Cattle on Feed Continues Strong Placements

TOPICS

USDAAFBF Staff

photo credit: North Carolina Farm Bureau, Used with Permission

Strong placements were expected ahead of the cattle on feed report as analyst ranges were from 3.6 to 13.1 percent above a year ago. This large range is in line with the strong feeder market seen over the course of October indicating the interest from feedlots to continue to fill pens even though estimated feeding returns have been negative for the last three months. The number of placed animals did slow in July and August as feeding returns declined, but September jumped to 13.5 percent higher as the five-market fed prices climbed out of their lowest point all year of $104.65 per cwt. The number of animals placed in October came in at 10 percent over last year, some of which can be attributed to one additional slaughter day this year compared to last.

Marketings have continued to be aggressive and so feedlot inventories have not become burdensome even though nine of the last running 12 months have shown placements over 10 percent ahead of the prior year. Marketings have remained 3 and 10 percent above a year ago all year, and in October they continued the positive trend coming in at 6 percent above 2016.

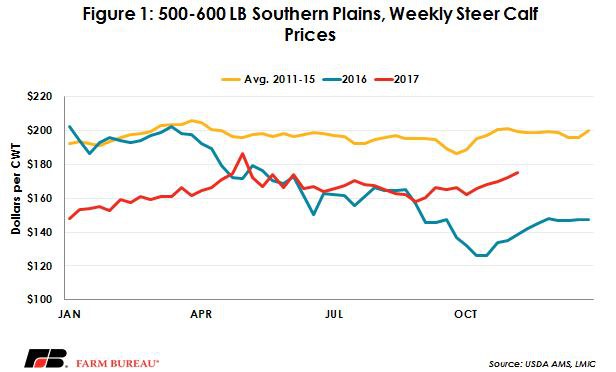

Feeder cattle of 500-600 lb. weights are maintaining strong prices this year and could be an indication of smaller feedlots taking advantage of low feed costs. With USDA noting another record high yield in corn, some row crop farmers with empty pens could take advantage of the diversification opportunity and feed out their grain as opposed to selling it. This is a hard number to follow as it does not show up in the monthly cattle on feed report. Figure 1 shows the price trajectory of 500-600 lb. feeders.

These higher than expected prices across the feeder cattle complex are likely a premonition of 2018 being another year of growth and expansion in the cattle sector. Southern plains 500-600 lb. weights were $36 per cwt above 2016 last week, while 700 and 800 lb. weights were $40 per hundredweight higher. Heifer slaughter has been above a year ago most of 2017, with about 12 percent more heifers slaughtered. However, last week the weekly slaughter number slowed sharply and is the first non-holiday week to show only a single-digit increase since July.

Top Issues

VIEW ALL