Reviewing ARC, PLC and SCO Commodity Safety Net Programs

photo credit: Alabama Farmers Federation, Used with Permission

Shelby Myers

Former AFBF Economist

For farmers with base acres and eligibility to participate in Title I commodity safety net programs, the deadline for election and enrollment of covered commodities such as corn, soybeans, wheat, seed cotton, rice and peanuts into Agriculture Risk Coverage or Price Loss Coverage is quickly approaching. The cutoff date for completing the program election and enrollment process for the 2019 crop year is March 16, and the closing date for the 2020 crop year is June 30. (A producer can sign up for both crop years ahead of the March 16 deadline.)

Farmers enrolling in ARC or PLC must make a one-time election on a commodity-by-commodity basis in either ARC-County Option or PLC, or they may enroll all covered commodities in ARC-Individual Coverage. Farmers choosing to enroll commodities in PLC may also purchase additional shallow loss coverage through the Risk Management Agency’s Supplemental Coverage Option program. For example, a producer may enroll all seed cotton base acres in PLC and SCO and enroll all soybean base acres in ARC-CO, or he or she may enroll all seed cotton and soybean base acres in ARC-IC.

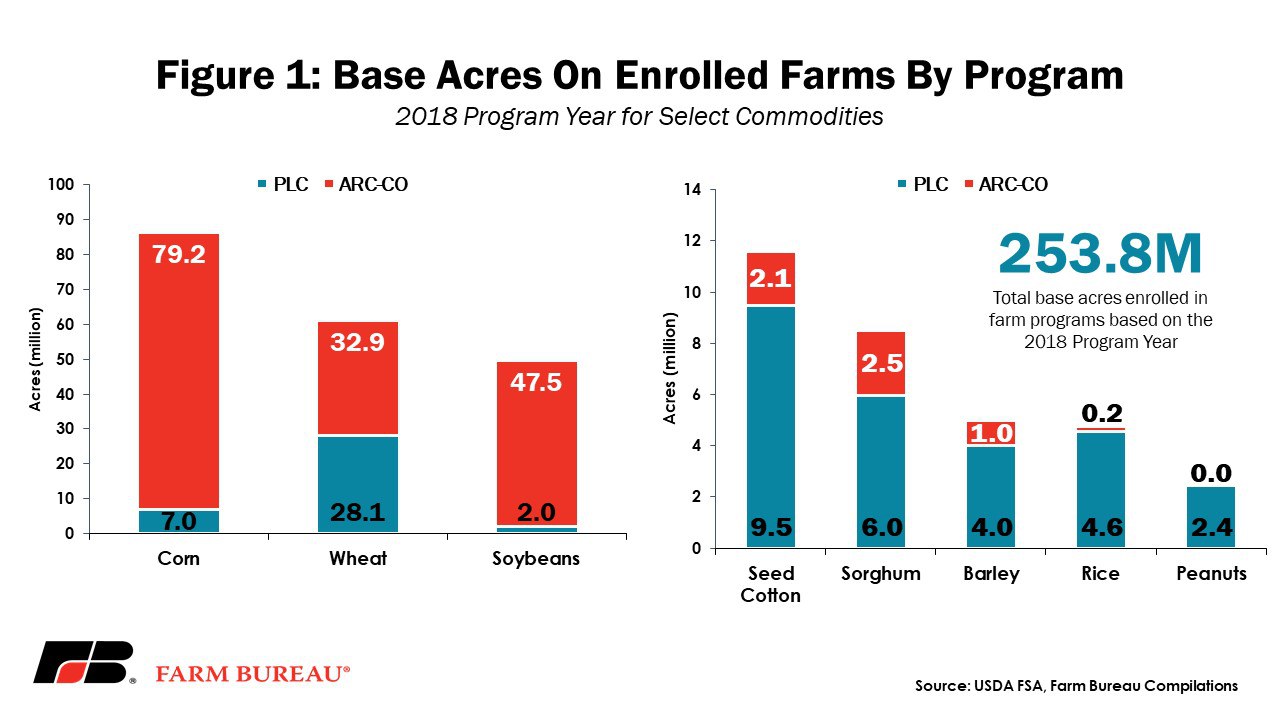

There are 22 covered commodities eligible for ARC and PLC. These commodities include corn, wheat, soybeans, seed cotton, grain sorghum, barley, rice-long grain, peanuts, oats, sunflowers, canola, rice-temperate japonica, dry peas, lentils, flaxseed, rice-medium grain, safflower, large chickpeas, mustard, small chickpeas, sesame, crambe and rapeseed. At the end of the 2014 farm bill sign-up periods in 2018, there were a total of 253.8 million base acres enrolled in ARC and PLC, with 68.4 million acres in PLC, 167.9 million acres in ARC-CO and 2.07 million acres in ARC-IC. Figure 1 highlights the base acres for select covered commodities based on the 2018 program year.

To assist farmers in making program decisions, this Market Intel provides an overview of each of the commodity safety net programs.

Agriculture Risk Coverage – County Option

Agriculture Risk Coverage is an income support program that provides payments when actual county-level crop revenue, based on county-average yields and the marketing year average price, falls below 86% of the benchmark revenue.

The benchmark revenue is the product of the five-year Olympic moving average of county yield and marketing year average prices. The five-year Olympic average drops the highest and lowest values from the sample and averages the remaining three values. For example, the 2019 program year will average prices and yields from 2013 to 2017. USDA’s projected benchmark and actual price calculations for ARC-CO can be found here.

Program payments under ARC-CO are capped at 10% of the ARC-CO benchmark revenue. ARC-CO program payments are paid on 85% of the farm’s base acres of the covered commodity. Previous Market Intel articles reviewed ARC-CO details and payment expectations for the 2019 program year, i.e., ARC-County, A Bird in The Hand for Some in 2019 and What’s in Title I of the 2018 Farm Bill for Field Crops?.

