Administration Revises Steel and Aluminum Tariffs, But Worrisome Impact to U.S. Ag Exports Remains

TOPICS

Trade

photo credit: AFBF Photo, Mike Tomko

Veronica Nigh

Former AFBF Senior Economist

On March 23, 2018, the Section 232 global steel tariff of 25 percent, along with a 10 percent tariff on aluminum imports, came into effect. The tariffs apply to imports of all steel and aluminum products unless the product or country of origin are specifically excluded. Some important trading partners were excluded, yet many remain. U.S. agriculture remains on high alert, and following recent Chinese announcements on tariffs impacting a number of agricultural commodities, were left wondering not if, but when additional U.S. agricultural exports could be targeted.

In a recent Market Intel article, Potential Aluminum and Steel Tariffs Bring Angst to Farm Country, we analyzed the share of agricultural exports on a state-by-state basis that were destined for countries that were the top producers of aluminum and steel. From that basis, 33 percent and 39 percent of 2017 U.S. agricultural exports went to the top aluminum and steel-producing countries, respectively. We then analyzed the share of agricultural exports on a state-by-state basis that were destined for countries that were the top exporters of aluminum and steel. From that basis, 50 percent and 70 percent of 2017 U.S. agricultural exports went to the top aluminum and steel-producing countries, respectively. Justifiably, this caused concern in the agriculture community and led to an effort to get our top trade partners on the list of excluded countries.

Some promising news came on March 22 when U.S. Trade Representative Lighthizer officially revealed the list of trade partners that are, at least temporarily, excluded from the steel and aluminum tariffs. The list includes Canada, Mexico, South Korea, the EU, Australia, Argentina and Brazil. This list of countries covers many of U.S. agriculture’s top export destinations. Canada, Mexico, the EU and South Korea were our first-, third-, fifth- and sixth-largest export markets in 2017, in that order. However, many important partners were left off the list.

