Harvest Outpacing Expectations

TOPICS

SoybeansMegan Nelson

Economic Analyst

photo credit: Arkansas Farm Bureau, used with permission.

Megan Nelson

Economic Analyst

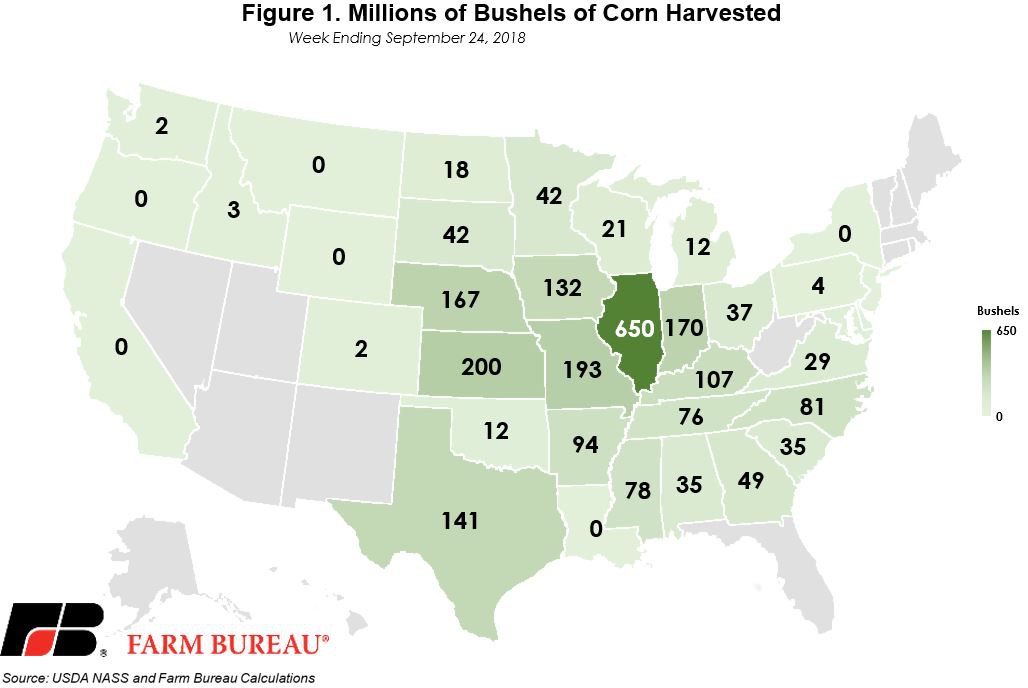

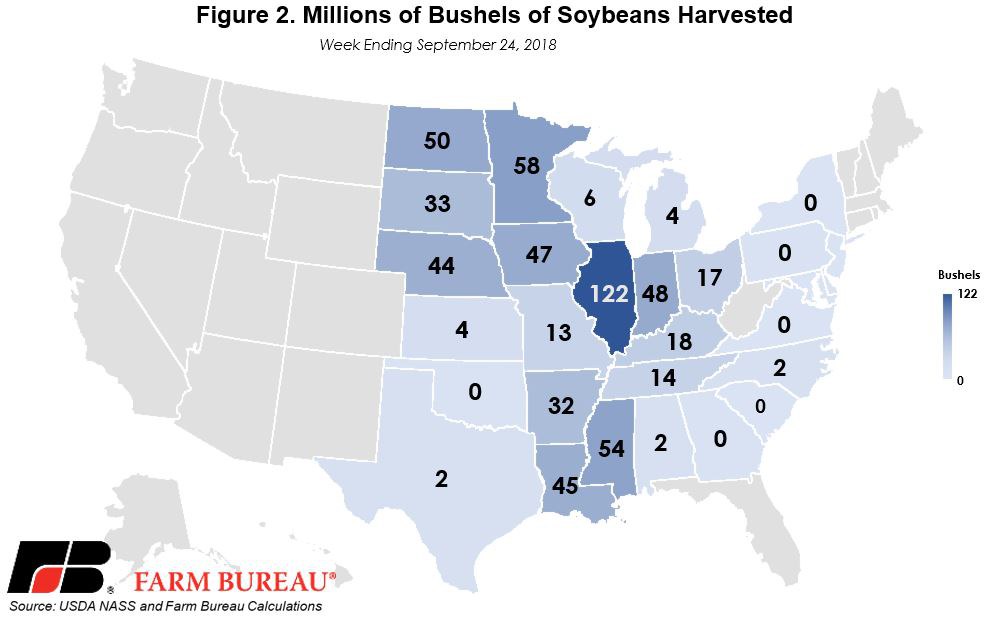

According to USDA’s September 24 Crop Progress report, the U.S. corn harvest, at 16 percent complete, is speeding along. Up 6 percentage points from the previous year and 5 percentage points from the five-year average, this represents a total of 2.4 billion bushels harvested, Figure 1. Harvest progress for U.S. soybeans is also picking up steam, with 14 percent of the soybean crop harvested. Like corn, the soybean harvest is up from last year’s 9 percent and up 6 percentage points from the five-year average, representing 657 million bushels harvested, Figure 2.

The rapid harvest pace should continue as conditions remain favorable throughout the Corn Belt. This year’s crop conditions have also led to predictions of record-setting yields for both corn and soybeans. Though farmers in the Corn Belt have only just begun harvest, Illinois growers have already harvested 650 million bushels of corn, representing 28 percent of the harvest. Illinois corn producers’ harvest rate is up 18 percentage points from the five-year average and 15 percentage points from last year. Also in Illinois, 122 million bushels of soybeans have been harvested, representing 17 percent of the harvest. Not too far behind the corn farmers in the state, Illinois soybean producers’ harvest rate is up 11 percentage points from the five-year avearge and 9 percentage points from last year.

For the week ending Sept. 24, USDA has revealed 69 percent of the U.S corn crop is in good-to-excellent condition, up 1 percentage point from last week. Current conditions remain improved over the five-year average of 67 percent good-to-excellent. Corn crops in poor-to-very-poor condition continue their five-week stretch at 12 percent. USDA’s estimates are slightly improved over analysts’ predictions of no change in corn or soybean crop conditions over the last week.

Like the U.S. corn crop, 68 percent of soybean crops are in good-to-excellent condition, up 1 percentage point from last week. Current conditions are up 8 percentage points from last year and 5 percentage points from the five-year average of 63 percent in good-to-excellent condition. Soybean crops in poor-to-very-poor condition have also remained steady at 10 percent.

Top Issues

VIEW ALL