Black Swan Event Shakes Up Dairy Margin Coverage Payment Forecast

TOPICS

Market IntelMichael Nepveux

Former AFBF Economist

photo credit: Mark Stebnicki, North Carolina Farm Bureau

Michael Nepveux

Former AFBF Economist

Intro

With market signals indicating an improving dairy economy and USDA’s own decision tool predicting low to no Dairy Margin Coverage payments this year, fewer dairy farmers opted into the 2018 farm bill’s flagship dairy program in 2020, But less than three full months into the year, the rapidly evolving situation under the COVID-19 pandemic reminds us of the importance of safety net programs such as Dairy Revenue Protection and DMC.

DMC is a voluntary, insurance-style program that makes payments when the national average income-over-feed-cost margin falls below a farmer-selected coverage level. Coverage is available from $4 per hundredweight to as high as $9.50 per hundredweight. Dairy producers pay premiums for coverage and may annually re-select their coverage options. In signing up for the 2019 coverage year, farmers had the option to make a one-time election and receive a discount on DMC premiums. Program payments may be triggered monthly and are made if the DMC margin falls below the farmer’s elected coverage level. Program payments are based on the amount of milk covered in the program and may range from 5% to 95% of a farm’s milk production history in 5% increments. Market intel has published a number of articles delving into the revamped dairy program and the potential benefits for participating farmers.

Brighter Economic Picture for Dairy Earlier in the Year

At the time of sign up for the 2020 program year, the brighter economic picture for dairy had USDA’s DMC decision tool projecting little to no payments. Part of the reason for that is DMC premiums are not actuarially fair, and thus are always in- or out-of-the money with respect to program payments. In the case of the 2020 sign-up, DMC was out-of-the-money.

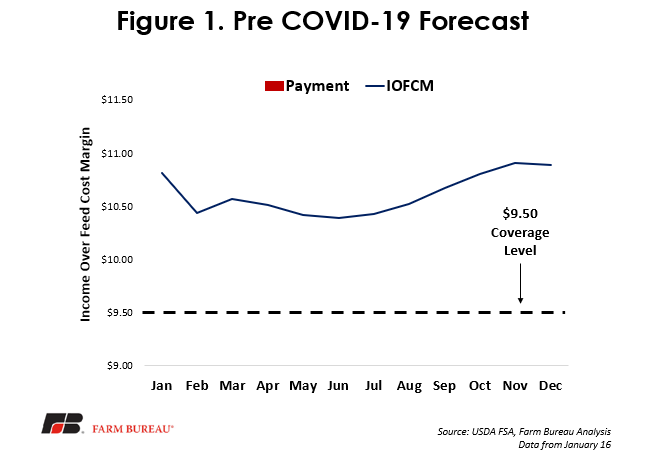

When calculating the income-over-feed-cost margin in mid-January, the all milk price in 2020 was expected to remain well above 2016-2019 levels, with projections averaging over $19/cwt for 2020 compared to the $15-$17 range more commonly seen over the past four years. In contrast to this previously forecasted milk price, the calculated composite feed cost was forecast to remain below $9 for 2020. The income-over-feed-cost margin is the difference between the all milk price and the composite feed cost. Figure 1 shows this forecast using data from Jan. 16, and before the black swan event of COVID-19. On Jan.16, USDA’s DMC decision tool was forecasting the IOFC margin to remain above the highest coverage level for every month of 2020, resulting in no 2020 DMC payments.

Things Change Quickly

With the rapid onset of restrictions related to COVID-19, the previously encouraging economic picture drastically changed quickly. Nearly every aspect of the U.S. economy has taken a hit from the coronavirus pandemic. Extreme volatility has become the norm in the equities and commodities markets. Entire industries have essentially shut down as much of the nation shelters in place and practices social distancing.

The dairy industry has not been immune to the shock from this black swan event. Class III and Class IV milk futures have sharply declined. The way Americans are eating for at least the next month is changing drastically as consumers shift food dollars away from restaurants and food service and into food-at-home spending. Fluid milk sales have offered a temporary bright spot in much of the negative environment. Milk has been flying off grocery store shelves, helping to offset the loss of the school lunch program. Shifting milk to fluid processors is helpful to reduce dairy product output at a time when demand is likely going to take a sizeable hit. However, it may be unlikely that this surge in consumer purchases of fluid milk will continue significantly into the future. Those consumers who cleared the shelves in panic may not be continue buying at the same volume. Milk powder prices have suffered as the export dependent market saw sales decline. Some dairy product manufacturers are closing down facilities and laying off workers under this difficult environment. Other spot markets for dairy products have struggled recently, with butter dropping to a five-year low.

