Pandemic Injects Volatility into Cattle and Beef Markets

TOPICS

Market IntelMichael Nepveux

Former AFBF Economist

photo credit: Colorado Farm Bureau, Used with Permission

Michael Nepveux

Former AFBF Economist

Intro

The self-distancing and quarantine protocols put in place to slow the spread of COVID-19 have reduced economic growth, shuttered consumers in their homes, and changed the way Americans purchase and consume food. A slowing economy is bad for all of the animal proteins, but beef -- typically the highest priced of the proteins and considered a luxury product in economic terms – stands to suffer the most when consumers spend less in response to wage cuts and job losses. Additionally, beef is used more heavily in the food service channel than pork. We already know that consumers will be shifting more of their food dollars to at-home spending as opposed to eating out (a one-two punch to food service in the form of greatly reduced demand caused by the recessionary pressures and social distancing efforts practiced by consumers). This shift by consumers, combined with panic buying as families stock up on supplies, is sending shockwaves through the American food, meat, and beef supply chain.

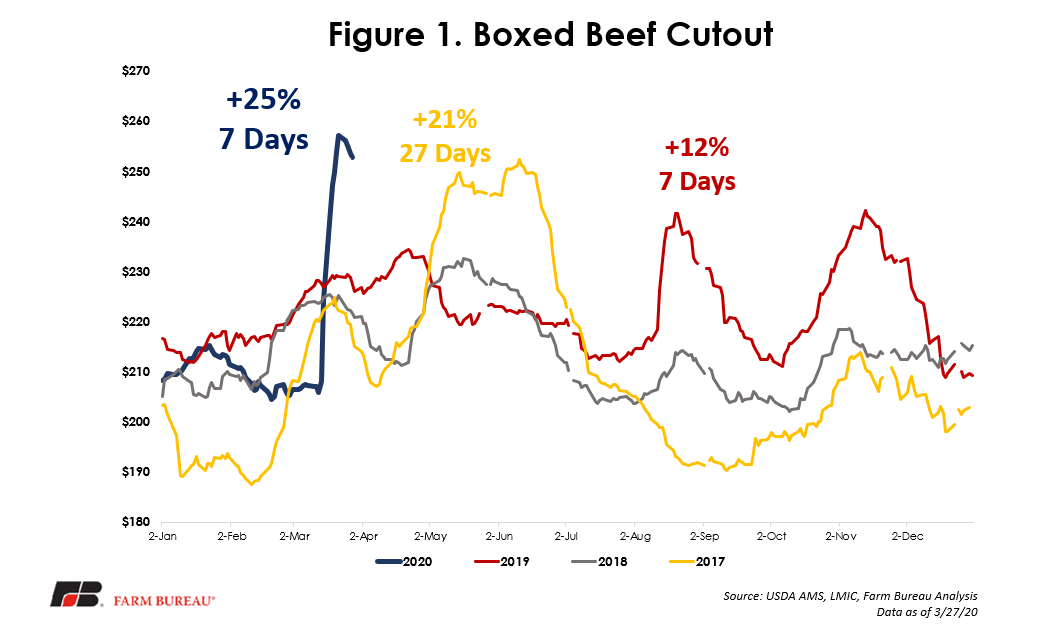

Record Jump in Boxed Beef Cutout

Beef prices tend to move higher in March and April as warmer weather drives spring features and we see increased traffic at food service restaurants. However, warmer weather cannot account for the historic jump that has occurred in the boxed beef cutout (Figure 1). In just a week, the daily boxed beef cutout has jumped 25% (calculated from the daily reported cutout as the difference between the peak and the low point preceding the peak, not the weekly boxed beef cutout report). The last time we saw a jump nearing this magnitude was in April/May 2017, and then it was spread out over a period of 27 days from low to high, and, at 21%, still a smaller percentage. In August 2019, another black swan event, a fire at one of the nation’s largest packing plants, caused a significant runup in the cutout as well, but that was an increase of 12% in seven days. Since its peak, the cutout has begun to weaken somewhat over the last few days.

