U.S. GDP Growth Continues Impressive Run

TOPICS

Market IntelBob Young

President

photo credit: DonkeyHotey / CC BY 2.0

Bob Young

President

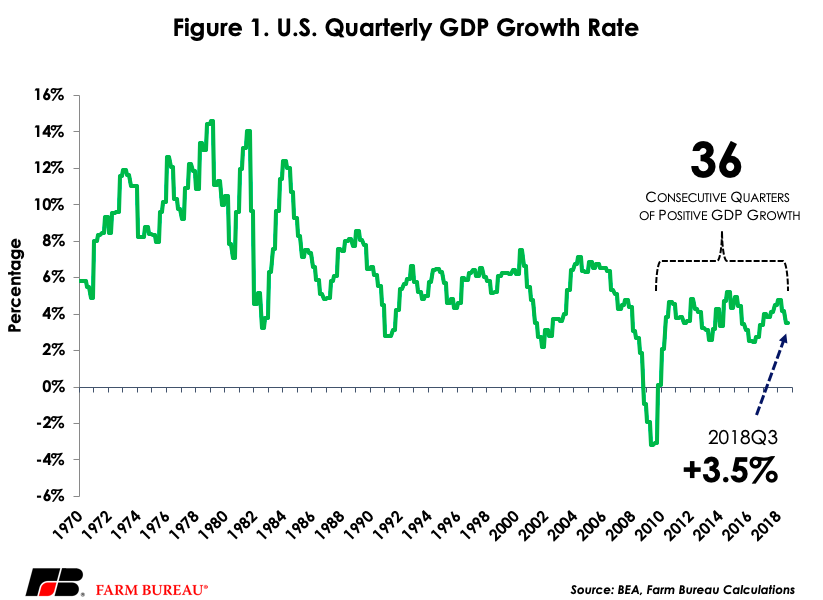

The Bureau of Economic Analysis released its second report on gross domestic product growth for the third quarter of 2018, confirming a preliminary release in October that indicated the economy grew at a real rate of 3.5 percent from July through the end of September. This marks 36 consecutive quarters of positive GDP growth which began in the 4th quarter of 2009.

Be clear that this is a ‘‘look back” report, with the more complete data allowing us the equivalent of a “further review” in football. The report substantiates how we thought the economy was behaving in the third quarter of this year but tells us nothing really about how the economy is performing now, or how it will perform in the months and year ahead.

While most of the discussion around GDP looks at percentage changes, it is informative once in a while to drop back to the actual numbers. On an annualized basis, the overall economy tripped the $20 trillion level in the first quarter of 2018 and is now functioning well above that point. The overall GDP estimate for the third quarter was $20.660 trillion.

Consumer spending alone drove slightly less than 2.5 percent of the growth in real GDP. Again, to put the numbers in perspective, consumer spending was just over $14 trillion (annualized basis) for the third quarter of 2018. Digging into those numbers a little, consumers boosted spending on recreational goods and vehicles – read that as consumer electronics and other toys – by $20 billion from year-earlier levels. Over half of the contribution to GDP growth from the consumer services portion came from increases in health care and food service/accommodations.

One of the most volatile components of the GDP is a shift in inventories in the gross private domestic investment category. Overall, the investment category contributed 2.5 percent of the GDP growth, a larger contribution than consumer spending, even though the overall level of investment is just $3.7 trillion (annualized basis). The inventory change, however, accounted for the lion’s share—2.3 percentage points—of the total 2.5 percent increase in the GDP for the category. In value terms, inventories rose by $89 billion in the third quarter of 2018, as opposed to a decline of $10 billion in the second quarter.

Exports fell in the third quarter of 2018 by $28 billion on an annualized basis. At the same time, imports increased $73 billion, leading to the net position on trade dropping the GDP by 1.9 percent.

The federal government contributed 0.2 percent to GDP growth, with national defense spending driving most of that. State and local government also contributed at a 0.2 percent rate.

The price indices used to adjust for inflation in the report pointed to a weakening of price pressure compared to the previous quarter. Overall, the price index grew by 1.7 percent for the third quarter of 2018, with personal consumption prices rising by 1.5 percent. The largest increases in prices seemed to come from investment costs on nonresidential and residential structures, both up by more than 3 percent. There were no other categories that rose more than 3 percent.

BEA’s report also includes corporate profits. Overall, before-tax profits were up 10 percent compared to the same quarter in 2017. At the same time, taxes are down 33 percent – fully $120 billion – boosting profits after tax and other adjustments by a net 19 percent.

Overall, this “look back” report shows the economy was ticking along very well in the third quarter. It is almost difficult to see how future quarters could be as good, so don’t be surprised when reports for 2019 are not quite as robust. We can’t expect Texas A&M to score over 70 points in every game.