One Big Beautiful Bill Act: Agricultural Provisions

TOPICS

Government

Daniel Munch

Economist

Samantha Ayoub

Economist

The House of Representatives’ advancement of H.R.1, the “One Big Beautiful Bill Act,” marks a significant step toward restoring longer-term certainty for farmers and ranchers after a series of short-term extensions of the 2018 farm bill. Reconciliation is a special legislative process that allows certain budget-related bills to pass with a simple majority in the Senate, bypassing the filibuster, making it a powerful tool for enacting key priorities. The bill combines several Farm Bureau-supported provisions, across commodity programs and tax policy, into one comprehensive package.

The bill comes amid continued debate over farm policy and persistent challenges in farm country, such as volatile markets, high production costs and weather disasters. While H.R.1 extends critical programs through 2031 and includes fresh investments in agriculture, the Senate is not required to take up the House version and may modify it significantly. As that process unfolds, farmers and ranchers are watching closely, urging lawmakers to retain and strengthen provisions that provide meaningful support for agriculture.

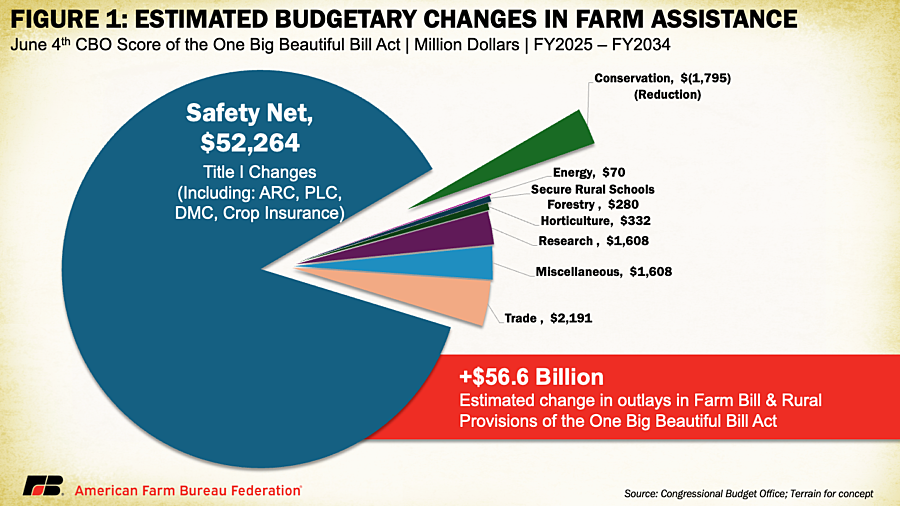

According to the nonpartisan Congressional Budget Office (CBO), the House-passed version of the One Big Beautiful Bill Act would increase agriculture-facing programs spending by $56.6 billion over the next decade (fiscal years 2025–2034). Of the total increase, $52.3 billion is tied to enhancements in the farm safety net, such as higher reference prices under Price Loss Coverage (PLC), adjusted formulas for Agricultural Risk Coverage (ARC) and expanded crop insurance support. The remaining $4.3 billion includes investments in trade promotion, rural school funding, livestock biosecurity, research and energy programs (Figure 1).

One Big Beautiful Bill Act – Digging into the Details

Farm Bill Provisions (Title I, Subtitle B – Investment in Rural America): H.R.1 includes a broad reauthorization of the farm bill’s non-discretionary spending provisions, updating and funding many core agriculture titles through 2031. Important provisions include:

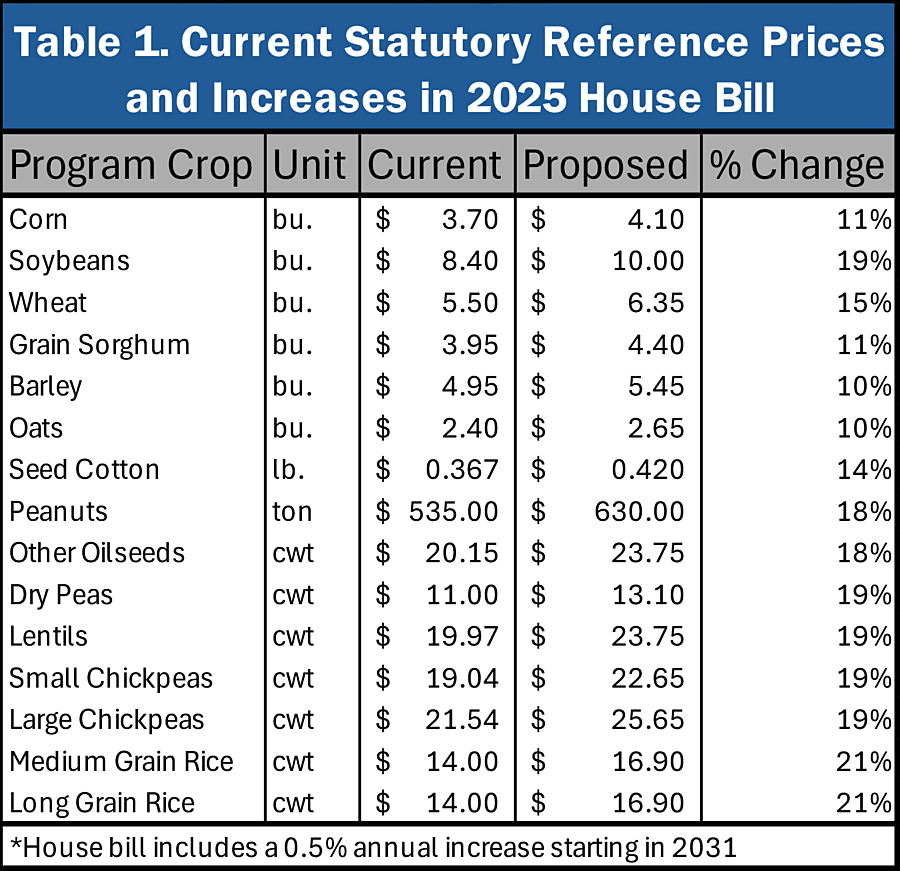

Safety Net (Commodity Programs and Crop Insurance): extension of key commodity support programs – including PLC, ARC, marketing assistance loans and Dairy Margin Coverage (DMC) – through the 2031 crop year, avoiding any lapse into outdated “permanent” farm law. The bill raises statutory reference prices (price guarantees) for major covered commodities by 10-21%. Additionally, H.R.1 introduces a reference price escalator mechanism beginning in the 2031 crop year, which increases reference prices by 0.5% annually on a compounded basis. This increase is capped at 115% of the original statutory value, allowing modest growth to reflect longer-term market trends while avoiding unchecked program expansion.

To provide a voluntary opportunity for base acreage alignment, the bill permits farmers to add up to 30 million new base acres, offering greater eligibility for commodity support while avoiding mandatory reallocations. The bill also raises marketing assistance loan rates for commodities – enhancing cash flow support during low-price environments.

H.R.1 updates the ARC program by adjusting the revenue guarantee and payment cap beginning in 2025 — increasing the coverage threshold to 90% of benchmark revenue and increasing the payment cap from 10% to 12.5% — to better target support during deeper revenue losses.

For dairy producers, the bill enhances the DMC program by increasing Tier I coverage eligibility from 5 million to 6 million pounds per farm. Farms can also use the highest production year from 2021 to 2023 as a new enrollment baseline. Those who commit to multiyear DMC coverage receive a 25% discount on premiums, encouraging long-term participation.

Crop insurance remains a cornerstone of the farm safety net. The bill increases premium support for beginning farmers and authorizes a new pilot insurance product for poultry growers to address risks related to market volatility of inputs such as natural gas and electricity, and adverse weather or animal health occurrences. Additionally, the definition of a "beginning farmer or rancher" is expanded from five to 10 years to align with USDA’s definition, allowing more producers to qualify for premium assistance over a longer period. The premium subsidy for beginning farmers is increased to 15 percentage points above the standard rate for the first two crop years, and 10 percentage points for crop years three through 10.

Together, these updates aim to strengthen the agricultural safety net and provide producers with tools to manage both market- and weather-related risks through 2031.

Conservation Programs: The bill continues long-term funding authority for USDA’s major conservation programs, including the Environmental Quality Incentives Program (EQIP), Conservation Stewardship Program (CSP) and Agricultural Conservation Easement Program (ACEP) through fiscal year 2031. While these levels exceed those provided under the 2018 farm bill, they primarily reflect the redirection of Inflation Reduction Act (IRA) funding into the permanent farm bill baseline rather than new program expansions. These updates are reflected in amendments to Section 1241(a) of the Food Security Act of 1985, which establish higher annual funding levels than those provided under the 2018 farm bill.