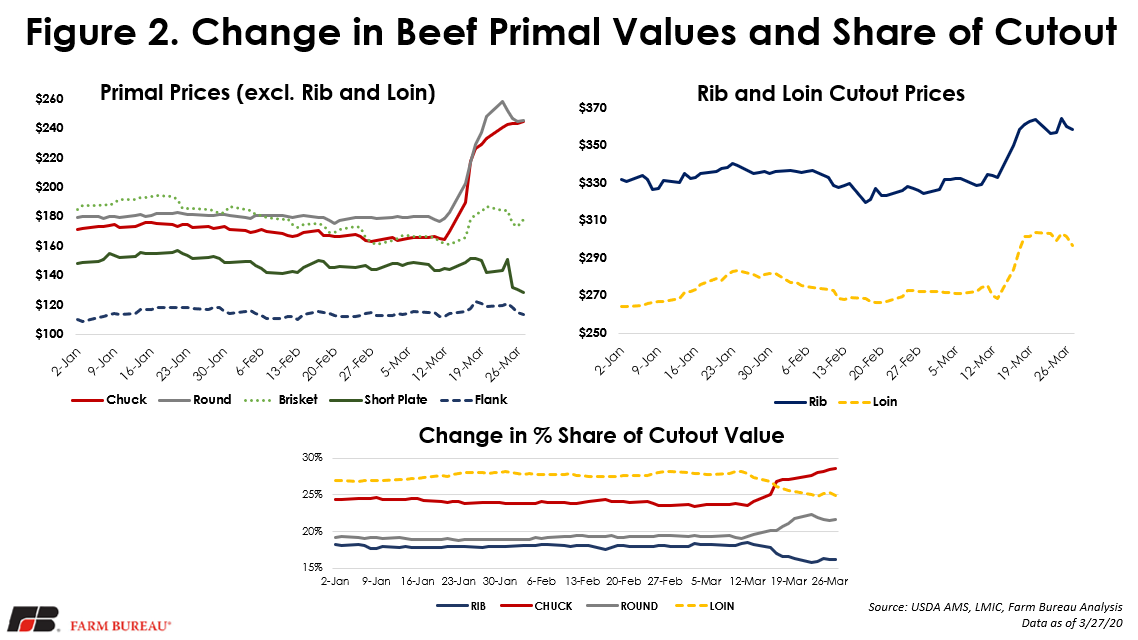

Many factors are influencing the value of the beef cutout. Figure 2 shows the various primal cuts of the cutout’s prices, as well as those primals’ percentage share of the cutout value. The gains in prices are not evenly distributed throughout the primal cuts, with the largest jumps in the chuck and round primals, which have increased $80.39 and $66.59, respectively, since March 12. Much of the chuck and round ends up in inexpensive cuts such as ground beef and economical cuts for slow cooking such as roast. The recent rush of sales at the retail level focused on these cuts as consumers looking to stock their freezers concentrated on ground beef and other lower-priced cuts. Before the COVID-19-induced panic buying, a large supply of beef sold at retail was already in ground form. There is also a large share of ground beef that works its way through food service and restaurant channels in the form of one of America’s favorite meals: the hamburger. It remains to be seen how well this demand channel holds up with to-go orders and drive through operations as dine-in services are suspended. In addition, shifting this product from food service to retail is not a logistically simple task because these are very different marketing channels, and the processor who produces curated proportioned product for a specific restaurant may not be able to immediately produce case-ready meat for the grocery store.

The rib and loin primals have increased as well, but not to the extent of the chuck and round, increasing $24.35 and $26.60, respectively, since March 12. The increase in the loin primal is somewhat unexpected, as this primal relies heavily on restaurant demand as opposed to retail demand. However, when looking into the subprimal cuts, the tenderloin, a valuable cut highly dependent on restaurant demand, was actually down over the last few weeks. Other primals had little to smaller increases, while the short plate primal actually saw a decrease over the time period. Friday’s National Retail Report indicated a 13% decrease in the feature rate for beef products. Feature activity is drastically lower as many locations have suspended retail advertisements due to retailers having little trouble moving product.

