Fresh/Chilled Beef Tariff Profile

TOPICS

Commodity Tariff ProfileMegan Nelson

Economic Analyst

photo credit: Right Eye Digital, Used with Permission

Megan Nelson

Economic Analyst

Our Market Intel series on commodity-specific tariff profiles continues with beef.

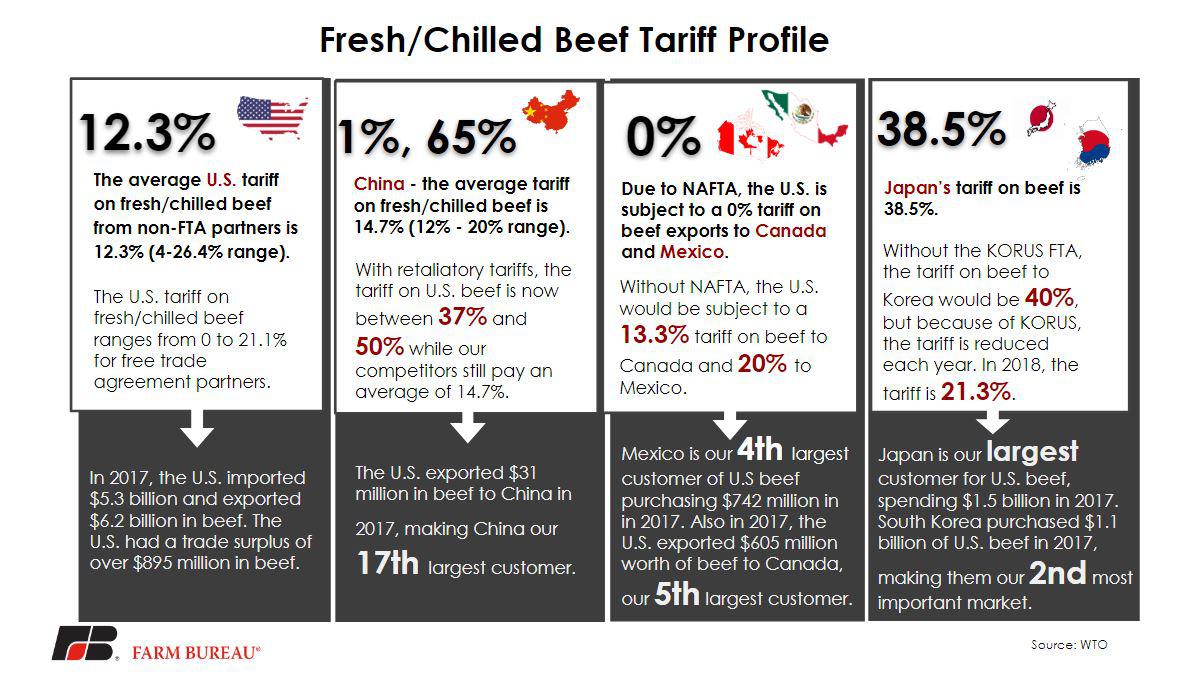

The U.S. produces, imports and consumes the highest percentage of fresh/chilled beef in the world. Representing 13 percent of the world’s exports of fresh/chilled beef, the U.S. exports $6.2 billion. The U.S. also imports $5.3 billion in beef, reflecting an $895 million trade surplus. The average U.S. tariff charged on fresh/chilled beef from non-free-trade-agreement partners is 12.3 percent, with a range from 4 percent to 26.4 percent. For our free trade agreement partners, however, the U.S. charges a tariff ranging from 0 to 21.1 percent.

Japan is the largest customer of U.S. beef, purchasing $1.5 billion in 2017, and one of the largest importers of beef in the world. Without any free trade agreement in place, imported beef to Japan is charged a 38.5 percent tariff. Japan’s household consumption rate of beef continues to trend upward in 2018 with monthly per-capita consumption 7.2 percent above 2017 rates. One of our top competitors, Australia, has increased exports to Japan 10.6 percent over last year, while the U.S. has decreased exports to Japan by 3.7 percent. Australia’s slaughter rates have increased above 50 percent in 2018, signaling the overall decrease of the cattle herd in 2019. Australia currently faces a 29.9 percent tariff on all exported fresh/chilled beef to Japan and will continue to see a declining rate per its FTA with Japan.

Like the other commodities outlined in this series, the North American Free Trade Agreement guarantees that U.S. beef exporters are charged a 0 percent tariff on beef into Mexico and Canada. Mexico is the fourth-largest consumer of U.S. fresh/chilled beef, purchasing $742 million in 2017. Following closely behind, our fifth-largest customer, Canada, purchased $605 million worth of U.S. beef in 2017. Without NAFTA, the U.S. would be subject to a 20 percent tariff on beef to Mexico and a 13.3 percent tariff to Canada.

Purchasing $31 million in U.S. beef, China in 2017 was our 17th-largest customer. The tariff on U.S. beef to China ranges from 12 percent to 20 percent, with an average tariff of 14.7 percent. However, with retaliatory tariffs in place, U.S. beef tariffs range from 37 percent to 50 percent. All the while, our competitors are still subject to an average tariff of 14.7 percent. The third-largest customer of U.S. beef is Hong Kong, purchasing $800 million worth of beef in 2017.

Due to the US-Korea FTA, the tariff on beef to South Korea is currently charged 21.3 percent as opposed to the 40 percent faced by our competitors. The KORUS negotiations included a year-by-year reduction for U.S. beef tariffs. By 2027, the tariff on U.S. beef to Korea will be 0 percent with no safeguard duties in place.

To read more in the series check out our deep-dive into soybean, wheat, corn, pork, and cotton tariffs.

Top Issues

VIEW ALL