Impact of the Farm Bill Change to the Class I Milk Price on Dairy Farm Income

TOPICS

Federal Milk Marketing Order

photo credit: Alabama Farmers Federation, Used with Permission

John Newton, Ph.D.

Vice President of Public Policy and Economic Analysis

For nearly two decades the price for Class I milk, i.e., milk used to produce beverage milk products, was based on the higher-of the advanced Class III and Class IV skim milk price. Class III milk is used to produce cheese and Class IV milk is used to produce nonfat dry milk powders. Advanced pricing allows fluid milk processors to know their milk procurement costs up to six weeks in advance and the higher-of element ensured fluid milk prices were always based on the highest-priced manufacturing class of milk (How Milk Is Priced in Federal Milk Marketing Orders: A Primer).

The 2018 farm bill eliminated the higher-of component of the Class I milk price formula and replaced it with a formula based on the simple average of the Class III and Class IV advanced prices plus 74 cents. The 74 cents was based on the historical difference between the Class III and IV skim prices to make dairy farmers and milk prices indifferent to this change over a long time horizon. However, anytime the spread between Class III and IV is wider than $1.48 per hundredweight, dairy farmers will end up with a lower Class I milk price than would have been the case under the higher-of. For perspective, from January 2000 to April 2019, the spread between the advanced Class III and Class IV price was larger than $1.48 nearly 40% of the time.

The new Class I milk price formula was effective May 2019 and remains in place unless modified by an amendment to the Federal Milk Marketing Order – either as an act of Congress or administratively through an FMMO hearing. Today’s article analyzes the two Class I milk price formulas and the multimillion-dollar impact the farm bill price change – coupled with COVID-19-related volatility in dairy markets – has had on dairy farmers supplying the Class I market.

Previous analyses reviewed the financial impacts of milk and dairy commodity price volatility on producer price differentials, de-pooling and the ineffectiveness of dairy risk management tools to offset negative PPDs, e.g., De-Pooling and Record-Large Negative PPDs Continue Into July, Negative PPDs to Offset Milk Price Rally, Revisiting Record-Large Negative PPDs on Milk Checks and Lack of DMC Payments Does Not Reflect Dairy Farmers’ Difficulties.

Policy Background

Long-time restrictions in USDA’s Dairy Forward Contracting Program prohibit dairy farmers from managing their fluid milk price risk by voluntarily entering into forward price contracts with milk processors for Class I milk. Meanwhile, these same restrictions do not apply for farmers managing risk and selling milk to yogurt, cheese, butter, milk powder or other dairy ingredient plants.

Before the 2018 farm bill, beverage milk processors, cooperatives and dairy farmers seeking to manage their beverage milk price risk had difficulties using Chicago Mercantile Exchange manufacturing milk futures contracts due to excessive basis risk related to the higher-of provision in milk pricing rules, e.g., Road Block to Risk Management — Investigating Class I Milk Cross‐Hedging Opportunities.

To facilitate improved risk management for beverage milk, at the request of dairy industry stakeholders the 2018 farm bill modified the Class I skim milk price to the simple average of the Class III and Class IV advanced prices plus 74 cents (Proposed Changes to Fluid Milk Pricing). This change in the milk pricing formula provided an opportunity for dairy industry participants to use a combination of CME manufacturing milk futures contracts to hedge Class I milk.

Importantly, this change also served as a policy alternative to allowing forward contracting in Class I milk. As a result, beverage milk price risk management could be facilitated, but not in the form of a farmer voluntarily entering into a forward price contract with their milk processor.