The share of the cutout value also shifted. In order to determine each primal’s share of the cutout, the current price of that primal can be multiplied by its share of the dressed carcass. Typically, the loin is the most valuable primal in terms of value in the cutout, even though the rib fetches a higher price (due to the total pounds the loin contributes to the carcass relative to the rib). However, this has shifted these relationships and the chuck has become the most valuable primal to the cutout. The round has also captured a much larger share and broken away from the loin. These shifting shares of the cutout help paint a bigger picture of what is driving the large cutout increase that results from a major jump in grocery store sales of certain meat cuts as people stocked up.

Something that should be mentioned here is the way that beef is sold. On a typical day, a retailer is not going to be able to order more meat for delivery the next day, that is not how the system works. The meat that retailers sell on a typical day is product that the retailer started planning sales around as many as three months before. They may have actually purchased the product as many as six weeks prior. This means that there is not a large volume of “unspoken for” meat in the market on a typical day, and much of the meat being processed in a plant is “spoken for”. The spike in the cutout is partly driven by a surge in demand as retailers look to refill their meat case, increasing competition for the small share of “unspoken for” meat. Because much of the meat delivered to grocery stores last week had been forward sold weeks or months earlier, less of it was valued at these historic cutout prices than some think.

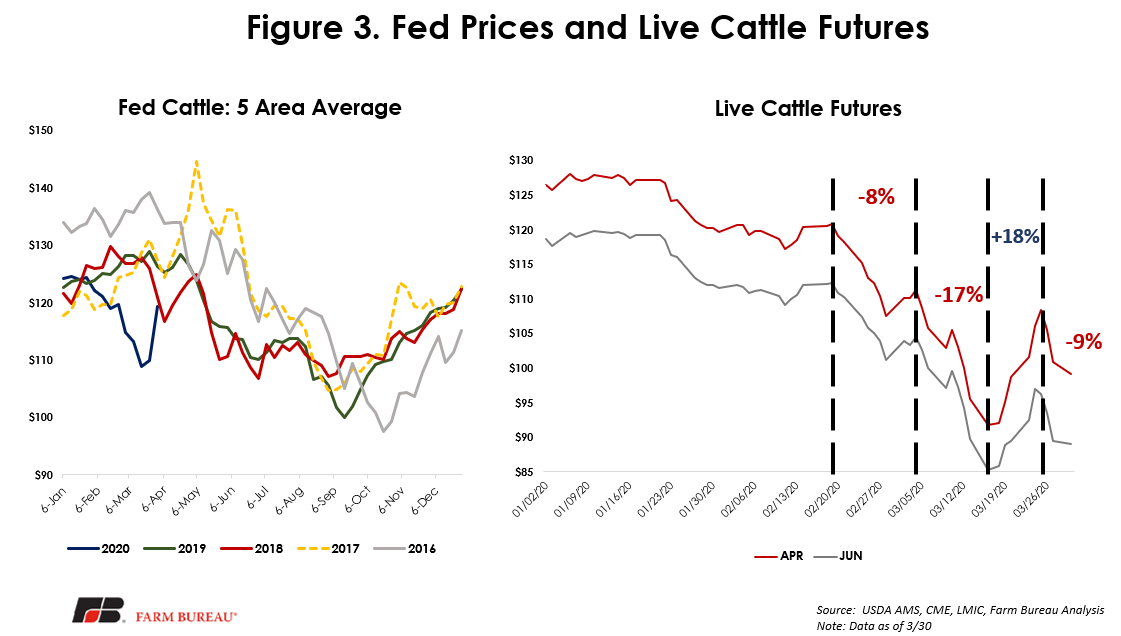

The Cattle Futures Roller Coaster

Futures prices are just that, an expectation of prices in the future. The impact to futures markets is likely somewhat a function of an expected economic recession and the likely decreased beef demand that will come with it. However, the extreme reaction and volatility extends beyond anticipated impacts to beef demand and likely is tied to panic selling as traders look to reduce their risk. Ultimately the enemy of the market here is uncertainty and the difficulty in trying to identify the “known unknowns,” and “unknown unknowns” of this particular event.