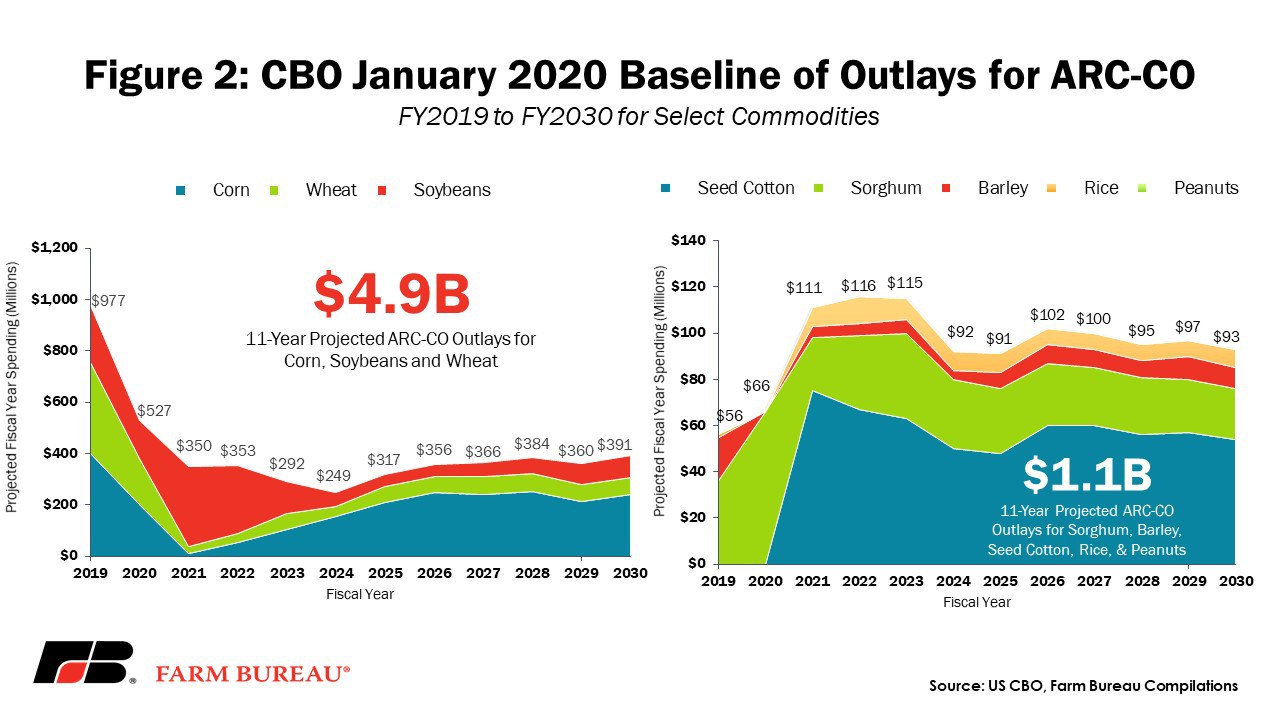

The Congressional Budget Office's January 2020 Baseline for Farm Programs projects ARC-CO expenditures over the next 10 years to total $5.29 billion. ARC-CO expenditures are expected to range from a high of $1.06 billion in 2019 to a low of $351 million in 2024. At $1.9 billion, corn is projected to be the maximum outlay over the 10-year period, with the largest expenditure, $401 million, projected in 2019. Soybean projections total $1.27 billion from 2020 through 2030, with the largest outlay projected at $311 million, in 2021. Outlays for wheat are expected to reach $739 million over the 10-year period, with the largest expenditure coming in at $354 million, in 2019. Seed cotton projections come in at $735 million over the next 10 years, with the highest outlay, $75 million, projected to occur in 2021.

Agriculture Risk Coverage – Individual Coverage

While ARC-CO is a commodity-by-commodity program, ARC-IC is a whole farm program that bases program benefits on individual farm yields for all covered commodities. An ARC-IC payment is triggered when the actual crop revenue for all covered commodities planted on the farm is less than 86% of the benchmark revenue and is capped at 10% of the individual weighted benchmark revenue. While ARC-CO program payments are paid based on 85% of the farm’s base acres, ARC-IC limits payments to 65% of the farm’s base acres.

