Soybeans Crowned King for 2018

photo credit: AFBF Photo, Right Eye Digital

John Newton, Ph.D.

Vice President of Public Policy and Economic Analysis

On March 29, 2018, USDA released its much-anticipated Prospective Plantings report. The prospective plantings report gives the first estimate of the area farmers are expected to plant to row crops for the upcoming year based on survey responses during the first two weeks of March. The largest takeaway from today’s report is that for the first time since the payment-in-kind program of 1983 soybean acres planted will be greater than corn acres planted. Today’s article reviews planting intentions for corn, cotton, peanuts, soybeans and all wheat.

Pre-report survey estimates in advance of the prospective plantings report were for 87.6 to 91 million acres of corn, 89.9 to 92.6 million acres of soybeans, 43.9 to 47.2 million acres of wheat and 13 to 13.6 million acres of cotton. The average of the analysts’ estimates was 89.4 million acres of corn, 91.1 million acres of soybeans, 46.3 million acres of all wheat and 13.3 million acres of cotton.

Soybeans

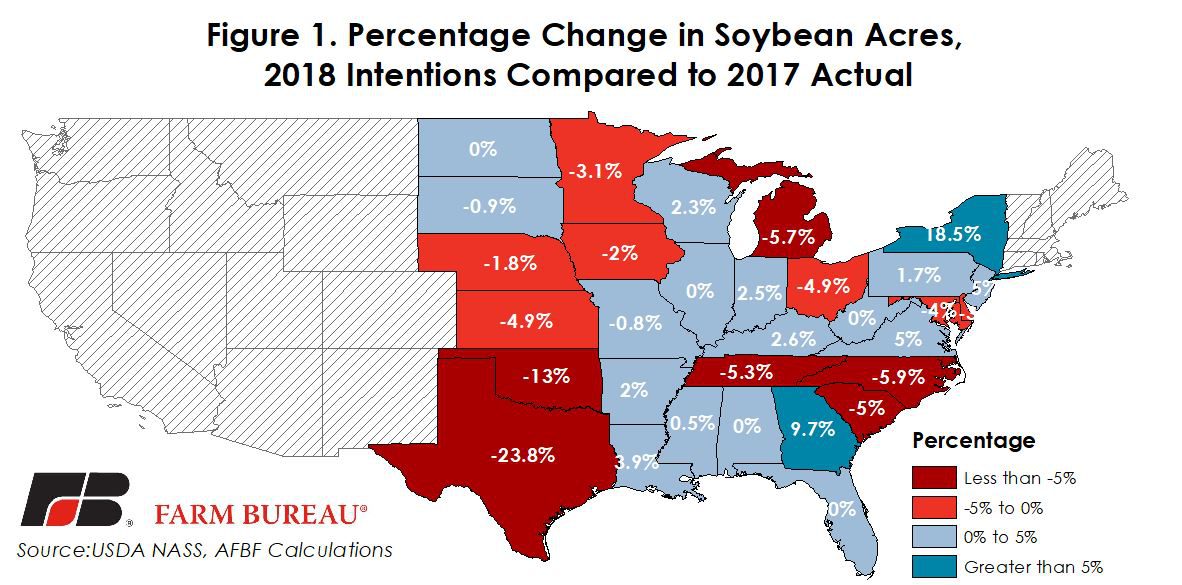

The Prospective Plantings report revealed that growers intend to plant a record 89 million acres of soybeans, a decrease of 1 percent from the 2017/18 crop year, 1 million acres below USDA’s February 2018 estimate and 2 million acres below the average trade estimate. Planted soybean area is above prior year levels in 16 of 31 states. Figure 1 highlights the year-over-year percentage change in soybean acres.