Packing plant disruptions are a significant risk to the cattle and beef markets. It’s impossible to tell what the ultimate impact will be if a worker (or workers) at a processing facility tests positive for COVID-19. In one example we have, the worker was relatively isolated and it did not significantly disrupt operations. Other instances have been more disruptive, and as more of the population tests positive and those who have been in contact with them have to self-isolate, we could potentially have more and more moderate disruptions that partially impact slaughter capacity for short periods of time. This is a potentially different situation from last year’s packing plant fire, which shuttered one of the nation’s largest facilities for months. In that instance, we rather quickly had a good idea of where things stood and were able to plan accordingly, contrasting with the current uncertainty in which we find ourselves.

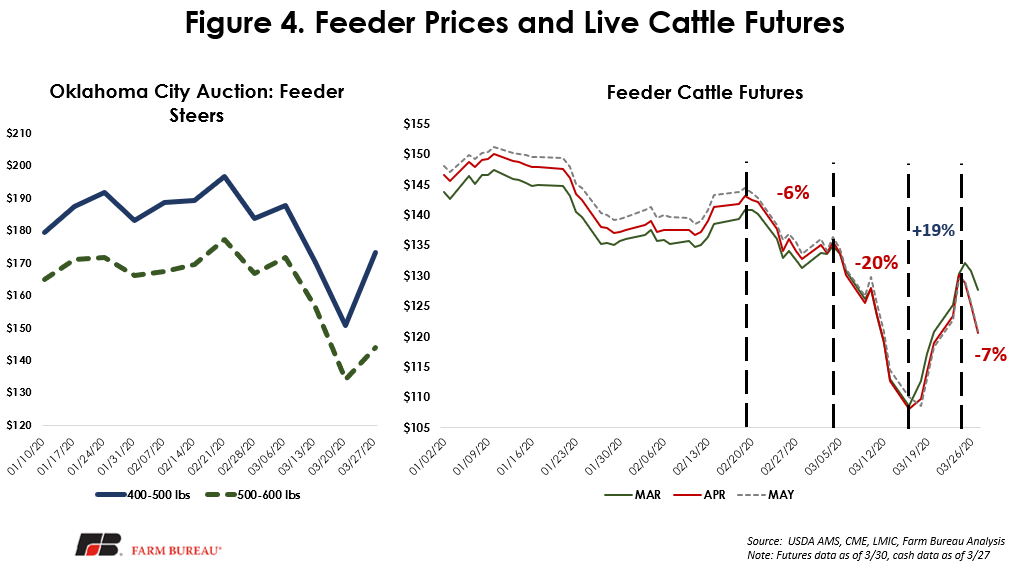

Since the end of February, and particularly in mid to late March, both live cattle and feeder cattle futures have been on a roller coaster (Figure 3 and Figure 4).

Again, one of the driving factors behind these swings is the extreme uncertainty surrounding the event (fun game: try to find an article about COVID-19 and cattle markets without the word “uncertainty” in it), and future expectations of macro factors.

Cash prices have been impacted as well, falling and rising for both fed and feeder cattle. The tightness of animal numbers and the decline of placements in the March Cattle on Feed report could potentially mean that when things return to normal later in the year, cattle prices could be moving into more bullish territory. However, the impacts of the virus are incredibly difficult to understand at this point. High cutout prices take some time to work through the system as there is a time delay between the purchase of the cattle and the sale of beef. The cattle sold to a processing plant today are not going to be in a retail case for a while. Cash fed cattle declined from a weekly average of around $120/cwt in mid-February to a low of around $109/cwt in mid-March. However, the recent increased activity of packer buying in the cash market has pushed fed cash prices up to around $119/cwt as of March 29 weekly data. Cash feeder cattle prices declined across the board, but the tightness in available feeder supplies led to an increase of approximately 10% last week. Oklahoma City Auction feeder steers of 500-600 lbs fell from $177/cwt in late February to $134/cwt in late March. However, prices have started to rebound in the most recent week, rising to $144/cwt. The 400-500 lbs category has rebounded more sharply, up to $173/cwt after falling to $150/cwt from $197/cwt.