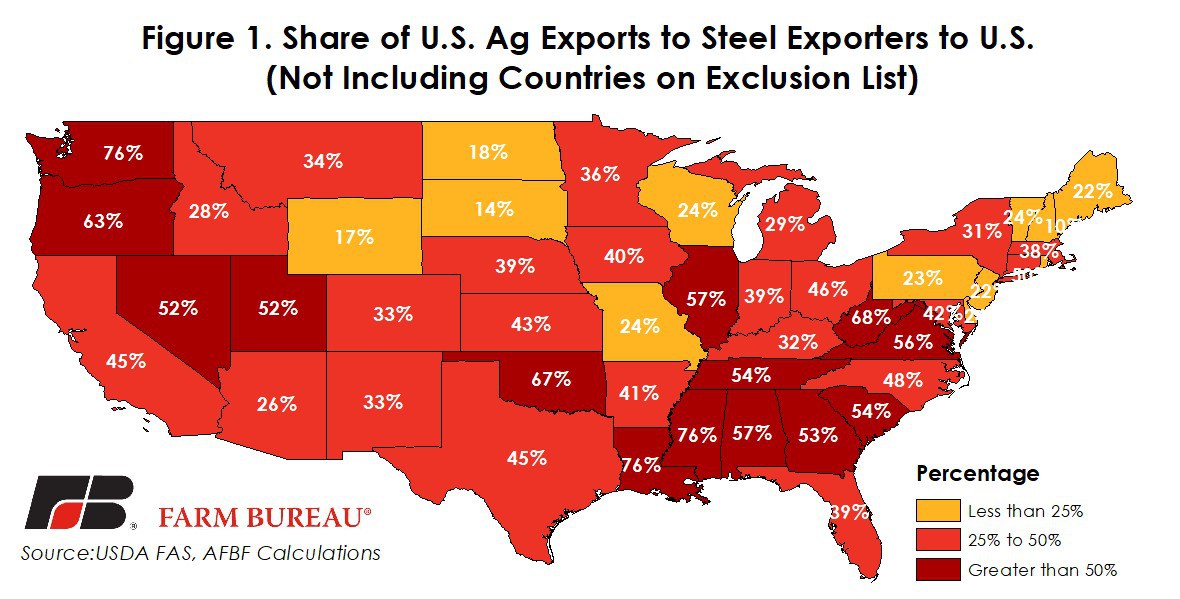

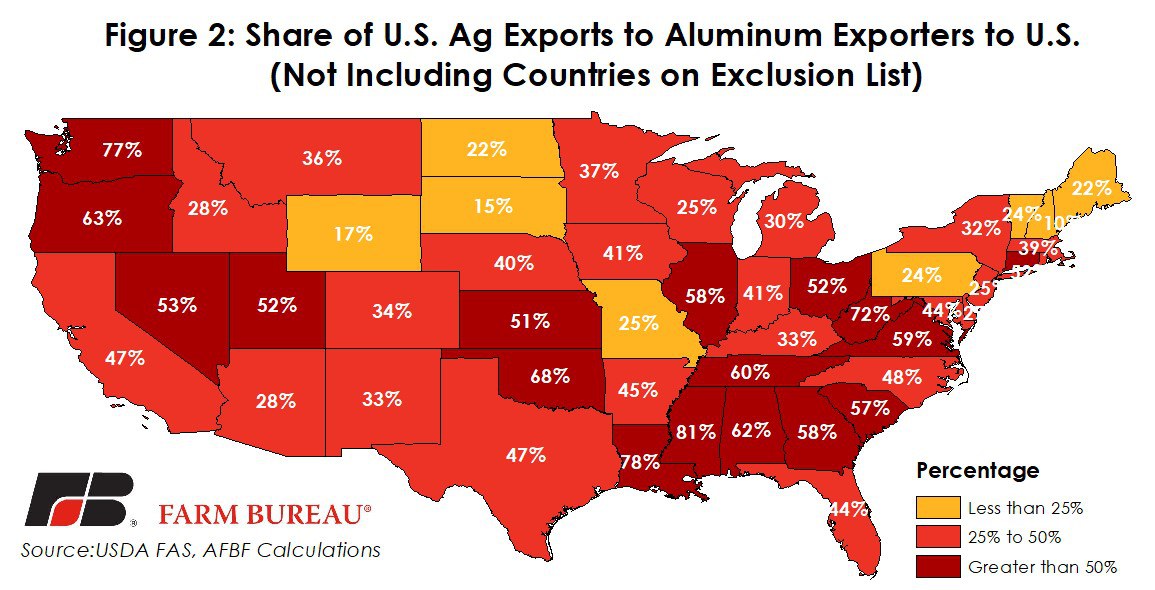

The new list of exclusions has led us to do another state-by-state analysis to determine what share of each state’s agricultural exports remain at risk to potential retaliation. We have simply added all agricultural exports to every country that exported steel and aluminum to the United States in 2017. Based on these metrics, 51 and 53 percent of U.S. agricultural exports in 2017 were destined for countries that export steel and aluminum, respectively, to the United States. Figures 1 and 2 reveal that for some states the share of agricultural exports at risk is much higher. The steel and aluminum tariffs should remain a concern for agricultural interests.

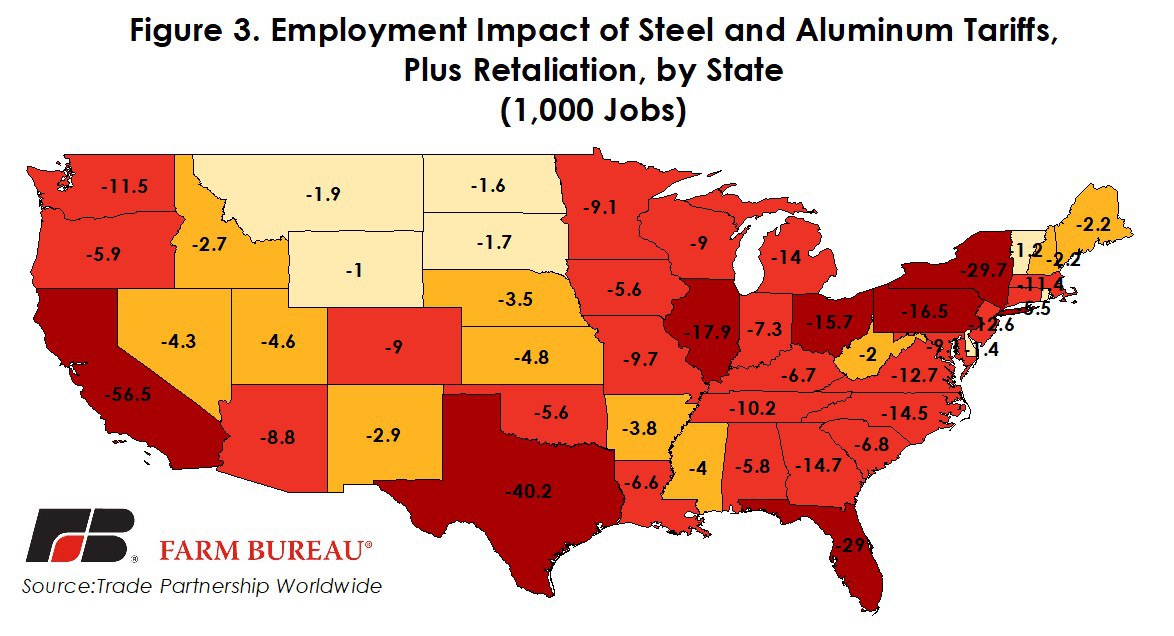

The impact that these tariffs could have is not limited to sales volume; there is justifiable concern that the tariffs will have an impact on jobs as well. The Trade Partnership Worldwide recently conducted a study, which suggests the steel and aluminum tariffs would provide a gain of 26,000-plus jobs in the steel and aluminum sector, but create a net job loss of 495,000 jobs elsewhere – including 31,500 job losses in food and agriculture, Figure 3.

The study took place before the product exemption process began and certainly before the country-exemption list was released, but it is instructive. It clearly demonstrates that U.S. manufacturers and consumers will be hit by increased input costs. Higher input costs lead to higher finished product cost, which leads to lower sales. Lower sales lead to lower labor demand. After all the exemptions play out, the impact on jobs may be a bit lower, but the direction is guaranteed to be the same.

Top Issues

VIEW ALL