The ARC-Cake is Mostly Baked

TOPICS

WheatMichael Nepveux

Former AFBF Economist

photo credit: AFBF Photo, Morgan Walker

Michael Nepveux

Former AFBF Economist

It is no secret that agricultural commodity prices have been hit hard in recent months. This low-price environment is due to a variety of factors, including favorable crop condition ratings that are driving expectations of another large crop, as well as uncertainty surrounding trade issues which threaten key markets for America’s farmers and ranchers to sell their products. These price declines have many searching for an understanding as to what farm bill tools are available for farmers to mitigate the impacts of trade tensions on their financial bottom line.

Two farm bill commodity assistance programs, Agriculture Risk Coverage and Price Loss Coverage, are designed to make payments to producers when national marketing year average crop prices, or crop revenue, falls below certain thresholds. Payment rates under ARC-CO depend on national average crop prices, county average crop yields, and five-year Olympic moving average smoothing of the product of these variables, while PLC payment rates depend on the difference between marketing year average crop prices and a target reference price. This is the first article in a two-part series and focuses on the potential support offered under the ARC-County in Title I of the farm bill.

2017/18 ARC-County Revenue Guarantee

ARC-CO is a county-based program, with payment rates determined by a statutory formula for each county. A program payment under ARC-CO is made when actual crop revenue, defined as the product of the county yield and marketing year average price, falls below 86 percent of the benchmark revenue, defined as the product of the 5-year OMA county yield and 5-year OMA crop price. Per acre payments are capped at 10 percent of the benchmark revenue guarantee. ARC-CO helps growers manage revenue risk by making program payments based on average crop revenue – thereby protecting against both price and yield declines.

For the 2017/18 marketing year, and based on USDA Farm Service Agency data, the OMA prices used in the ARC benchmark guarantees were $3.95 per bushel for corn, $10.86 per bushel for soybeans and $6.12 per bushel for wheat. Currently, USDA projects 2017/18 marketing year average prices of $3.40 per bushel for corn, $9.35 per bushel for soybeans and $4.73 per bushel for wheat – all below the ARC benchmark prices.

In examining the 2017/18 marketing year, the final actual revenues used to determine ARC-CO payments will not be known until the end of the marketing year. For corn and soybeans, the final marketing year average prices will be published at the end of September; for wheat the marketing year average price will be published at the end of August.

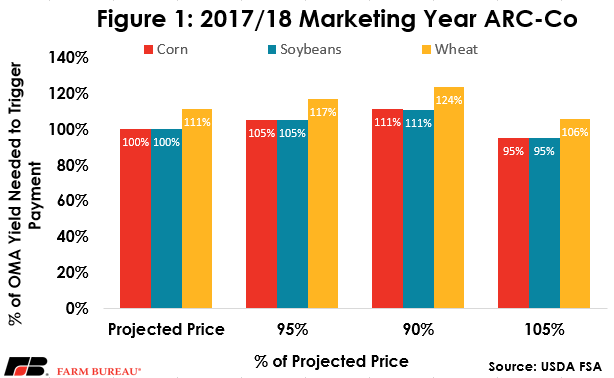

However, it can be helpful to look at the situation in terms of what crop yields would be needed to trigger a payment in this low-price environment by comparing OMA crop yields to 2017 county yields published by the National Agricultural Statistics Service. In a declining price environment, yield multipliers, defined as the product of 86 percent and the OMA price divided by the actual (in this case projected) price, can boost ARC-CO coverage so that payments are triggered even if actual yields do not fall below the benchmark yield. For example, the coverage multiplier for wheat is 111 percent, i.e. 1.11 = 0.86 x $6.12÷$4.73. Figure 1 examines this relationship, as well as potential changes under a sensitivity analysis with both declining and increasing projected prices.

Under the current projected marketing year price, and due to the depressed price environment, corn and soybean yields only need to fall below the county OMA crop yield in the county to trigger a payment on base acres. For farmers with wheat base enrolled in ARC-CO, wheat yields less than 111 percent of the county OMA yields will trigger a payment.

While the probability of yields occurring at the OMA yield level may seem good (and thus increase the chances of a payment), it should be noted that the July World Agricultural Supply and Demand Estimates report is projecting the 2017/18 national yield of each of these crops to be above the OMA yield. If there are payments, it will come down to county-by-county conditions.

Will ARC-CO Trigger?

For the 2017/18 marketing year, projections on whether or not ARC-CO will trigger can be made using the most recent NASS yield data, as well as price forecasts made in the most recent WASDE reports. It should be remembered that the yields may differ from those used by FSA in its final determination.