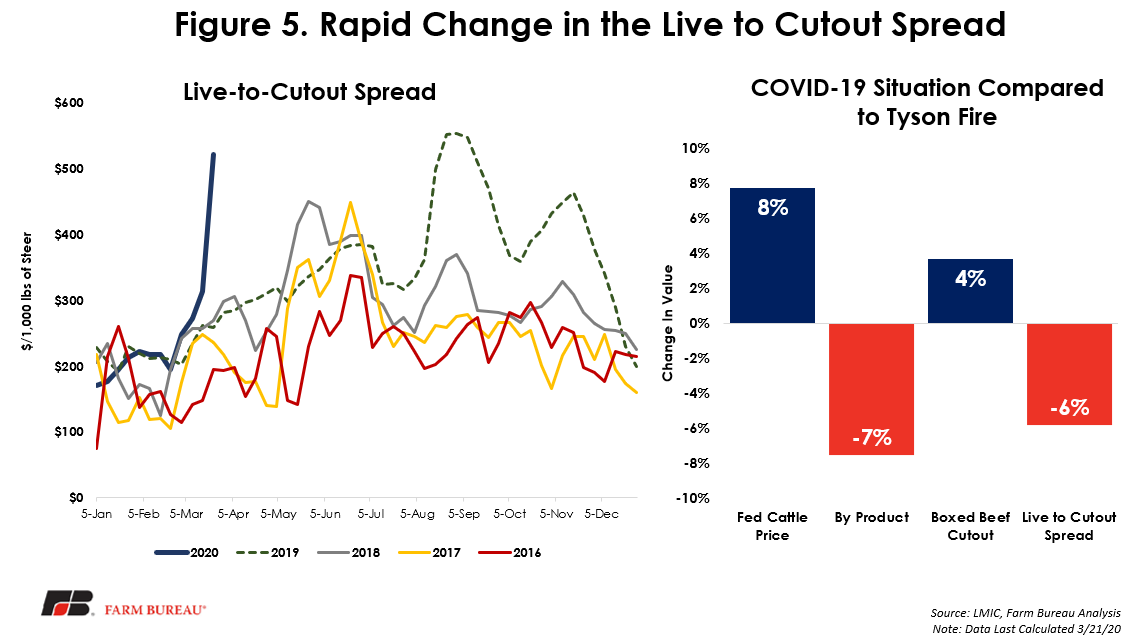

Live-to-Cutout Spread Widens Dramatically, Still Below Other Black Swan Events

With the dramatic spike in the cutout and drop in fed cattle prices, packer margins significantly increased. This is to be expected if the price of a business’ output rises and the price of its input falls. The Livestock Marketing Information Center maintains a database of calculated gross margins on a 1,000 lbs.-of-steer basis. These calculations are essentially the spread between inputs and outputs and do not include processing costs (energy, labor, etc.) and fixed costs. However, they still offer a good measure of the overall relative health of packer margins, and right now they are exceedingly healthy, as shown in Figure 5 with data current as of March 21. Since the last week of February, the live-to-cutout spread has more than doubled, rising almost $275 per 1,000 lbs-of-steer. As the markets reacted to the uncertainty caused by this pandemic, a parallel has often been drawn to last year’s packing plant fire in Holcomb, Kansas. This is an understandable comparison as in the previous black swan event, the cutout also spiked in a dramatic fashion, and COVID-19-related increase in the cutout eclipsed even the packing plant fire. However, the current live-to-cutout spread has remained below the spike that occurred during the packing plant fire, at least as the data show so far. Part of this is due to where the various components of the spread started and ended during this period. When comparing the values at the peak of the packing plant fire to the most recent calculation, the live-to-cutout spread is 6% lower than the last event, even with a higher boxed beef cutout. Two other components of the calculation are the reason for this. The By-product values received by the packer, e.g., hide, tallow, bone meal, etc., are 7% lower than they were last August. Additionally, the price of the input, fed cattle, is higher by 8% versus August. So far (there is a lag in the data), this black swan event has kept the spread below the events of last year.

