One Big Beautiful Bill: Senate Edition

TOPICS

Government

Samantha Ayoub

Economist

Faith Parum, Ph.D.

Economist

The Senate passed their version of the One Big Beautiful Bill Act on July 1. This Market Intel highlights the significant differences between that bill and the bill advanced in the House of Representatives on June 22. For a full overview of provisions benefiting farmers and ranchers, see our previous Market Intel, “One Big Beautiful Bill Act: Agricultural Provisions.”

The Senate provided support for farmers and ranchers nationwide by passing their version of the “One Big Beautiful Bill Act (OBBBA).” Some details of the House bill were altered to ensure compliance with the Byrd Rule, which requires that all provisions of a reconciliation bill impact the government’s budget – through changing revenues or spending. This rule is enforced by the Senate parliamentarian who determines if any part of the bill is non-Byrd Rule compliant, which would require 60 –votes to pass.

The final Senate bill provides additional investments in agricultural support programs and additional certainty for farmers’ and ranchers’ tax bills.

Investing in Agriculture

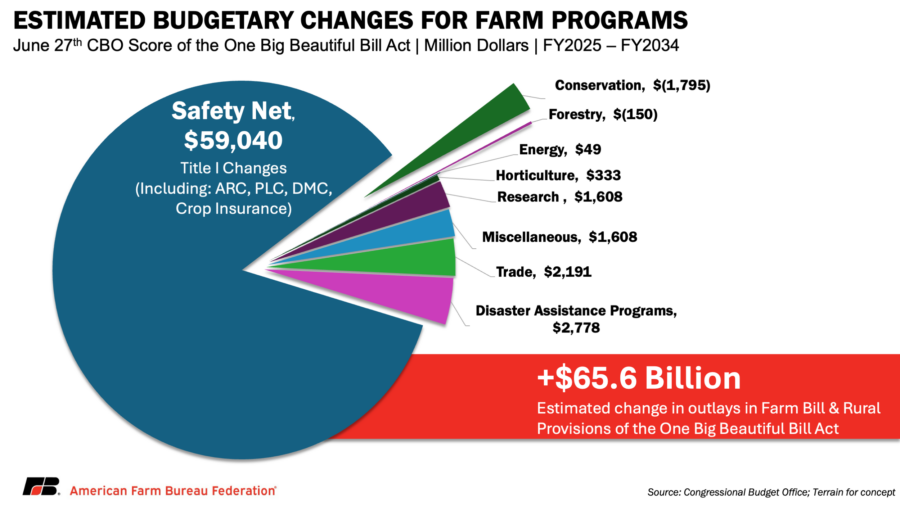

Both the House and Senate budget reconciliation packages aim to strengthen the farm safety net by updating key commodity risk management programs. Both versions continue Agricultural Risk Coverage (ARC) and Price Loss Coverage (PLC) payments, and increase reference prices and commodity loan rates. These updates better reflect today’s higher production costs and market conditions. Overall, the Senate version invests over $65.6 billion into the farm safety net, $9 billion more than in the House version.

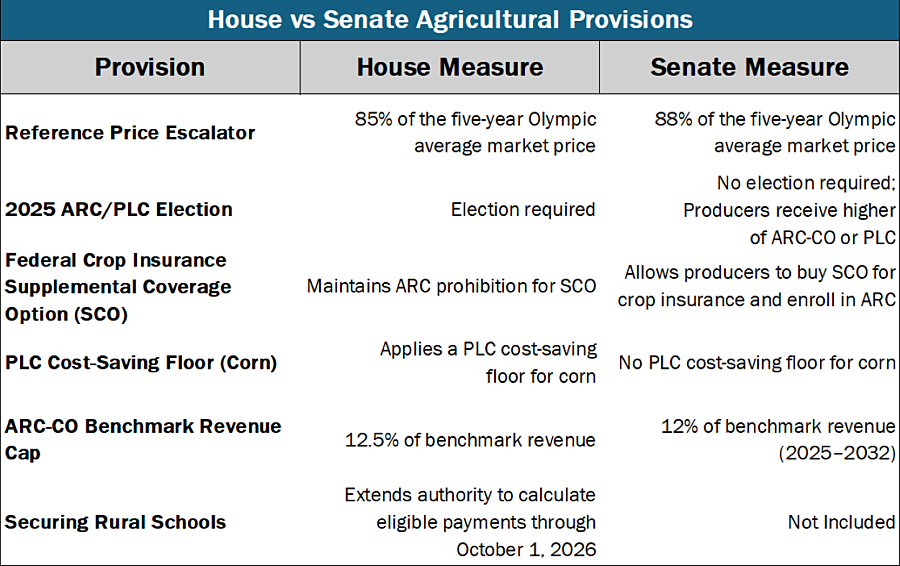

In addition, there are a few key differences between the House and Senate text. First, while the Senate keeps the updated reference prices from the House version, the Senate text increases the PLC reference price escalator calculation to 88% compared to the current 85%. Remember, this is the provision included in the 2018 Farm Bill that can adjust the effective reference price based on past market prices. The Senate also includes a escalator that increases reference prices by 0.5% a year starting in 2031, identical to the House, but caps the increase at 113% of the original statutory reference price, slightly below the House cap of 115%. The Senate also addresses the current crop year already in progress and allows producers to automatically receive the higher of the ARC-CO or PLC payment without having to make an election for the 2025 crop year. Additionally, the Senate does not move forward a House plan for a PLC cost-saving floor for corn that would limit support when market prices are high. Both versions improve ARC-CO by increasing the benchmark revenue cap, though the Senate increased the cap to 12%, while the House set it at 12.5% for crop years 2025 through 2032.

