USDA Announces Tariff Relief for the Seafood Industry

TOPICS

USDA

photo credit: AFBF Photo, Mike Tomko

Shelby Myers

Former AFBF Economist

On Sept. 9, USDA released details of the $530 million Seafood Trade Relief Program (STRP), which will provide direct support to eligible seafood species that have suffered more than $5 million in retaliatory trade damages. Retaliatory tariffs remain in place on U.S. seafood exports to China. The affected species include Atka mackerel, crab (Dungeness, king, snow, southern tanner), flounder, geoduck, goosefish, herring, lobster, Pacific cod, Pacific Ocean perch, pollock, sablefish, salmon, sole, squid, tuna and turbot. The new STRP, created by USDA, will be funded by the Commodity Credit Corporation and administered by USDA’s Farm Service Agency.

Qualified fishermen include U.S. commercial fishermen who have a valid federal or state license or permit to catch seafood and bring their catch to shore to sell or transfer them to another party, such as a legally permitted or licensed seafood dealer. Those who process the catch at sea and sell to the same legally permitted entity that harvested or processed the product are also eligible. Outside of geoduck and salmon, seafood that is grown in controlled conditions is, in general, not eligible for STRP. If requested by FSA, the commercial fisherman must also provide supporting documentation to provide production evidence for the amount and type of certified landings.

Producers will be subject to payment limitations, with no person or legal entity receiving more than $250,000, and an adjusted gross income limit of $900,000, unless at least 75% of a person’s AGI comes directly from farming, ranching, forestry, seafood harvesting or related activities.

