What is Dairy Revenue Protection?

photo credit: Alabama Farmers Federation, Used with Permission

John Newton, Ph.D.

Vice President of Public Policy and Economic Analysis

Dairy Revenue Protection (Dairy-RP) is a concept plan of insurance, developed by the American Farm Bureau Federation, American Farm Bureau Insurance Services and other collaborators which would allow dairy farmers to purchase risk management protection against declines in quarterly revenue from milk sales, i.e. unexpected declines in milk prices, unexpected declines in milk production, or both.

To accurately capture the farm-level revenue risk, dairy farmers will determine how their milk is priced under the policy by selecting to use a classified milk price or a combination of the milk components in their milk (milkfat, protein, and other milk solids). Dairy-RP would function similarly to crop revenue protection polices in that the revenue guarantee would be based on futures prices, expected production, and market-implied risk, and would be priced using actuarially appropriate methods.

The concept plan has been presented to the Federal Crop Insurance Corporation for approval to be offered to dairy producers. A survey for dairy farmers to provide input into product development is available online at www.farmbureausellscropinsurance.com.

Why Dairy Revenue Protection?

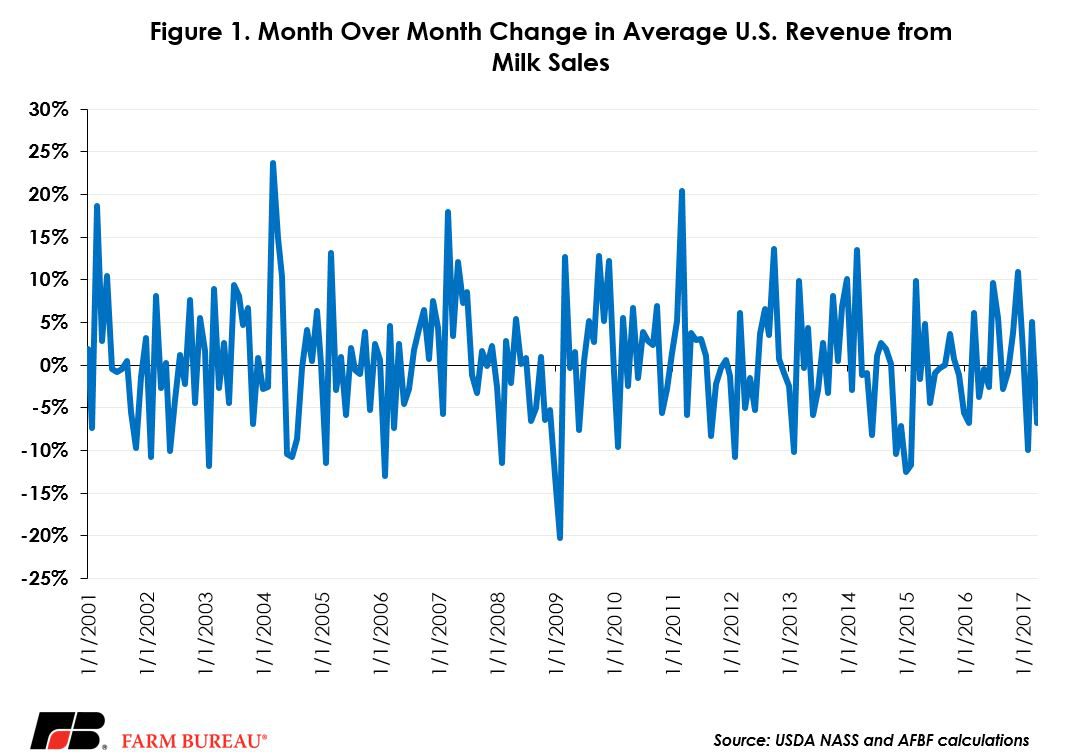

In dairy risk management, one size does not fit all. Dairy-RP fills a gap in risk coverage by addressing two key sources of dairy farm revenue risk: milk price basis and variability in milk production, which combined can lead to large changes in milk revenue from month to month and from farm to farm, Figure 1.

Consider these two sources of revenue risk in more detail: price and production. First, there is not a uniform price of milk in the U.S. Instead, every farmer receives a different price for milk produced on his or her farm. Milk prices and the value of milk components are formula-based, directly tied to wholesale commodity prices for cheddar cheese, butter, and dry milk powders. The final farm-gate milk price depends on these regulated milk prices, the components in the milk produced by the farmer, plus the financial return from market-wide revenue sharing pools and any farmer-negotiated premiums and marketing fees.