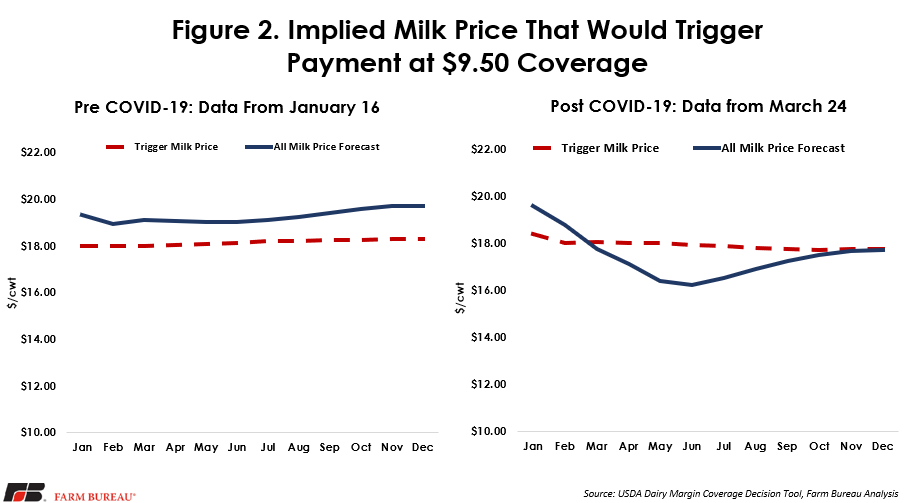

This new reality has already significantly altered the picture for the DMC program, and completely upended the forecast from just two months ago. Using the forecasted composite feed cost and the forecasted all milk price, one can calculate an implied all milk price at various coverage levels that would trigger a payment. We can then compare this trigger price to the forecasted all milk price to see when payments may kick in.

Figure 2 compares the forecasted all milk price and trigger price from Jan. 16 against the forecast on March 24. As discussed in Figure 1, there was no expectation of a payment for any month in 2020 with the all milk price forecasted to remain well above the trigger price. However, the forecast from March demonstrates how quickly unexpected events can change a forecast and shows the all milk price forecast falling below the trigger price for much of 2020.

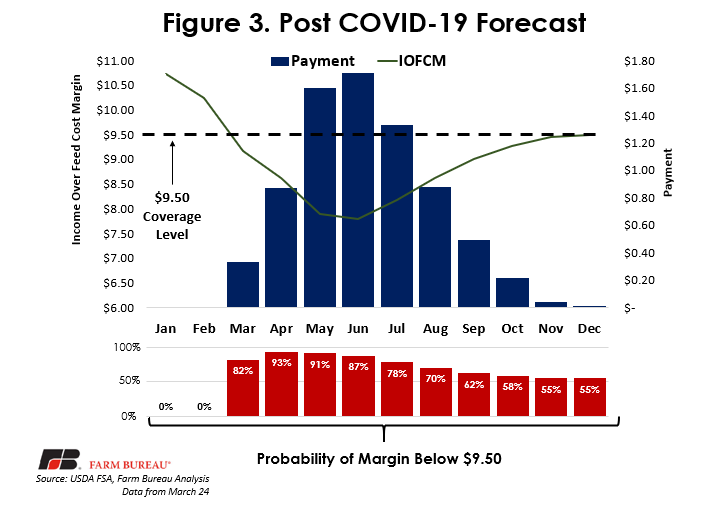

Figure 3 shows USDA’s decision tool forecasted IOFC margin and projected payments as of March 24. While no payments were forecast in January, now every single month from March through December is projected to receive a payment. The projected payments range from a low of $0.01/cwt in December to a high of $1.71/cwt in June.

Conclusion

The sudden and drastic change in dairy markets illustrates the importance of safety net programs such as Dairy Revenue Protection and DMC. However, because of the lack of expected payout during the sign-up time frame, only 47.8% of operations with production history and 56.2% of the volume of established production history were enrolled in DMC in 2020. Meanwhile, 76 billion pounds of milk has been insured by Dairy Revenue Protection and could be eligible for an indemnity for nearby quarters given current price expectations.

The low participation in DMC leaves quite a bit of uncovered milk in Title I safety net programs. The Senate’s recent legislation providing support to agriculture from the coronavirus does provide $9.5 billion in funding for agriculture, a portion of which will be allocated to dairy.

Top Issues

VIEW ALL