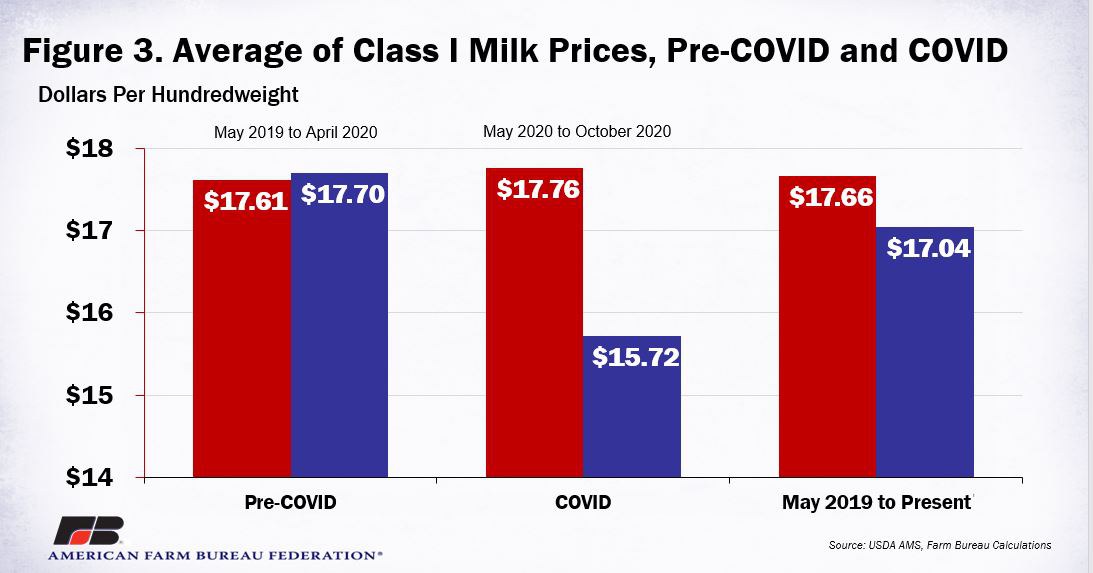

Old Versus New Class I Milk Prices

The new Class I milk pricing rule went into effect in May 2019, and for the most part, the two prices were similar, with an average difference of 9 cents per hundredweight in the dairy farmers' favor before COVID-19. In fact, during nine of the 12 months the new pricing formula was in place, the new Class I milk price was greater than it would have been under the higher-of formula.

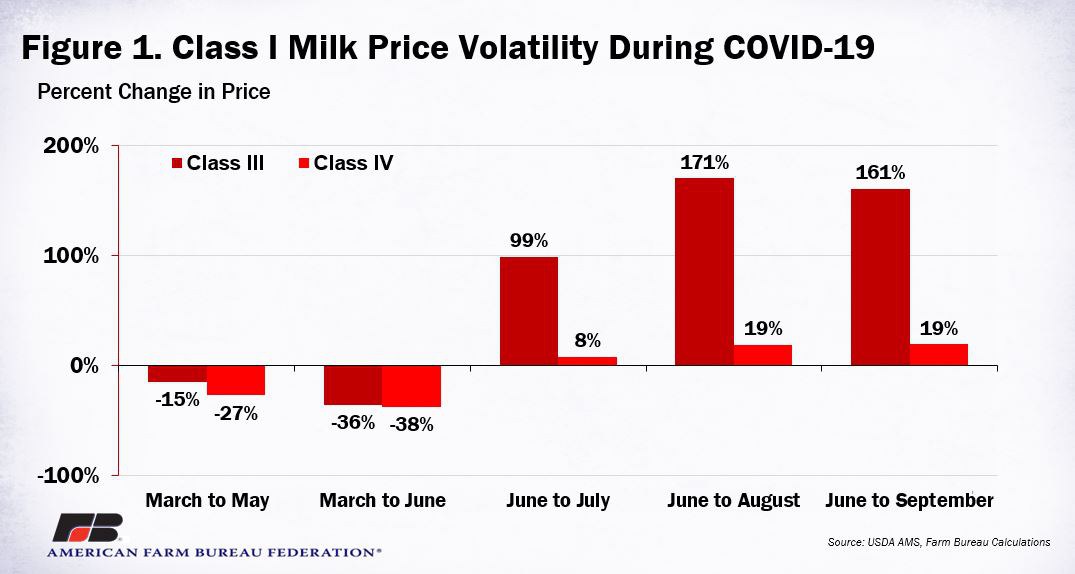

From late February to late April, when the May Class I milk price was announced, and late May, when the June Class I milk price was announced, advanced Class III and Class IV milk prices collapsed. The advanced Class I milk price fell by 15% and 36%, respectively, from March to May and March to June. The advanced Class IV milk price fell by 27% and 38%, respectively, during these same periods. Even still, the June Class I advanced price was 38 cents per hundredweight higher than the pre-farm bill formula.

