EPA Finalizes New Renewable Fuel and Biomass-Based Diesel Volume Standards

TOPICS

RFSMichael Nepveux

Former AFBF Economist

photo credit: Getty

Michael Nepveux

Former AFBF Economist

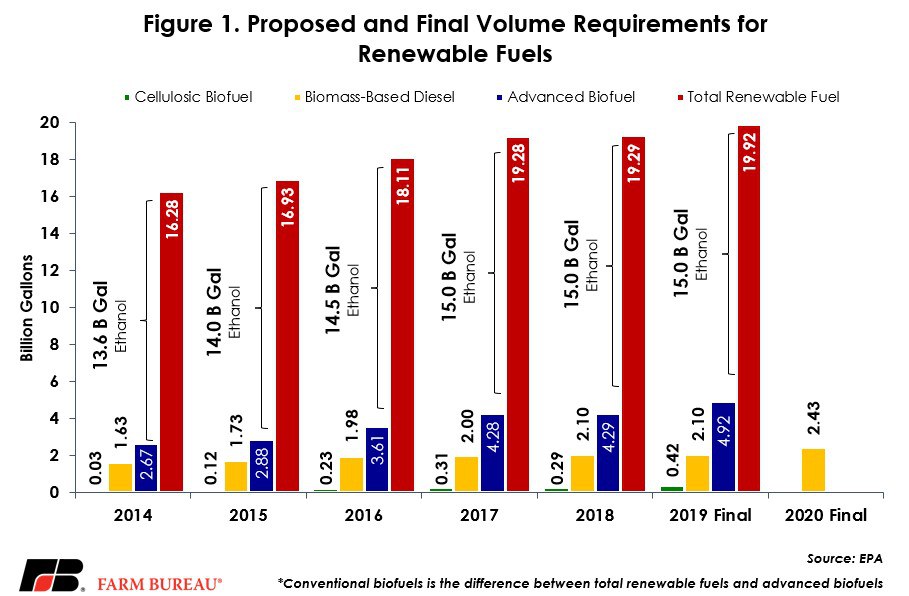

On Nov. 30 the Environmental Protection Agency released its finalized volume standards for total renewable fuel, total advanced biofuel and cellulosic biofuel for 2019, as well as the finalized biomass-based diesel volume for 2020. The finalized rule, which largely mirrors the proposed rule released in June, increases volumes in all four categories.

The Renewable Fuel Standard program is a national policy requiring that a certain volume of renewable fuel replace conventional petroleum-based fuel. The RFS contains four renewable fuel categories: total renewable fuel, advanced biofuel, cellulosic biofuel and biomass-based diesel. The differences between the previously proposed volumes and the finalized volumes is driven by an approximately 40-million-gallon increase in cellulosic biofuel.

The finalized rule would boost total renewable fuel volumes to 19.92 billion gallons, an increase of 630 million gallons from the 2018 volumes of 19.29 billion gallons, and up 40 million gallons from June’s proposed rule. The total advanced biofuel volume would increase by the same amount, from 4.29 billion gallons in 2018 to 4.92 billion gallons in the finalized rule. The finalized rule retains the proposed volume of 2.43 billion gallons for biomass-based diesel, an increase of 330 million gallon from 2019. Biomass-based diesel volumes must be finalized a year before the other biofuel categories, meaning this finalized rule is setting volumes for 2020. The new proposed cellulosic volumes, 418 million gallons, represent an increase of 130 million gallons, up from 288 million gallons in 2018.

Noteworthy about the finalized renewable volume obligations: They trigger the RFS “reset,” which will allow EPA to propose new statutory levels for the law.

Renewable fuels provide a significant and steady market for American growers. While increases in the proposed volumes are certainly a step in the right direction, this announcement presents a missed opportunity to correct EPA’s overuse of the small refinery exemptions in recent years. These finalized volumes do not seem to account for any expected use of the exemptions, which hopefully means that EPA does not intend to erode the RVOs with the waivers in 2019.

Top Issues

VIEW ALL