Time to Update Section 2032A Special Use Valuation

TOPICS

TaxesMegan Nelson

Economic Analyst

photo credit: AFBF Photo, Mike Tomko

Megan Nelson

Economic Analyst

There are a variety of tax laws that help protect farm and ranch individuals, partnerships and family corporations from estate taxes including 2032A Special Use Valuation. Section 2032A was implemented to allow agricultural land owners to determine the value of their property based on the use value rather than the potential development value.

The maximum reduction in property value under 2032A was established in 1997 at $750,000 and is adjusted annually for inflation. Currently, the inflation-adjusted maximum adjustment for 2032A is $1.16 million – 55% higher than the value established more than two decades ago. Meanwhile, during this same time period, USDA’s National Agricultural Statistics Service indicated that cropland values have increased by 223% and agricultural land values, including on-farm buildings, have increased by 241% (Land Values and Cash Rents Are Higher in 2018).

Clearly, the 2032A Special Use Valuation has not kept pace with the skyrocketing value of cropland and agricultural land and, as such, needs to be updated and modernized so that it fulfils its intended purpose of allowing farm and ranch families to continue their businesses in the event of a death in the family.

Background

The IRS describes the estate tax as a tax on your right to transfer property at your death. The tax is levied at the fair market value on what is known as a “gross estate,” which includes everything an individual owns or has certain interests in at the time of his or her death, such as cash and securities, qualified real property (real estate), insurance, trusts, annuities, business interests and other assets. Filing is required for estates with combined gross assets and prior taxable gifts exceeding $11.4 million for decedents dying in 2019. The tax rate is capped at 40%.

In 2017, the Tax Cuts and Jobs Act doubled the estate tax exemption from $5.5 million to $11 million per person through 2025. When indexed for inflation the current estate tax exemption is $11.4 million. This key change in the tax system temporarily protects most farmers and ranchers. However, those whose businesses are at the top of the exemption level continue to be subject to estate taxes and the planning costs associated with them (What Do the Tax Cuts Mean for Farmers and Ranchers?).

Section 2032A Special Use Valuation

Passed in 1976, Section 2032A Special Use Valuation is a tool to help farm and ranch families preserve their businesses by allowing family business owners to manage their estate tax liability. The provision allows farmers and ranchers to pay estate taxes on the value of farmland based on agricultural use, rather than what it would be worth if it were sold for development. For 2019, the maximum reduction in the estate value is $1.16 million.

For example:

A 5,500-acre farm

A developer may be willing to pay -

Fair market value (highest and best use) of $6,500 per acre = $35.7 million

However, if the family farm is passed down and meant to continue the business it would be valued at -

Productive Agriculture land-value = $3,000 per acre = $16.5 million

The difference in the total estate value is $19.3 million

However, the maximum amount that the estate value can be reduced is $1.16 million, making the farm's estate tax value $34.6 million.

Since the first $11.4 million of any estate is exempt from taxation, the remaining $23.2 million would be taxed at a rate of up to 40%, equalling a maximum estate tax liability of $9.3 million. If the maximum reduction in the estate value was greater than $1.16 million, the estate tax burden could be greatly reduced.

Requirements

To qualify for the 2032A deduction, the property must be used as a farm or in a trade or business at the time of the decedent’s death, proving historical usage. Additionally, there must be proof that the land was substantially used as a farm or trade business. The IRS requires that these two qualifications be demonstrated in a specific way - 25% of the adjusted value of the estate must consist of qualified real property. For example, if the total value of the estate is $100,000, the fair market value of the land and buildings built on the land must be valued as at least 25% of the total value, or $25,000. The qualified real property must also make up at least 50% of the estate. So, for the same estate valued at $100,000, 50%, or $50,000, must be in farm assets such as equipment, livestock or agricultural land and buildings.

Additionally, the property must have been used as a farm for five of the eight years prior to the decedent’s death, or a family member must have been part of the farm business with the decedent. The deduction also only stands if the farm is being passed down to an heir. A qualified heir, as defined by the IRS, is a member of the decedent’s family who acquired the property and is a lineal descendant, spouse, parent or spouse of a lineal descendant.

Conditions

After an executor of a farm or ranch family has elected to use Section 2032A Special Use Valuation and filled out form 706, they are committed to continue operating their farm or ranch business for 10 years. If they stop farming or ranching, sell the farm or ranch outside of the family or change the use of their property, they must repay forgiven estate taxes. In addition, certain activities that may trigger an estate tax recapture include, but are not limited to, timbering or selling a conservation easement.

If all conditions of the 2032A election are met, the property qualifies for a reduced estate tax value based on its actual specialized use. The aggregate decrease in the value of qualified real property, indexed for inflation, cannot exceed $1.16 million for 2019. This election is designed with the goal of easing the estate tax burden by providing continuity of the existing business.

Limitations of Section 2032A Special Use Valuation

The Section 2032A deduction is meant to protect family-owned farms and ranches from estate taxes. However, given the rapid inflation in farmland values, the deduction is no longer aligned with the needs of modern agriculture.

