Are Under $8 New-Crop Soybeans Likely?

TOPICS

Trade

photo credit: Kansas Farm Bureau, used with permission.

John Newton, Ph.D.

Vice President of Public Policy and Economic Analysis

One of the key assumptions underlying futures and options markets is that futures prices are unbiased estimates of terminal prices and that volatility estimates inferred from put and call options are unbiased estimates of risk to the futures price. Because these principles are generally accepted, one can use the futures price and the option-implied volatility to estimate the distribution of the futures contract at expiration.

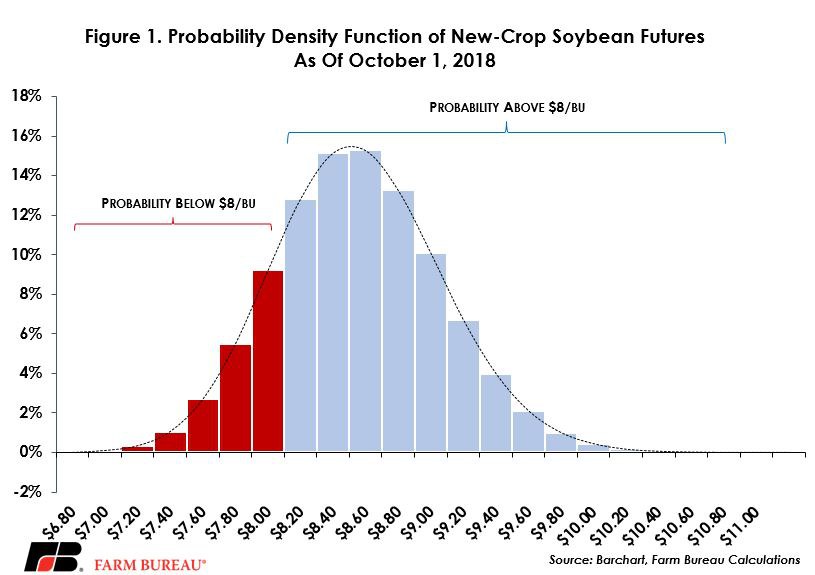

For example, based on the Oct. 1 futures and options settlement prices, there was a 50 percent probability that November soybean futures would expire between $8.21 per bushel and $8.91 per bushel. The mean of the price distribution was $8.58 per bushel, and the median price was $8.44 per bushel. Because of the skew of an assumed log-normal price distribution, the mean is greater than the median price. Figure 1 highlights the probability density function for new crop soybeans as of Oct. 1.

Currently, as identified in Figure 1, there is less than a 20 percent probability that the new-crop soybean futures contract will expire below $8 per bushel (red-shaded bars indicate probability densities under $8 per bushel). That was not always the case.

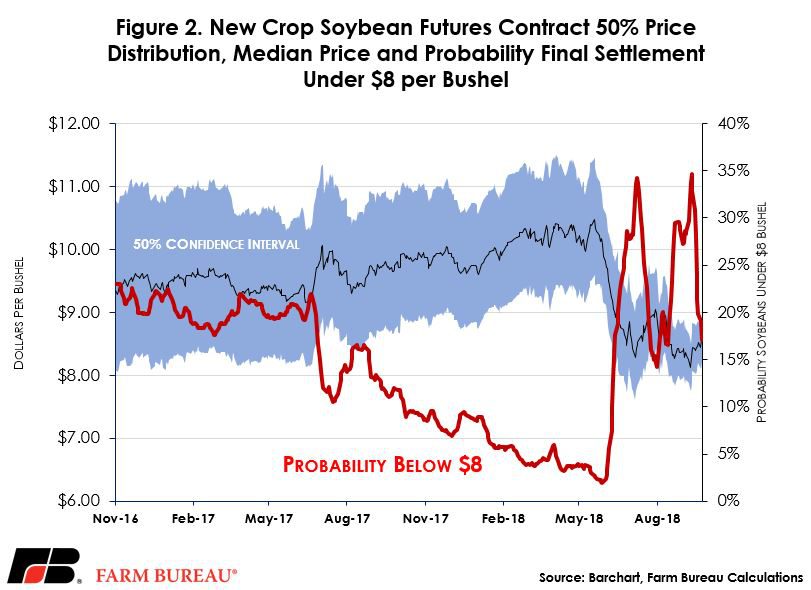

New-crop soybeans settled as high as $10.53 per bushel in the spring of 2018, and at that point in time, the market expectation was a near 0 percent probability that the final settlement price would be below $8 per bushel. As the trade disputes accelerated, and favorable growing conditions became known, the probability for below $8 soybeans jumped to more than 30 percent in July 2018. The probability for below $8 soybeans eclipsed 30 percent again following the September projections for a record-large soybean crop. Importantly, as the time to maturity decreased, the uncertainty and distribution around the mid-point decreased as evidenced by the smaller 50 percent confidence interval. Figure 2 highlights the expected distribution, and probability for below $8 soybeans, for new crop soybeans as of late 2016 to present.

This growing season for soybeans has experienced very high volatility due to demand uncertainty and expectations for a record-large supply. The increased uncertainty was captured in the options-implied volatility and provided insight into the market risk expectations. While the current majority-expectation is for soybeans to settle above $8 per bushel, at times during the growing season the market did price in more downside risk and a likelihood for sub-$8 beans.

While the likelihood for sub $8 dollar new-crop soybean futures is decreasing, as harvest continues many farmers across the U.S. are already experiencing cash prices well below these levels.

Top Issues

VIEW ALL