What’s in Title I of the 2018 Farm Bill for Field Crops?

TOPICS

Wheat

photo credit: North Carolina Farm Bureau, Used with Permission

John Newton, Ph.D.

Vice President of Public Policy and Economic Analysis

Following a prolonged downturn in the farm economy – now entering its fifth year – farmers and ranchers have the risk management certainty they need in the form of a five-year farm bill. Among the changes in the 2018 farm bill are evolutionary improvements to commodity support programs such as the Marketing Loan Program, Price Loss Coverage and Agriculture Risk Coverage. Today’s article highlights the provisions of the commodity support programs, excluding dairy, included in Title I of the farm bill. A future Market Intel will review significant enhancements made to the dairy title.

Improvements to Marketing Loan Rates

Marketing loans are used post-harvest and provide an opportunity for growers to use their crops for collateral on loans. The loan value is based on the marketing loan rate, and is a portion of the crop’s value. Risk management support is facilitated by these loans as farmers with a marketing loan may choose to forfeit the crop if the market price falls below the loan rate.

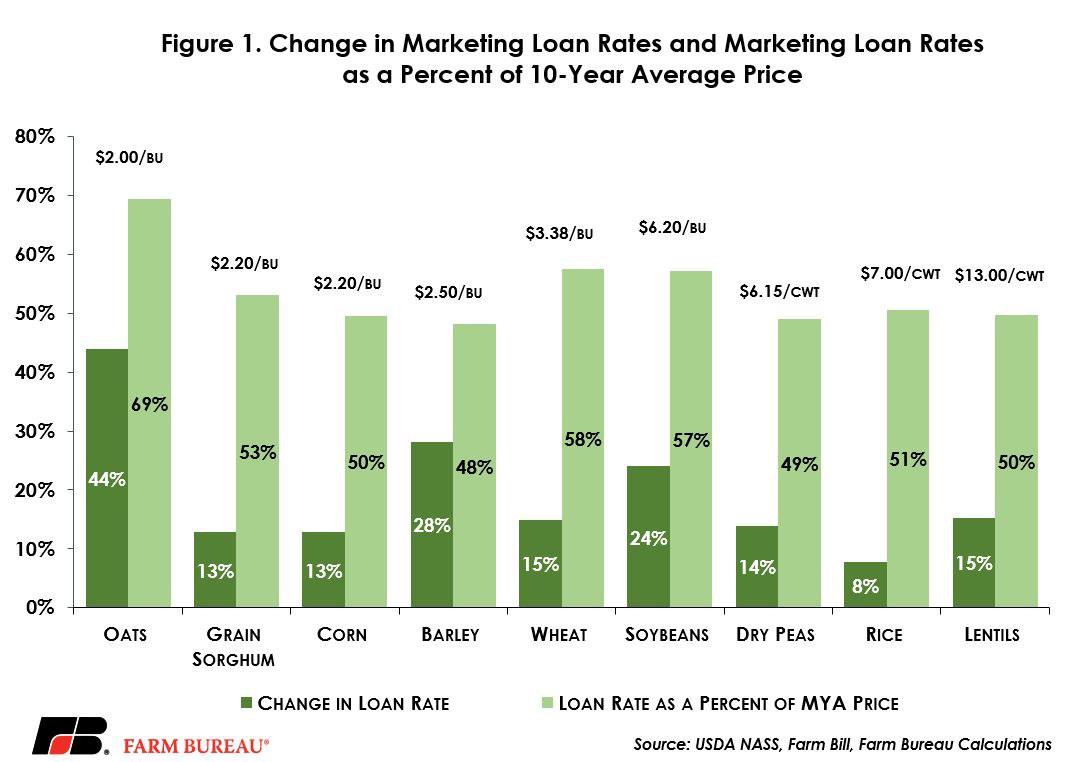

Marketing loan rates have not been meaningfully changed in more than a decade. The update included in the new farm bill allows these rates to be increased and modernized. Loan rates were increased for all crops other than upland cotton, peanuts and minor oilseeds. Corn saw loan rates increase from $1.95 per bushel to $2.20 per bushel. Soybean loan rates were increased $1.20 per bushel from $5 per bushel to $6.20 per bushel. Figure 1 highlights the percentage change in loan rates provided by the farm bill for selected crops and the loan rate as a percent of the 10-year marketing year average price.

