China Still Behind on Phase One, But Catching Up Quickly

TOPICS

Trade

photo credit: Sgt. Mikki Sprenkle/Public Domain

Veronica Nigh

Former AFBF Senior Economist

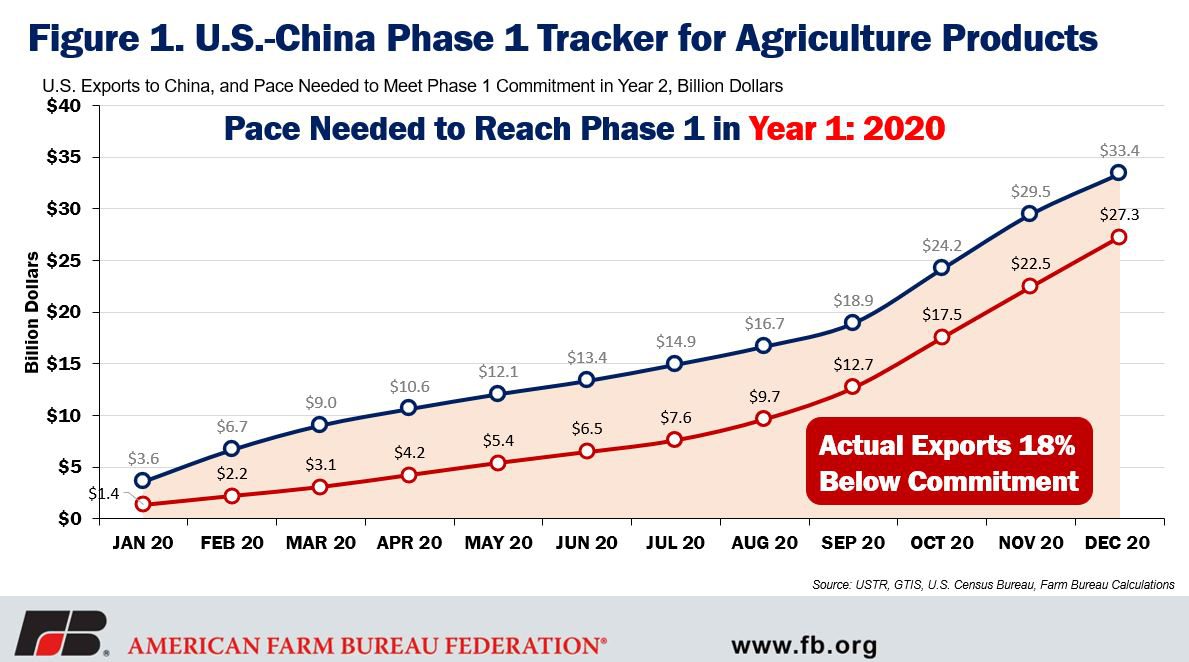

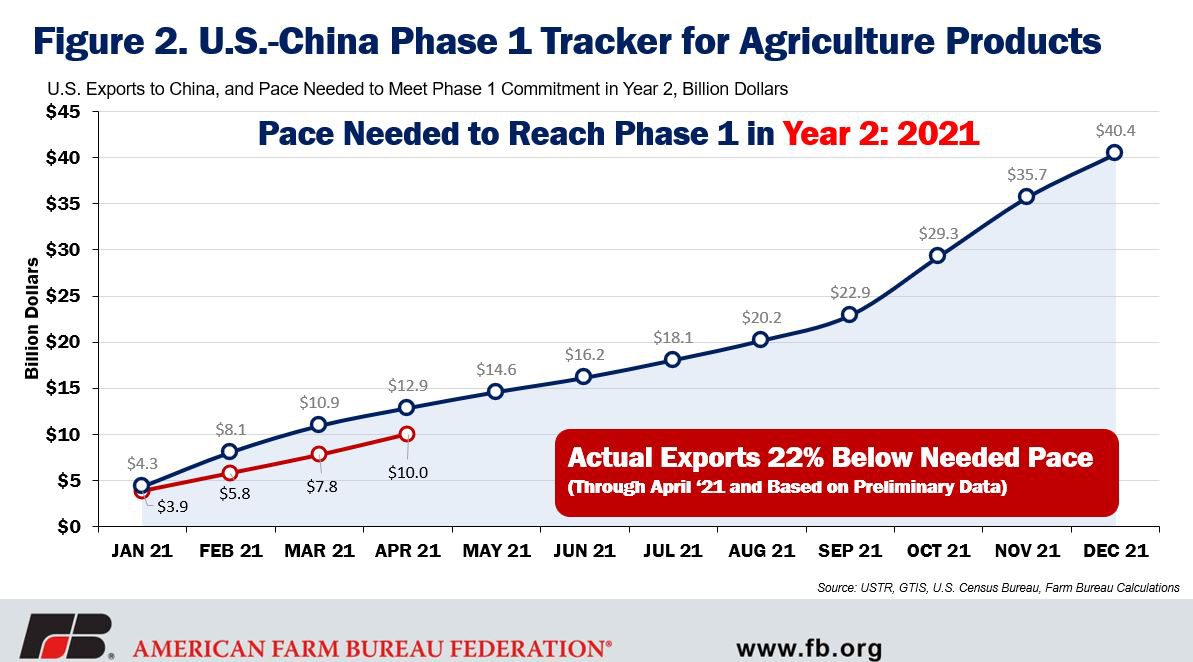

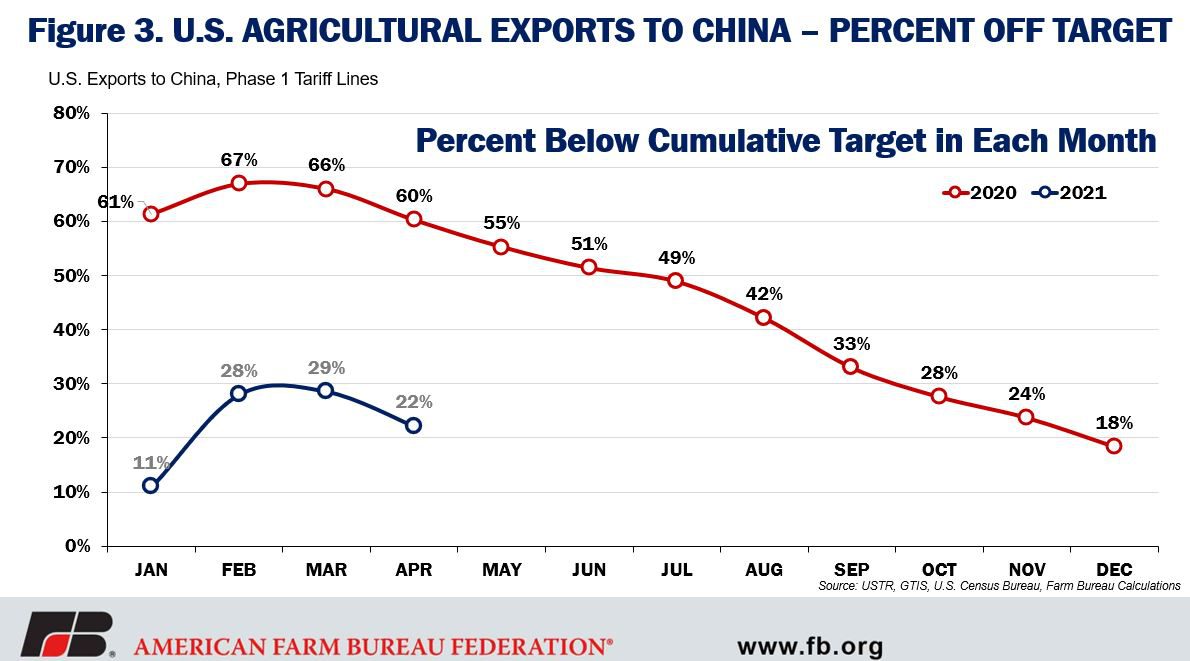

The Phase One Agreement, signed by the United States and China in January 2020, committed China to large, huge even, purchases of U.S. agricultural products in 2020 and 2021. Phase One laid out that over the course of 2020 and 2021, total exports of U.S. agricultural products to China would increase by $73.8 billion, which is equivalent to $80 billion in Chinese imports, once shipping and freight are added. The agreement split the total purchases into individual annual commitments – 45% of the total, or $33.4 billion, was to be purchased in 2020 and 55% of the total, or $40.4 billion, was to be purchased in 2021. China missed the 2020 target by $6.15 billion and is 22% behind through the first four months of 2021, but purchases are coming on strong.