Corn

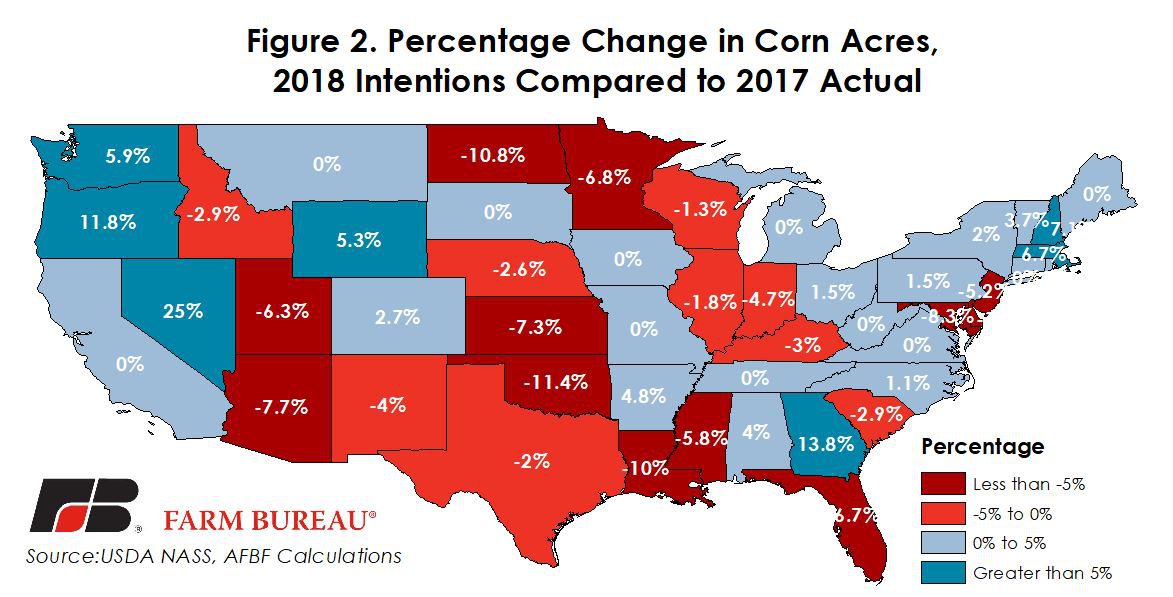

For the 2018/19 marketing year, U.S. producers intend to plant 88 million acres of corn, down 2 percent from the prior year, and 2 million acres below USDA’s February 2018 projection and 1.4 million acres below the trade estimate. Compared with last year, planted acreage of corn is expected to be lower in 21 of 48 states. Figure 2 highlights the year-over-year percentage change in corn acres.

Wheat

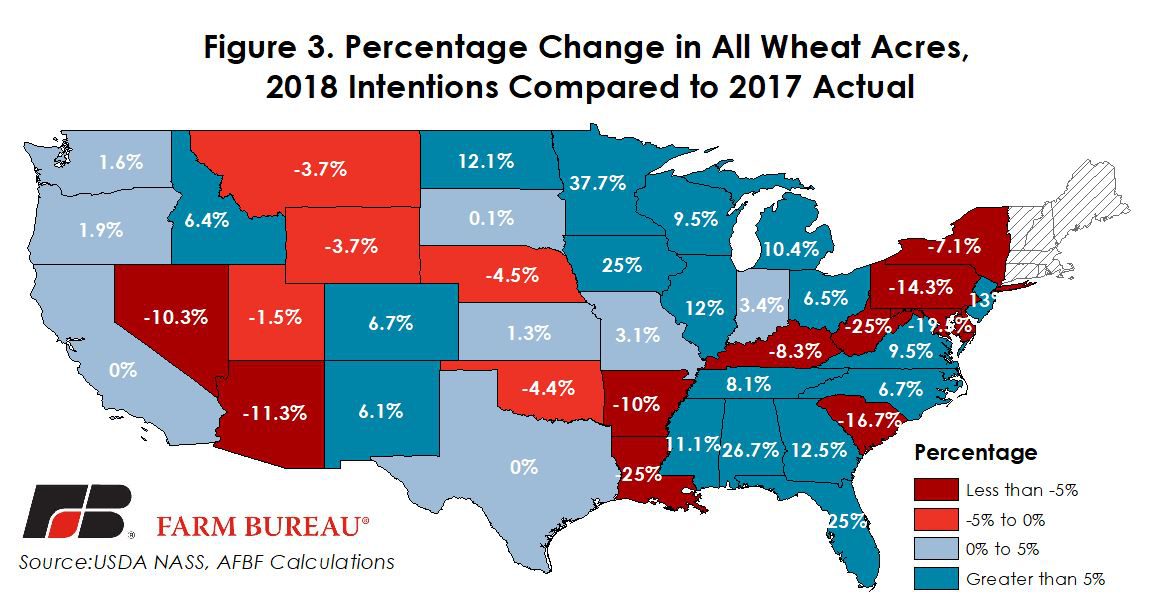

USDA’s February projection for all wheat acres planted in 2018 was 46.5 million acres, up 0.5 million acres from 2017. Survey results indicate U.S. producers intend to plant 47.3 million acres of wheat in 2018, up 3 percent from prior year levels and above both USDA’s projection and the trade estimate. However, if realized this would be the second lowest all wheat acreage since records began in 1919. Figure 3 highlights the year-over-year percentage change in all wheat acres.