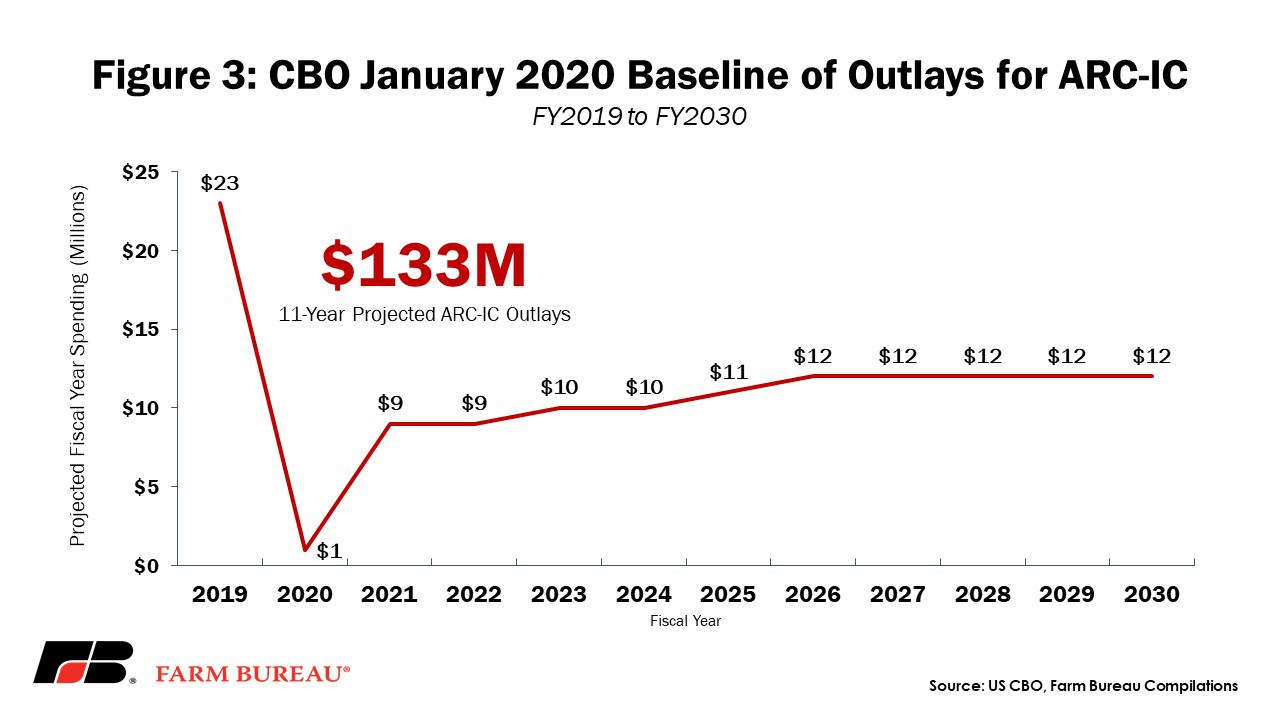

The CBO’s 10-year projections put the ARC-IC program cost at $109 million from 2020 through 2030. The largest expenditure for the program, $23 million, is estimated to occur in 2019.

Price Loss Coverage

The PLC program delivers a deficiency payment when the effective price of a covered commodity is less than the effective reference price, i.e., when the price of a commodity falls below a specific price floor. For example, a $3.30 market year average price for corn is below the effective reference price of $3.70 and would trigger a program payment of 40 cents per bushel. The effective price equals the higher of the MYA or the national average loan rate for the covered commodity.

A new feature in the 2018 farm bill is a floating reference price in PLC. Under a floating reference price, the effective reference price is determined by comparing the statutory reference price to 85% of the five-year Olympic moving average of the MYA price, selecting the higher one, then comparing it to 115% of the reference price and picking the smallest. Projected PLC payment rates based on the effective reference prices are here.

Like ARC-CO, PLC program payments are made on 85% of the farm’s base acres and the farm’s PLC program yield. Farm owners will have an opportunity in 2020 to voluntarily update PLC yields of each individual covered commodity on their farm. The updated yield is equal to 90% of each covered commodity’s 2013-2017 simple average yield, but a yield floor equal to 75% of the county yield is in place to address any poor crop yields in the sample period. Yield updates can occur until Sept. 30.

