Corn and Soybean Harvest Move Toward the Finish Line

TOPICS

Winter WheatMegan Nelson

Economic Analyst

photo credit: Arkansas Farm Bureau, Used with Permission

Megan Nelson

Economic Analyst

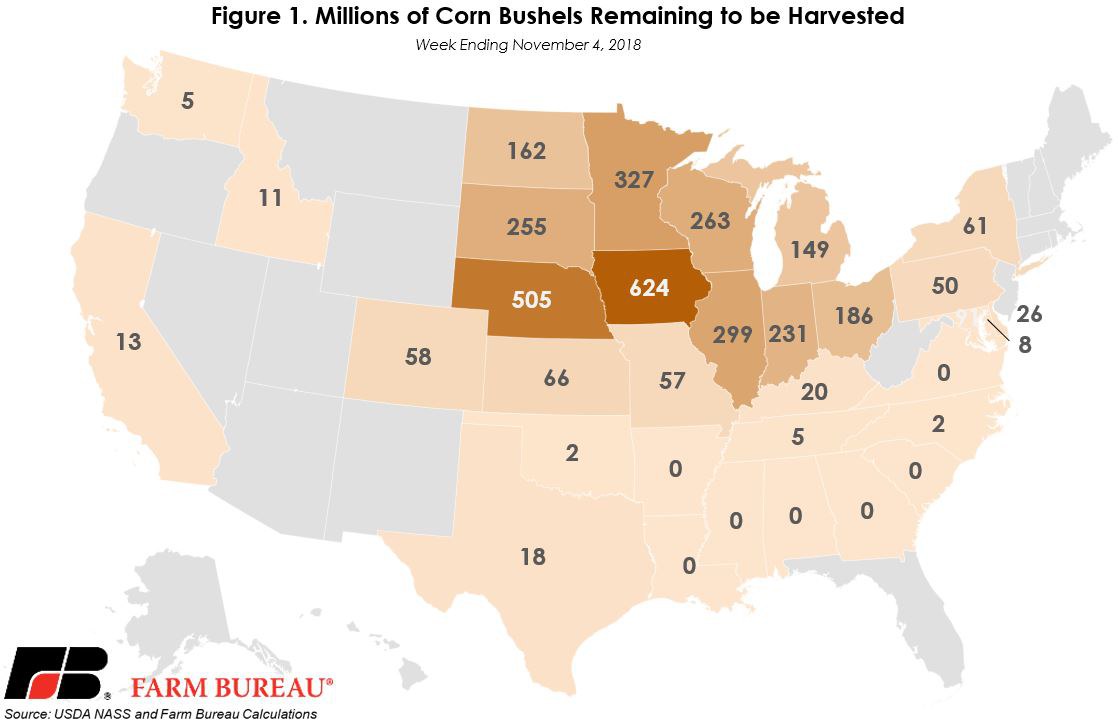

USDA’s Nov. 5 Crop Progress report revealed the U.S. corn harvest is 76 percent complete. Down slightly from the five-year average of 77 percent complete, the corn harvest pace remains up from the previous year, representing an 8-percentage point difference from last year’s 68 percent complete. Rain has continued to slow harvest; however, the aggressive harvest pace is continuing throughout the Corn Belt. U.S. corn growers have harvested 11.4 billion bushels so far this year, leaving 3.4 billion bushels remaining. Figure 1 illustrates the state-by-state outlook for millions of corn bushels remaining to be harvested for the week ending Nov. 4.

