Farm Bankruptcies Continued to Climb in 2025

TOPICS

Farm Economy

photo credit: North Carolina Farm Bureau, Used with Permission

Samantha Ayoub

Economist

Key Takeaways

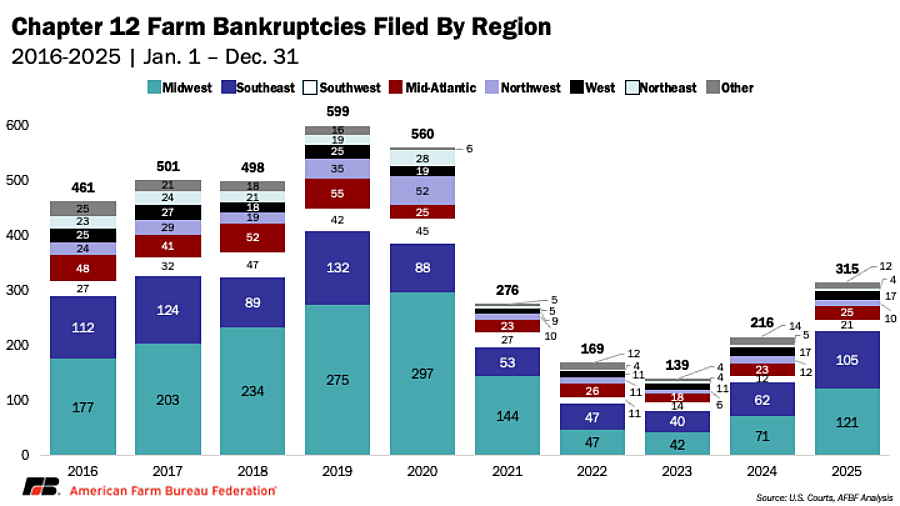

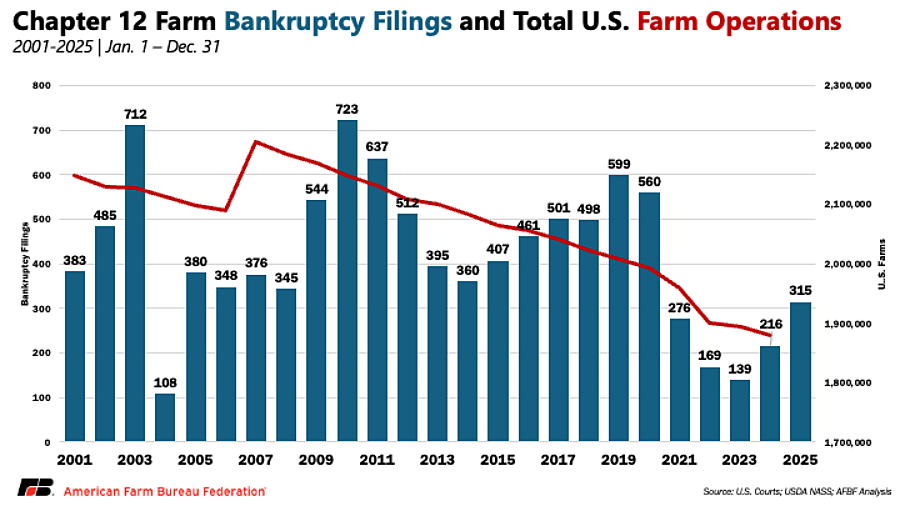

- Chapter 12 bankruptcies increased for the second year in a row, reaching 315 filings in 2025. This is a 46% increase from 2024.

- The Midwest and Southeast filed 121 and 105 Chapter 12 cases, respectively, far outpacing any other regions. Deep crop losses across commodities common in these two regions have compounded after years of declining receipts and rising expenses.

- Families must earn the majority of their income from farming to qualify for Chapter 12. As off-farm income becomes more important for family benefits and supporting farms during economic downturns, many family farms are not eligible for Chapter 12 bankruptcies and may have to close altogether when debt and operating expenses become too great.

As we look ahead to another year of challenges in the farm economy, indicators of farm financial health are under close inspection. Filing for Chapter 12 bankruptcy is a last resort for farmers who have undertaken large debt to continue operating with increased flexibility for payments. AFBF Market Intel reports have long followed annual filings of Chapter 12 family farm bankruptcies, and this year’s uptick is another reminder of the strain American farmers and ranchers face.

