Broiler Hatchery Data Shows Expansion

AFBF Staff

photo credit: Alabama Farmers Federation, Used with Permission

Weekly broiler hatchery data has been showing aggressive growth in the first few weeks of 2018, topping last year’s figures by 3 percent in both the number of eggs set and the number of chicks placed. This weekly data is reflective of a longer-term trend of growing poultry supplies. The week ending Jan. 13 marked the 84th week -since May of 2016- that the number of eggs set in the U.S. has shown a year-over-year increase. The number of chicks placed out of those eggs set has not quite been so aggressive, seeing some weeks with year-over-year declines, nonetheless 2017 chicks placed averaged 2 percent higher on a weekly basis.

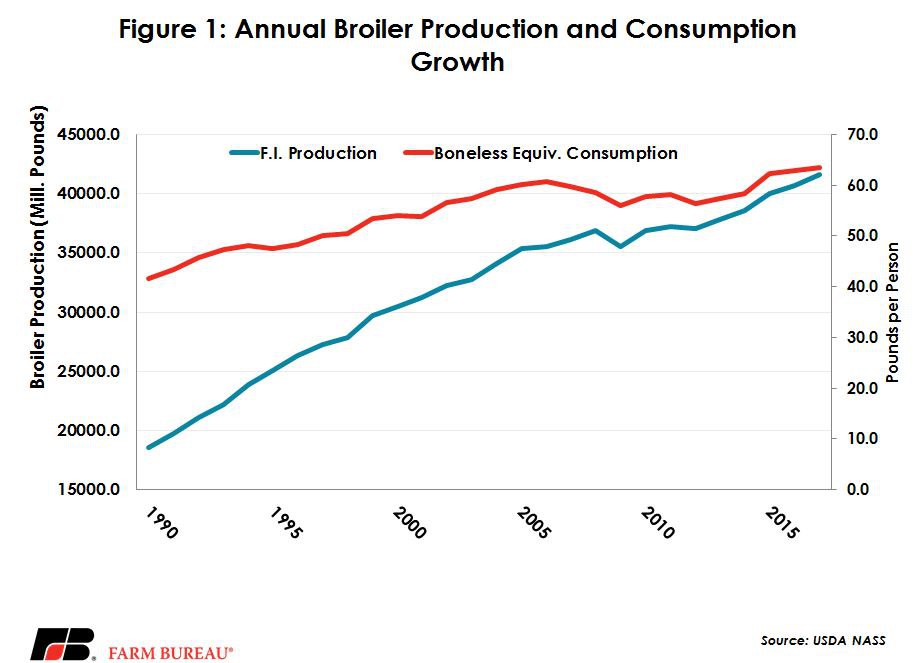

Federally inspected broiler production has been gaining for almost a decade, as has consumption. Americans eat nearly 65 pounds of boneless broiler meat per person annually-over 50 percent more than they ate in 1990. The U.S. population has increased significantly-by 30 percent- during that time period, while broiler meat under federal inspection increased 124 percent. This year, broiler production is expected to expand another 2 percent, and as the World Agricultural Supply and Demand Estimates report notes, “broiler returns are favorable for the time being.” Feed costs are the number one input, and as mentioned in our last Market Intel “Can Monster Crop Yields Continue?”, the last couple of years of high yields and production has moved prices in the feed complex lower.

USDA will release 2019 numbers in February but this trend is expected to continue for broiler production. There is not a fundamental reason on the horizon to change the current trajectory. Consumption and exports are both expected to continue to grow, along with another modest bump in production. However, a global or even a U.S. recession could put the supply and demand numbers out of whack enough to curb production or a new negative health claim against eating poultry. On the supply side, a disease outbreak could alter the current trend, but for now cost of production measures are low and consumers continue to eat more chicken. Figure 1 shows the increase in production along with the growth in consumption on a boneless equivalent since 1990.

Top Issues

VIEW ALL