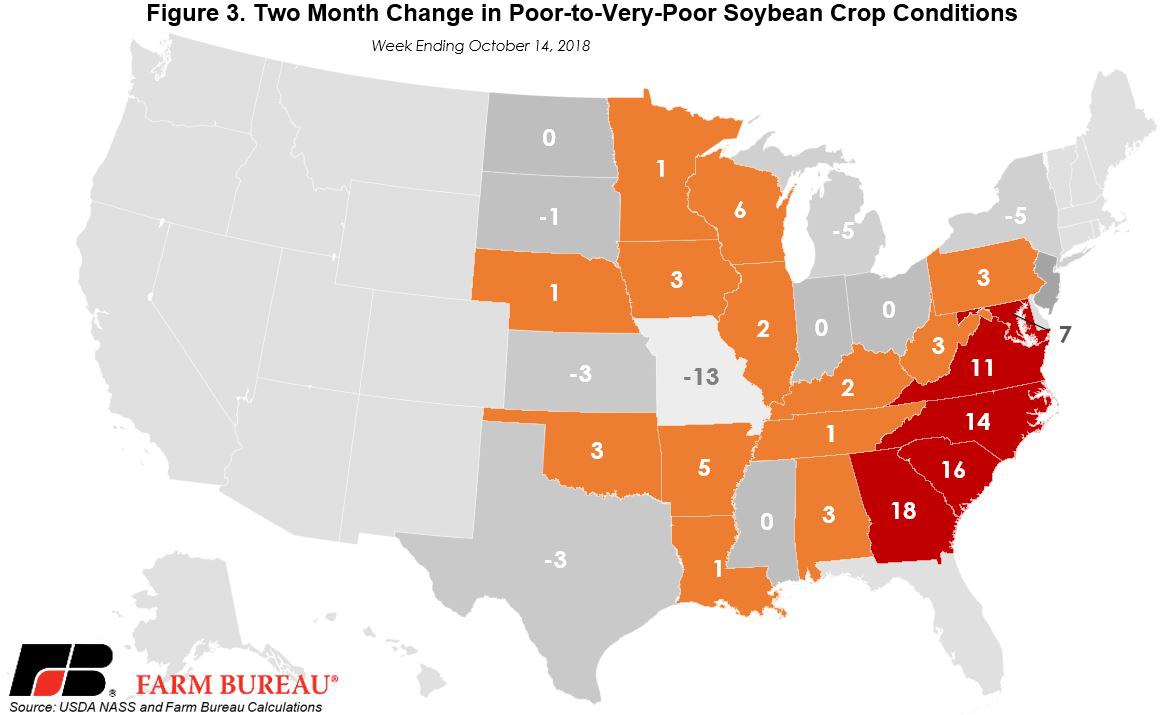

Late season rains and residual flooding have led to saturated fields and a rise in crop damage throughout the Southeast. Georgia soybean producers are seeing an 18 percent increase in crops in poor-to-very-poor condition since August. Figure 3 outlines the two-month percentage point change in soybean crops in poor-to-very-poor condition on a state-by-state level. As shown on the map, there was a dramatic increase in the percentage of crops in poor-to-very-poor condition after Hurricane Florence hit the Southeastern coast.

USDA estimates the U.S. corn crop in good-to-excellent condition continues unchanged at 68 percent. Crop conditions remain improved over last year’s 65 percent good-to-excellent. The corn crop in poor-to-very-poor condition is holding at 12 percent.

Top Issues

VIEW ALL