Egg-cellent Supply, Lower Retail Prices on Tap

TOPICS

PoultryMichael Nepveux

Former AFBF Economist

photo credit: Alabama Farmers Federation, Used with Permission

Michael Nepveux

Former AFBF Economist

With Passover and Easter approaching, Americans across the country are focusing on eggs. While many folks are dying hardboiled eggs a variety of colors, or maybe stuffing candy into the hinged, plastic varieties, most are not thinking about the complex environment under which this protein-packed, perishable food is delivered to them. As children (and, let’s be honest, many adults) meticulously comb through their backyards, lifting every rock and peeking into every crevice in search of prizes, they may not think about how their enthusiasm tends to fuel a seasonal bump in table-egg prices. The egg market is far too complex to distill into one short Market Intel, so what follows is a high-level look at egg production in the U.S.

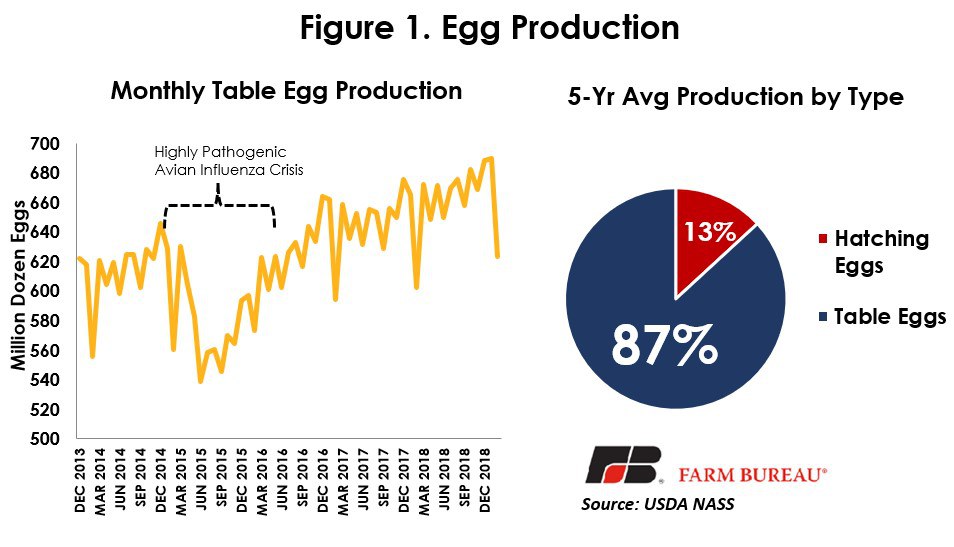

Egg Production

In 2018, almost 9.1 billion dozen eggs were produced in the United States. A whopping 87 percent, or 7.9 billion dozen, of these were for table-egg production, eggs intended for human consumption either as whole eggs sold at retail or eggs broken and processed into egg products. The remaining 13 percent, or 1.2 billion eggs, were intended for hatching eggs, to replenish the chicken layer flock, and to go into broiler (meat) production. One common theme that is hard to avoid when talking about egg production in the U.S. is the outbreak of highly pathogenic avian influenza, or HPAI, and the industry’s recovery since the outbreak. Between December 2014 and June 2015, more than 50 million chickens and turkeys in the U.S. died as a result of HPAI, either from the disease or from being culled to protect the health of the remaining birds. While the broiler industry (chickens raised for meat) mostly escaped HPAI’s destruction, about 12 percent of the U.S. table-egg laying population died. The U.S. government spent nearly $900 million to stop the disease.

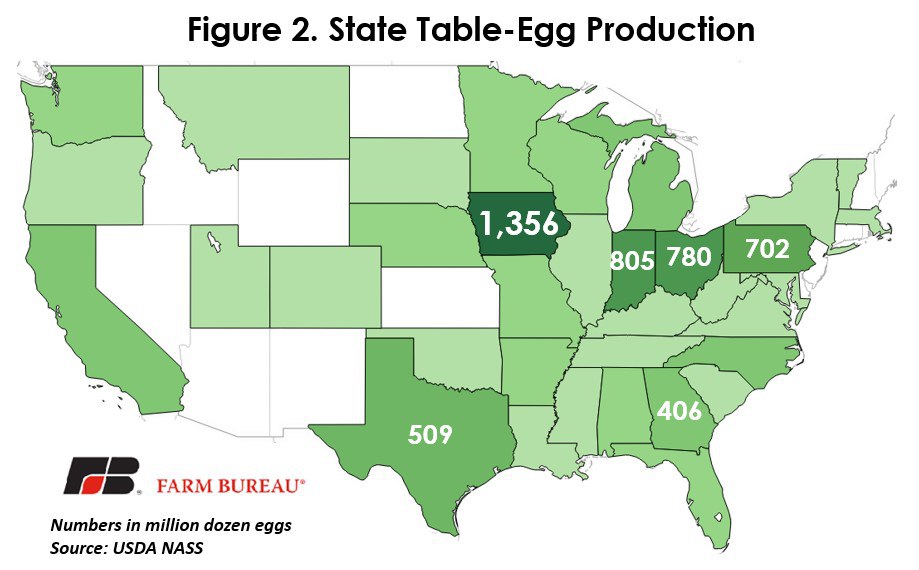

In the U.S., a large share of the layer flock is in the corn belt, with Iowa claiming the top egg-producing spot at 1.36 billion dozen eggs. Iowa is followed by Indiana, Ohio, Pennsylvania, Texas and Georgia in table-egg production. This concentration is partly why HPAI was so devastating, as the outbreaks were largely consolidated in Northwest Iowa and Southwest Minnesota (a sizeable turkey production region).

