Tariffs Hit the Hide Market

Michael Nepveux

Former AFBF Economist

photo credit: Colorado Farm Bureau, Used with Permission

Michael Nepveux

Former AFBF Economist

The U.S.-China tariff tit-for-tat continued several weeks ago when China imposed another $60 billion in tariffs on U.S. exports, after the U.S. slapped tariffs on an additional $200 billion worth of Chinese goods. U.S. hides were among the casualties of this most recent round.

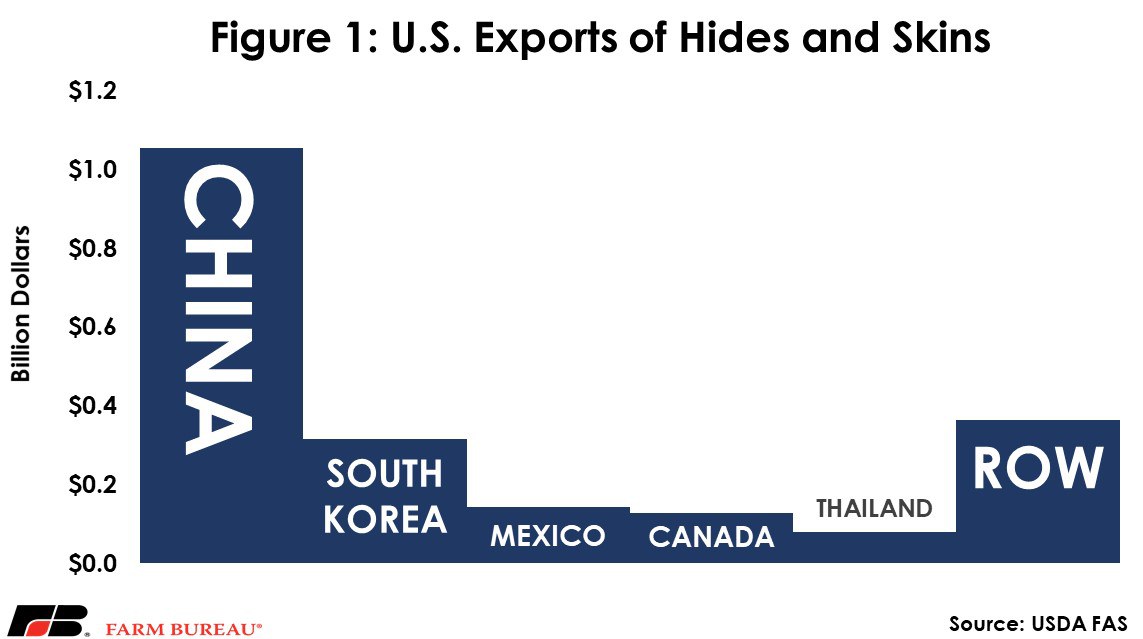

With a massive leather goods production industry, China is by far the largest importer of hides and skins in the world. Over half of U.S. skin and hide exports go to China.