The U.S. Courts report that 315 farm bankruptcies were filed in calendar year 2025, up 46% from 2024. While still down from recent highs, this is the second year in a row of increased filings. Chapter 12 also does not reflect larger trends in farm closures that may be the only option for certain struggling operations.

Declining Farm Receipts Drive Local Increases

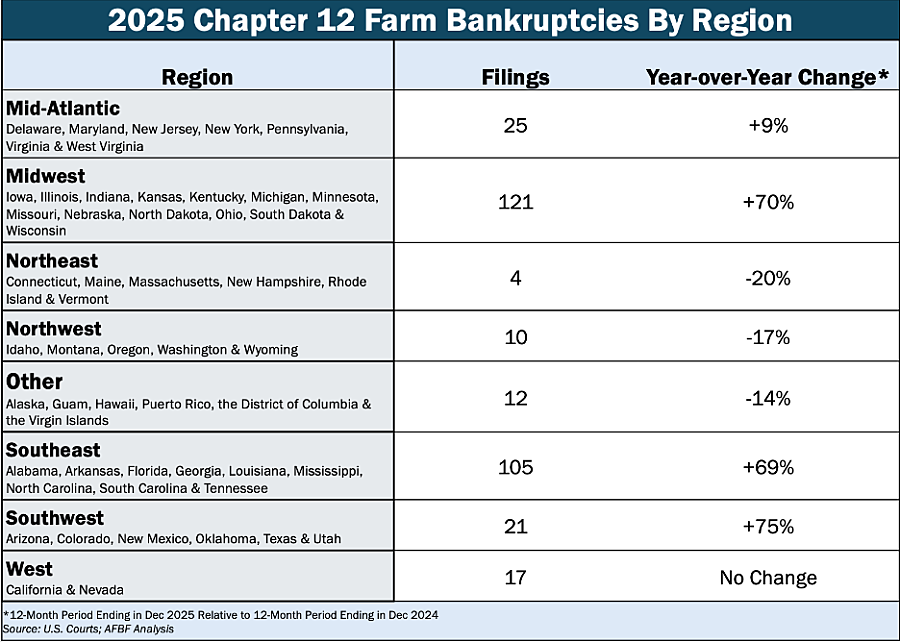

The most recent farm income forecast confirmed that the farm economy has faced extreme financial pressure, with little relief in sight. Significant losses are expected across crop sectors for another year, and many livestock sectors are also tightening margins. The Midwest and Southeast each filed 121 and 105 Chapter 12 cases, respectively, far outpacing any other regions. This is a 70% increase in filings for the Midwest, and a 69% increase in the Southeast.