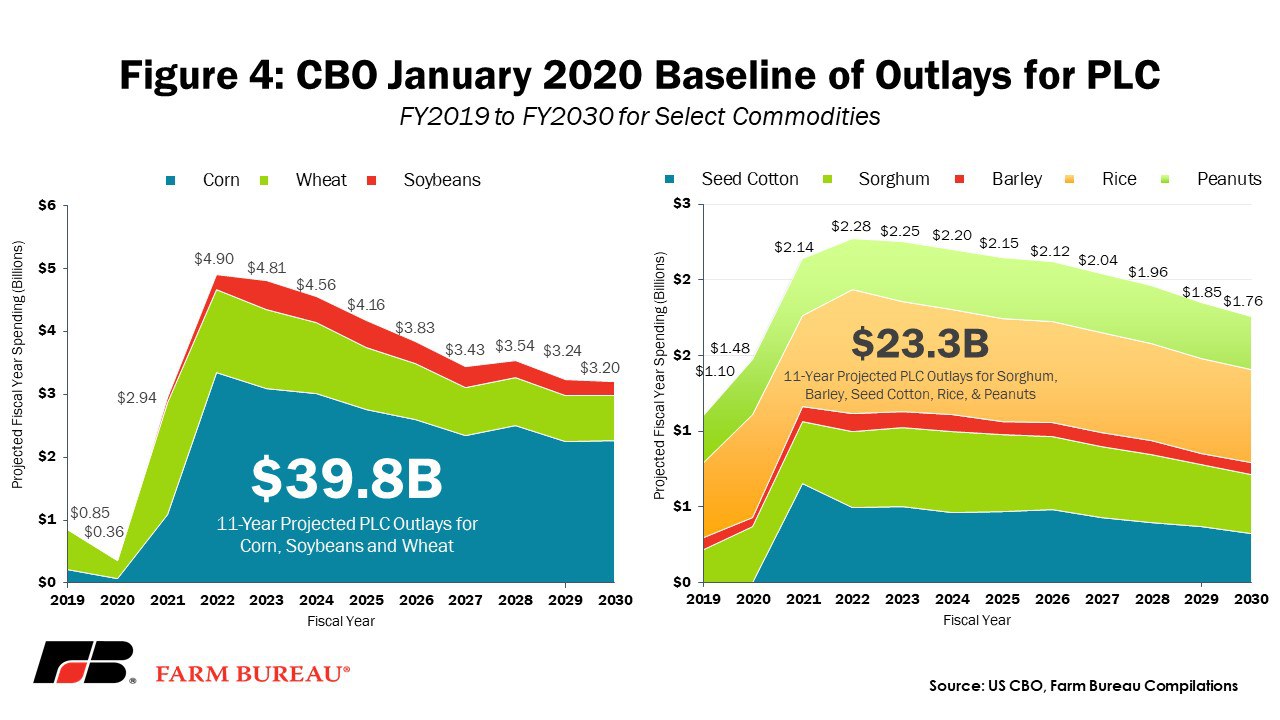

The PLC projections from CBO put total expenditures at $62.98 billion from 2020 through 2030. Those projections run from a high of $7.3 billion in 2022 to a low of $2.03 billion in 2019. Corn is projected to be the largest expenditure overall at $25 billion, with the largest outlay, $3.3 billion, occurring in 2022. A total of $10.5 billion is expected to be spent on wheat over the 10-year period, with the largest expenditure, $1.78 billion, occurring in 2021. Total spending for seed cotton is projected at $4.8 billion and rice is expected to come in at $7.4 billion from 2020 through 2030. Soybeans are projected at $3.04 billion over the 10-year period, with the largest expenditure, $467 million, occurring in 2023.

Supplemental Coverage Option

SCO, commonly known as shallow loss coverage, is a county-level crop insurance product provided by RMA that offers additional coverage for a portion of the underlying crop insurance policy deductible. It is considered a companion plan and can be added as an endorsement to a crop insurance product at a subsidy rate of 65%. SCO provides participating farmers an opportunity to buy up additional coverage, up to 86%, when used with Yield Protection, Revenue Protection or Revenue Protection with the Harvest Price Exclusion policies.

Producers who elect to participate in PLC also have an option to purchase SCO. It is available for spring barley, corn, soybeans, wheat, sorghum, seed cotton and rice and for alfalfa seed, canola, cultivated wild rice, dry peas, forage production, grass seed, mint, oats, onions, potatoes and rye in select counties.