Although this shift reinforces long-term baseline investments in working land conservation, the bill does not retain all IRA-funded initiatives. For example, it rescinds $450 million in unobligated IRA funds that had been allocated for competitive forestry grants to non-federal landowners. According to the Congressional Budget Office, these adjustments collectively result in a net reduction of $1.8 billion in conservation spending over the next decade.

The bill also renews smaller initiatives that were not funded in the last farm bill extension. This includes the Grassroots Source Water Protection program, which safeguards well water, and the Voluntary Public Access and Habitat Incentive program, which rewards farmers for opening land to hunting and recreation. In addition, the Feral Swine Eradication and Control Pilot Program, a vital initiative to combat over $1.6 billion in annual damages caused by invasive wild pigs, is extended with new funding through 2031.

Trade Promotion: An earlier draft of H.R.1 would have increased funding for USDA’s core trade promotion programs — including the Market Access Program (MAP), Foreign Market Development (FMD), Emerging Markets Program and Technical Assistance for Specialty Crops through 2031. However, due to jurisdictional constraints in the reconciliation process, the proposed investment was restructured into a new Agricultural Trade Promotion and Facilitation Program. This new initiative maintains a similar purpose and function to MAP and FMD and provides $285 million annually in permanent mandatory funding through a separate account. Because the bill does not modify or replace MAP or FMD, which are typically funded at $200 million and $34.5 million per year, respectively, the new program effectively doubles USDA’s total trade promotion capacity.

Research and Innovation: H.R.1 maintains support for USDA research agencies and land-grant universities, providing targeted investments across agricultural research programs. For example, it allocates $175 million starting in fiscal year 2026 to the Specialty Crop Research Initiative, more than doubling current funding levels, to advance research in pest control, crop breeding and mechanization for high-value crops. The bill also expands scholarship support for 1890 Land-Grant Universities, which serve historically Black institutions with agricultural programs. Mandatory funding that will eventually total $200 million a year is directed to competitive grants aimed at modernizing research infrastructure at aging facilities nationwide. These new investments are intended to strengthen agricultural innovation capacity through improved labs, updated technologies and science-driven approaches to production challenges.

Rural Development, Forestry and Schools: H.R.1 extends the Secure Rural Schools program through 2026, providing critical funding to counties with national forest lands for rural education, roads and emergency services. This continuation is especially important for timber-dependent communities in the West, where local tax bases are limited by federal land ownership.

Energy Programs: Under the bill’s energy title extensions, USDA’s farm energy and biofuel programs are reauthorized through 2031 to spur renewable energy innovation in rural America. This includes the Biobased Markets Program (BioPreferred), which promotes biobased (plant-derived) products through federal procurement and labeling and the Bioenergy Program for Advanced Biofuels, which provides payments to producers of biodiesel, cellulosic ethanol and other next-generation fuels.

The bill’s tax title also extends the 45Z clean fuel tax credit to 2031 while providing additional flexibilities in the emission scores for feedstocks. The 45Z update also includes limiting eligible feedstocks to those produced in the U.S., Mexico or Canada, preventing the import of other feedstocks for use in the program. By extending these programs, H.R.1 encourages the growing market for domestic farm-derived renewable energy, supporting corn ethanol, soybean biodiesel and emerging fuels from agricultural residues like animal manures which could now be eligible for the 45Z tax credit.

Specialty Crops, Horticulture and Organics: The bill delivers tailored support for specialty crop growers (fruit, vegetable, nut and nursery crop farmers) and the organic sector. It increases funding for the Specialty Crop Block Grant Program – grants to state ag departments that enhance the competitiveness of local specialty crop industries – starting in 2026, with guaranteed annual funding thereafter. Additional resources are devoted to combating plant pests and diseases: H.R.1 boosts the Plant Pest and Disease Management and Disaster Prevention Program to better shield growers from invasive threats (for example, citrus greening and spotted lanternfly).

For organic agriculture, the bill reauthorizes programs that provide organic market data, technology upgrades for tracking organic imports and cost-share assistance to farmers transitioning to organic certification.

