Who Holds Farm Debt?

TOPICS

Market Intel

photo credit: AFBF Photo, Mike Tomko

John Newton, Ph.D.

Vice President of Public Policy and Economic Analysis

USDA’s 2018 Farm Sector Income Forecast projected farm sector debt at a record-high $409.5 billion, up 4.2 percent, or $16.4 billion, from 2017 levels. Real estate debt in 2018 was projected at a record $250.9 billion, up 5.4 percent or $12.8 billion. Non-real estate debt was also projected to be record-high at $158.6 billion, up 2.3 percent, or $3.6 billion, from prior-year levels.

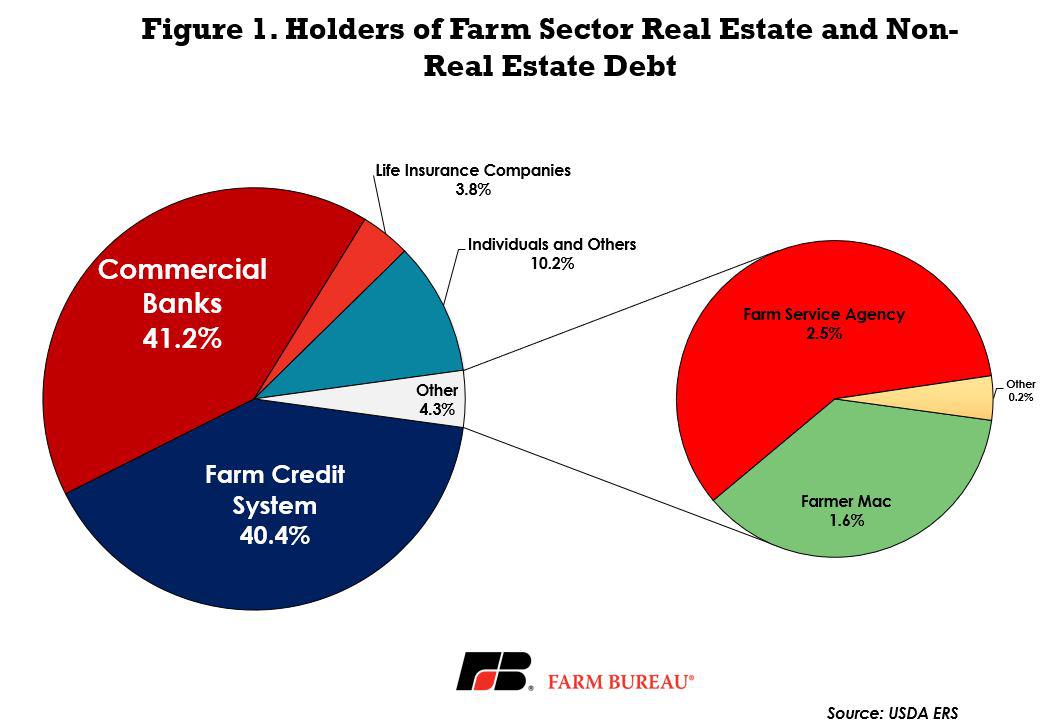

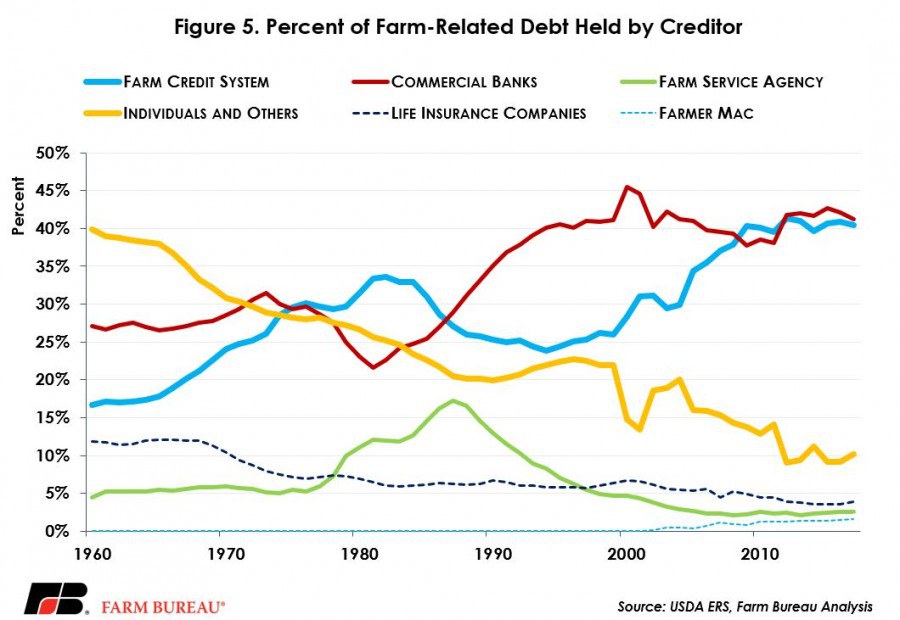

There are a variety of creditors that lend into agricultural credit markets. These creditors include but are not limited to customer-owned Farm Credit institutions, commercial banks, life insurance companies, individuals, Farmer Mac and USDA’s Farm Service Agency. The largest creditors are the Farm Credit institutions and commercial banks, holding a combined $321 billion, or 81 percent, of agricultural debt in 2017.