Egg Pricing

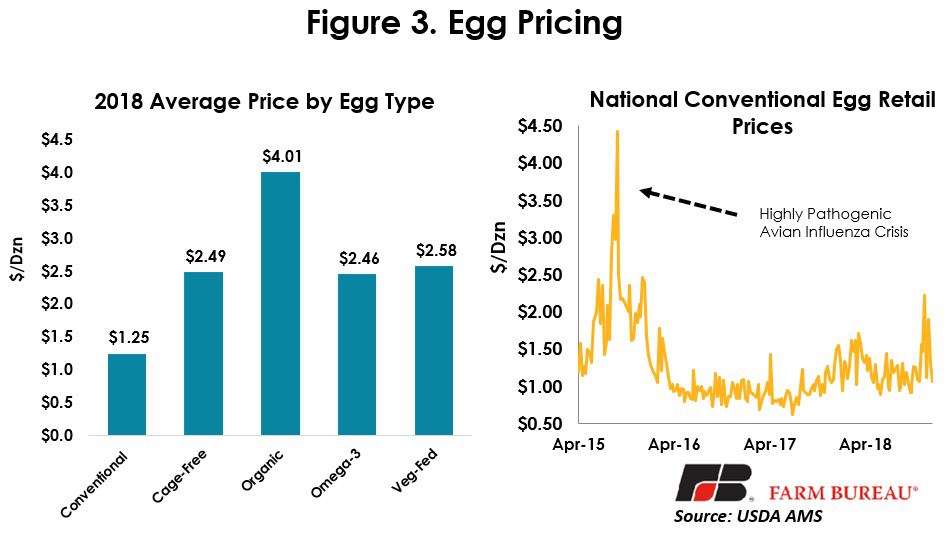

Retail prices spiked dramatically when the effects of HPAI worked their way down the egg supply chain. Since then, the industry ramped up production, suppressing prices within the $0.70/dzn to $1.10/dzn range for much of 2016 and 2017. Since the end of 2017, there has been some moderate recovery in prices as the demand/supply imbalance has been eroded, as shown in Figure 3.

Consumers demand a variety of egg products when it comes to table-eggs, and as a result producers have to produce several different niche types for market. Figure 3 examines the price differences between some of these consumer preferences. Conventionally produced eggs, as one would expect, are the most affordable, at $1.25/dzn for 2018. The next three on the list are relatively close in price: cage-free ($2.49), Omega-3 ($2.46) and veg-fed ($2.58). Coming in most expensive are organic eggs at $4.01, more than three times the price of conventional.

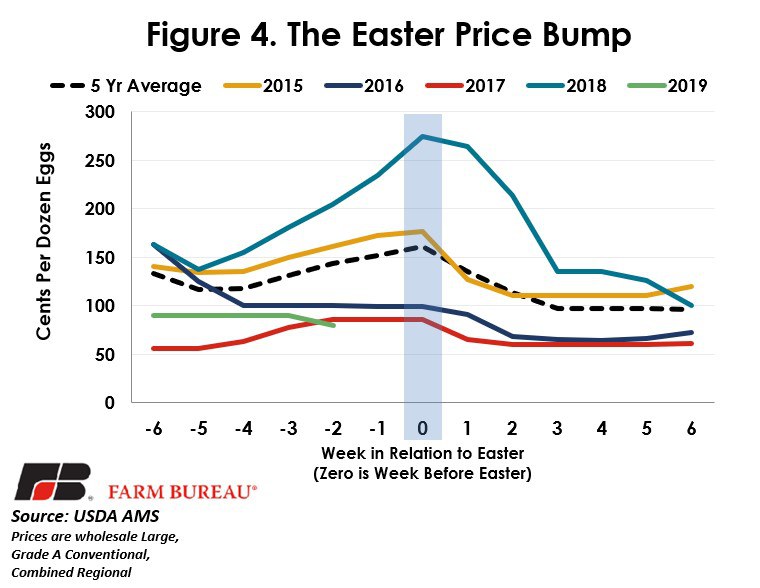

Holiday Price Bump

Egg prices are subject to some seasonality, with the market often experiencing some level of price increase in the weeks leading up to Easter (April 21 in 2019), followed by a fairly quick decline. In March 2019, wholesale egg prices (Combined Regional, Grade A Large) averaged 93.02 cents/dzn. This is a decline of 56 percent from 2018, but an increase of 38 percent from 2017. 2018 prices occurred during a slight expansion in production (2 percent increase in 2018), leading supply to outpace demand and place downward pressure on egg prices so far in 2019. USDA estimates that shell egg disappearance this holiday season is estimated to be 5 eggs per household, down 2.5 eggs from 2018. Since the outbreak of HPAI in 2014/2015, egg prices have experienced increased volatility, sometimes deviating somewhat from the normal seasonal pattern, with wide variances from year to year. So far, 2019 doesn’t appear too likely to replicate the normal seasonal bump that occurs leading up to the holiday, instead declining moderately just 2 weeks out to 79.47 cents/dzn.