Then, following government intervention in cheese markets and cooperative-led supply reduction programs, cheese prices rallied sharply while nonfat dry milk prices rallied only marginally. From June to July the advanced Class III price rose by nearly 100% and from June to August the price change had reached 171%. Meanwhile, during these same periods, the advanced Class IV milk price rose by 8% and 19%, respectively, Figure 1.

Due to the rapid rise in Class III prices and a modest increase in Class IV prices, the spread between the two was $6.83 per hundredweight in July, $10.96 per hundredweight in August, $10.30 per hundredweight in September and $3.56 per hundredweight in October.

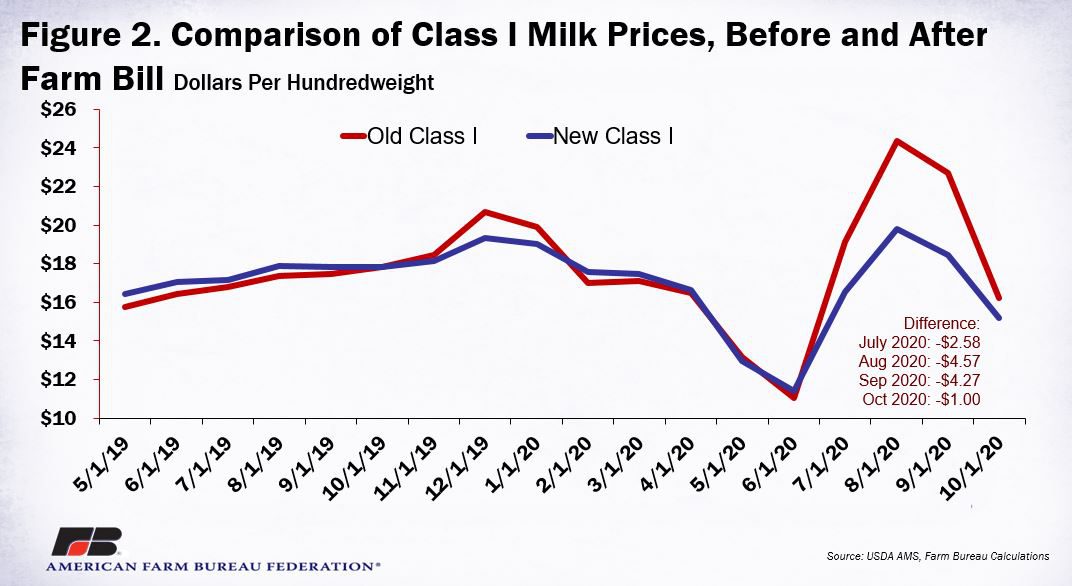

As a direct result of no longer including the higher-of in the milk price formula, the Class I milk price never fully captured the rally in Class III milk prices. Instead, the new Class I milk price was as much as $4.57 per hundredweight below the higher-of formula price in August and $4.26 lower in September. As identified in Figure 2, had the higher-of formula still been in place, the Class I mover would have exceeded $24 per hundredweight in August. That’s before Class I location adjustments are added. In South Florida, for example, with the $6 per hundredweight location adjustment, the Class I milk price would have been more than $30 per hundredweight in August 2020.

From May 2020 to October 2020, the average difference between the old and new Class I milk prices was $2.04 per hundredweight in favor of the beverage milk processor, i.e., dairy farmers’ regulated minimum prices were lower than what they would have been if the higher-of was still in place. Going back to May 2019, the Class I milk price is 62 cents per hundredweight lower than the pre-farm bill higher-of formula, Figure 3.