Improvements to Price Loss Coverage

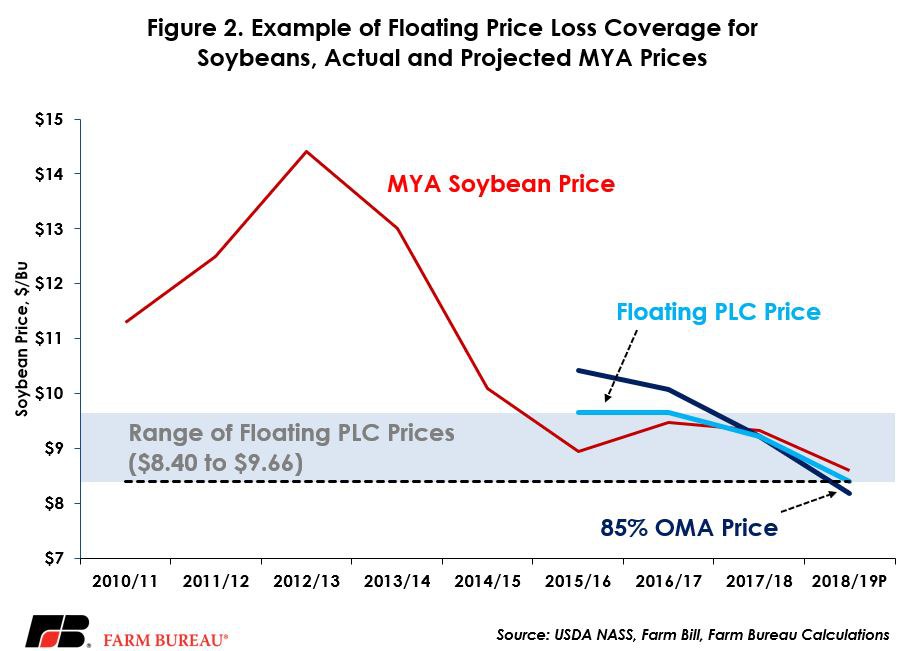

The new farm bill makes several changes to ARC and PLC that will improve risk management support. Specifically, under PLC, fixed reference prices are now allowed to “float” higher based on the Olympic moving average price and may increase to as much as 115 percent of the statutory reference price. For example, the soybean reference price established in the 2014 farm bill is $8.40 per bushel, but under the floating reference price the PLC support price could move as high as $9.66 per bushel.

When 85 percent of the Olympic moving average price is greater than the statutory reference price, support under PLC is increased. This allows for higher crop prices to be incorporated into the support programs. Had this floating PLC been available in prior crop years, the support price for some crops would have been greater due to the high price environment of 2010 to 2012. For example, the soybean PLC reference price would have been $9.66 per bushel for both the 2015/16 and 2016/17 marketing years – triggering program payments of 71 cents per bushel and 19 cents per bushel, respectively. Figure 2 highlights the concept of a “floating” PLC reference price using historical soybean prices and current USDA projections.

Importantly, the aforementioned change in marketing loan rates also impacts the performance of PLC. Marketing loan rates are used to establish the maximum payment under PLC, and as a result, higher loan rates reduce potential program payments under PLC.

Improvements to Agriculture Risk Coverage

There were a number of subtle changes to ARC in both the price and yield calculations that will improve revenue support. First, by allowing PLC reference prices to float higher, the plug prices under ARC are also allowed to float. As a result, benchmark prices can be no lower than the maximum of the statutory reference price or 85 percent of the Olympic moving average.

Second, under the historical ARC provisions the plug yield was 70 percent of the county’s transitional yield. The farm bill changes the plug yield in the ARC benchmark revenue calculation to be no lower than 80 percent of the county’s transitional yield. This change will increase the benchmark revenue guarantee for growers in many counties that experienced below average crop yields in recent years.

