Brazilian Soybean Exports Seizing a Chinese Opportunity

TOPICS

Trade

photo credit: North Carolina Farm Bureau, Used with Permission

John Newton, Ph.D.

Vice President of Public Policy and Economic Analysis

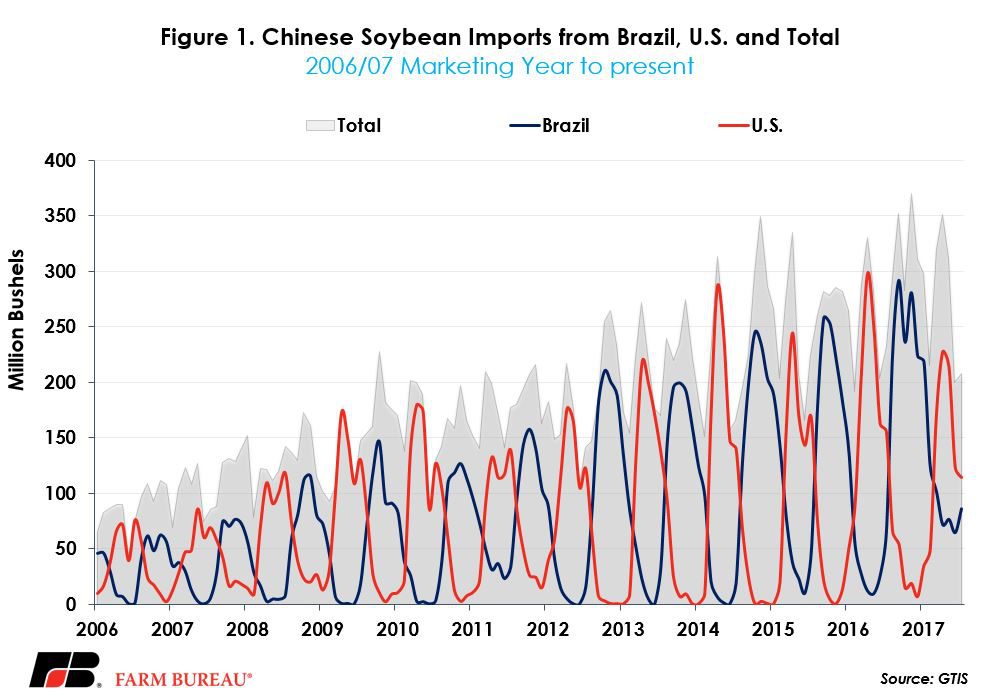

For many reasons, Brazilian exports of soybeans to China are surging. First, following a record soybean crop of 4.19 billion bushels in 2016/17, Brazilian soybean ending stocks reached a record-high of approximately 940 million bushels. Then, Brazilian soybean farmers are expected to top that record with a crop of 4.23 billion bushels for the 2017/18 marketing year. Given two back-to-back record harvests, and record-large inventory levels, the increase in Brazilian soybean exports was no surprise. For the 2017/18 marketing year, Brazilian soybean exports are projected at a record-high 2.7 billion bushels, marking the eighth consecutive year of record soybean exports.

Meanwhile, following back-to-back record soybean crops in the U.S., and partially due to the low protein content of U.S. soybeans, exports are projected to fall 5 percent in 2017/18 to 2.1 billion bushels. Due to reduced export volumes, U.S. soybean ending stocks are projected at 550 million bushels – the second-highest on record behind 574 million bushels in 2006/07. The slowdown in U.S. exports, combined with record crops in Brazil and a production shortfall in Argentina created an opportunity for Brazil to expand its footprint in China. Chinese soybean imports in 2017/18 are projected at a record-high 3.56 billion bushels, up 4 percent from the prior year.

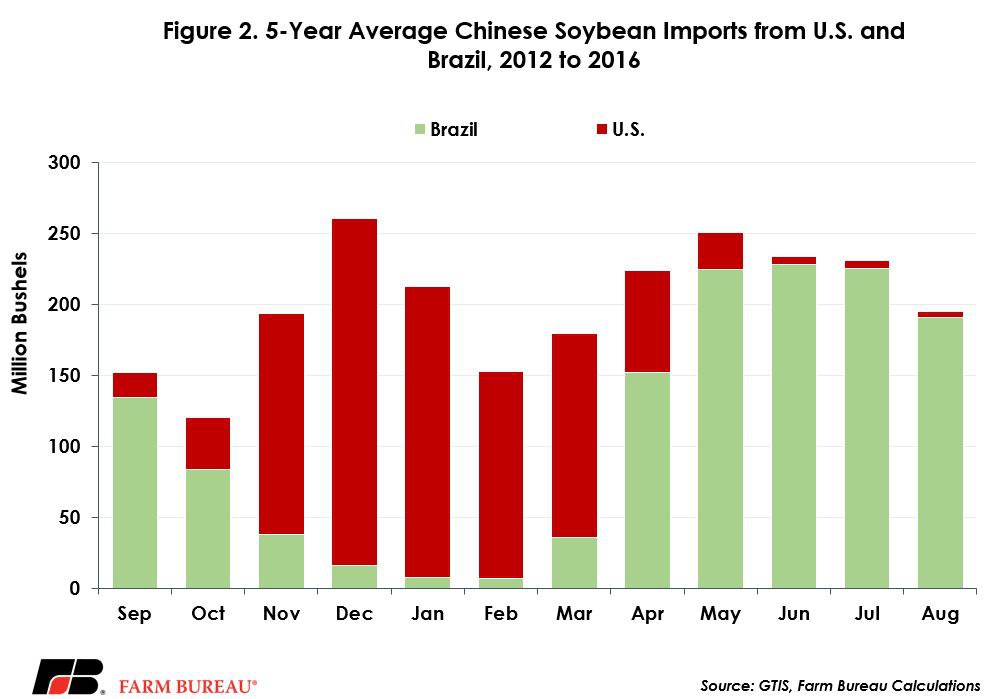

Through March of the 2017/18 marketing year, Brazilian soybean exports have totaled 741 million bushels, up 126 percent over prior marketing-year levels, and up 130 percent over the 5-year average. Meanwhile, U.S. exports to China through March total 932 million bushels of soybeans, down 23 percent from prior-year levels but down only 2 percent from the 5-year average. It is important to note that Brazilian exports to China generally peak in the late spring and continue through October, while U.S. exports to China peak in the winter months immediately following harvest, Figure 2.

Given the concern around China’s response to steel and aluminum tariffs, all eyes now turn to USDA’s May 10 World Agricultural Supply and Demand Estimates. The May WASDE will provide the first projection of the U.S. soybean balance sheet for the 2018/19 marketing year. Importantly, these estimates will be the first update to U.S. exports and ending stocks following China’s announcement of a potential 25 percent tariff on U.S. soybeans.