Miscellaneous and Livestock Provisions: H.R.1 addresses a grab-bag of important programs that don’t neatly fit into a farm bill title but matter on the ground. A major highlight is animal agriculture health: the bill injects significant new funding into the three-pronged National Animal Disease Preparedness, Detection and Vaccine Bank programs. Starting in 2026, USDA must spend $233 million per year on animal disease prevention and response, a seven-fold increase over previous levels. This means more resources to stockpile vaccines, bolster veterinary diagnostics and train state responders – a timely investment to protect livestock farmers from devastating outbreaks. This increases resources to counter significant threats like foot-and-mouth disease, highly pathogenic avian influenza and screwworm. As poultry producers in multiple states have learned the hard way, an outbreak of avian influenza can decimate flocks overnight. Similarly, a single case of foot-and-mouth disease in U.S. livestock could halt billions in exports. Ensuring veterinary readiness is a direct line of defense against these market shocks.

The bill also directs USDA to conduct a mandatory biennial cost survey of dairy processors to assess the actual manufacturing costs of converting raw milk into cheese, butter and nonfat dry milk — products used to set Class III and IV milk prices under the Federal Milk Marketing Orders. Developed with direct input from Farm Bureau, this provision ensures that future make allowance updates are based on consistent, up-to-date data, a long-standing request from dairy farmers seeking fairer and more transparent pricing formulas.

The bill extends USDA’s Livestock Indemnity Program and other disaster assistance programs, originally made permanent in the 2014 farm bill, ensuring ranchers continue to receive support for losses caused by extreme weather, predators and other eligible events, while expanding support to indemnify for the full value of gestating livestock. It also expands funding for the Sheep Production and Marketing Grant Program through 2026 to support innovation and marketing efforts in the sheep and lamb industry.

Several previously expired or “orphaned” programs are revived and funded through 2031, including the Pima Cotton Trust Fund and Wool Apparel Manufacturing Trust Fund, which assist U.S. textile manufacturers, as well as the wool research and promotion program. The bill also extends the Emergency Citrus Disease Research and Extension Program — focused on combatting huanglongbing (citrus greening) — through 2031, providing researchers with sustained funding to develop long-term solutions to protect citrus groves in Florida and other key growing regions.

To further support U.S. cotton growers, H.R.1 modernizes the Upland Cotton Competitiveness Program (“Step 2”) to reflect global trade realities. With nearly 80% of U.S. cotton exported, this update helps American farmers compete against heavily subsidized foreign cotton, keeping U.S. cotton in the market, prices stronger at home and rural economies more resilient.

Nutrition Title: Alongside farm programs, H.R.1 also reauthorizes nutrition assistance – chiefly the Supplemental Nutrition Assistance Program (SNAP) – with some reforms, aiming to balance support for vulnerable families with reducing incidents of fraud. The bill extends SNAP and related nutrition programs through 2031. It includes updated work requirements for able-bodied adults without dependents, minor program integrity reforms and continued support for food banks via The Emergency Food Assistance Program (TEFAP).

Savings from these changes, scored by CBO as reducing federal nutrition spending, enabled expanded investment in the farm safety net and rural development without increasing overall agricultural spending.

Tax Provisions Benefiting Farmers, Ranchers and Rural Businesses (Title XI, “The One Big Beautiful Bill”): H.R.1 also delivers major tax relief and incentives that can directly impact farm and ranch families. These include:

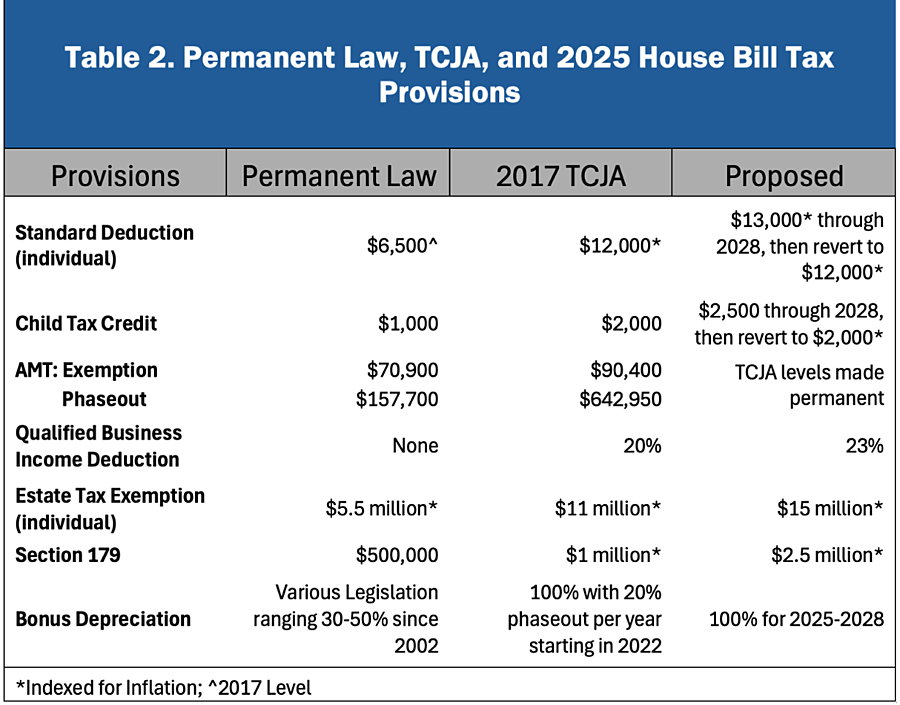

Permanency of 2017 Individual Tax Code Provisions: Nearly 98% of farms and ranches operate as sole proprietorships, partnerships or S-corporations and did not benefit from the permanent tax relief granted to corporations in 2017. H.R. 1 grants permanency to numerous tax provisions important to families and farms in Title XI, Part 1, preventing their tax rates from increasing if left to expire at the end of 2025. These provisions include expanded tax brackets with a lower maximum tax rate, a doubled standard deduction and child tax credit and increased thresholds for Alternative Minimum Tax (AMT) liability. The bill goes a step further to temporarily enhance some provisions, adding $1,000 per individual to the standard deduction and $500 per child to the child tax credit through 2028.

Qualified Business Income Deduction (Section 199A): For pass-through entities, H.R.1 makes permanent – and improves – the 20% qualified business income deduction introduced in 2017. Starting in 2026, the deduction would increase to 23% of business income with adjustments to allow the deduction to phase-out more slowly for high earners. This lowers the share of farming profits spent on taxes and is a big win for small businesses nationwide that compete alongside corporations with lower tax rates.

Estate Tax Relief for Family Farms: H.R.1 makes the estate tax exemption permanent at $15 million per individual (or $30 million per couple), indexed for inflation. Without this change, the exemption was set to drop back to $5.5 million after 2025, a level that’s wildly out of step with today’s farm economy. With skyrocketing land values, equipment costs and input prices, even modest-sized farms can easily exceed that threshold, meaning upon the owner’s death, far more family operations would face massive tax bills than previously estimated. By locking in a higher, inflation-adjusted exemption, the bill helps ensure more family farms can transition smoothly to the next generation without being forced to sell off land or assets to pay the IRS.

Enhanced Business Expensing and Depreciation:The bill raises Section 179 small business expensing limits to $2.5 million (up from about $1.29 million), with a higher phase-out threshold of $4 million. In addition, H.R. 1 restores full bonus depreciation for capital investments in 2025 through 2029, canceling the remaining phase-down of this expensing benefit. Practically, these provisions mean farmers can continue to write off the entire cost of new equipment, land improvements like drainage tile, modernized barns and other essential capital upgrades in the year of purchase, rather than depreciating them over many years.

In addition, H.R.1 delivers practical tax relief that matters on the ground. Higher thresholds for 1099-K reporting reduce unnecessary paperwork for farms that hire independent contractors or custom services. And by extending key biofuel and renewable energy credits, the bill lowers the cost of on-farm energy projects from biodiesel blending to manure-to-methane systems. Together, these updates cut red tape, reduce expenses and support farmers as they manage razor-thin margins.

One Big Beautiful Bill Act - Conclusions

H.R.1 represents a meaningful step toward securing the tools farmers and ranchers need to navigate today’s volatile economic landscape. While not all-inclusive, the bill reflects many of Farm Bureau’s core priorities: strengthening the farm safety net, delivering long-term tax relief, supporting market access and investing in animal health and ag innovation. As the Senate considers its path forward, Farm Bureau will continue advocating for a final package that upholds and builds upon these critical wins for American agriculture.

Top Issues

VIEW ALL