Cotton

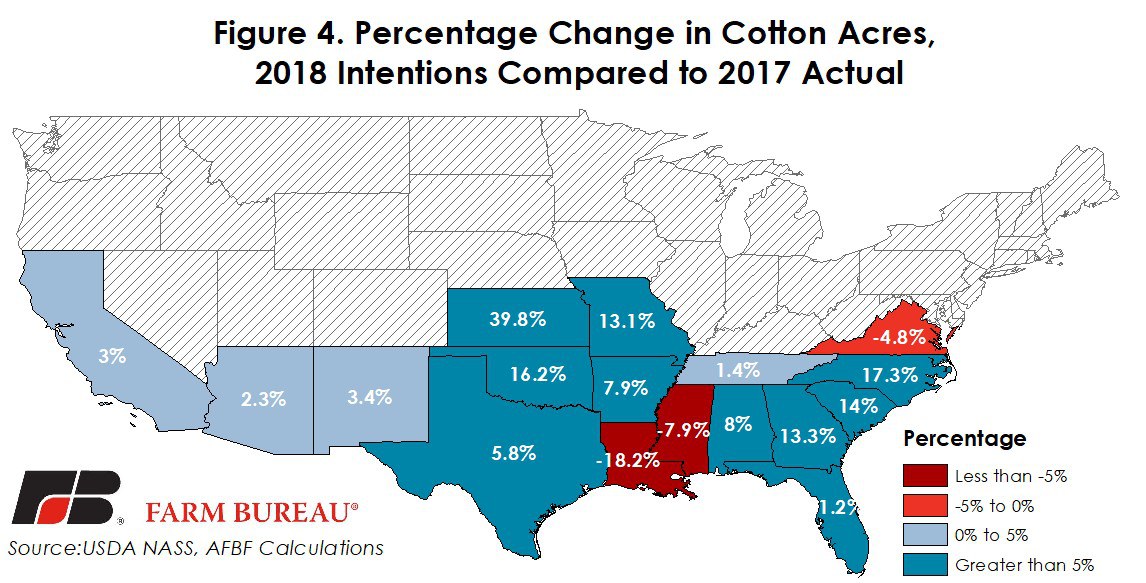

USDA’s February projection for all cotton acres planted in 2018 was 13.3 million acres, up 700,000 acres from 2017. For the 2018/19 marketing year, U.S. cotton producers intend to plant 13.5 million acres, up 7 percent from the prior year and above both the average of analysts’ estimates and USDA’s February projection. Compared to last year, cotton acreage is expected to increase in 14 of 17 states. Figure 4 highlights the year-over-year percentage change in cotton acres.

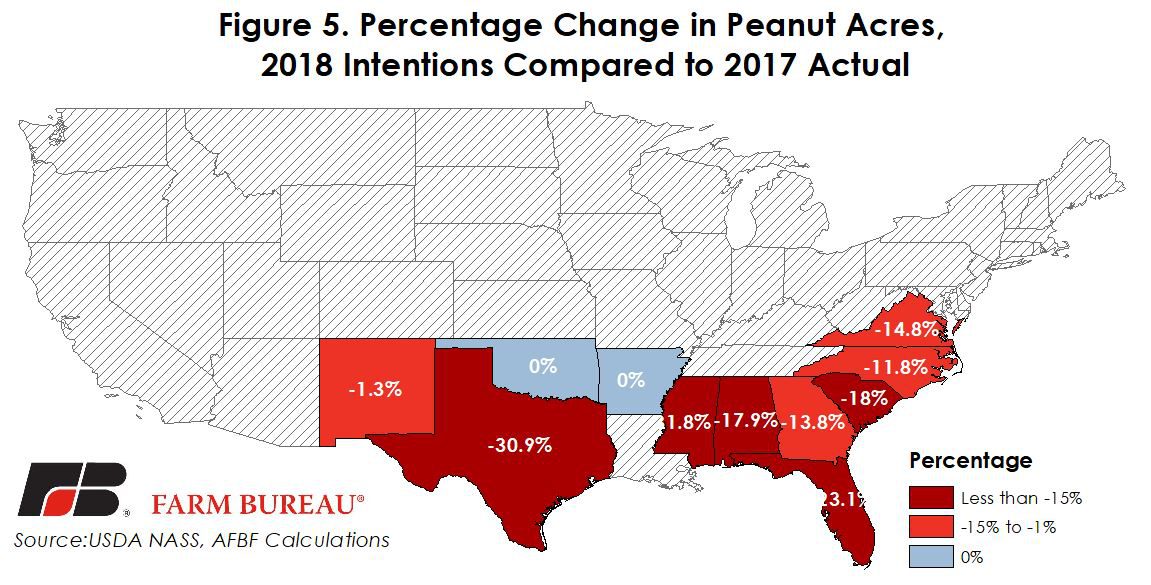

Peanuts

Finally, for the 2018/19 crop year, U.S. peanut producers intend to plant 1.5 million acres of peanuts, down 18 percent from last year. Lower peanut acreage was anticipated given more favorable projected returns per acre for competing field crops such as corn, soybeans, and cotton. Figure 5 highlights the year-over-year percentage change in peanut acres.

Implications

USDA’s Prospective Plantings report provides the first survey-based estimate of acreage for the upcoming crop year. A variety of factors could ultimately change what growers plant this year. For example, if poor growing conditions in South America lead to a smaller than anticipated crop size, U.S. farmers could respond by planting even more soybean acres. The next opportunity to evaluate actual acreage decisions will be USDA’s June 29, 2018, Acreage report.

Planting has begun in some Southern states, but has not begin in earnest in the Corn or Cotton Belts. As planting ramps up, USDA’s weekly Crop Progress report will provide estimates on the pace of planting, and crop conditions throughout the growing season.

Our upcoming series, “Market Intel Minute,” will provide timely updates on growing conditions, the pace of planting, harvest progress, the pace of consumption and other time data series to help farmers and ranchers make informed and timely management and marketing decisions.

Top Issues

VIEW ALL