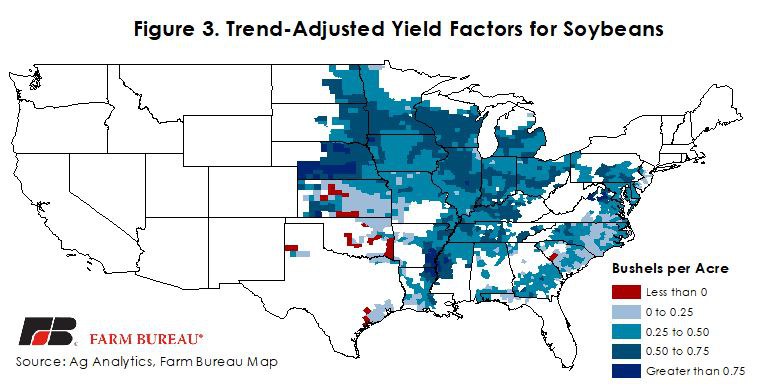

Third, USDA Risk Management Agency trend-adjusted yield factors will be incorporated into benchmark and actual yield calculations. In many cases, trend-adjusted yield factors will increase crop yields to reflect productivity improvements. Trend-adjusted yield factors for soybeans are highlighted in Figure 3.

In addition, 25 counties that are larger than 1,400 square miles and with more than 190,000 base acres may be divided into administrative units for determining program benefits. This allows for yield deviations within the county to be captured in both the benchmark and actual ARC revenues, providing more accurate risk management support in larger counties that may experience deviations in growing conditions across the county.

Finally, data from the RMA crop insurance program will be the primary source of yield data as opposed to USDA National Agricultural Statistics Service yield surveys. This change is designed to improve the integrity of the ARC program by using an average of county-level crop yields reported to RMA.

Base Acres and Yield Updating

ARC makes program payments on 85 percent of a farm’s base acres. PLC also makes program payments on 85 percent of a farm’s base acres but also utilizes PLC program yields to determine the gross payment due to the farm. The 2018 farm bill addresses both base acres and PLC program yields.

First, ARC and PLC program payments will be eliminated for growers who have not planted a crop on their historical base acres over the last decade. Program payments on the base acres subject to this provision would be suspended, but not eliminated, meaning future farm bills could reactivate those base acres making them eligible in the future for program payments. As compensation for having program payments suspended, farmers and ranchers could enroll those base acres in the Conservation Stewardship Program for five years at an annual program payment of $18 per acre.

Second, many farmers experienced poor crop yields during 2008 to 2012, the period used to establish program yields under PLC in the 2014 farm bill. To address this yield shortfall, the 2018 farm bill will provide an opportunity to update PLC program yields based on crop yields from 2013 to 2017, with a floor equal to 75 percent of the county average crop yield. The yield update will be effective for the 2020 crop year.

ARC or PLC Election

The 2014 farm bill provided a one-time opportunity for growers to elect either ARC or PLC on a commodity-by-commodity basis. The ARC or PLC election was binding for the five-year life of the farm bill.

The 2018 farm bill provides an opportunity for growers to first re-elect ARC or PLC coverage in 2019 on a commodity-by-commodity basis, effective for the 2019 and 2020 crop years. Then, beginning in 2021, growers will have an opportunity to make an annual re-election of ARC or PLC for the three remaining crop years.

This flexibility allows growers to more frequently choose which risk management tool meets the needs of their farm, and their crops, for the marketing year.

Summary

There are a variety of risk management tools in the farm bill to protect farmers and ranchers from adverse declines in either crop revenue or prices. These programs include but are not limited to the marketing loan program, ARC and PLC.

The 2018 farm bill made several improvements to both program prices and yields to enhance the effectiveness of these tools in helping farmers manage risk. Marketing loan rates are increased, PLC support prices may float higher, PLC program yields are increased, and the prices and yields used in ARC are improved. Growers are also allowed frequent program elections to make sure the tools they are using are better aligned with their risk management needs.

While some growers may have their base acres suspended, the farm bill also provides short-term compensation for growers impacted by these provisions by allowing these acres to remain in conservation programs.

Top Issues

VIEW ALL