Farm Sector Bankruptcy Rates Decline

TOPICS

Market Intel MinuteMegan Nelson

Economic Analyst

photo credit: Alabama Farmers Federation, Used with Permission

Megan Nelson

Economic Analyst

Based on caseload statistics from the United States Courts database, Chapter 12 bankruptcy filings decreased in the first half of 2018 compared to the first half of 2017. From January to June 2018, family farmer and family fisherman Chapter 12 filings totaled 251 cases, down 26 cases or 9 percent from 277 filings during the first half of 2017.

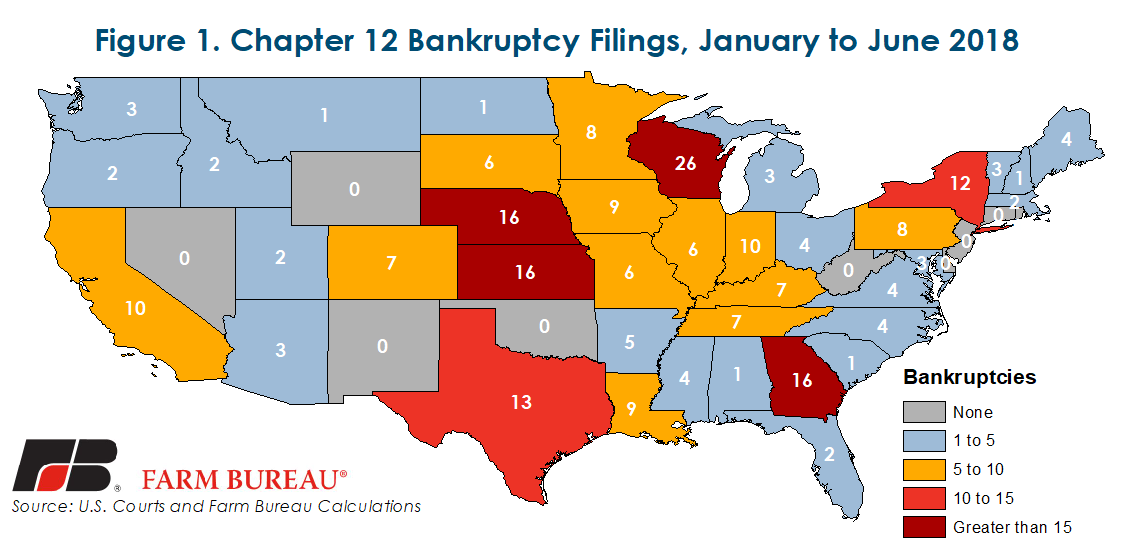

The decline in farm bankruptcies comes despite expectations for acceleration in 2018. This aligns with USDA projections for farm sector equity and debt to remain flat in 2018 after adjusting for inflation. Figure 1 identifies Chapter 12 bankruptcy filings by state. Chapter 12 bankruptcy filings were the highest in Wisconsin, at 26, followed by Georgia, Kansas and Nebraska at 16 each.

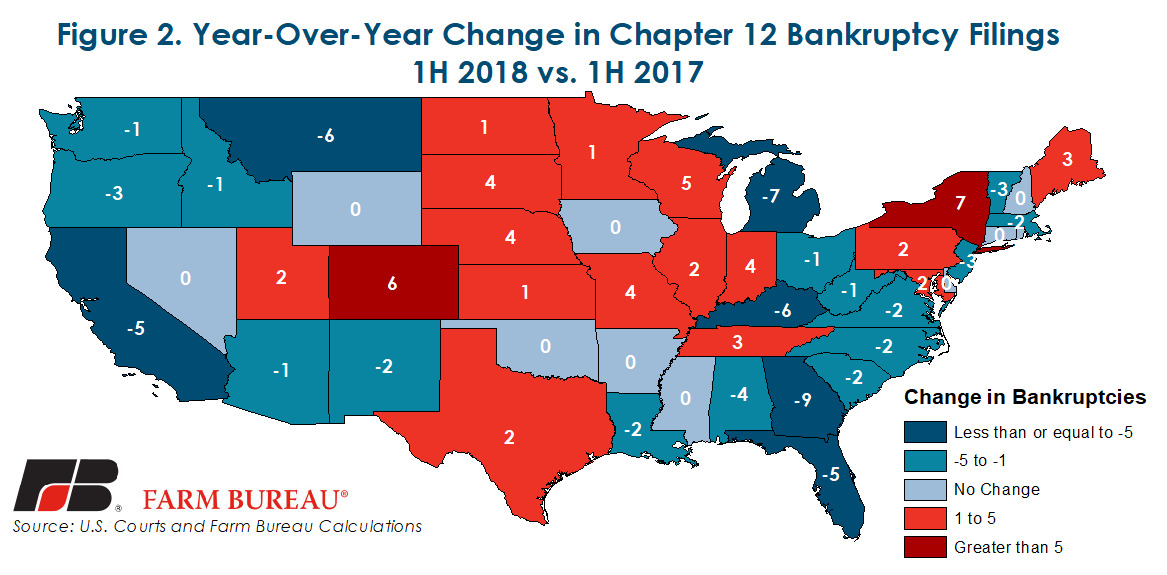

Figure 2 highlights the year-over-year change in bankruptcy filings. Georgia saw the largest decline in Chapter 12 filings, followed by Michigan and Montana. New York and Colorado saw the largest increase in bankruptcy filings.

Top Issues

VIEW ALL