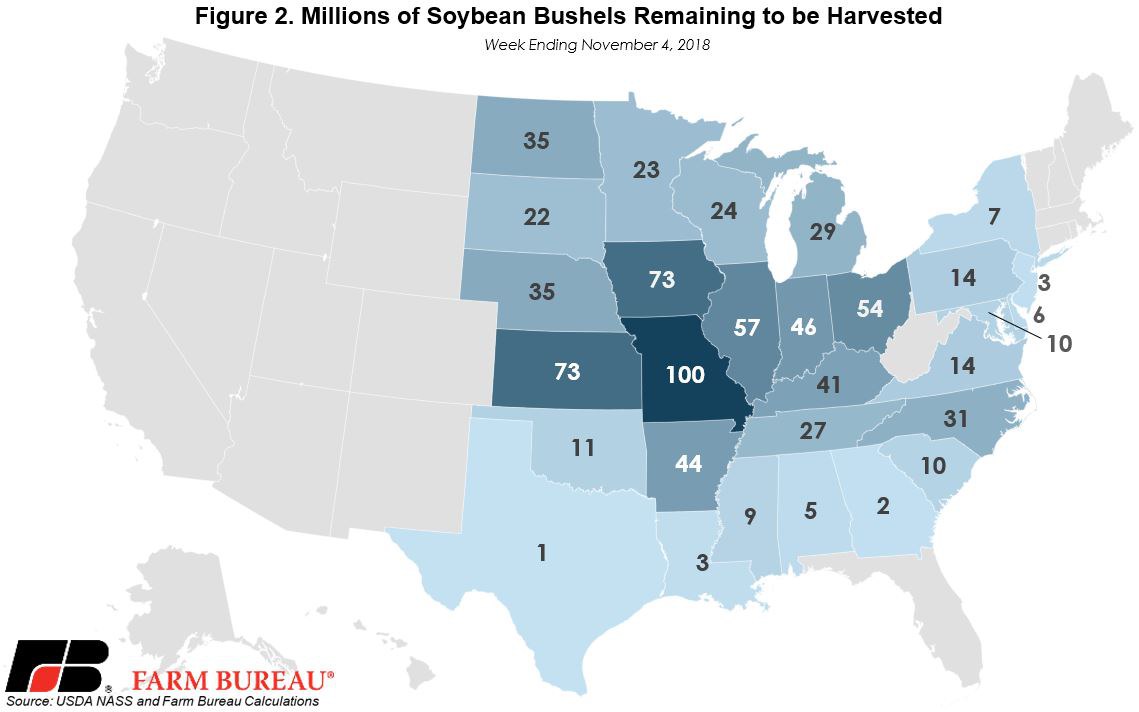

The Crop Progress report also indicates that the U.S. soybean crop is catching up to historical averages with 83 percent of harvest complete. The U.S. soybean crop is down 6 percentage points from last year’s rate as well as the five-year average of 89 percent complete for this time of year. The current harvest rate is down from analysts’ estimations of 84 percent complete for this week. U.S. soybean producers have harvested 3.9 billion bushels of soybeans with 797 million bushels remaining. Figure 2 outlines the state-by-state outlook for millions of soybean acres remaining to be harvested for the week ending Nov. 4.

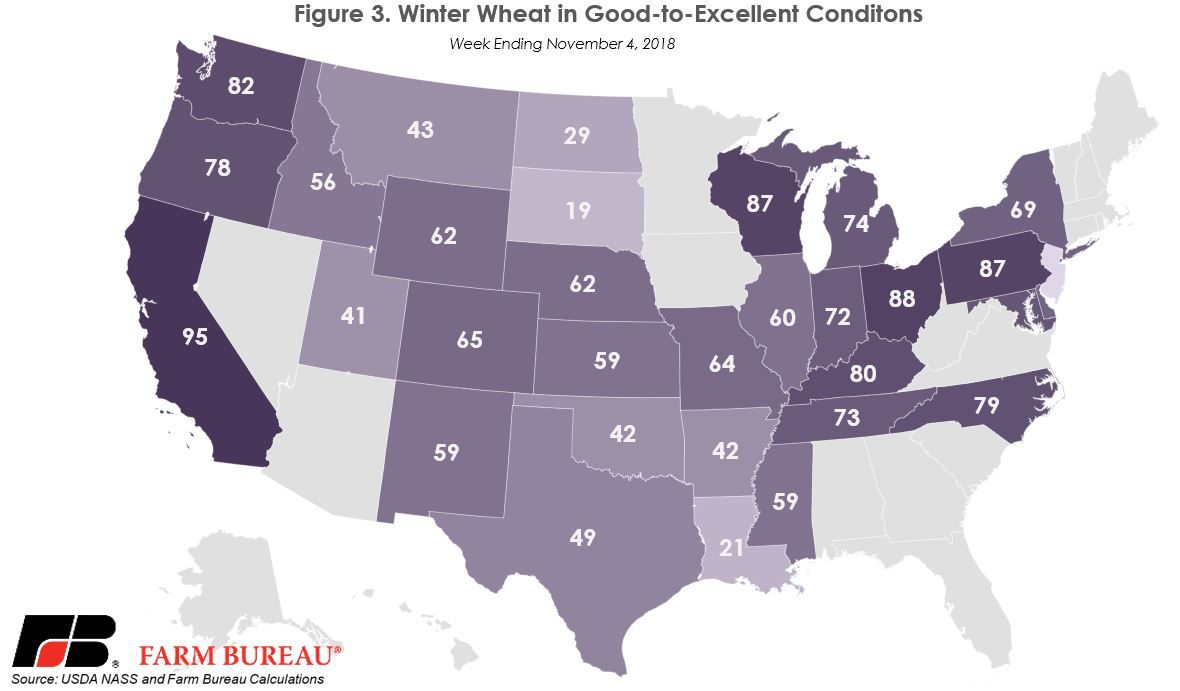

With the winter wheat crop now in the ground, USDA estimates that 55 percent of the U.S. crop is in good-to-excellent condition. Current conditions are up 1 percentage point from the five-year average and down 3 percentage points from this time last year. Analysts predicted a more modest improvement to condition, estimating 54 percent of the U.S. winter wheat crop in good-to-excellent condition. The winter wheat crop is in poor-to-very-poor condition for the week ending Nov. 4, at 11 percent. These conditions represent a 1 percentage point increase from the five-year average and a 2-percentage point increase from the previous year.

Top Issues

VIEW ALL