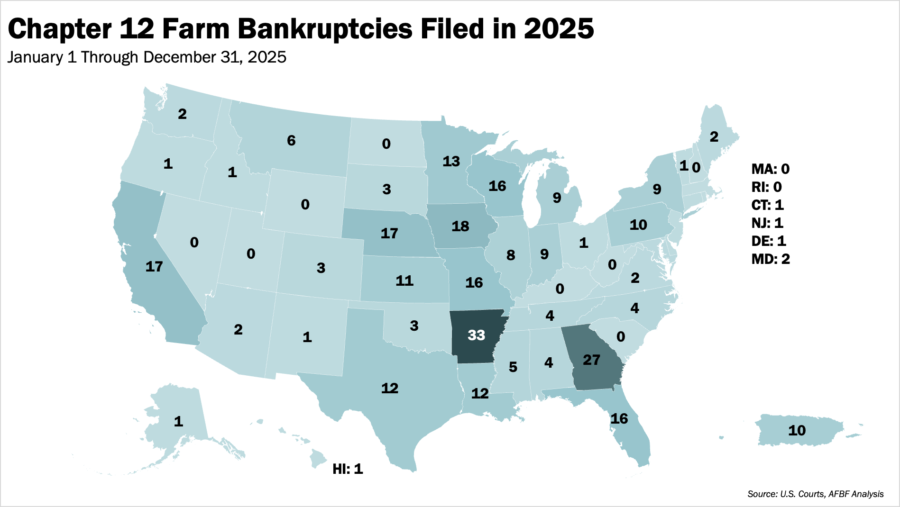

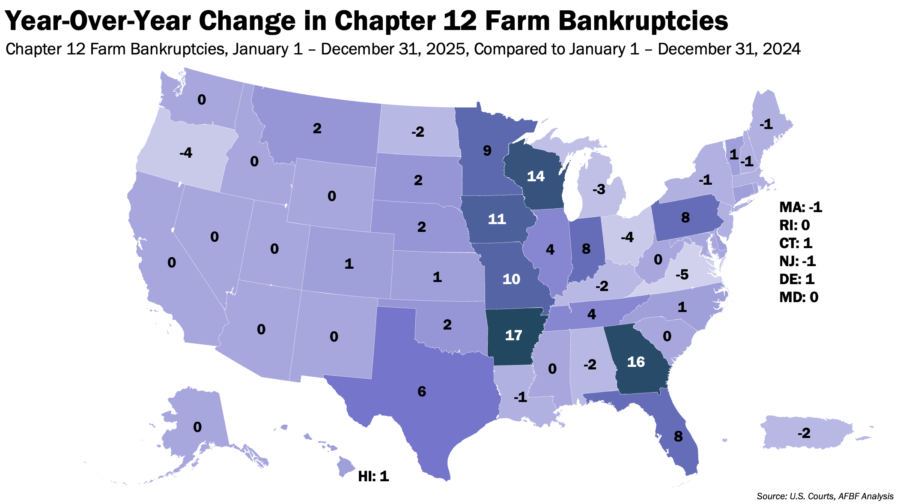

Deep losses across commodities common in these two regions have compounded after years of declining receipts and rising expenses. For example, rice farmers are expected to lose over $200 per acre in loss, even after supplemental assistance. The nation’s leading rice- producing state, Arkansas, leads the U.S. in Chapter 12 filings in 2025 with 33 filings, more than double 2024 and the most in the state in the 21st century. Georgia follows with 27 filings, up 145% from 2024, reflecting both losses per acre in principal row crops and limited support for high-cost specialty crop production. Other Southeast states with double-digit bankruptcies include Texas and Louisiana with 12 each, and Florida with a 200% increase from 2024 to 16 filings.

In the Midwest, principal row crop losses combined with weakening dairy, hog and poultry markets have led to double-digit Chapter 12 filings in Iowa (18, +220%), Nebraska (17, +29%), Missouri (16, +167%), Wisconsin (16, +700%), Minnesota (13, +300%) and Kansas (11, +10%).

Other states with significant increases in filings in 2025 include Montana, with 200% more filings, and Pennsylvania with a 160% increase in filings. While California was unchanged from 2024, they tie for fourth-highest number of filings with 17 in 2025, reflecting continued price and cost pressures on their diverse agricultural industries.

Yet Another Sign of a Struggling Farm Economy

Farm bankruptcy filings are a lagging indicator that spike when prolonged financial pressures push farms to explore last resorts. According to the Federal Reserve Bank of Kansas City, farmers are taking more larger operating loans and taking longer to repay them. USDA estimates that total farm debt will rise 5.2% to a record $624.7 billion in 2026, highlighting the financial backing farmers need under current conditions.

This is driven especially by the need for additional lines of credit simply to cover input costs, rather than business investments. Nearly 40% more new farm operating loans were opened in the fourth quarter of 2025 than in 2024. At the individual farm level, the average operating loan in 2025 was 30% larger with an average maturity, or payment length, three months longer than 2024. For machinery and equipment loans specifically, the average maturity hit the highest level since 2021, signaling how difficult it is to invest in operational upgrades. On top of this drastic need for credit to get through the year, interest rates remain above decade averages, with interest expenses expected to reach a record $33 billion in 2026 across the farm economy.

All of these credit and debt factors rare stretching farmers and ranchers to the brink. With expected financial pressures into the future, Chapter 12 provides an opportunity to better manage the debt loads that have kept operations afloat.

Chapter 12 Bankruptcy not Always an Option

However, many farms do not qualify for Chapter 12. Particularly in down years, off-farm income has become a crucial resource for many farms to provide benefits for their families and support their farming enterprise. Yet, earning most of your income from off-farm employment disqualifies farmers from Chapter 12. So, many families may face the even more difficult decision to sell land, limit production or close their farm altogether. This continues the alarming rate of farm loss in the United States, with over 160,000 farms closing between 2017 and 2024.

Conclusion

Increases in Chapter 12 bankruptcies once again highlight the continued pressures American farmers and ranchers face. A fourth consecutive year of expected declines in farm income will continue to strain agriculture, placing further reliance on credit options that are growing thin. For many families, excessive debt loads could be met with little flexibility as Chapter 12 eligibility prohibits them from using the tool specifically designed to accommodate downturns in the farm economy. Instead, we will likely continue to see increases in both bankruptcy and farm closures, further straining the remaining farms – and the food, fiber and fuel supply chain for all Americans.