Bearish Quarterly Hogs and Pigs Report

photo credit: Alabama Farmers Federation, Used with Permission

Bernt Nelson

Economist

USDA’s second Quarterly Hogs and Pigs report of 2025, released on June 26, contains key metrics for the hog industry including inventory, the number of pigs saved from every litter and the number of hogs kept for breeding. Hog farmers experienced one of their worst economic years in history in 2023. Though small levels of profitability returned in 2024, farmers are still fighting to make up for their 2023 losses. This Market Intel provides analysis of the second quarterly report of 2025 and what it means for hog profitability through the rest of the year.

The Report

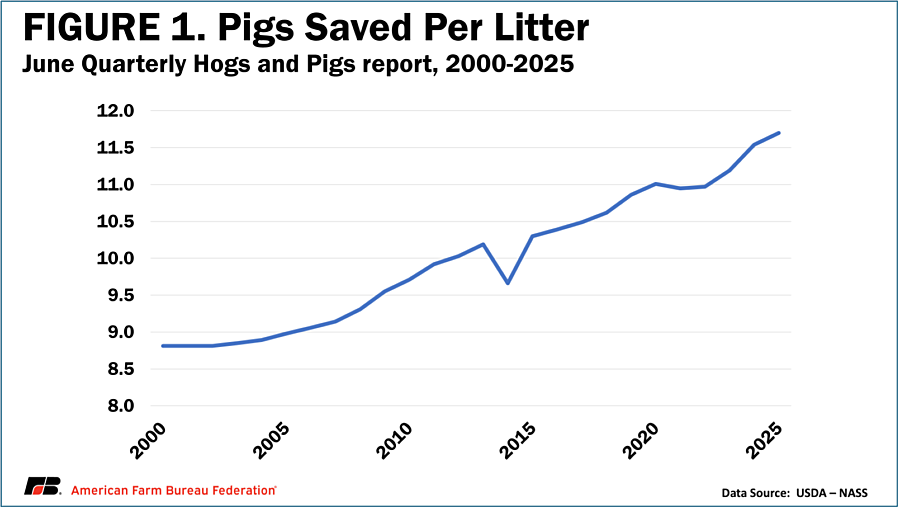

This was a bearish report. The total inventory of hogs and pigs in the U.S. on June 1 is estimated to be 75.1 million, up 1%, or 390,000 from March 1, and up 246,000 from a year ago. This is the highest June 1 inventory since 2020. Pigs kept for breeding were estimated at 5.98 million, down slightly from last year and the lowest breeding inventory in a decade. Pigs saved per litter are the number of piglets that make it to weaning age for each litter born to a sow (female pig). USDA estimates pigs saved per litter is 11.7, which is a record high for the second quarter (Figure 1). The rising number of pigs saved per litter combined with lower pigs kept for breeding is evidence of improved production that continues to elevate the total hog inventory.

Production

According to USDA’s June Livestock, Dairy, and Poultry Outlook, hog slaughter for the month of May was 10.4 million pigs, up about 3% from May 2024. This brought total production (meat that comes from hog slaughter) for May to about 2.2 billion pounds, up more than 3% from last year. The larger growth in production is likely due to higher carcass weights, which is common in the second quarter of the year. The increased production likely reflects packers increasing May slaughter to meet growing demand for pork leading up to grilling season. If production continues at this pace and demand continues to show strength, prices could remain steady through the summer months.

Demand

Domestic

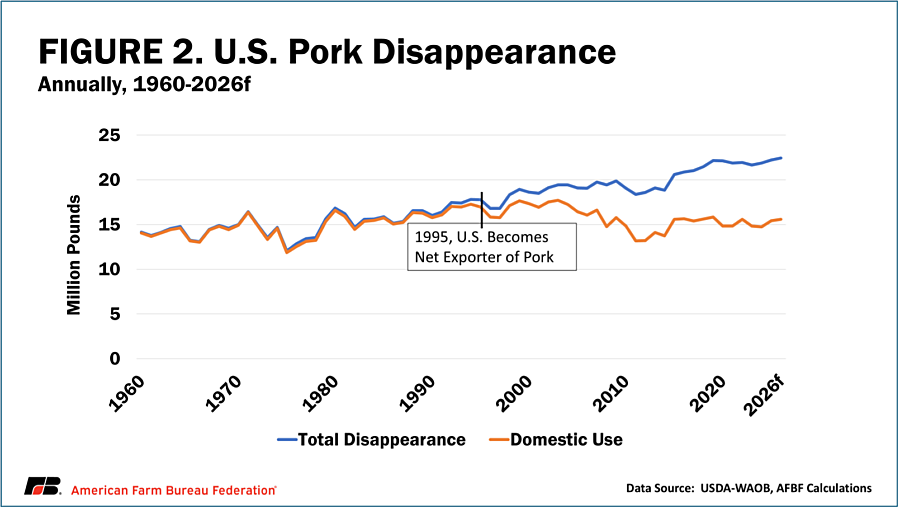

Disappearance is a term used to describe the amount of a product, like meat, that is available for use in the domestic market. It is calculated by subtracting exports and ending stocks from the total supply. U.S. pork disappearance has remained largely unchanged for over 50 years (Figure 2). In fact, the difference in the average disappearance since 1960 and forecasted disappearance for 2025 is just 154 million pounds. This might seem like a lot but when change in population is accounted for, the average U.S. consumer is only consuming about half a pound per year more this year than the average consumption over the last 65 years.

Pork needs increased demand to bring hog prices higher. While consumer demand for beef, a pork alternative, remains strong despite record beef prices, it is possible that consumers could tire of the high beef prices and buy pork instead.

Exports

The U.S. became a net exporter of pork in 1995. Increased productivity has allowed for exports to grow, adding market value to U.S.-raised hogs. According to the National Pork Board, exports accounted for about 30% of pork and pork variety meat production in 2024, adding $66.53 of value to every hog sold. This makes export markets very important for hog prices.

The top five export markets for U.S. pork are Mexico, Japan, South Korea, Colombia and China (Figure 3). According to its Livestock, Dairy, and Poultry outlook, USDA expects 2025 pork exports to be 6.95 billion pounds, down 2.3% from 2024. A major part of the lower projection is attributed to uncertainty with trade partners. Another contributing factor is increased price competition from other top production countries such as Brazil.

Prices

Slaughter hog prices have increased dramatically in grilling season. The national weekly weighted average slaughter hog carcass price was $106.96 per cwt for June 14-21, over 21% higher than the same week in 2024. It was noted earlier that USDA’s June Livestock, Dairy, and Poultry Outlook indicated strong consumer demand contributing to these prices. However, summer months tend to bring summer heat, and when temperatures are hot, hogs put on weight more slowly. This can lead to lower production, tightening supply. This would increase hog, and pork, prices through July.

Conclusions

USDA’s second Quarterly Hogs and Pigs report of 2025 delivered largely bearish signals, driven by record productivity and a growing hog inventory that continues to pressure prices. Still, the outlook isn’t without optimism. Pork remains a more affordable protein compared to beef, and continued consumer interest, both domestically and abroad, could provide some demand-side support. If seasonal heat slows weight gain and tempers supply growth, farmers may see some upward price movement through the summer months. While challenges remain, especially after the severe losses of 2023, these dynamics offer opportunities for improved margins in the second half of the year.

Top Issues

VIEW ALL