As an example of the regional differences in milk prices consider that during 2016, average mailbox-milk prices ranged from $14.31 in Michigan to $17.27 in New England, and averaged $15.95 per hundredweight in all reported areas. There is not a USDA-sponsored risk management tool that can capture this variability in milk prices. However, because Dairy-RP would allow a farmer to value milk based on the milk components or a mix of Class III and IV milk prices, much of the farm-level basis risk can be addressed.

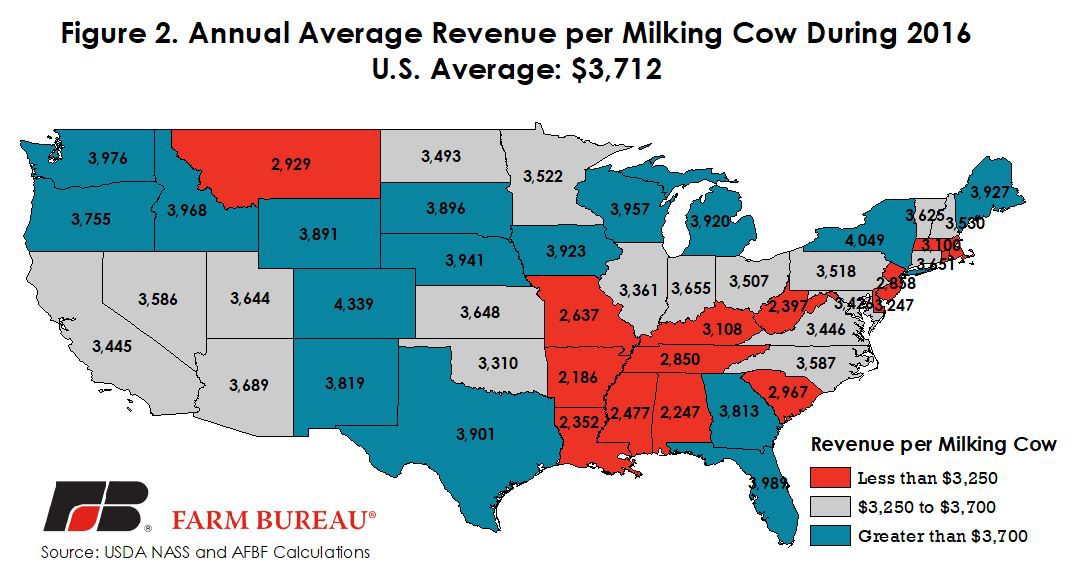

Second, milk cow productivity varies substantially from farm to farm due to a variety of factors including the breed of milking cow, climate conditions, the quality of feed, and stage of lactation. For example, during 2016, the average U.S. dairy cow produced 62 pounds of milk per day; however, across the U.S. animal productivity varied greatly. In Alabama, the average milking cow produced 36 pounds of milk per day while the average milking cow in Colorado produced 71 pounds per day.

By extension, the amount of revenue a dairy cow generates each month varies based not only on productivity but also on the monthly average value of the milk and is different for every farmer across the U.S. During 2016, average revenue per cow ranged from $2,186 in Arkansas to $4,339 in Colorado. The U.S. weighted average was $3,712. Figure 2 identifies the annual average revenue generated per milking cow during 2016. Dairy-RP provides an opportunity to protect the revenue generated per milking cow.

Dairy farmers have long been challenged by variability in milk revenue. However, following the rapid rise in livestock feed prices in 2007, the USDA dairy safety nets were re-tooled to focus on income-over-feed-cost risk (milk price minus feed costs). These tools do not manage directly the revenue risk experienced by dairy farmers. This gap in risk coverage was highlighted by recent trends in milk prices. In 2016, milk prices fell by nearly 50 percent from their 2014 highs, yet because feed prices also fell substantially the income-over-feed-cost margin used to trigger USDA safety net programs fell by a smaller amount. The net impact is dairy farmer revenue fell by $14.7 billion from 2014 to 2016. Dairy-RP is designed to help farmers manage against these unanticipated declines in revenue and, if approved, would be offered in addition to margin-based insurance products currently available to dairy farmers.

How Does Dairy-RP Work?

The concept is simple. Dairy-RP would protect dairy farmers against quarterly revenue losses caused by declines in the value of milk or milk components, or unexpected declines in milk production.