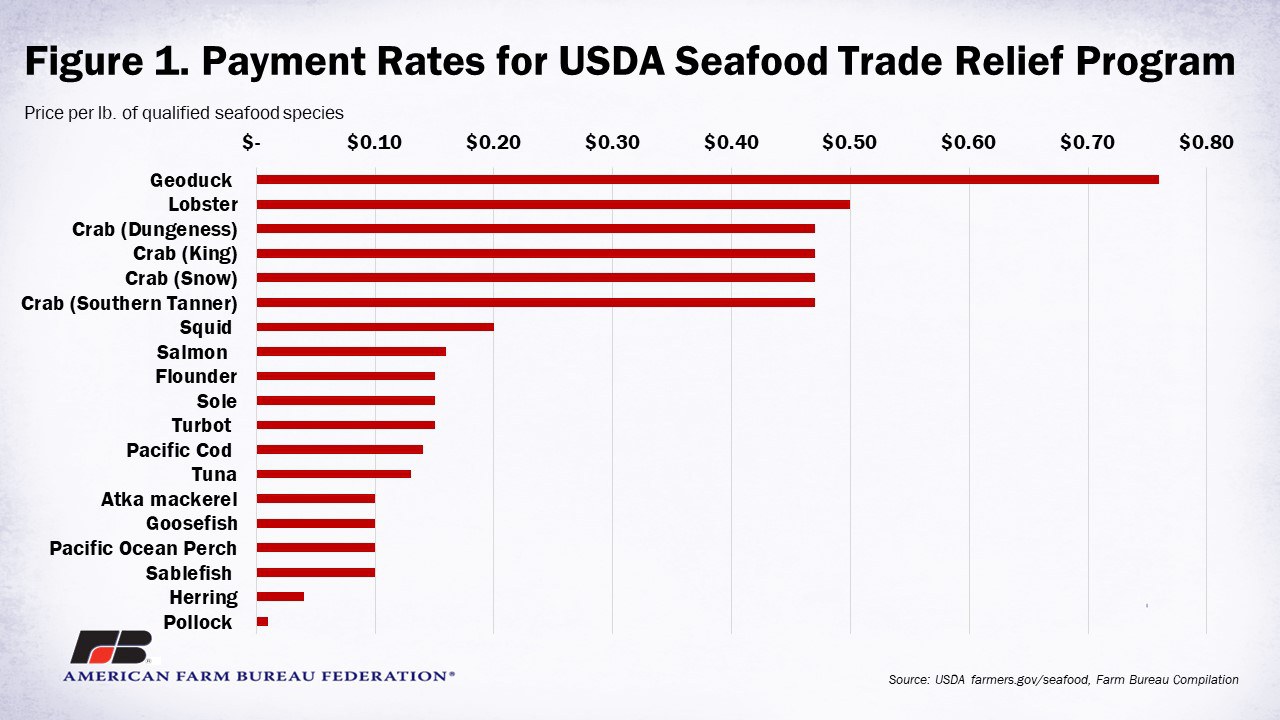

The STRP payment rates were calculated using USDA’s assessment of the expected trade damage using partial equilibrium trade modeling and factors in items like tariff levels, the amount of production affected by the trade disruption, the sensitivity of the retaliating country’s consumers to higher prices due to the tariffs, and the availability of substitutes for U.S. products. Based on the increased tariff, the economic models simulate the expected reduction in U.S. exports to the retaliatory partner market, holding other factors constant. Trade damages are calculated as the difference in trade with the tariff and the baseline without the tariff. Payment rates reflect the estimated severity of the impact of trade disruptions to U.S. seafood caught and sold commercially, and the adjustment to new trade patterns for the types of seafood products. Figure 1 displays the STRP payment rates of qualified seafood types.

Fishery Product Exports Have Struggled

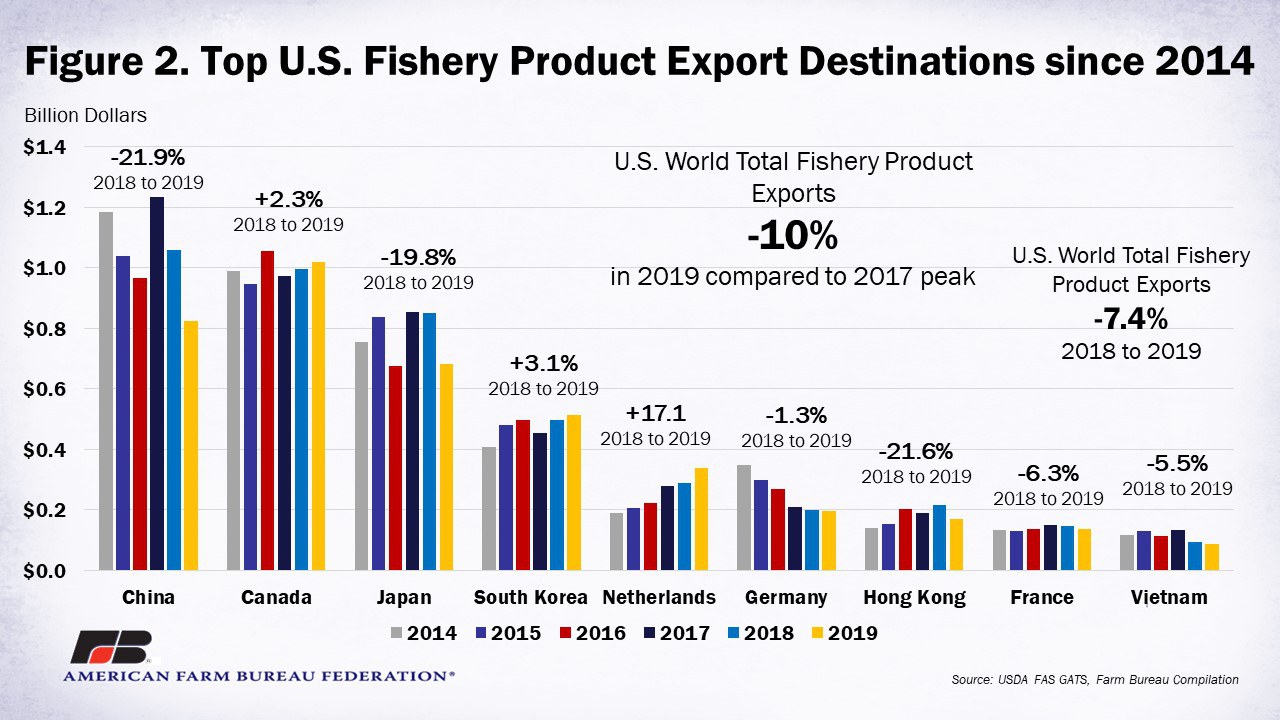

The U.S. fishery product industry, prior to trade renegotiations, was a $5.6 billion export business during its peak in 2017. Since then, the industry has suffered nearly a 10% reduction in exports to other countries. In 2019, exports of U.S. fishery products totaled $5.04 billion, down 7.4% from 2018, when $5.4 billion worth of fishery products were exported.

