Strong February Jobs Report Belies Economic Effects of COVID-19

TOPICS

Market IntelBob Young

President

photo credit: Mark Stebnicki, North Carolina Farm Bureau

Bob Young

President

The February jobs report, released March 6, showed another whopping 273,000 new jobs, the same figure in the January report. Though the more than 250,000 new slots is impressive, recall the survey is conducted the week of the 12th of the month – before COVID-19 hit the economic markets. The economic situation is very different today than it was on Feb. 12.

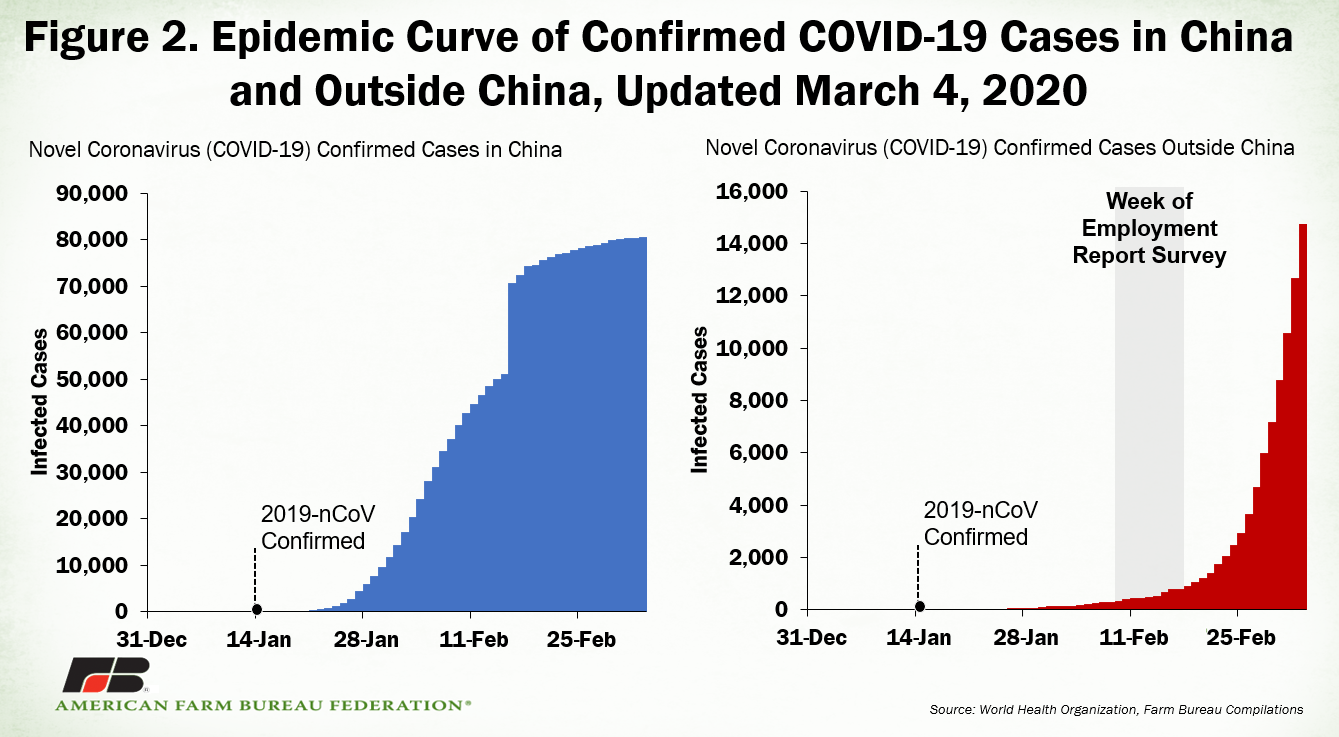

The Dow Jones industrial average averaged over 29,000 during that week, when the COBID-19 virus was almost exclusively in China. While deaths from the virus were still climbing there, overall, reports of new cases were showing signs of flattening.

With these caveats in mind, the report shows a strong economy as of the middle of February. Where we go from here is anybody’s guess.

The private service-producing sector contributed 167,000 new jobs to the overall figure. For the last three months, this component has averaged over 170,000 new jobs per month. Health care and social services comprised 56,500 of that total, with leisure and hospitality taking the top spot with 51,000 new slots. The health care sector continued to chug along, adding 31,600 jobs, the bulk of them in doctor’s offices, home health care services and other ambulatory services. Social assistance employment has shown considerable growth over the last year. Since February 2019, this sector has added nearly 200,000 new jobs, with another 24,900 coming this month.