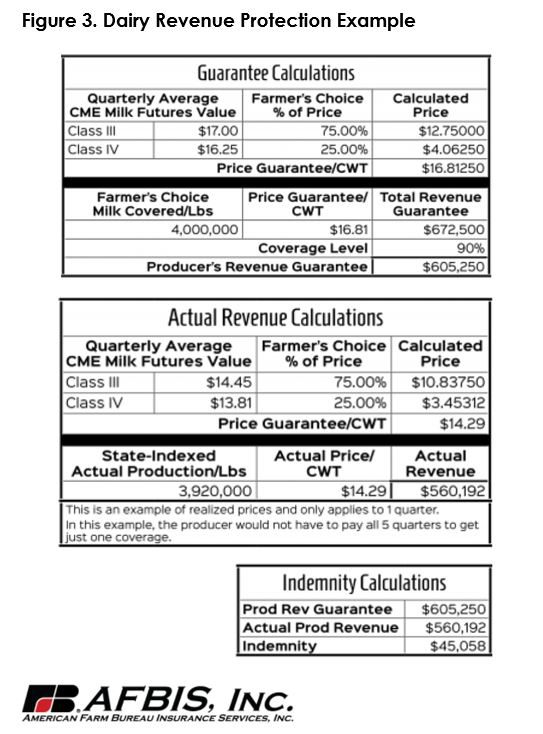

For each quarterly policy, the farmer would choose either a milk- or component-based pricing policy. For a milk price policy, the farmer would choose an average milk price for the quarter based on a combination of Chicago Mercantile Exchange milk futures for Class III and IV milk. For a component-based policy, the farmer would choose the amount of milkfat and protein to cover during the quarter. These component levels are multiplied by the implied CME prices for butterfat, protein and other milk solids to determine the component-value of the milk.

The farmer would then choose how much milk production to cover during the quarter. The farmer’s elected volume of milk will be indexed using average expected state milk yield per cow. For example, a farmer electing to insure 1 million pounds of milk with an expected state average milk yield of 5,000 pounds per cow would be covering the equivalent of 200 milking cows (1,000,000÷5,000 = 200). These animal unit equivalents would be used to determine the actual state-indexed milk production volume and actual revenue once USDA announced the final milk and component prices.

The expected revenue during the quarter would be the product of the value of milk and the amount of covered milk. The dairy farmer would then select between 70 and 90 percent of revenue coverage he or she wishes to insure for the quarter. The product of the expected revenue and the coverage level is the Dairy-RP revenue guarantee. With a 90 percent coverage level, the farmer is electing a 10 percent policy deductible.

Once the monthly milk and component prices are announced for the quarter, and USDA’s milk production report identifies the actual milk production per cow for each state, the state-indexed actual revenue will be compared against the revenue guarantee. If the actual revenue is below the guarantee, the farmer is paid a policy indemnity based on the difference. If the state-indexed actual revenue is above the revenue guarantee the farmer pays only the policy premium. Figure 3 identifies this indemnification process for a milk price policy covering 4 million pounds during a quarter.

Importantly, under Dairy-RP a farmer has only four decisions to make:

- The value of milk protected;

- The amount of milk production to cover;

- The level of coverage (from 70 to 90 percent of the revenue guarantee); and

- Which quarterly contracts he/she wishes to purchase.

Dairy-RP insurance policies would be sold daily and would insure a quarter of milk production. Policies would be sold by USDA-approved insurance providers and could be purchased voluntarily for an individual quarter, or a strip of quarters, up to 5 quarters out. The price of the policy would vary daily based on the farmer-selected parameters and on the expected risk in the market.

Like other crop insurance policies, USDA would provide a premium discount to purchase Dairy-RP and the discount would increase as the farmer’s elected deductible increased, i.e. 70 coverage has a higher premium discount than 90 percent coverage. Preliminary economic analyses indicate that a Dairy-RP policy, covering 90 percent of the milk revenue, could cost 5 to 40 cents per hundredweight, depending on the quarter of the year covered and other policy parameters.

Summary

The success of federal insurance programs is well documented. Insurance policies cover most of the field crop acreage planted each year. In 2016, nearly 90 percent of all corn, wheat, soybean, cotton and rice acres were protected by an insurance policy. For many of these crops, revenue-based policies represent 80 to 90 percent of all policies sold. In addition to field crops, insurance policies covering price or margin risk are available for cattle, swine, lamb and dairy cattle.

Farmers pay billions of dollars in premiums each year for insurance, and if market prices, yields or revenues decline, farmers receive indemnity payments. In 2016, due to declining crop prices, $2.2 billion in insurance indemnities were made on behalf of corn, cotton, rice, soybean and wheat farmers. Dairy-RP would have provided similar protection in 2015 and 2016 when milk prices fell by nearly 50 percent and the total U.S. farm value of milk fell by nearly $15 billion.

Dairy farmers need additional risk management tools that reflect the diversity of milk production. While Farm Bureau continues to work to improve the dairy safety nets available from USDA, the efforts to develop a new revenue-based insurance product will greatly improve the dairy safety net by providing another option in the risk management toolbox.

In efforts to get additional farmer input on Dairy-RP, American Farm Bureau Insurance Services is hosting an online survey for dairy farmers at www.farmbureausellscropinsurance.com. Farmer input will be used for market research and for further policy development.

Top Issues

VIEW ALL