How Much Corn and Soybeans Was in Storage?

TOPICS

Soybeans

photo credit: AFBF Photo, Philip Gerlach

John Newton, Ph.D.

Vice President of Public Policy and Economic Analysis

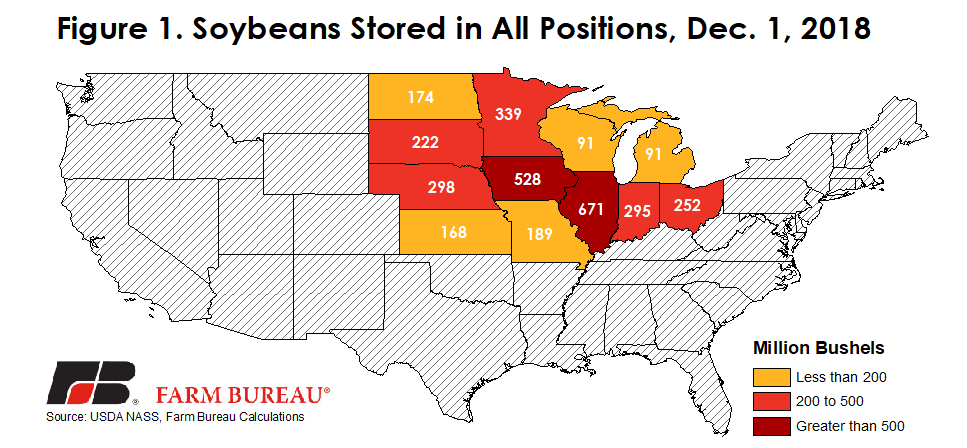

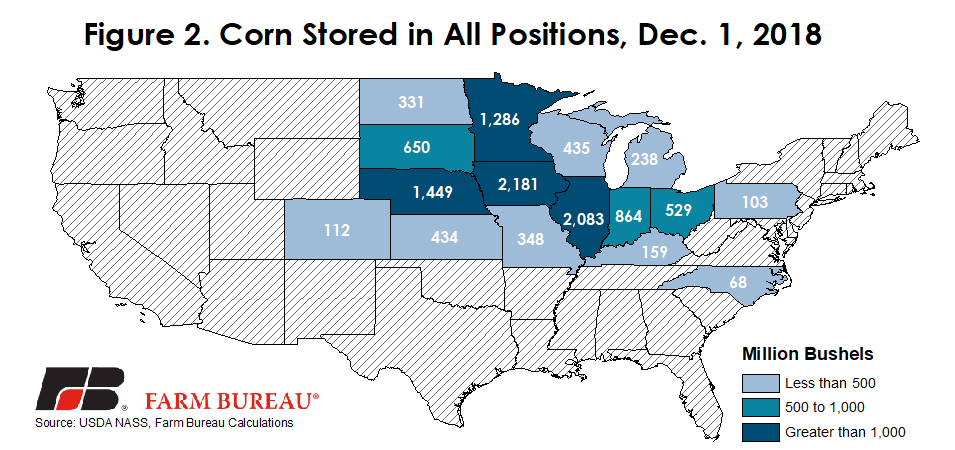

USDA’s most recent Grain Stocks report indicated that at the beginning of December 2018 a record 3.74 billion bushels of soybeans and 12 billion bushels of corn were stored across the U.S. These stock levels were up 18 percent for soybeans and down 5 percent for corn relative to prior-year levels. Given marketing year average prices of $8.60 per bushel and $3.55 per bushel for soybeans and corn, respectively, these stock levels represent $32 billion of soybeans in inventory and $42 billion of corn in inventory. Combined, $74.6 billion in corn and soybeans were in storage as of Dec. 1, 2018.

Figures 1 and 2 highlight total soybeans and corn stored in all positions, on Dec. 1, 2018. The next Grain Stocks report will be released March 29 and will provide an estimate of corn and soybeans in storage as of March 1.