2025 Tax Cliff: The Impact of the Tax Code

Samantha Ayoub

Economist

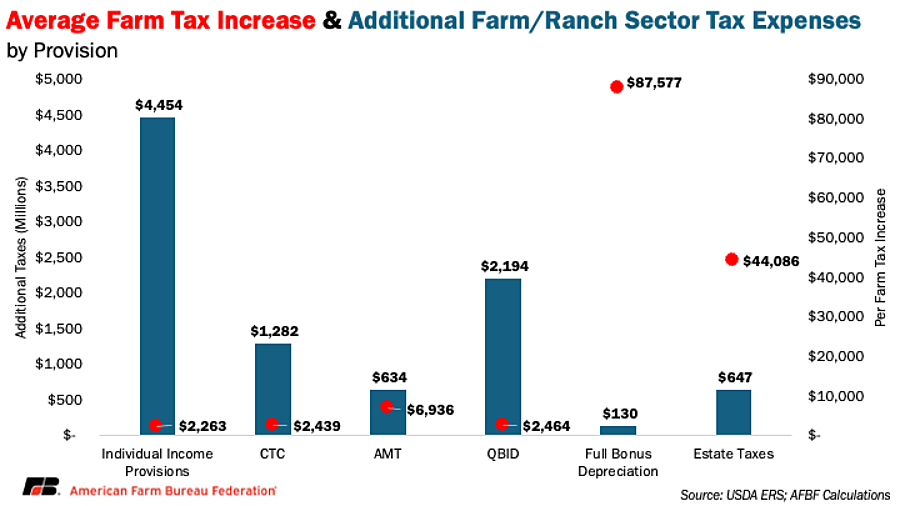

The Dec. 31, 2025, expiration of many provisions of the 2017 Tax Cuts and Jobs Act (TCJA) adds a new task to the 2025 congressional to-do list: updating the tax code. Many TCJA provisions provided important relief for farm families. While reductions in the corporate income tax rates were made permanent in 2017, income tax cuts for individuals began to phase out in 2022, with the biggest tax increases coming with expirations at the end of 2025. This Market Intel report is the fifth in a series exploring the expiring TCJA provisions – including individual tax provisions, the qualified business income deduction, capital expensing provisions and estate taxes– and their impact on farm families.

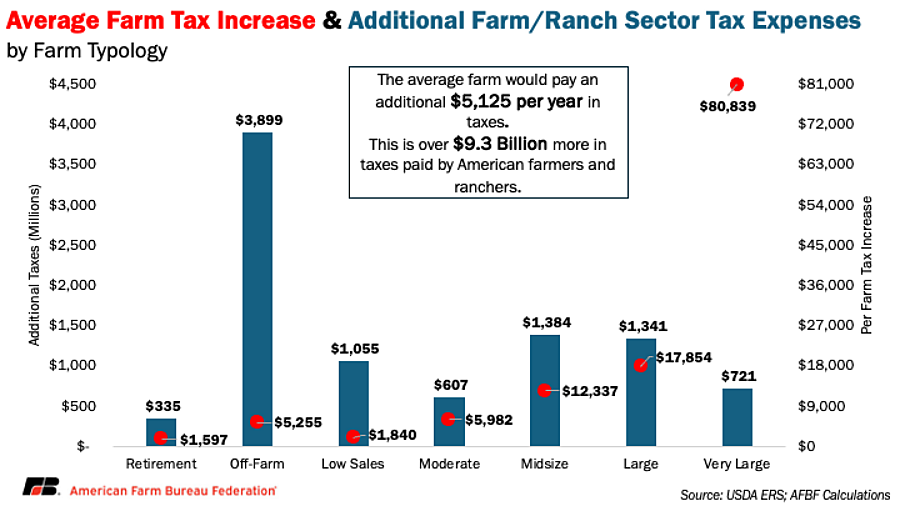

At a time when so many farmers and ranchers are facing razor-thin margins at best and considerable losses at worst, congressional action – or inaction – on tax policy will be a make or break in farm country. Farm families of all sizes were among the 65% of Americans with lower federal taxes after TCJA was passed. If TCJA expires, USDA estimates that farmers and ranchers will spend an additional $9 billion on federal taxes each year.

The size of a federal tax bill can make or break farm profitability, particularly for small farms on the brink of breaking even. Each dollar that comes out of a farm family’s bank account to pay taxes is one less they can spend on improvements to their homes and farms, one less to hire an additional worker, one less to spend at other businesses in their community and one less they can put toward growing food, fiber and fuel.

Property taxes and fees reached record levels in 2024, and federal income taxes are set to soar in 2026 – rising by more than $5,000 per farm on average – due to the temporary nature of the TCJA provisions. This huge tax increase comes on top of above-average production expenses and low crop prices.

Moderate farms are the first group of farmers to make a profit, and that profit is, on average, less than $45,000, even in favorable economic conditions. That means over 13% of their already meager profits would be eaten up by higher taxes. These farms especially are having to make significant capital investments in their operations without the revenues to cover them.

Tax hikes could lead to less production and potential job cuts because assets would have to be diverted from the farm or ranch to pay a federal tax. EY estimates that expiration of TCJA provisions would lead to agriculture losing 49,000 jobs equaling $3 billion in wages and reduce overall economic activity by $10 billion.

Other than Section 179 capital expensing, all other tax provisions crucial to farm and ranch families are set to revert to permanent law at the end of the year. Larger family farms are generally affected by even more of the expiring provisions like bonus depreciation and estate taxes since they require more capital assets to operate. These bigger family farms, however, are still facing the losses and thin margins that come with high production costs and low revenues, while also contributing more agricultural products for the supply chain than their small counterparts.

The effects of increased taxes described above are only for farms and ranches, but expiration of TCJA tax provisions would likely have ripple effects through the entire ag supply chain and rural communities. These are not only many of the jobs that help sustain farms and ranches in down ag economies, but the feed stores, grain elevators and equipment mechanics needed for the whole agricultural supply chain.

Conclusion

Most farming risks, like markets and weather, are out of farmers’, ranchers’ and Congress’ hands, but there is something that can be done about current policy-driven risks like the TCJA expirations and an outdated farm bill. Farm families already face several unknowns on their balance sheet from labor costs and yearly revenues; policy permanency, particularly with a favorable tax code, is one way policymakers can provide a bit of stability for the 2% of Americans providing food, fiber and fuel for our nation and the world.

Top Issues

VIEW ALL