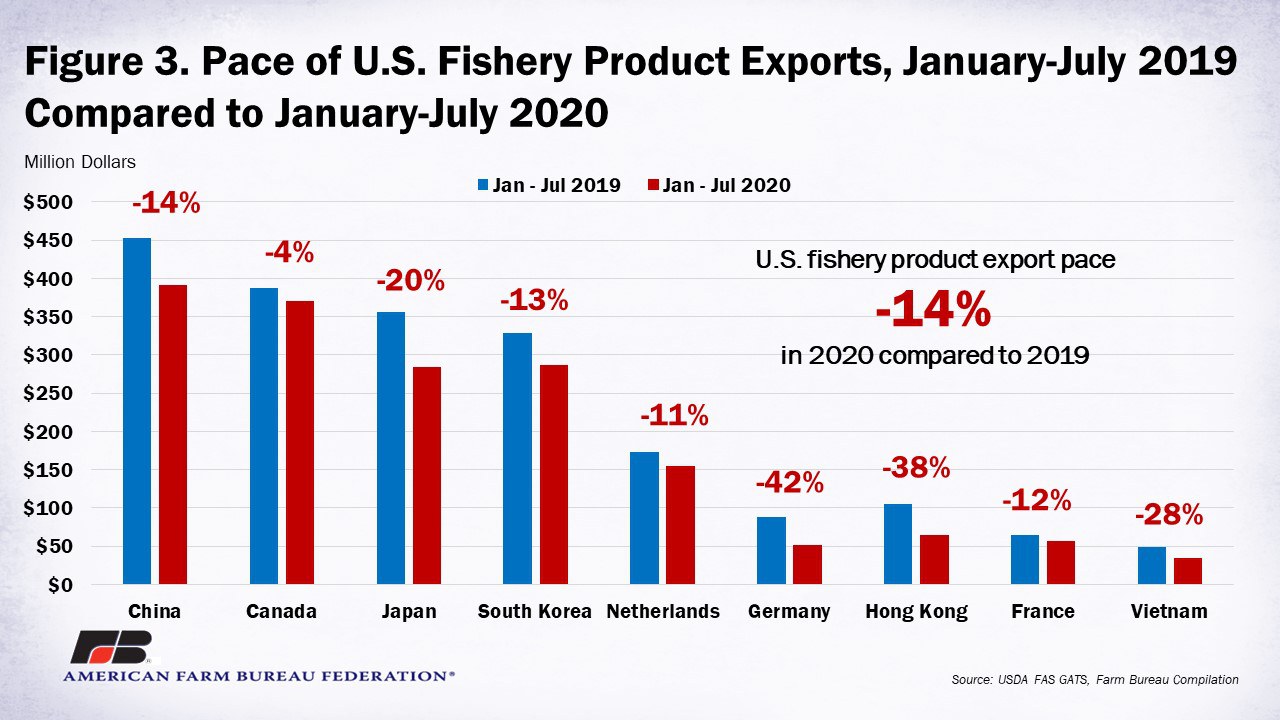

During the 2017 export peak, $1.2 billion worth of U.S. fishery products were exported to China, making it the number one destination for U.S. fishery products. As of July 2020, U.S. fishery product exports to China are down 14% from 2019. The most recent data shows the U.S. exported $826 million in fishery products to China in 2019, 21.9% below the amount exported in 2018, which was just over $1 billion.

With $997 million worth of seafood exported to Canada in 2017, it was the second-largest export partner of the U.S. for fishery products. As of July 2020, the U.S. has exported only $284 million in seafood products, which is 20% less than July 2019, when the U.S. exported $328 million worth. In 2019, the U.S. experienced a slight uptick in fishery product exports to Canada, with just over $1 billion worth exported, 2.3% higher than in 2018, when $997 million worth was exported.

Japan was the third-largest export destination in 2017, when $855 million in U.S. fishery products went to Japan. The pace of exports to Japan in 2020 compared to 2019 shows the U.S. is down 20%. In 2019, the U.S. exported just under $682 million worth of fishery products, 19.8% below the amount exported in 2018, when exports were $850 million.

Figure 2 displays the top U.S. fishery product export destinations since 2014 in order of top export destinations in the 2017 peak year. Figure 3 displays the pace of U.S. fishery product exports from January-July of 2019 compared to January-July of 2020.

Summary

Retaliatory tariffs have resulted in a year-over-year decrease in exports to most of the top fishery product destinations in 2019 compared to 2018, along with the slowed pace of fishery product exports in 2020 compared to 2019. To help eligible seafood species that have suffered more than $5 million in retaliatory trade damages, USDA has created the $530 million Seafood Trade Relief Program. Eligible species include Atka mackerel, crab (Dungeness, king, snow, southern tanner), flounder, geoduck, goosefish, herrings, lobster, Pacific cod, Pacific Ocean perch, pollock, sablefish, salmon, sole, squid, tuna and turbot. Program enrollment is open Sept. 14 through Dec. 14. The application can be found online, but fishermen should make an appointment with their local USDA Service Center to apply.