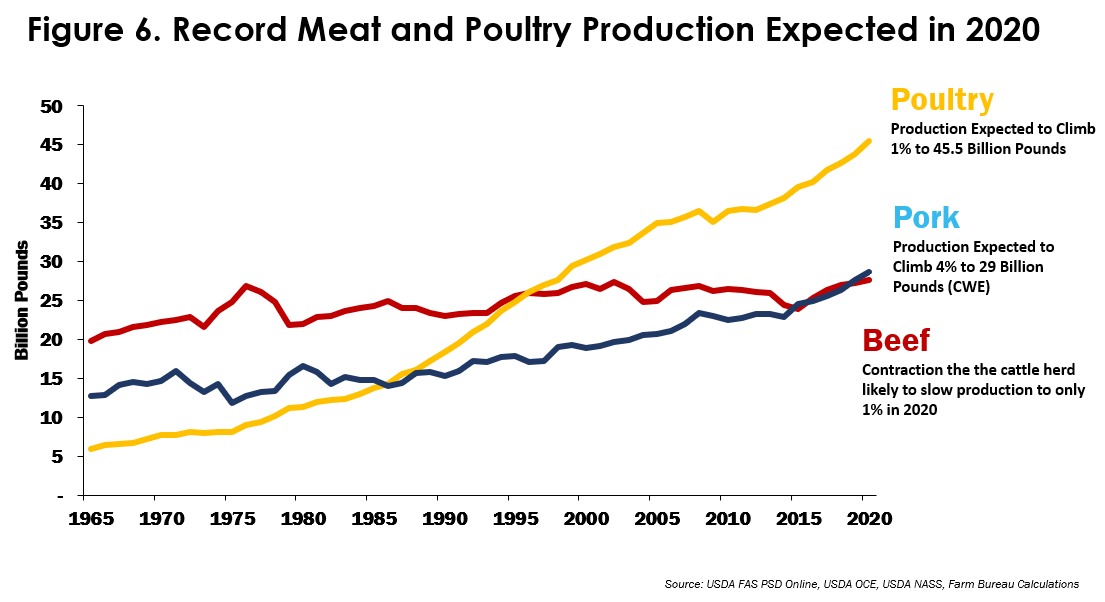

Production and Availability of Product

With expectations of record setting meat and poultry production in the U.S. this year, there is no shortage of meat. The problem we have is currently a logistical one and, in the future, the expectations is for a demand challenge given projections for negative GDP growth. The pictures of empty grocery store aisles flooding social media fail to account for the massive undertaking behind the scenes to restock those shelves. The men and women of agriculture are #StillFarming and will continue to make sure that America is fed. The question here is how long the stockpiling will last, because there is a large amount of meat coming down the supply chain and when consumers go back to week-to-week purchasing, they will see greater supplies (potentially even an oversupply) at the retail level.

Animals continue to come to market, meaning meat supplies at the retail level will be restocked. Cattle slaughter estimates continue to increase, with initial weekly estimates for last week at 676 thousand head, 4% higher than the previous week. In addition to more cattle coming to market, fed cattle weights continue to run well above year-ago levels and the weekly fed beef supply in the last few weeks has been running nearly 10% higher than last year’s levels. One big component of this is increased numbers in the Saturday kill, clocking in at 75 thousand head, 5,000 more than the previous Saturday and 28,000 head up from two weeks before. It should be noted that these numbers are initial estimates from USDA, and actual cattle slaughter data is available on a two-week lag.

Conclusion

This global pandemic has injected never-before-seen uncertainty into the cattle and beef markets. As consumers were emptying meat cases, the boxed beef cutout rose to historic levels, and cattle futures zigged and zagged as far as they could in both directions -- all while cash markets gyrated wildly. In economics, one of the underlying assumptions behind much of our analysis is the concept of ceteris paribus, or “all else equal,” which means we conduct our analysis with the assumption that everything else stays the same. Currently, every possible piece that could be moving is moving, and in this environment, we must remind ourselves that all else is not equal, and no one knows with certainty how everything will unfold.