Overall impact of the drop byproduct value on U.S. cattle producers

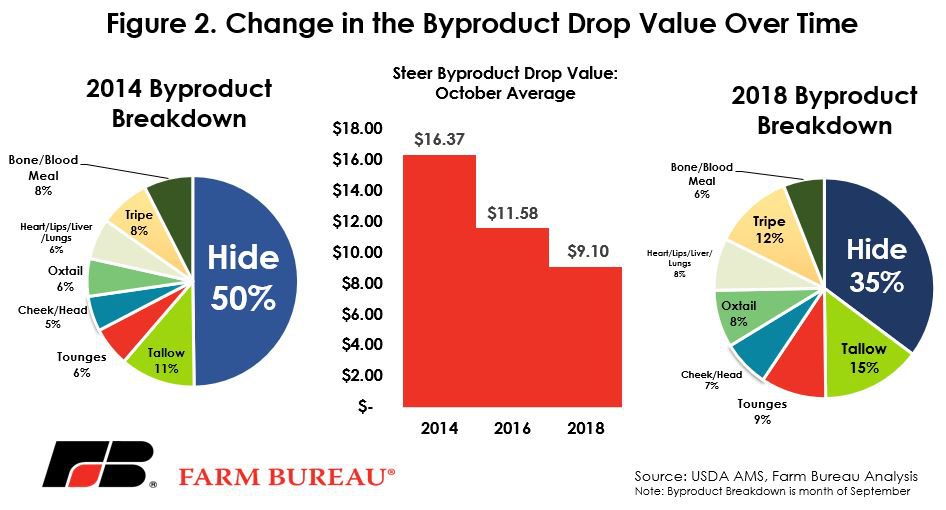

When cattle are processed, no part of the animal goes to waste. Instead, additional value is captured for every part that U.S. consumers do not eat. Edible cuts that we don’t eat get exported to countries where consumers want them. Hides are turned into leather, while bones and blood are turned into meal, and other parts of the animal are made into fats and greases used to make things like renewable diesel. These byproducts add to the overall value of the animal, with recent byproduct drop values averaging 8 percent of the value of the live fed steer. There is even research to suggest that increasing the by-product values by 10 percent could lead to an increase of 1.4 to 2.4 percent in the steer’s value. In August of 2014, steer byproduct drop values peaked at $16.83, and subsequently sharply declined throughout 2015. This moderated and recovered in 2016, but since then, this byproduct value has declined, reaching a low of $9.01 in August. The biggest driver of this decline is the drop in the value of hides. As the value of the hide has declined, so too has its share of the overall byproduct drop value.

Where do hides fit in in the drop value?

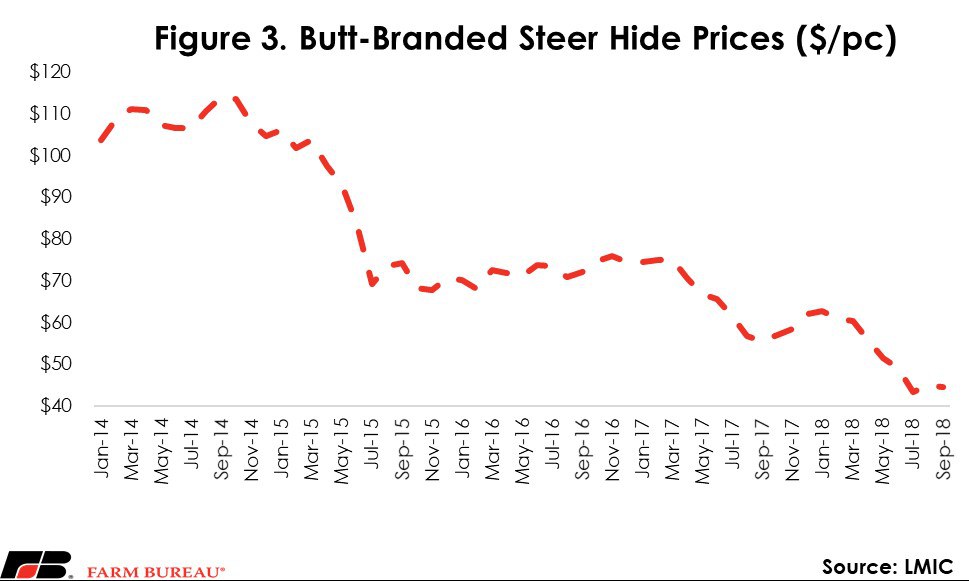

Hides account for the largest share by far of the byproduct value. However, hide prices have experienced substantial declines over the previous five years, leading hides to account for lower percentages of the overall drop value, as well as in the overall percentage of the live steer value.

This price decline has been happening for a few years now and has been pushed along by two significant factors: increased supply of hides, as well as struggling demand from China. The increased supply in hides is driven by larger numbers of domestic and foreign cattle being processed. This is the inevitable result of an expansionary phase in the cattle market in recent years.

Before these tariffs were added, China had been experiencing reduced demand for hides, a phenomenon driven by several factors including the substitution of materials, rising labor costs and tightening environmental regulations. The leather industry faces increasing and substantial competition from petroleum-based synthetic materials, particularly in footwear manufacturing. Unfortunately, while the high hide prices of two years ago were a short-term boon for the industry, they exacerbated this switch to cheaper synthetic materials. China has seen labor costs rise, spurring some factories to move to other parts of Asia. According to USDA’s Foreign Agriculture Service, shoe manufacturers reported a 500 percent increase in their labor costs over the past 30 years. In that same FAS report, tanners and shoe manufacturers reported that environmental regulations have tightened significantly over the past few years as Chinese regulators are now putting their foot down on waste water, solid waste and gas released from tanners and shoe factories.

What are the overall takeaways?

Despite the downturn in the Chinese leather industry, the country will continue to play an important role for U.S. hides. Additionally, the recent tariffs are ultimately not to blame for the tough price environment that U.S. hides are operating in. These price declines are more tied to market fundamentals, as well as increasing competition from substitutes. It should certainly be noted that U.S. tariffs on leather product imports from China will also have a measurable impact on U.S. hide prices as it depresses demand for the output of the hide market’s largest customer. Ultimately however, Chinese tariffs on U.S. hides will only make these tough times tougher for the hide industry.