Farmers’ Share of Food Dollar At Record Low

TOPICS

USDA

photo credit: Maddison Stewart, Arkansas Farm Bureau; used with permission.

John Newton, Ph.D.

Vice President of Public Policy and Economic Analysis

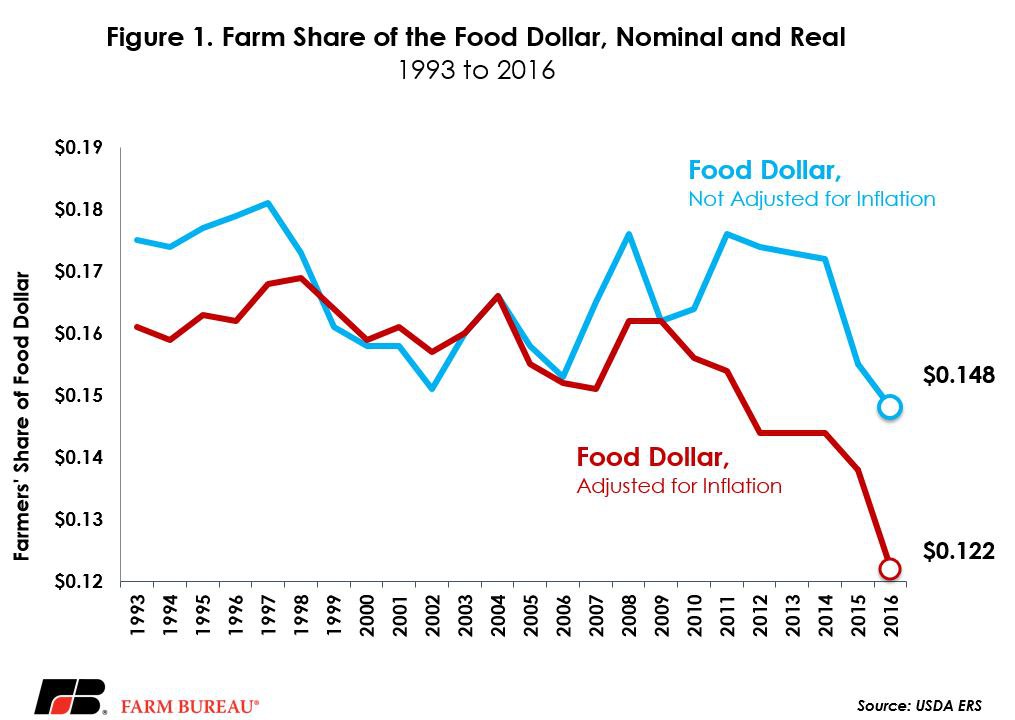

USDA’s Economic Research Service’s Food Dollar Series recently revealed that in 2016 the farmers’ share of the food dollar fell to 14.8 cents, down 4.5 percent from the prior year and the lowest level since the series was launched in 1993. When adjusted for inflation, in 2009 dollars, the farmers’ share of the food dollar was 12.2 cents, down 11.6 percent from 2015 and again the lowest level since the series began. The farmers’ share of the $1 spent on domestically produced food represents the percentage of the farm commodity sales tied to that food dollar expenditure. Non-farm related marketing associated with the food dollar, i.e. transportation, processing, marketing, etc., rose to a record-high of 85.2 cents.

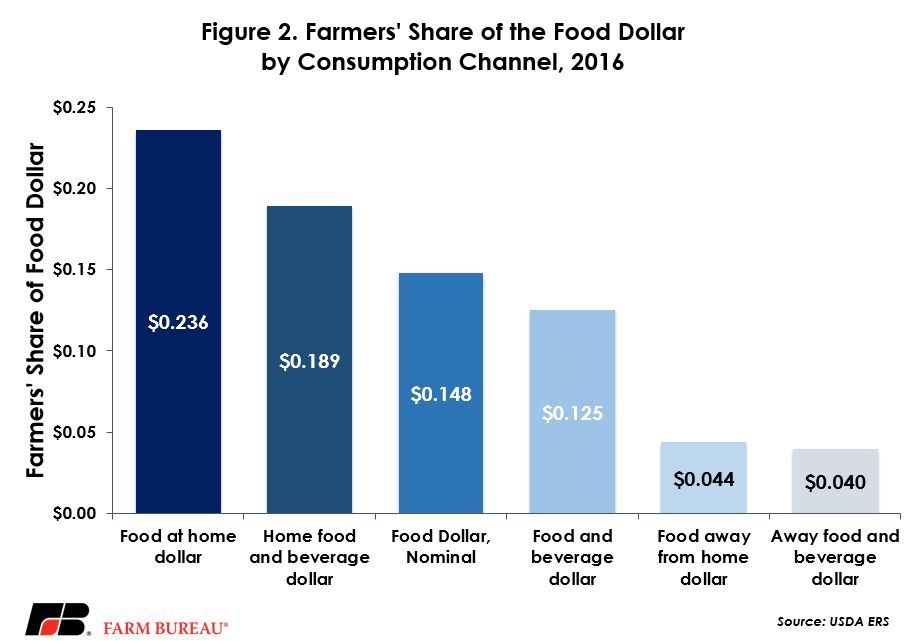

USDA tracks several other methods of food consumption in the Food Dollar Series. For 2016, the farmers’ share of food consumed at home was 23.6 cents, down 2.9 percent from the prior year. For food and beverages consumed at home, the farm share was 18.9 cents, down 3.8 percent from 2015. The largest decline in the farm share of the food dollar was in food consumed away from home. The farm share of food away from home was 4.4 cents, down 10.2 percent from the prior year. The smaller share of the food dollar consumed outside of the home is attributable to the costs of restaurant food service and preparation. For all but the food and beverage dollar consumed at home and the food at home dollar, the farmers’ share of the food dollar is at record-low levels.