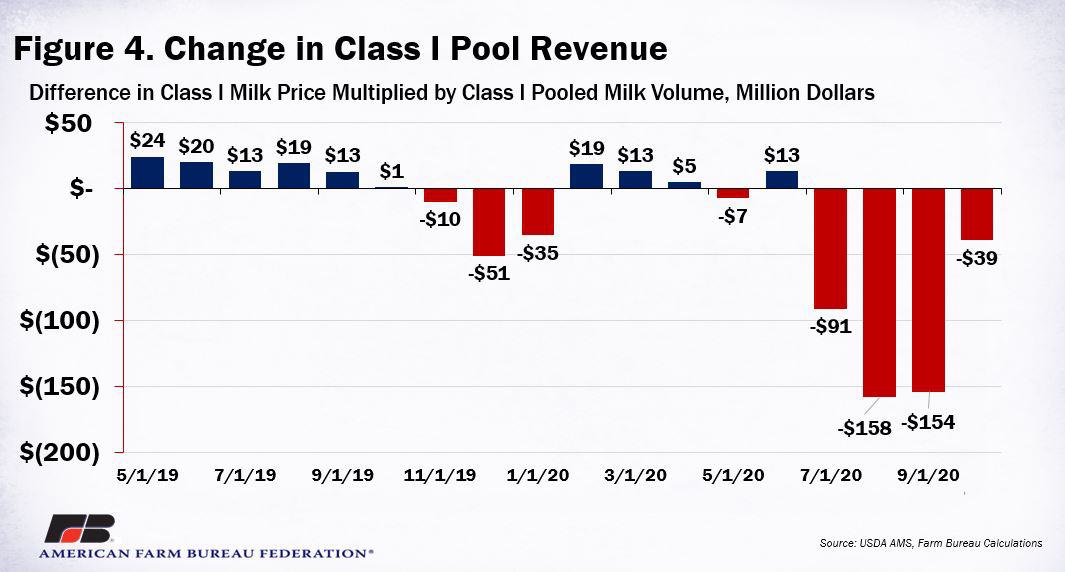

Impact on Class I Revenue

To estimate the impact on dairy farmer revenue, the difference in the Class I milk price was multiplied by the Class I pool volume across all FMMOs. In the 12 months before COVID-19 that the new Class I formula was in place, nearly 44 billion pounds of milk were pooled in Class I. With the 9 cents per hundredweight difference in the milk price, an estimated $32.4 million in additional Class I revenue was generated in the FMMO pool.

Since COVID-19, and assuming historical Class I utilization trends, it is estimated that more than 21 billion pounds of Class I milk will be pooled from May to October. Combining this pooled milk volume with the shortfall in the Class I milk price, it is estimated that the change in the Class I milk price formula represents more than $436 million in lower pool revenues. Cumulatively, since the Class I milk price formula was modified, the pooled value of Class I milk is $403 million lower than it would have been under the higher-of formula eliminated in the 2018 farm bill, Figure 4.

Summary

The 2018 farm bill modified milk pricing rules to facilitate improved risk management for beverage milk processors, cooperatives and dairy farmers. While the stated goal of improving risk management was achieved, the unintended consequences of this change were exasperated by COVID-19-related price volatility. These include record-large negative PPDs, mass de-pooling of milk and Class I milk prices and revenue that are more than $2 per hundredweight and $400 million, respectively, lower than what they would have been under the previous milk pricing rules.

Anytime the Class III and IV advanced prices differ by more than $1.48 per hundredweight, the Class I milk price will be lower than the higher-of formula and the likelihood of negative PPDs and de-pooling incentives will increase as a result. Historically, the spread between Class III and IV has been above $1.48 nearly 40% of the months from January 2000 to April 2019.

This change to the milk pricing rules did not proceed through a formal rulemaking process. Farmers, now aware of the impacts of this change, are likely to give this renewed attention as they consider potential improvements in the FMMO to deal with recent and future challenges. The current Class I milk pricing rules are in place through April 2021, after which the milk price can be modified by an amendment to the Federal Milk Marketing Order. That seems like just as good a time as any to begin the discussion on improving FMMOs. But before we do that, modified bloc voting should be allowed to provide dairy farmers a voice and a vote on what happens to their farm’s milk price, e.g., Dairy Farmers Deserve a Voice and a Vote on Policy That Impacts Their Farms.

Top Issues

VIEW ALL