At the end of 2017, data from USDA’s Economic Research Service revealed that commercial banks held a record $162 billion in farm-related debt. Second to commercial banks was the Farm Credit system, holding $159 billion in both real estate and non-real estate farm debt. The remaining creditors include individuals at $40 billion, life insurance companies at $15 billion, the Farm Service Agency at $10 billion and Farmer Mac at $6 billion. Figure 1 highlights the holders of farm-related debt.

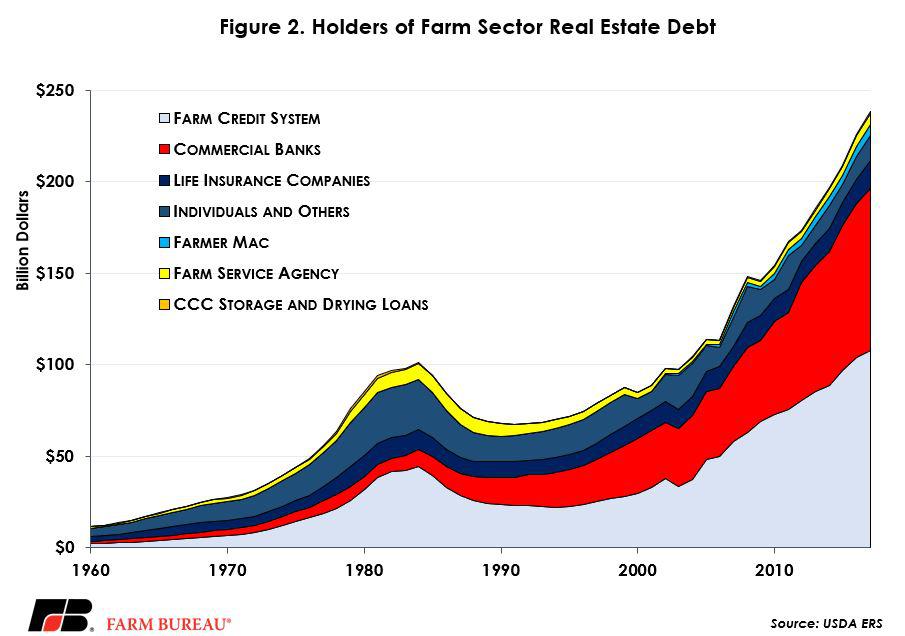

While Farm Credit is the second-largest creditor in agriculture, these customer-owned cooperatives are the largest creditors in farm real estate. At the end of 2017, the Farm Credit system held $108 billion in farm real estate debt, representing 45 percent of total real estate debt. Second to Farm Credit were commercial banks. At the end of 2017, commercial banks held $89 billion in farm real estate debt. Figure 2 highlights the holders of farm-related real estate debt.