The Senate version updates the Federal Crop Insurance program to allow farmers to purchase the Supplemental Coverage Option (SCO) while enrolled in ARC. Historically, SCO was only available to those enrolled in PLC, limiting coverage options. Expanding access to both ARC and SCO will give farmers more flexibility and strengthen their risk management tools.

Secure Rural Schools was not included in this version of the OBBBA because the Senate had already chosen to reauthorize the program as a stand-alone bill. The Senate passed the Secure Rural Schools Authorization Act of 2025 in June. A companion standalone bill has been introduced in the House of Representatives, but it has not yet been taken up for a vote.

Preventing Tax Increases

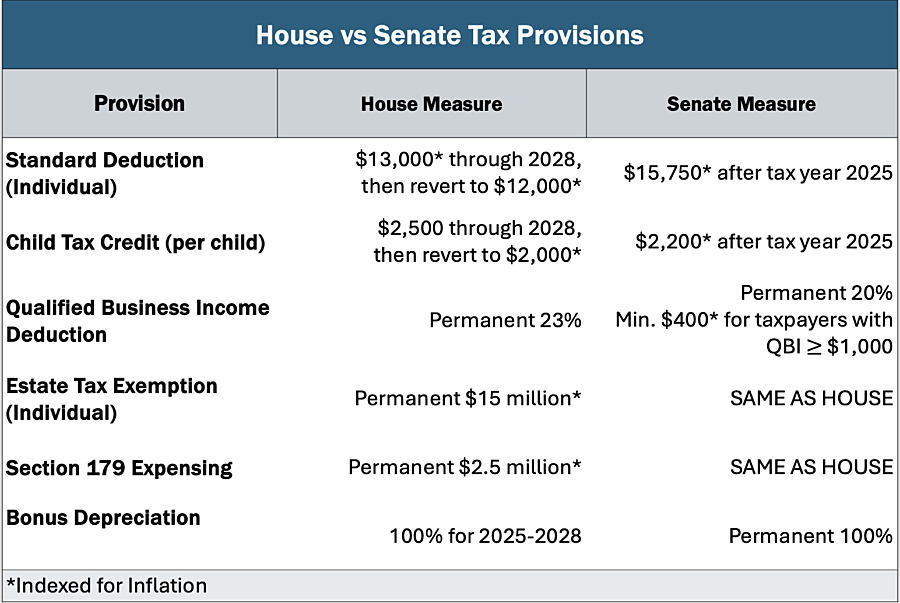

The Senate provided permanency in this version of the bill. This version of the OBBA makes additional tax relief investments beyond the Tax Cuts and Jobs Act (TCJA) provisions, but lowers some deductions below House levels to limit the cost of extending them into perpetuity.

For example, the standard deduction under the Senate bill will rise permanently to $15,750 instead of the temporary increase to $13,000 included in the House plan. Full bonus depreciation will also be made permanent under the Senate bill. However, the child tax credit will only increase to $2,200 – but permanently – compared to $2,500 through 2028 in the House bill.

On the business front, farmers, ranchers and rural businesses will continue to receive tax parity to their corporate counterparts through a permanent Section 199A deduction. The Senate chose to keep the deduction at 20% and add a minimum deduction of $400 (indexed for inflation) for any pass-through business with over $1,000 of qualified income instead of raising the deduction to 23%.

Other crucial provisions for agriculture were also included in the Senate bill. Domestic research and development (R&D) expenses will permanently be depreciable in the year they are incurred. For domestic R&D expenses incurred between 2021 and 2024 that are still being amortized, companies will be able to deduct the remainder of their expenses in the next one or two tax years.

The Senate OBBB also includes an increased deduction for state and local taxes (SALT). TCJA capped SALT deductions at $10,000. The Senate’s bill raises this cap to $40,000 in 2025, followed by $40,400 in 2026 and a 1% increase each year following until 2029. However, the cap will revert to $10,000 in 2030. The House also starts at $40,000 in 2025 and increases 1% per year through 2033.

Based upon the Protecting American Farmlands Act, this version of the OBBBA allows capital gains from the sale of farmland to be paid in four equal yearly installments if the land is sold to a farmer who commits to keep farming the land for at least 10 years. This gives farmers flexibility while also incentivizing keeping farmland in farming. Other provisions impacting farmers and ranchers include an extension of the 45Z clean fuel production credit through 2029 for fuel produced using North American feedstocks, which we will address in detail in a later Market Intel.

Conclusions

Many farm bill programs could not be included in reconciliation because they are policy, not budgetary. Those updates and extensions will have to be addressed in what many are dubbing a “skinny farm bill.” This includes suspending permanent price support which is required to replace individual commodity support programs from the 1930s and 1940s with the new reference prices. It was tossed out of the reconciliation bill after being ruled non-compliant to the Byrd Rule but it is needed to set commodity program prices to modern levels and cover crops without their own program in permanent law.

The One Big Beautiful Bill Act will now cross back to the other side of the Capitol for final approve by the House of Representatives. There are two paths of action the House could take: approving the Senate bill as it stands or going to conference to reconcile differences between the two packages. President Trump has set a goal of July 4 for signing the final bill, so it is bound to be a busy few days in Washington, D.C., as this bill moves closer to the finish line.