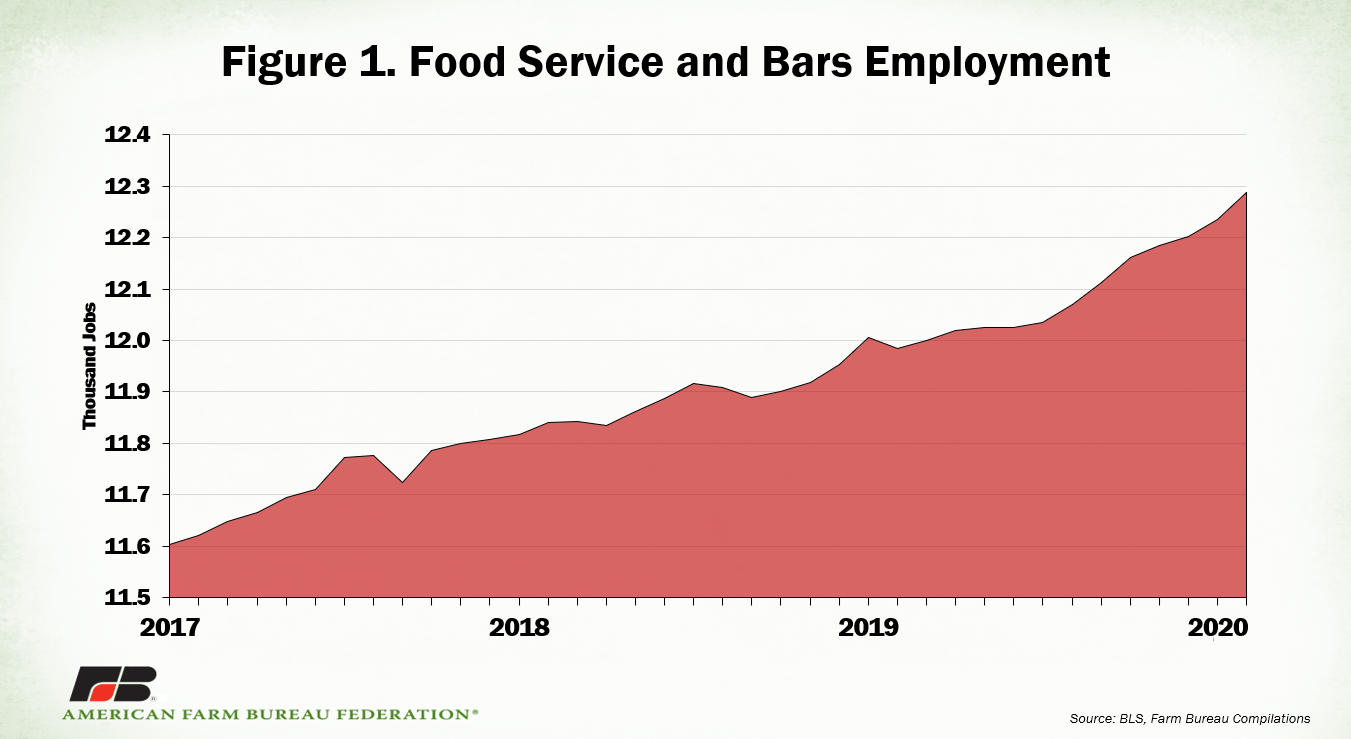

The uptick in hiring in food service and drinking establishments is a good indicator of consumer optimism. The sector added 52,600 new jobs, after picking up over 31,000 jobs last month. Feeling like they have money, more people are eating out. It is interesting to note the other half of leisure and hospitality - arts, entertainment, and recreation - was flat, with only 1,200 new jobs. People are going to restaurants and bars in droves, but they’re not boosting their time at other recreational activities.

Retail trade continues to hemorrhage jobs. While only down 7,000 slots this month, clothing and clothing accessories stores slipped 12,200 jobs. Perhaps an early reaction to COVID-19, health and personal care stores picked up 10,900 new posts.

On the actual production side of the ledger, construction came in strong again this month, with 42,000 new positions. Over half of those (25,600) were in specialty trade contractors, with another 9,700 jobs in residential building. Low interest rates are probably driving some of the new housing starts.

The manufacturing sector only added 15,000 new jobs, 11,000 of those in durable goods. Of that figure, 6,800 were in motor vehicles and parts.

Overall, it was a very positive report, one that by itself would alleviate any concerns about a downturn in the economy in the next few months. But what a difference a few days can make. Figure 2 shows the confirmed COVID-19 cases outside of China. The week of the employment survey corresponded to very few cases outside of China.

The black swan of COVID-19 and its impact on the global economy has been significant. The Chinese economy will at least show a substantial decline in growth rates for the first quarter of 2020, and may even turn negative. After contracting in the fourth quarter of 2019 due to new tax policies, the Japanese economy will likely decline again the first quarter of 2020. Oil demand is driving prices down into the mid-$40 per barrel, and it’s uncertain whether recent action by OPEC and Russia will be sufficient to add stability.

Back in the U.S., the Federal Reserve, along with other national banks, are lowering interest rates to stem the tide. In addition, equities markets have shed trillions in the last few days and the travel industry is facing what will be one of its worst quarters ever.

What comes next? The short answer has to be, no one knows. The longer answer is, still, no one really knows, but some scenarios come to mind. If the virus is somewhat contained, one would expect the economy to come back strong. The employment report suggests the underlying economy wants to grow. If this infection holds on for months to come, shutting down travel and, more importantly, supply chains and consumer demand, we could be in for a rough ride.

Top Issues

VIEW ALL