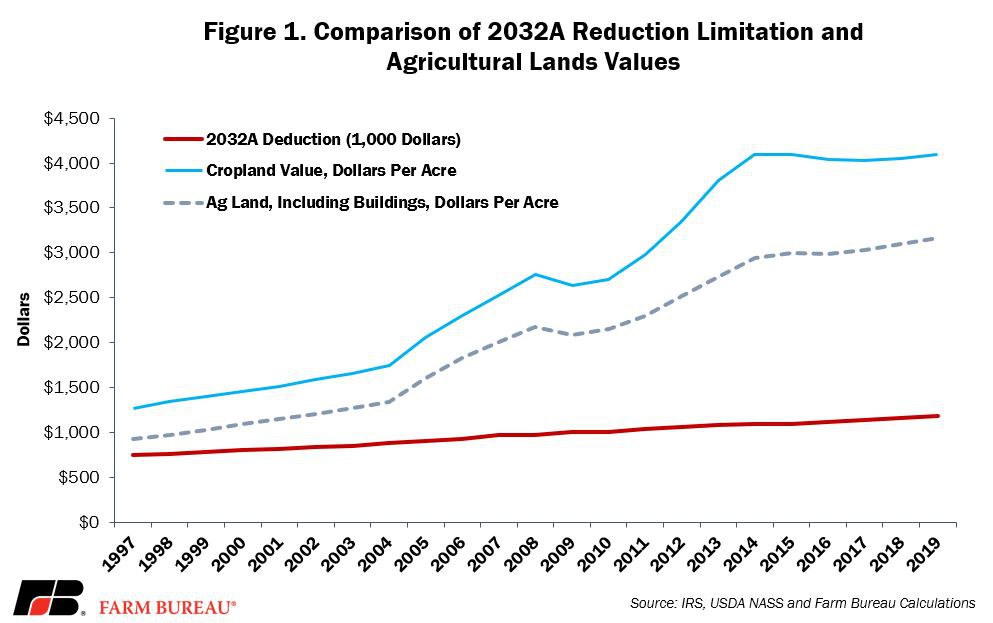

The original 2032A deduction of $750,000 was designed to increase with the pace of inflation. However, the rate of the deduction has significantly trailed the increase in farm asset values. The deduction in 2019 at $1.16 million is 55% higher than in 1997. Meanwhile, according to USDA, cropland values have increased 223% and agricultural land values, including on-farm buildings, have increased by 241% -- far above the change in the 2032A deduction.

Figure 1 illustrates the comparison between the rate of the 2032A reduction limitation compared to agricultural land values. While the 2032A deduction is increasing with inflation, it does not keep pace with the rate in which agricultural lands are increasing in value.

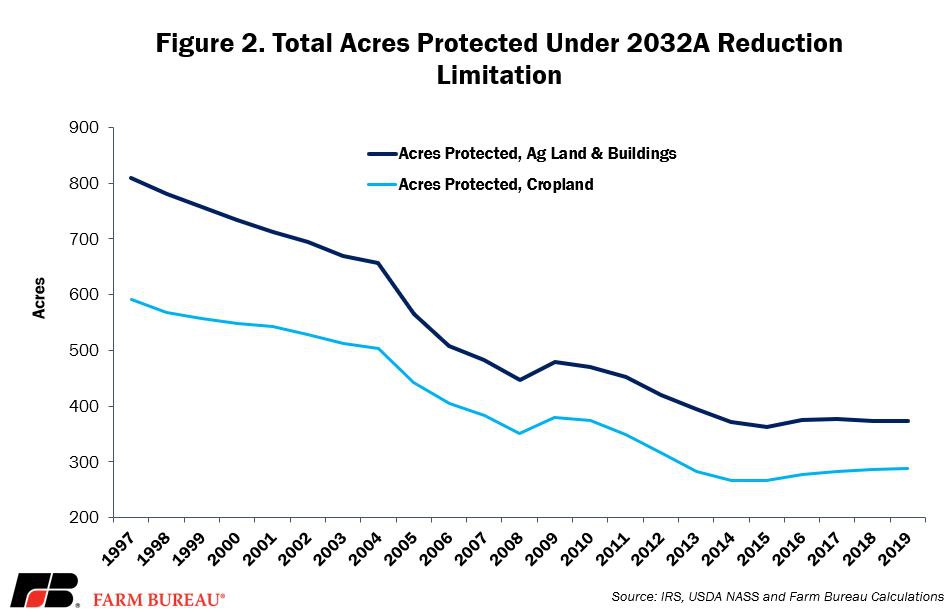

For further comparison, according to USDA’s average cropland value data, in 1997, the special use deduction of $750,000 would have protected 591 acres of cropland and 810 acres of agricultural land, including buildings. Today, the inflation-adjusted 2032A deduction protects only 286 acres of cropland and 374 acres of agricultural land including buildings – that’s 50% less land area. Figure 2 outlines the decrease in total acres protected under the 2032A reduction limitation.

Summary

The Section 2032A valuation tool for estate tax purposes was designed to provide farm and ranch families some protection from burdensome estate taxes when passing down the family business. The deduction carefully delineates between types of property eligible for the Special Use Valuation and qualifying for the 2032A election is not easy.

Though the reduction limit originally outlined in the law was updated to increase with inflation, it no longer provides the level of protection it was meant to offer farmers and ranchers.

At the current rate, the resulting savings from Section 2032A fail to compensate for the restrictions put on farm and ranch businesses. However, expanding the maximum deduction would allow more farm and ranch land to qualify for Section 2032A Special Use Valuation, making it once again a helpful estate planning tool.