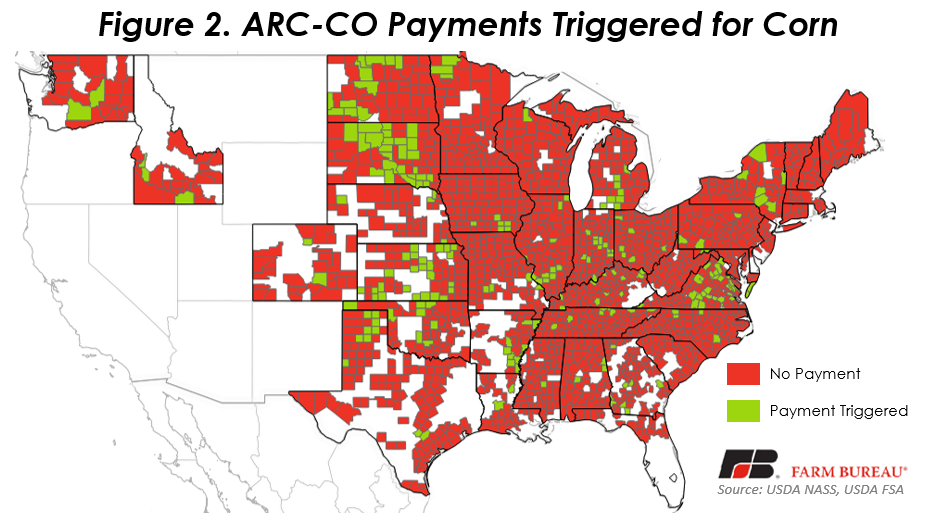

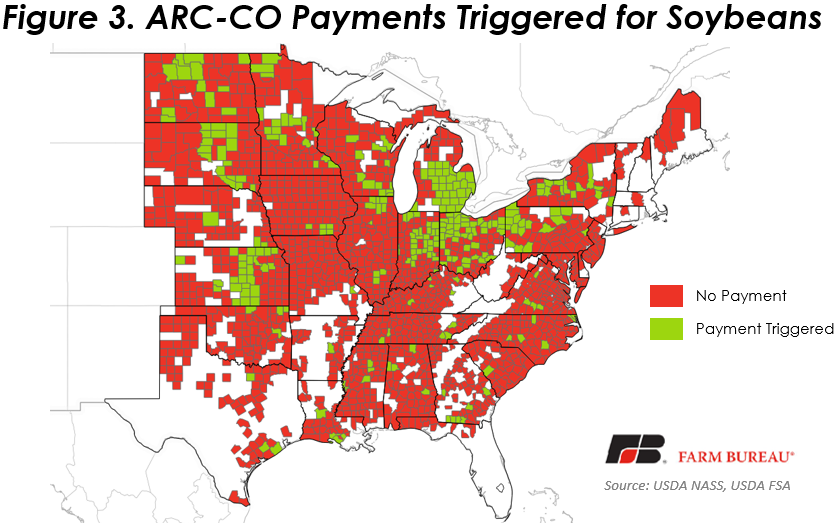

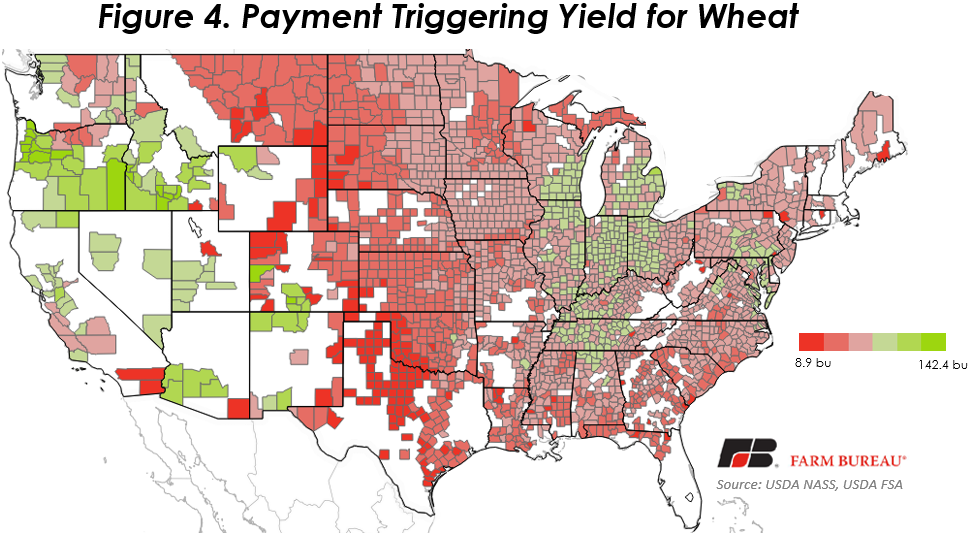

Figures 2 and 3 show counties that would have an ARC-CO payment triggered using WASDE projected prices with NASS estimated yields for corn and soybeans. Due to favorable growing conditions for the 2017/18 corn and soybean crops, ARC-CO payments are not expected to be triggered in many counties. Under ARC-CO, for corn, triggered payments are expected in just over 200 counties; for soybeans, triggered payments are expected in just under 300 counties. Again, this is estimated using NASS yields (which could differ from final FSA yields), and projected prices (which still have time to change). Figure 4 shows the payment-triggering yield by county for wheat.

Summary

Under ARC-CO, the coverage multiplier for corn and soybeans is 100 percent and for wheat it is 111 percent. This means payments would be triggered in counties which have yields equal to or less than the OMA yields for corn and soybeans (or 111 percent of the OMA yield for wheat).

It should be noted that with WASDE national yield forecasts at above historical levels, payments may not be triggered in many counties. If prices decline on good crop ratings and market uncertainty, those coverage multipliers will increase, making it easier for payments to be triggered in. However, since the marketing year is mostly over, there remains little chance prices will decline substantially from WASDE forecasts. By the time prices declined substantially amidst the trade uncertainty, most of the marketing year had already passed, leaving little chance to materially impact the marketing year average price. As a result, for the 2017/18 crop, ARC-CO is unlikely to offer much support in response to these price declines.

While some farmers have requested trade and not aide, the ARC-CO cake is essentially baked and is unlikely to provide much support to farmers because of trade-related price declines.

Top Issues

VIEW ALL