China Phase ‘Two’: What We Know Right Now

John Newton, Ph.D.

Vice President of Public Policy and Economic Analysis

Trade policy decisions made by the administration will impact farmers and ranchers in the countryside. This Market Intel is part of a series exploring agricultural trade, including the potential impacts of trade policy changes.

China Phase Two

After months of negotiations with the Chinese, President Trump has announced a Deal on Economic and Trade Relations with China which includes:

- Agreements on the flow of the precursors used to make fentanyl;

- The eliminations of China’s current and proposed export controls on rare earth elements and other critical minerals;

- The end of retaliation against U.S. semiconductor manufacturers and other major U.S. companies;

- Commitments to purchase U.S. soybeans beginning in November and December of 2025; and

- The reduction of Chinese tariffs on a variety of U.S. agricultural products including chicken, wheat, corn, cotton, sorghum, soybeans, pork, beef, aquatic products, fruits, vegetables and dairy products.

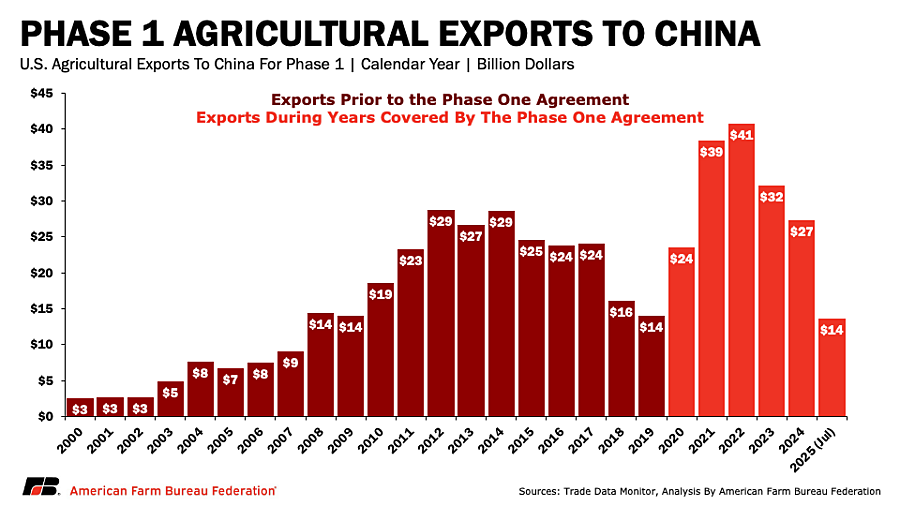

The agricultural-related provisions are reminiscent of the 2020 Phase One deal with China that included agricultural purchase commitments that resulted in more than $60 billion in agricultural exports over the first two years of the deal.

China’s Historical Agricultural Purchases

Before the Phase One agreement, U.S. agricultural exports to China had grown steadily from 2000’s $2.6 billion to 2012’s record $28.7 billion, mirroring a broader era of export expansion that positioned China as the anchor of U.S. demand growth. During Phase One negotiations, agricultural exports to China fell sharply – as they have this year, reaching a low of $14 billion in 2019. In response to the downturn in the farm economy created by the pullback in agricultural purchases by China, the previous Trump administration provided a total of $23 billion in economic aid delivered directly to farmers and ranchers.

During the years covered by the Phase One agreement, U.S. agricultural exports to China surged to $24 billion in 2020, $39 billion in 2021 and peaked at $41 billion in 2022. During the first two years of the Phase One agreement, China purchased more than $60 billion in U.S. agricultural products. While short of the $80 billion goal, these Phase One purchases contributed significantly to an increase in crop cash receipts to a record $283 billion and a record-high U.S. net farm income in 2022 of $182 billion.

Despite provisions allowing for consultation should the purchase commitments fall short, China gradually redirected portions of its feed, cotton and livestock imports toward alternative suppliers, and U.S. exports to China began to slow, dropping to $32 billion in 2023 and $27 billion in 2024. Year-to-date, through July 2025, U.S. exports to China stand at only $14 billion, a figure expected to rise as China follows through on new purchase commitments of U.S. agricultural products.