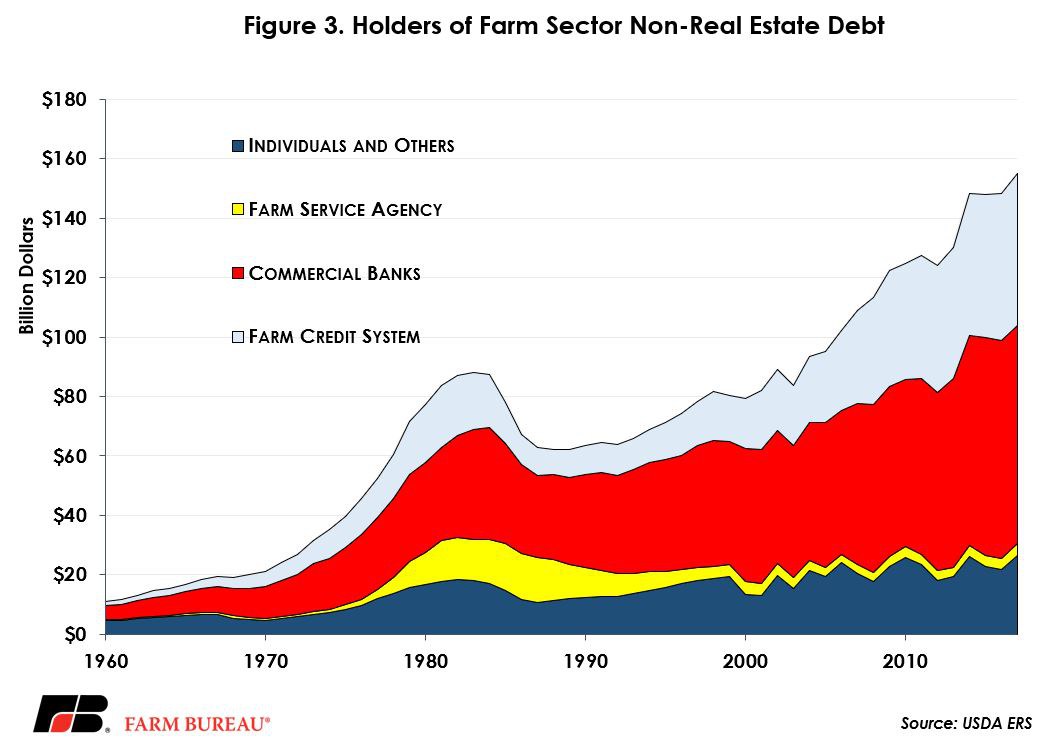

For non-real estate debt, the largest creditors in agriculture are commercial banks. At the end of 2017 commercial banks held nearly 50 percent of all non-real estate debt at a record $73 billion. The Farm Credit system held $51 billion in non-real estate debt, representing 33 percent of all non-real estate farm debt. The third largest creditor were individuals, who held 17 percent of non-real estate debt totaling $26.5 billion. Figure 3 highlights the holders of farm-related non-real estate debt.

Risk Exposure

Data from the Chicago and Kansas City Federal Reserves confirm that real estate debt carries a lower borrowing cost, i.e., interest rate. The lower interest rate reflects the relative risk of lending for real estate versus non-real estate needs.

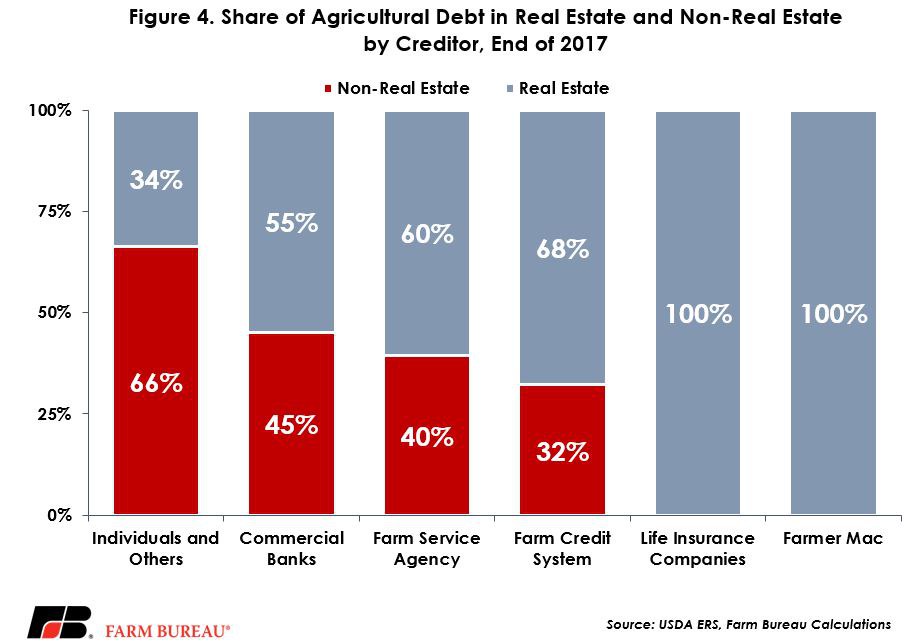

Across the agricultural creditor landscape, the exposure to real estate and non-real estate debt varies. Individuals and others have the highest proportion of non-real estate debt at nearly 70 percent. Among the larger Farm Credit and commercial bank lenders, 68 percent of the debt held by Farm Credit is in real estate, while only 55 percent of the debt held by commercial banks is in real estate. Life insurance companies and Farmer Mac are fully invested in farm real estate debt, Figure 4.

Summary

In 2018, agriculture-related debt is expected to be a record $409.5 billion. In 2018 inflation-adjusted dollars, farm debt in 2018 is the highest since the 1980s. The largest creditors in agriculture are commercial banks, holding 41 percent of farm debt, 47 percent of non-real estate debt and 37 percent of real estate debt. Following commercial banks, the customer-owned Farm Credit institutions hold 40 percent of farm debt, 33 percent of non-real estate debt and 45 percent of real estate debt. These farm lenders support rural communities by making loans on real estate, farm production and rural infrastructure initiatives.

Top Issues

VIEW ALL