SCO follows the coverage of the underlying policy, i.e., if Revenue Protection is the underlying policy, then SCO would provide additional revenue protection; if Yield Protection is the underlying policy, then SCO would provide additional yield protection. For example, if a corn grower purchases a Revenue Protection policy with a 75% coverage level as the underlying policy, the grower has the option to buy the additional 11% in SCO coverage up to 86% total revenue protection. A payment is triggered on the underlying policy when the individual revenue is less than 75% of the expected insured level. However, the SCO coverage begins to pay when the county average revenue falls below 86% of the expected level It is paid in full when county revenue falls below the original 75% coverage level of participation.

Producers who elect to participate in either ARC-CO or ARC-IC are not eligible for SCO.

Summary

The 2018 farm bill made several modifications to the ARC and PLC programs, and producers now have an opportunity to re-elect on a commodity-by-commodity basis new program determinations for ARC and PLC for the 2019 and 2020 crop years. Then, beginning with the 2021 crop year, producers will be able to make an annual election in ARC or PLC on a commodity-by-commodity basis.

Making these elections can be complex and farmers must consider several factors such as expected prices and yields, as well as the impact of prevented plantings on program performance. To help farmers make an informed decision ahead of the March deadline, there are two web-based decision-making tools available. These include the Gardner-farmdoc Payment Calculator, a University of Illinois tool that offers farmers the ability to run payment estimate modeling for their farms and counties for ARC-County and PLC, and the ARC and PLC Decision Tool, Texas A&M’s user-friendly tool that allows producers to analyze payment yield updates and expected payments for 2019 and 2020. Producers who have used the tool in the past should see their username, and much of their farm data will already be available in the system.