Phase Two Soybean Commitments

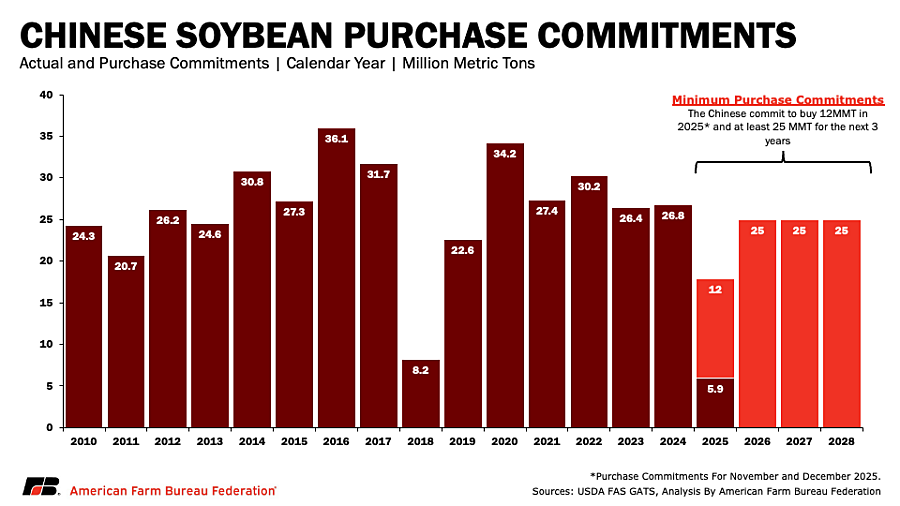

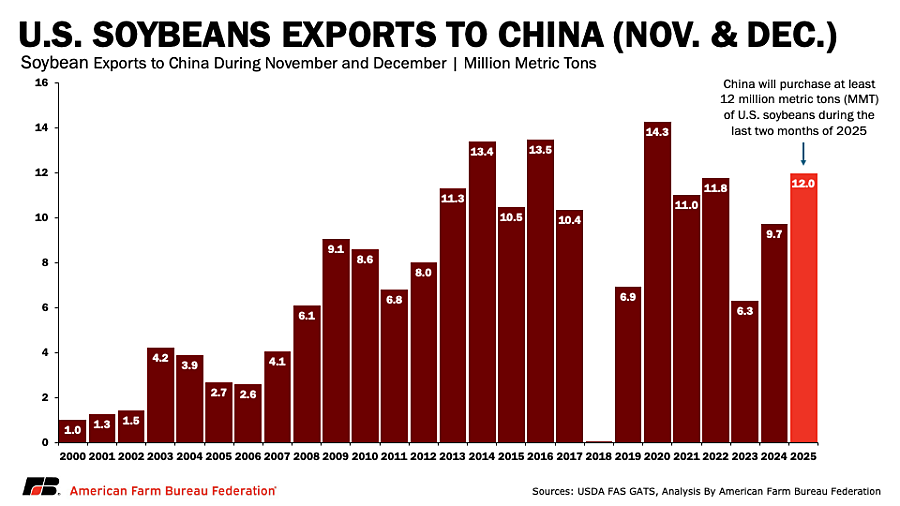

As part of the recently announced Deal on Economic and Trade Relations China will purchase at least 12 million metric tons (MMT) of U.S. soybeans during the last two months of 2025 and purchase at least 25 MMT of U.S. soybeans in each of 2026, 2027, and 2028. Additionally, China will resume purchases of sorghum and hardwood logs from the U.S., but specific quantities have not been announced.

Specific to soybeans, both goals are achievable. Historically, over the last decade U.S. farmers have exported an average of more than 27 MMT of soybeans each calendar year. While the commitment to purchase 25 MMT falls slightly short of the historical average, it’s important to acknowledge that these commitments are a minimum, and not a maximum purchase amount. Exports at or above these agreed-upon quantities would represent a minimum of approximately $32 billion received by farmers based on today’s marketing year average price projection of $10 per bushel (this total would move higher as export volumes or soybean prices move higher).

Relative to the 12 MMT commitment for the rest of 2025, it is a lofty but achievable goal. Over the last decade, U.S. soybean exports to China during the last 2 months of the calendar year averaged 9.5 MMT. If realized, China’s purchases of 12 MMT of soybeans in November and December of this year would be the fourth-highest export volume in history. When combined with nearly 6 MMT of soybeans already exported in calendar year 2025, total soybean purchases would approach 18 MMT, before increasing to 25 MM over the next 3 calendar years.

Summary

Over the course of more than two decades, China has grown into a major market for U.S. farmers and ranchers, and their participation, or lack thereof, ripples across the farm economy, reaching deep into rural communities where export strength often determines whether small towns grow or fade. Under the Phase One agreement, U.S. agricultural exports to China reached record-highs and largely contributed to record-high cash receipts for crops and record-high U.S. net farm income.

The expectation in farm country is the newly announced Deal on Economic and Trade Relations with China could have a similar impact on U.S. agricultural exports and the broader U.S. farm economy. While not a cure-all, especially with other priorities like year-round E-15 and fair and enforceable trade agreements in other parts of the world, China remains the 800-pound gorilla in the room that many hope will begin to turn around farm income and generate economic activity in the communities farmers and ranchers call home. Whether that hope becomes reality will depend on consistent follow-through by both parties and a geopolitical and market environment that allows the deal to endure.