Top-Line Numbers

According to Census Bureau data, total exports of agricultural and related products covered under the agreement for the most recent month available, April 2021, were $2.2 billion. April was the first month in 2021 in which actual exports met or exceeded the value of exports needed to reach the year-end goal. January – April 2021 agricultural and related product exports totaled just over $10 billion, which is 22% less than the $12.9 billion needed to reach the year-end goal.

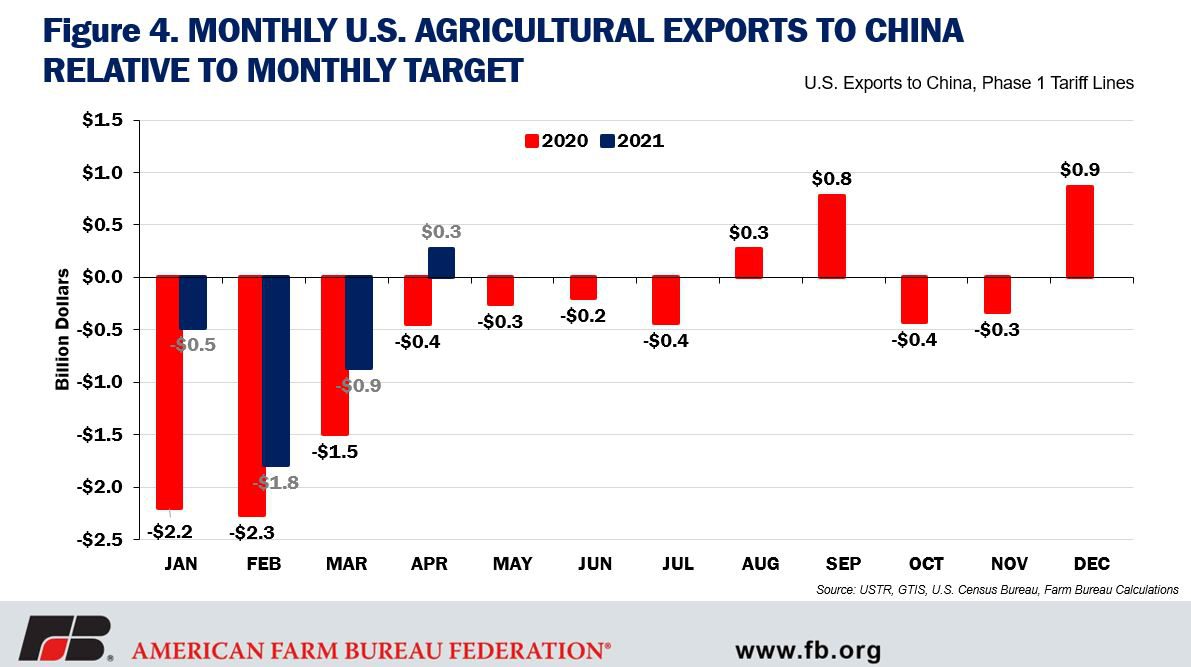

While being behind the goal seems like bad news, U.S. agricultural exports, relative to the Phase One commitments, are in much better shape in 2021 than they were over the same period in 2020. Cumulative January through April 2020 exports were 60% below the cumulative total that would have been needed to achieve the 2020 target. As seen in Figure 2, U.S. exports started gaining considerable ground relative to the needed pace in April 2020, with the first month in which actual exports exceeded “needed” exports occurring in August. That increasing pace brought the gap between China’s purchasing target and China’s actual purchases to 18%. And while missing the 2020 target by 18%, or $6.15 billion, is significant, it’s sizably better than when exports were two-thirds off the target during the early months of 2020.

Conclusion

Given what we’ve seen thus far in 2021 in terms of sizable purchase commitments of new crop commodities expected to ship in the latter months of 2021 and current commodity prices, there is a real chance that the 2021 Phase One commitment level might be reached. If achieved, the $40.4 billion in exports to China would blow past the $27.2 billion record for exports of agricultural products covered by the agreement achieved last year. Only time (and the threat of cancellations) will tell.

Top Issues

VIEW ALL